Managing investments can be time-consuming and complicated. Moreover, finding the best portfolio management software in this saturated market is equally challenging.

Fortunately, there are several portfolio management software programs that can simplify the process and help you keep track of your portfolio. From basic tracking to advanced analysis tools, these software programs help you manage your investments more efficiently and make informed decisions.

In this article, we review the 5 best portfolio management or portfolio tracking programs that are currently available in 2025.

- Empower;

- Quick Deluxe;

- Mint;

- Acorns;

- Morningstar Instant X-Ray.

What is a portfolio management software program?

A portfolio management or portfolio tracking software program is a computer-based tool that helps individuals and organizations manage their investments. These programs provide a range of features, including portfolio tracking, performance analysis, and reporting.

They also offer real-time data on market trends and conditions, allowing users to make informed investment decisions. It’s essential for day traders and long-term investors alike!

With the ability to integrate with multiple financial institutions and provide a comprehensive view of investments, portfolio management software programs have become an essential tool for individuals and organizations looking to optimize their portfolios and achieve their investment goals.

The 5 best portfolio management software programs

Empower | The gold standard with more than 3 million users worldwide

Empower, former Personal Capital, provides a comprehensive portfolio management software platform, including investment tracking, portfolio analysis, and financial planning. It integrates with multiple financial institutions and gives a complete financial picture in seconds.

Quicken Deluxe | The best option for organizing taxes, spending, and retirement with one tool

Quicken Deluxe offers personal finance management, including portfolio tracking, budgeting, and bill payment services. It allows users to import and categorize investments, track performance, and create watchlists.

Mint | Free money and spending management used by over 30 million and counting

Mint is a user-friendly personal finance management tool, also offering investment tracking, budgeting, and bill-paying services. It is available on both web and mobile platforms.

Acorns | The option best designed to automate your saving, spending, and investing

Acorns is a micro-investing platform, rounding up spare change from transactions and investing it in a diversified portfolio. It offers easy portfolio management and automatic rebalancing.

Morningstar Instant X-Ray | Costly, but a must-have for serious portfolios and long-term investors

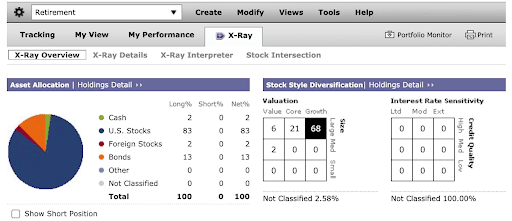

Morningstar Instant X-Ray provides a comprehensive view of a portfolio’s holdings, including asset allocation, sector weightings, and top holdings. The tool allows users to assess the diversification and potential risks in their portfolio, but comes with a cost of $34.95 per month.

| Name | What We Like | To Consider | Cost |

| Empower | Leading tracking, analysis, and planning. | Can be costly depending on your needs, and is complex at first. | Free, with paid options |

| Quicken Deluxe | An excellent option for those focused on retirement. | The cost is not necessary given the competition. | $4.99 monthly |

| Mint | The world’s go-to budget tracker and debt clearer. | Not for heavy investors or those bothered by ads. | Free |

| Acorns | Easy to use and perfect for passive investing. | A 100% robotic advisor and not for traders. | $3 monthly and up |

| Morningstar Instant X-Ray | Comprehensive, customizable, and research driven. | The high cost seemingly restricts it to professional investors. | $34.95 monthly or $249 a year |

1. Empower

The gold standard with more than 3 million users worldwide.

Empower offers a range of services focusing on investment tracking, portfolio analysis, and financial planning. Here’s a detailed review of its portfolio management software tools:

Pros

-

Investment Tracking: Empower provides a comprehensive view of your investments, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). It integrates with multiple financial institutions to provide a complete picture of your investments, making it easy to track performance and monitor your progress towards your investment goals.

-

Portfolio Analysis: Our number one pick provides a complete portfolio analysis, including asset allocation, sector weightings, and top holdings. It also provides a comparison against benchmark indexes, allowing you to assess the diversification and risk level of your portfolio.

-

Financial Planning: Empower provides financial planning services, including retirement planning, budgeting, and debt management. It integrates all of your financial information, providing a comprehensive view of your financial situation, and helping you make informed decisions to achieve your financial goals.

- Mobile App: Empower has a mobile app that provides access to your investment portfolio, financial planning tools, and budgeting features. It offers real-time data and alerts, making it easy to manage your finances on-the-go.

Cons

-

Cost: Empower offers both free and paid services, with the paid services being relatively expensive compared to other portfolio management software programs.

- Complexity: The platform offers a range of features, which may be overwhelming for some users who are new to investing or portfolio management.

Overall, Empower’s portfolio management software program is comprehensive and provides everything a serious investor needs–for free. Our number one pick.

2. Quicken Deluxe

The best option for organizing taxes, spending, and retirement with one tool.

Quicken Deluxe is also comprehensive, providing users with a range of tools for managing their finances and investments. The platform has been around for over 30 years and has a proven track record as a go-to portfolio management software program.

Pros

-

Investment Tracking: Quicken Deluxe integrates with multiple financial institutions, including brokerage firms, banks, and retirement accounts, to provide a complete view of a user’s investment portfolio. The platform provides a detailed summary of investment performance, including return on investment (ROI), total value, and investment gains and losses.

-

Budgeting and Financial Planning: In addition to investment tracking, it also offers budgeting and financial planning tools that help users manage their expenses and set financial goals.

-

Investment Analysis: It gives a range of investment analysis tools, including portfolio diversification and investment performance analyses. With Quicken, these tools feel comprehensive and lean towards reliable decision making.

- Mobile App: It offers a mobile app for both iOS and Android devices, allowing users to access their portfolios from their smartphones or tablets.

Cons

-

Cost: Quicken Deluxe is a paid service and has removed its free option, albeit in line with other portfolio management software programs in 2024.

- Complexity: The platform offers a range of features, which may be overwhelming for some users who are new to investing or trading.

3. Mint

Free money and spending management used by over 30 million and counting.

Mint allows users to track their investments, budget their spending, and manage their financial goals. Mint offers a range of features that make it an attractive option for investors looking for an easy-to-use and accessible portfolio management software program.

Pros

-

User-Friendly Interface: Mint has a clean and user-friendly interface that makes it easy for users to navigate and access their investment information. The platform is also mobile-friendly, allowing users to access their portfolios from their smartphones or tablets.

-

Budgeting and Financial Planning: In addition to investment tracking, Mint also offers budgeting and financial planning tools that help users manage their expenses and set financial goals.

-

Investment Tracking: Mint integrates with multiple financial institutions, including brokerage firms, banks, and retirement accounts, to provide a complete view of a user’s investment portfolio. The platform provides a summary of investment performance, including return on investment (ROI) and total value.

- Free to Use: Mint is a free service that does not charge any fees for using its portfolio management software program.

Cons

-

Limited Investment Analysis: While Mint provides a comprehensive view of a user’s investments, it does not offer an as-detailed review you might find with other portfolio management software programs. This can feel limiting for some investors.

- Advertising: Mint relies on advertising to generate revenue and may display ads on its platform. This can be distracting for some users and compromises privacy.

Overall, Mint’s option is highly accessible, free, and just detailed enough for investors to notice real improvements to their portfolios.

4. Acorns

The option best designed to automate your saving, spending, and investing.

Acorns is a robo-advisory platform that provides users with a portfolio management solution designed to make it easy to invest and save money. Acorns uses a round-up feature to automate savings and investment, allowing users to invest their spare change into a diversified portfolio of ETFs.

Pros

-

Easy to Use: Acorns is designed to be user-friendly, making it an accessible option for those who are new to investing or portfolio management. The platform’s round-up feature makes it easy for users to save and invest their spare change.

-

Automated Investment Management: The platform uses a robo-advisory feature to automate investment management, providing users with a diversified portfolio of ETFs that is designed to match their investment goals and risk tolerance.

-

Low Minimum Investment: It requires a low minimum investment, making it an accessible option for those who want to start their investing journey with less.

- Low Fees: It charges low fees, which makes it an affordable option for those looking to manage their finances and investments.

Cons

-

Limited Investment Options: Acorns only offers a limited number of investment options, which may not be suitable for most investors.

-

No Tax-Loss Harvesting: It does not offer tax-loss harvesting, which can result in higher taxes for long-term investors.

- No Human Advisor: It is a fully automated platform and does not offer the option of working with a human advisor.

Overall, Acorns’ portfolio management software program is a user-friendly and affordable option for those who are looking for an easy and automated way to invest and save money. It comes with a low minimum and low fees, making it exceptionally attractive to learners.

5. Morningstar Instant X-Ray

Costly, but a must-have for serious portfolios and long-term investors.

Morningstar Instant X-Ray is primarily a portfolio analysis tool that helps users evaluate the holdings, risk, and diversification of their portfolios. It provides users with insights into their portfolio’s investment style, sector, and geographic exposures, and helps them identify any potential risks and inefficiencies.

Pros

-

Comprehensive Portfolio Analysis: Morningstar Instant X-Ray provides a comprehensive analysis of a portfolio, helping users understand their investment style, sector and geographic exposures, and potential risks and inefficiencies.

-

Easy to Use: The software is easy to use and provides clear and concise information, making it accessible for all levels of experience.

-

Customizable: It allows users to customize their analyses based on their investment goals and risk tolerance, making it a versatile tool for all types of investors.

- Access to Morningstar Research: By using Morningstar Instant X-Ray, users also have access to Morningstar’s extensive research and analyses, providing them with valuable insights into the markets and individual investments.

Cons

-

Limited Trading Capabilities: Morningstar Instant X-Ray is a portfolio analysis tool, not a trading platform, and therefore does not offer the ability to buy or sell investments directly from the software.

-

Limited Tax Analysis: The software does not provide in-depth tax analysis, which may be a drawback for those looking for more comprehensive tax planning and optimization tools.

- Subscription Cost: Morningstar Instant X-Ray is a subscription-based software, and users may have to pay an ongoing fee to access the platform and its features.

Overall, Morningstar Instant X-Ray’s portfolio management software program is a valuable tool for investors looking for the most comprehensive analysis of their portfolios, although at a steeper cost.

Bottom line

Portfolio management software programs help investors and traders in four irreplaceable ways:

- Streamlined investment tracking. These programs allow investors to easily track and monitor all of their investments in one place.

- Data-driven decision making. By providing a centralized repository for investment data and analytics, portfolio management software enables investors to make informed decisions based on real-time data and trends.

- Risk management. Many portfolio management software programs come with built-in risk management tools that help investors to assess and manage the risks associated with their investments.

- Improved investment performance. By automating many of the manual tasks associated with portfolio management and providing data-driven insights, portfolio management software improves investment performance over time.

In 2025, and possibly at no cost, there is no reason why serious investors should enter into the markets without first equipping themselves with the very best tools out there.

If you need further guidance or have questions, feel free to reach out to us. We wish you the best in your investment journey!

FAQs

What is the best portfolio management or tracking software available?

The best portfolio management software depends on individual needs and investment goals. It’s recommended to research and compare different software programs to find the one that best fits your goals.

Is there a portfolio management software available in the UK?

Yes, there are options for UK investors, such as Kubera.

Is there a portfolio management software available in Europe?

Yes, there are options for EU-based investors, such as Kubera.

Is there a portfolio management software available in Canada?

Yes, there are options for Canadian investors, such as Interactive Brokers. However, this is not a dedicated portfolio management software.

Is there a portfolio management software available in Australia?

Yes, there are options for Australian investors, such as Interactive Brokers. However, this is not a dedicated portfolio management software.