If you are looking for a trustworthy online broker to conduct your trading or investing activities safely, you have probably wondered: Interactive Brokers (IBKR) or Freedom24? Which one is better?

To help you pick the right broker for your financial markets journey, we established an unbiased comparison of Interactive Brokers and Freedom24, covering a wide range of relevant topics, such as pricing, trading platforms and products available.

Interactive Brokers vs Freedom24 in a nutshell

| Area | IBKR | Freedom24 |

| Product offering | SEC, FINRA, SIPC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB | Stocks, ETFs and US options |

| Interest on cash | EUR: 1.514%; USD: 3.14% (December 2025) | Not applicable |

| Trading platforms | Easy to complex (for all investor levels) | Easy to navigate |

| Account types | It’s a tie – both have similar solutions. | It’s a tie – both have similar solutions. |

| Account currencies | AUD, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, JPY, MXN, NOK, NZD, SEK, SGD or USD | EUR, USD, GBP, KZT, CHF, HKD |

| Account opening, cash and portfolio transfers | The account opening process is generally slow. | Takes less time. |

| Fees | From $0.35 for US stocks; From €1.25 for ETFs | Quite high for stocks and ETFs; average for US options |

| Education, research and demo account | It’s a tie – both have similar solutions. | It’s a tie – both have similar solutions. |

| Security | Regulated by top-tier institutions. | Regulated by a mid-tier institution. |

| Customer Support | It’s a tie – both have good customer support. | It’s a tie – both have good customer support. |

| Verdict | Best overall | Best for direct bond investments |

1. Flash overview of Interactive Brokers and Freedom24

IBKR, founded in 1978, is a well-regulated broker under several financial regulators: SEC, FCA (UK), CBI and more. The broker’s primary platform, Trader Workstation (TWS), is known for its complex interface, making it suitable for advanced traders (and you can take advantage of a great referral system!)

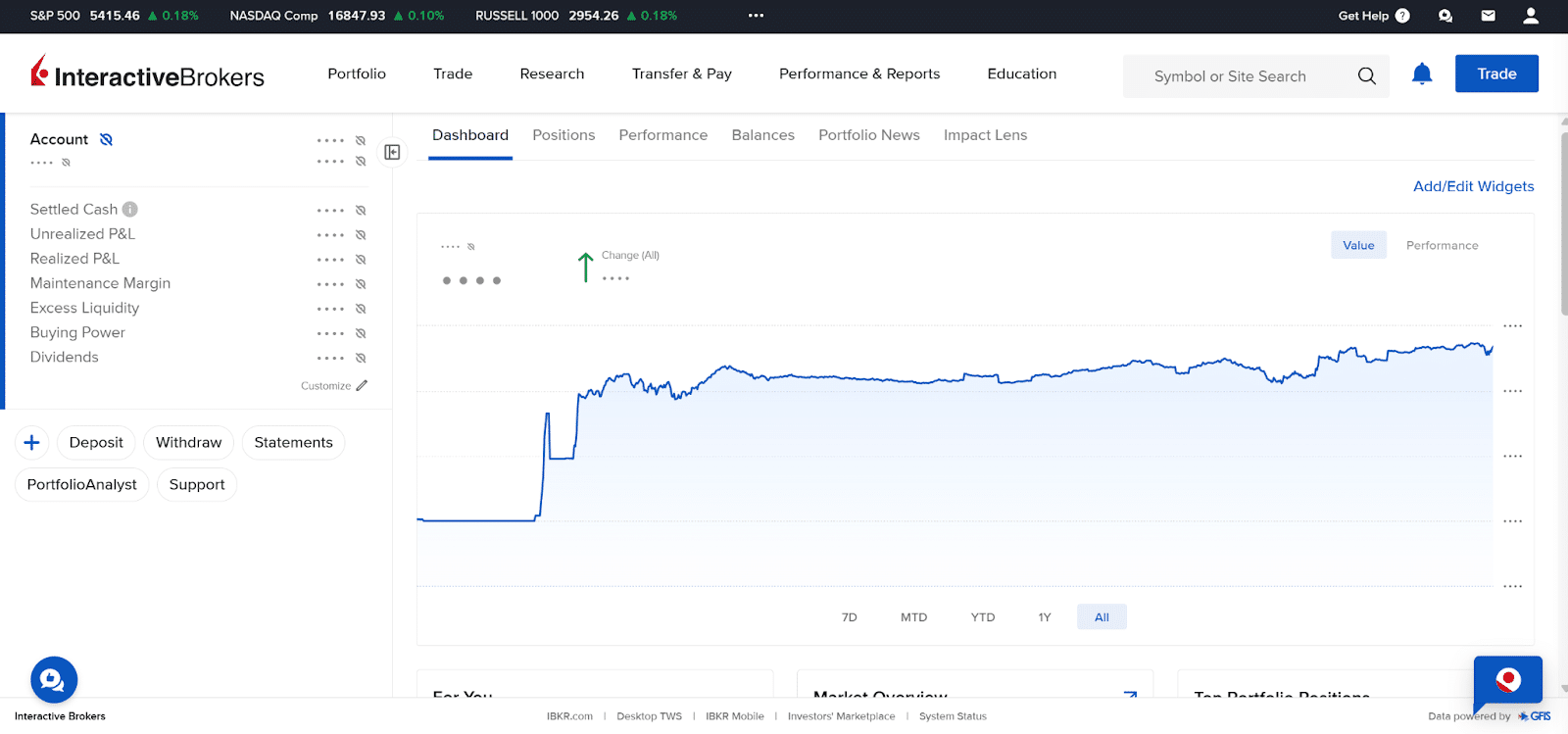

Still, beginner investors have access to more friendly platforms like the Client Portal, IBKR Desktop and the IBKR GlobalTrader mobile app. It also stands out for its strong customer support and comprehensive educational resources.

Freedom24, launched in 2015, as part of Freedom Holding Corp, is regulated by CySEC. The broker provides access to various financial instruments, including stocks, ETFs, and options. Freedom24 offers both web-based and mobile platforms that are more tailored toward experienced investors. It is gifting shares for new users.

2. Product offering

Both IBKR and Freedom24 offer a diverse range of financial instruments, covering a wide variety of asset classes The table below summarises the products available for trading with IBKR and Freedom24.

| Asset Class | IBKR | Freedom24 |

| Stocks | ✔ | ✔ |

| ETFs | ✔ | ✔ |

| Bonds | ✔ | ✔ |

| Options | ✔ | ✔ |

| Spot currencies | ✔ | ✔ |

| Fractional shares | ✔ | ✘ |

| CFDs | ✔ (Forex, crypto, indices, commodities) | ✘ |

Source: Interactive Brokers and Freedom24 – EU websites

If you are looking for stocks, ETFs and options, Interactive Brokers is the broker of choice (lower commissions). If you plan on investing in bonds, you might consider Freedom24.

3. Trading platforms

One of the key value propositions of an online broker lies in the investment platform it provides. In this field, solid and competitive brokers tend to pursue an innovative approach in an attempt to supply investors with the best and most recent trading and decision-supporting customisable tools.

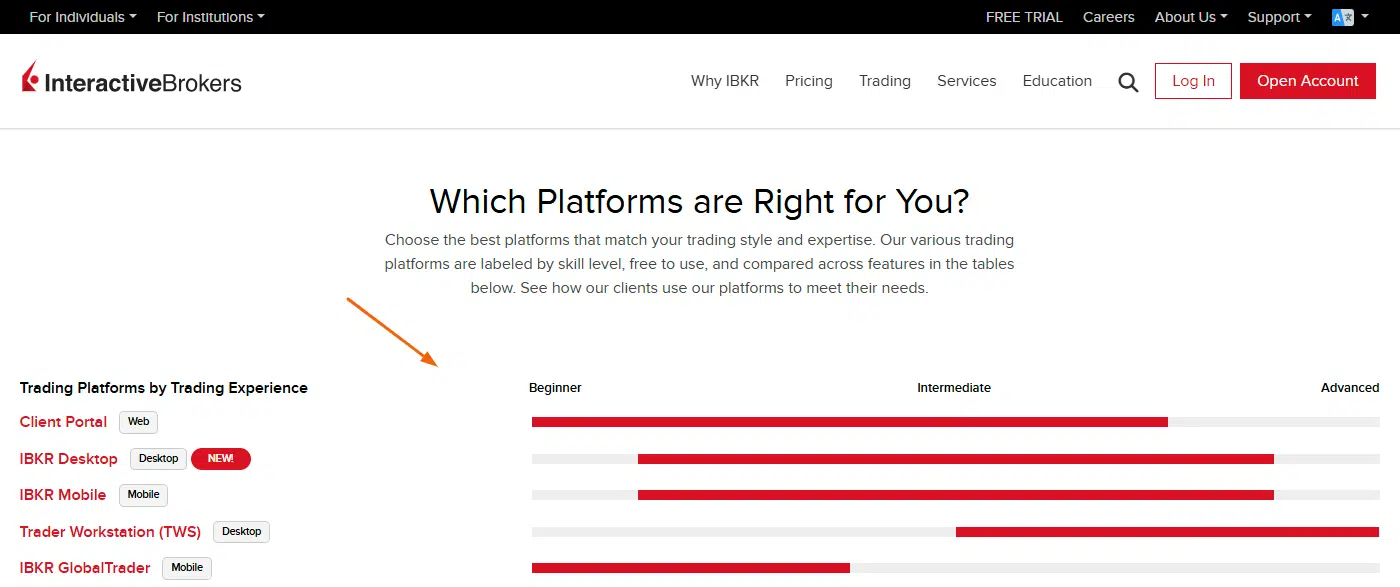

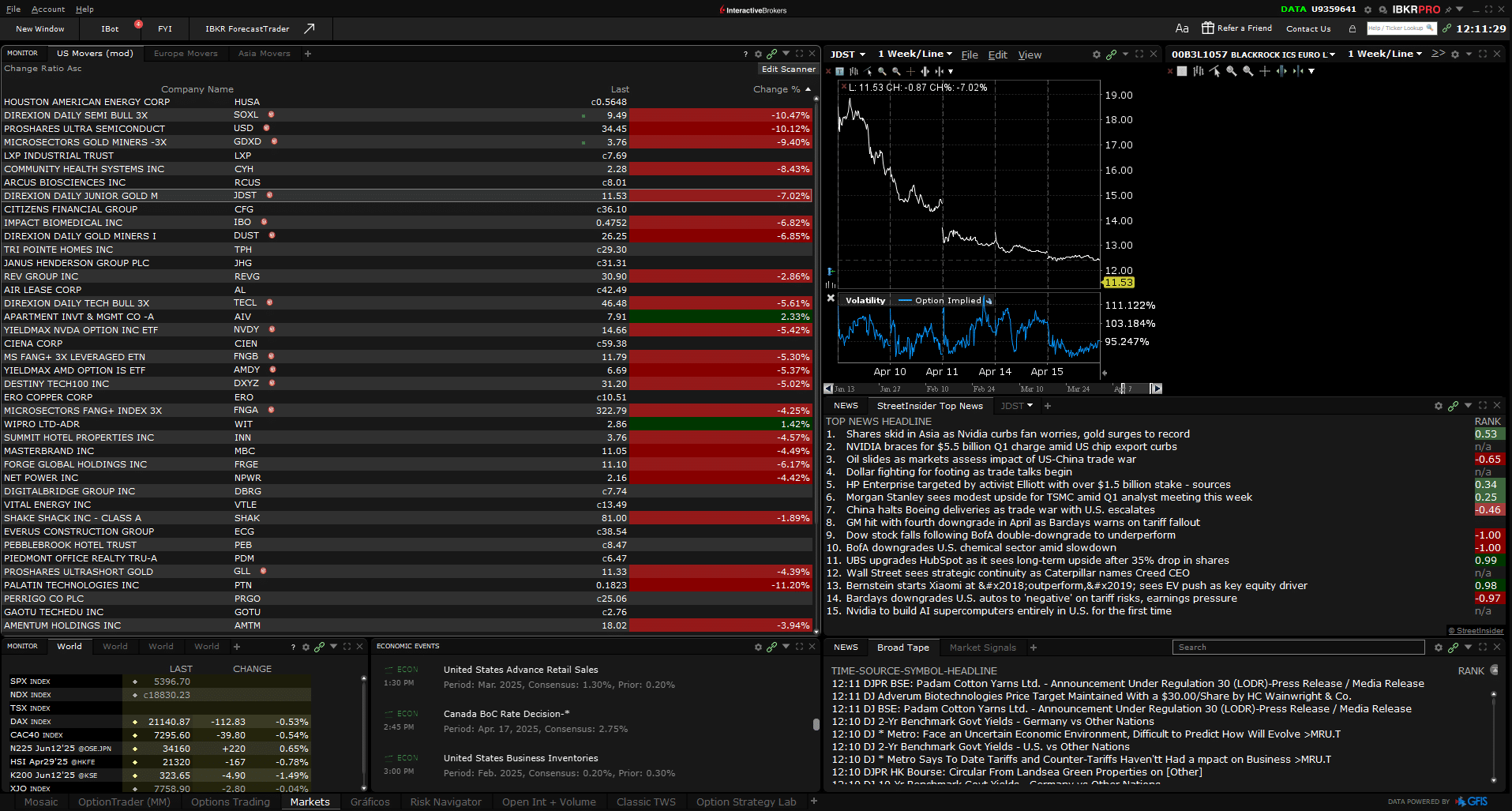

Interactive Brokers trading platforms

IBKR provides both desktop and mobile trading platforms. Its award-winning platform, Trader WorkStation (TWS), is known for being complex, making it ideal for traders with advanced experience. However, you have access other user-friendly platforms:

Freedom24 trading platform

Freedom24’s web platform and mobile app cater to advanced traders. However, the user experience can feel slightly overwhelming for beginners due to the wide range of products and tools.

You have access to several features such as the “Trade”, “Member Area”, and “Charts”:

The demo terminal appears as soon as you complete the first step of registration (between the step when you fill your e-mail and the final confirmation with a selfie and opening a real account).

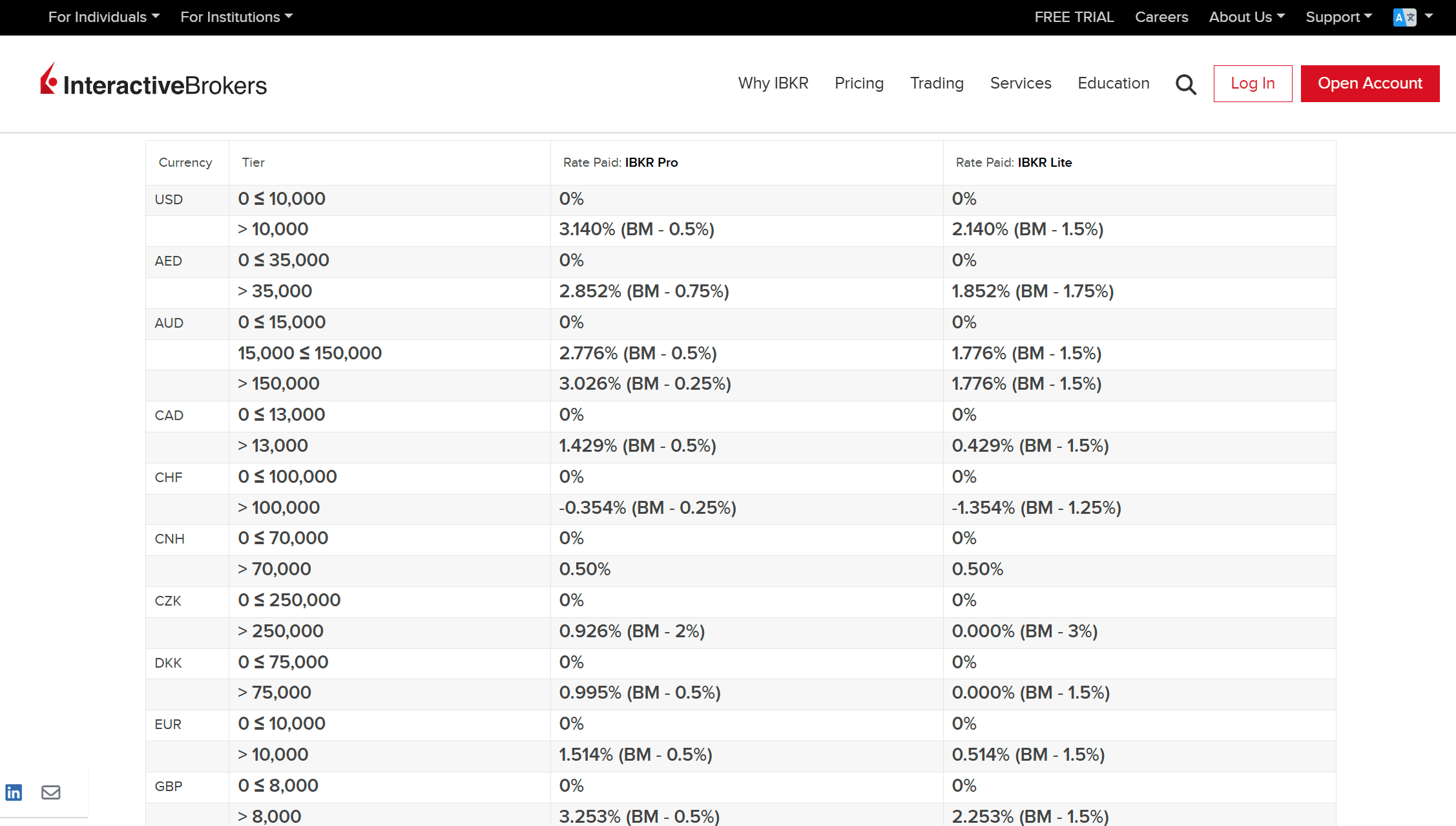

4. Interest on cash

Given the rise in interest rates, most brokers are offering clients the possibility to generate returns from their cash. Several brokers offer these rates, as you can find here. Quick summary for IBKR and Freedom24:

| Currencies | IBKR | Freedom24 |

| EUR | 1.514% | Not applicable |

| USD | 3.14% | Not applicable |

| GBP | 3.253% | Not applicable |

Source: IBKR and Freedom24 – EU websites – as of December 2025

IBKR offers interest on uninvested cash in client accounts. It may vary between regions, but the overall rates are the following:

5. Account types

There are two fundamental types of brokerage accounts:

- Cash – where trading of derivatives and short-selling of securities is either not permitted or significantly limited.

- Margin – where trading of derivatives and short-selling of securities is widely available. It is also possible to borrow, with an associated financing cost, against your current holdings (collateral) to further expand your investment financial capacity. Margin accounts are constantly monitored for risk, and positions may be closed if the collateral value drops below a certain threshold established by the online broker. Finally, it is worth noting that this leverage may result in losses that surpass the capital invested in abrupt adverse market movements.

Interactive Brokers and Freedom24 offer both a cash and a margin account.

6. Account opening, cash and portfolio transfers

Account opening

IBKR and Freedom24 both have an account opening process that runs fully online. They both require documentation to prove ID and, address. Neither of these brokers establishes a minimum amount to be deposited to open an account.

Account opening approval is typically faster with Freedom24, averaging one business day, whereas with Interactive Brokers, it might take, on average, two to three business days.

Cash transfers

For Interactive Brokers, you can only deposit and withdraw via bank transfer (Wire/SEPA). By using a Wire transfer, you have one free withdrawal per month. Subsequent withdrawals in that same month will incur a fee of EUR 8.00. With SEPA (transfers only in EUR), you also have one free withdrawal a month, after which a fee of EUR 1.00 is applied.

In Freedom24, cash deposits and withdrawals are made essentially via bank transfers or credit cards, with no broker-added fees. You can also deposit through digital assets (USDT).

Portfolio transfers

Both brokers support transfers of existing portfolios in and out of their accounts. Currently, Interactive Brokers’s process seems to be more streamlined. In any case, the process of transferring securities from one institution to another should always be seen on a case-by-case basis, as it requires the two institutions to interact and analyse the assets to be transferred.

7. Pricing – trading and non-trading fees

When choosing an online broker, you often want to study the costs involved. While that is a more than fair concern, IBKR and Freedom24 both offer their users competitive pricing.

First, it is important to establish that there are fees for trading, where the broker charges a fee (commissions or spreads), and for non-trading services, like withdrawal fees.

Trading fees

| Fees | IBKR | Freedom24 |

| Stocks | From $0.35 per trade | From €1.2/order + (0.25%+€0.012) per share |

| ETFs | From €1.25 per trade | From €1.2/order + (0.25%+€0.012) per share |

| Options | Up to $0.65 per contract | From $0.65 per contract |

| CFDs | From 0.00008 | Not applicable |

| Currency conversion fee | 0.002% | ~0.20% |

Non-trading fees

| Fees | IBKR | Freedom24 |

| Withdrawal fees | Up to €8 (first withdrawal in a single month is free) | €7 per withdrawal request |

| Inactivity fee | €0 | €0 |

| Custody fee | €0 | €0 |

8. Investor security

The security of your assets is of utmost importance when choosing a broker. Besides local investor protection schemes that might be established in your country’s jurisdiction, it is important to understand the broker institution you are working with.

Interactive Brokers regulation and protection

IBKR subsidiaries are fully supervised by top-tier regulators such as the US Securities and Exchange Commission (SEC) and the UK Financial Conduct Authority (FCA).

When opening an account, you will sign up through one of the IBKR subsidiaries. Here are the main ones:

| Subsidiary | Regulatory body | Investor protection amount | Applicable regions |

| Interactive Brokers Ireland Limited | CBI | Up to €20,000 | Europe |

| Interactive Brokers UK Limited | FCA | Up to £85,000 | UK |

| Interactive Brokers LLC | SEC | Up to $500,000 for securities | US |

Freedom24 regulation and protection

Freedom Finance Europe Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license CIF 275/15, and it is registered in several countries under the “freedom to provide services”.

In the unlikely event that the segregated assets cannot be returned to clients, Freedom24 falls under the Investor Compensation Fund (ICF), which compensates for any losses from non-returned investments up to EUR 20,000.

Please note, however, that Freedom24 is not regulated by top-tier regulators like the FCA, SEC and ASIC.

9. Customer support

If any doubt related to your trading or investment activity arises, you will certainly want to have the best possible assistance. Hence, customer service is another important dimension when choosing an online broker.

IBKR and Freedom24 have comprehensive FAQ pages and make phone and email channels available to clients. It is important to highlight that not every language is supported.

Interactive Brokers vs. Freedom24 – comparison verdict

To sum it up, here is our verdict:

- Interactive Brokers: Best broker overall

- Freedom24: Best for direct bond investments

All angles considered, Interactive Brokers stands out from Freedom24 as a price-competitive, solid institution, and offering the best combination of financial instruments, tools, and solutions for the whole investment journey.

Nonetheless, if you are looking for direct bond investments, Freedom24 would be your choice between these two platforms.

For more information on each platform, please consult our research:

Disclaimer: Investments in securities and other financial instruments always involve the risk of loss of your capital. The forecast or past performance is no guarantee of future results. It is essential to do your own analysis before making any investment.