Revolut is a financial technology company from the United Kingdom founded in 2015 that provides banking services. In 2019, they released a feature within their app called Revolut Trading, where you can trade financial instruments such as stocks, cryptocurrencies, and commodities.

One popular financial instrument among investors who want to diversify their investments are the ETFs (exchange-traded funds). We can define the instrument as a security that tracks a specific asset or a group of assets. It is traded in stock exchanges, similar to stocks, representing a group of securities or commodities that often share similarities.

In this article, you will find out if you can trade ETFs in Revolut and alternative platforms to trade these instruments.

Can you trade ETFs on Revolut?

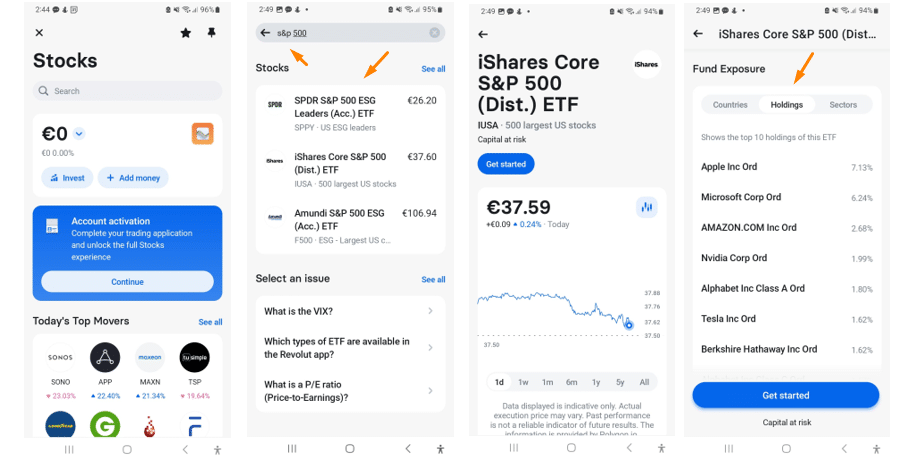

It depends: some users can trade ETFs on Revolut, while others cannot. It will depend on the entity you are a customer, as mentioned by Revolut:

- Revolut Securities Europe UAB: +100 ETFs at your disposal, tracking investments in AI, cybersecurity, hydrogen, as well as world indices such as the S&P 500, Nasdaq, the German DAX or the British FTSE.

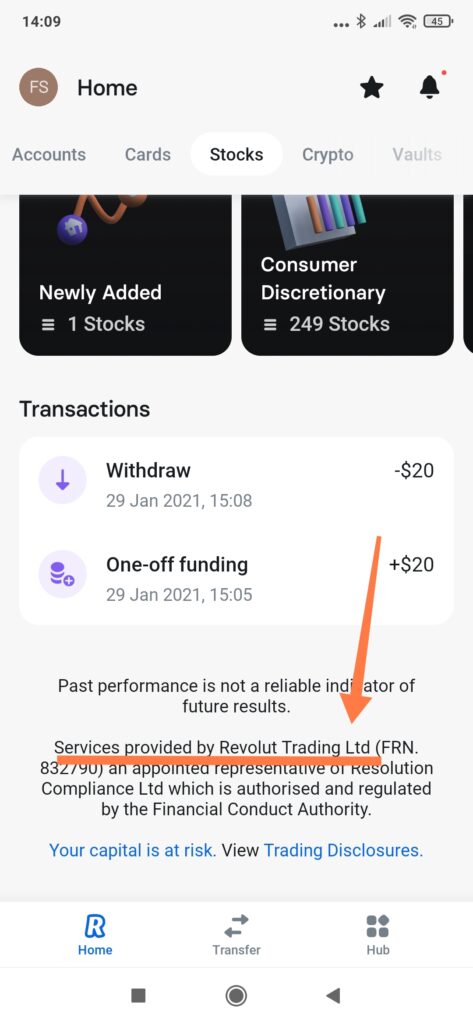

- Revolut Trading Ltd: no ETFs available yet.

You can see the entity you sign-up by selecting “Stocks” and scrolling all the way down:

Note that products offered by Revolut vary according to region. If you live in the US, you already have access to more than 200 ETFs in Revolut, as some online news articles state. There are also a few reports on Reddit forums made by US clients who can see ETFs in their investment platforms.

ETF Trading Fees

Depending on your plan, fees for ETF trading may vary:

- Standard Plan: 1 free trade per month;

- Plus Plan: 3 free trades per month;

- Premium Plan: 5 free trades per month;

- Metal Plan: 10 free trades per month.

After the free transactions for each plan, a 0.25% commission per trade (min. €1) of the order amount will be applied.

Best Revolut Alternatives for trading ETFs

To help us answer this question, we focused on low-cost brokers, which are available in most countries in Europe. Given that, here are our suggestions:

eToro

With over 30 million users, eToro is the leading social investing platform (copy and follow other traders/investors). It offers commission-free ETF trading (other fees apply).

Disclaimer: Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Interactive Brokers

Founded in 1978, IBKR is one of the world’s most trustworthy brokers. It offers an enormous range of financial products (stocks, ETFs, Options,…), and low currency conversion fees (FX fees).

💡 Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors.

XTB

Broker that offers commission-free stocks and ETFs in many countries/regions (Czech Republic, France, Germany, Italy, Poland, Portugal, Romania, Slovakia, Spain, South America, UAE and UK). It also allows you to invest in stocks, CFDs, cryptocurrencies, and forex with low fees.

Disclaimer: 76-83% of retail CFD accounts lose money.

DEGIRO

One of the leading online brokers in Europe due to its low-cost structure. It offers low cost ETF trading (external fees apply) and a wide product portfolio.

Disclaimer: Investing involves risk of loss.

Top tier regulators supervise all the companies mentioned here, like the UK’s Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC).

eToro at a glance

50% of retail CFD accounts lose money.

Founded in 2007, eToro is an international online broker with over 30 million users who can trade over 3,000 financial assets, including stocks, ETFs, Cryptos, and CFDs on Stocks, ETFs, Commodities, Forex, Indices, and Cryptocurrencies. ETFs are traded commission-free, as a whole, or fractional shares (other fees apply). EU, US and UK stocks have a $1 commission.

eToro’s investment platform, accessible through both web and mobile platforms, is a social trading hub. Here, investors can engage in discussions about investments, speculations, and market news with fellow investors. eToro also allows users to replicate trading strategies (CopyTrader™) and invest in ready-made investment portfolios (Smart Portfolios) based on thematic investment strategies.

The demo account is particularly useful for a beginner ($100,000 of virtual money). It lets you have a real experience hands-on as you would be using real money. So, when switching to a real account, you will notice no difference between your training and the real-life of investing. On the downside, there is a withdrawal of $5.

eToro is fully regulated and supervised by top-tier regulators such as the UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) in Australia. The subsidiary in Europe, formerly known as “eToro (Europe) Ltd,” is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC).

For more details, visit our eToro review and visit eToro’s website directly.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 50% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Interactive Brokers at a glance

Founded in 1978 and publicly listed in NASDAQ (ticker: IBKR), Interactive Brokers is a global online broker that surpassed major financial crises, showing resilience and a rigorous risk management process.

Interactive Brokers offers an advanced investment platform that includes a wide range of products (stocks, options, mutual funds, ETFs, futures, bonds, and currencies) from 150 markets, solid trade execution (IB SmartRouting), and a set of technical and fundamental tools to help you in your investment decisions.

On the downside, Interactive Brokers’ fee structure is quite complex, the registration process is lengthy but fully online, and the broker doesn’t offer commission-free trading. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most brokers.

Interactive Brokers also launched IBKR GlobalTrader, a modern mobile trading app to trade Stocks, Options, and ETFs, ideal for beginner investors. Some of the features of IBKR GlobalTrader include automatic currency conversions, fractional shares, demo account, and more.

Want to know more about Interactive Brokers? Check our Interactive Brokers Review and visit IBKR’s website directly.

XTB at a glance

70-80% of retail CFD accounts lose money.

Founded in 2002, XTB is a major player in the brokerage industry with extensive worldwide experience, regulated by the Financial Conduct Authority (FCA) – plus other relevant regulatory bodies – and listed on the Warsaw Stock Exchange.

You can invest through xStation 5 and xStation Mobile in different investment products, such as stocks, ETFs, and CFDs on stocks, Forex, indices, commodities, and cryptocurrencies (this product offering may vary slightly from country to country). It offers 0% commission on stocks and ETFs, but only in some countries*.

Opening an account and transferring money is a quick and hassle-free process. For beginners, it presents a demo account where you can trade as if it were real money to help you feel the investment platform firsthand, and you get access to educational tools. For intermediate and advanced investors, you will find plenty of technical and fundamental tools to help you better assess your investment decisions.

On the downside, you will face an inactivity fee of €10/month after one year of non-trading, and if you have not deposited in the last 90 days, it charges high commissions on CFDs of cryptocurrencies but low costs for Forex. XTB is not available in the United States and Australia.

Want to know more about XTB? Check our XTB Review and visit XTB’s website directly.

*The Czech Republic, France, Germany, Italy, Poland, Portugal, Romania, Slovakia, Spain, South America (all countries), UAE and the UK.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 70-80% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

DEGIRO at a glance

Investing involves risk of loss.

Founded in 2013, DEGIRO is a low-cost brokerage firm that has become very popular due to its low rates! With over 3 million users, the innovative platform has become widely known for its “do-it-yourself” philosophy in the sense that you have everything at your disposal to start investing on your own. It offers a wide range of financial assets to trade, including stocks, ETFs, bonds, options, futures contracts, warrants, investment funds, and some leveraged products (not quite the same as CFDs. More info here).

For instance, you can trade ETFs for a low cost (a €1.00 flat handling fee – external costs – still apply). The web trading platform is basic, but it is efficient and straightforward to use. In a matter of minutes, you get used to it. The same applies to its mobile app. On the downside, there is an absence of any significant fundamental research, a €2.50 connectivity fee applies, a €1.00 commission on US stocks applies, and pricing alerts are missing.

Regarding security, DEGIRO is the Dutch branch of flatexDEGIRO Bank AG (a German-regulated bank). In the unlikely event that the segregated assets cannot be returned to clients, DEGIRO falls under the German Investor Compensation Scheme, which compensates any losses from non-returned assets up to 90% (with a maximum of €20,000), so do bear this in mind if you are planning to invest much larger volumes. Furthermore, any money deposited on a DEGIRO Cash Account with flatexDEGIRO Bank AG will be guaranteed up to an amount of €100,000 under the German Deposit Guarantee Scheme.

Still any doubts? Go through our DEGIRO Review and visit DEGIRO’s website directly!

What to look for in an online broker to trade ETFs?

Now that you have a few alternatives to trading ETFs, we can help you by listing a few factors you should consider when choosing the broker you will trade with. We can list a few of these factors that can help you reach a decision:

- Currency conversion fees: if you want to trade ETFs, brokers may charge small amounts to convert different currencies to dollars. You can consider this when choosing the broker to pursue your investments, as it will affect the ETF’s price and overall P%L.

- Commissions: similar to the point above, brokers may also charge commissions for trading ETFs, which should also be considered when trading the instrument.

- Range of ETFs offered: the variety of ETFs offered by the broker may also influence your decision. If you do not have a specific fund that you want to invest in, it could be better to have more options.

- ETF screener: this may be a handy tool for you and something to consider when choosing your broker. You can use the screener to compare and filter different funds according to your desired criteria, narrowing down the available funds according to your preference.

Bottom line

ETFs are popular financial instruments traded in brokerage firms and exchanges like stocks. But compared to stocks, they offer higher diversification and, therefore, less risk. Investing in ETFs is an interesting alternative for those who want to invest in a specific field or sector but do not have the time, money, or knowledge to diversify their portfolio.

You may be allowed to trade ETFs in Revolut, but you should definitely consider other, more reliable options. You need to set your objectives and goals and pick the broker that better suits those needs.

Note that this article is for informational purposes only and should not be considered financial advice. We hope we can help you with your choice and wish you the best of luck with your investments!