Known for its low fees and social trading feature, eToro has become a very popular broker. Some other eToro pros include various financial products, an intuitive platform, and low minimum deposits.

However, eToro is not without its cons, namely only accepting one currency for trading (USD), having a $5 withdrawal fee, high spreads on certain products, offering primarily CFDs, etc.

Depending on your situation, consider other platforms that can meet your investing needs in a better way. These are our top picks for eToro alternatives:

Best eToro alternatives in 2025

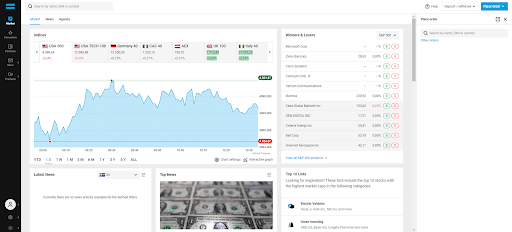

Interactive Brokers | Best global broker overall

Having been founded in 1978, it is one of the world’s most trustworthy brokers. It offers a wide selection of financial products (stocks, bonds, ETFs, mutual funds, currencies, options, and futures) from more than 150 global markets at reasonable commissions (free for US investors) and low currency exchange fees.

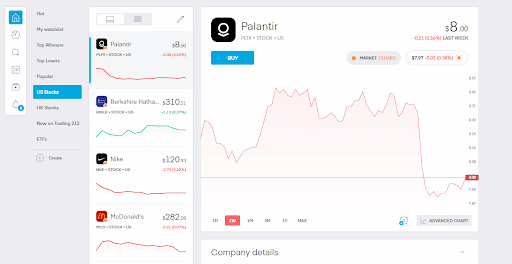

Trading 212 | Best for commission-free stocks and ETFs

A simple and intuitive platform, commission-free stocks & ETFs trading, and fractional shares make Trading 212 ideal for beginner investors. The platform has amassed over 4 million customers and has excellent customer reviews.

DEGIRO | Best European broker for ETFs

DEGIRO is one of the leading online brokers in Europe (available in 15 European countries), with over 3 million users. It has become popular primarily due to its low-cost structure.

Disclaimer: Investing involves risk of loss.

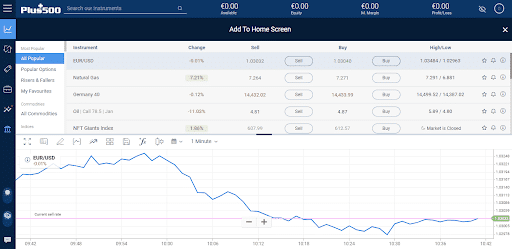

Plus500 | Best for CFD trading

Plus500 is a multi-asset online broker that offers no commissions when trading CFDs in Indices, Forex, Commodities, Cryptocurrencies, Shares, Options, and ETFs. It also offers an account for those who want to invest in real shares called Plus500 Invest.

82% of retail CFD accounts lose money.

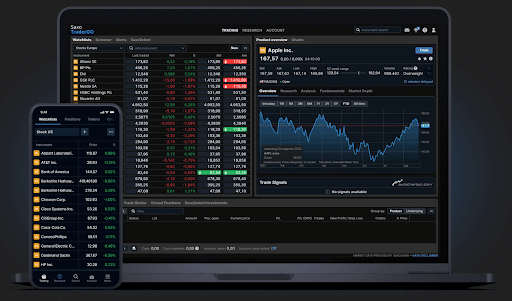

Saxo Bank | Best broker for experienced traders

This Danish broker offers experienced traders access to exchanges worldwide. It has a wide financial product selection, including options, forex options, commodities, futures, and more. It is most suitable for advanced investors because of its relatively high fees.

| Broker | Minimum deposit | Supported Products | Available in | Trading fees (US stocks) |

| Interactive Brokers | $0 | Stocks, bonds, ETFs, mutual funds, currencies, options, and futures | Internationally (exceptions apply) | From $0.0005 (Tiered) to $0.005 (Fixed) – Free to US investors |

| Trading 212 | €/£10 | Stocks, ETFs (Trading 212 Invest), CFDs (Trading 212 CFD) | Internationally (not available in the US, Canada, and other countries) | Commission-free (other fees may apply) |

| DEGIRO | €/£1 | Stocks, ETFs, bonds, options, futures | Europe | €/£1 per trade |

| Plus500 82% of retail CFD accounts lose money. |

$100 | Stocks (Plus500 Invest), CFDs (Plus500 CFD) | Internationally – not available in the US and other countries (Plus500 CFD) | 0.006$ per share – higher on other exchanges (Plus500 Invest) |

| Saxo Bank | £0 (depending on your residency) | Stocks, ETFs, bonds, currencies, futures, options, mutual funds, CFDs | Internationally (exceptions apply) | $1 minimum (Classic account) |

For a full comparison of the brokers presented here, make sure to check our broker comparison page.

Interactive Brokers at a glance

Having been around since 1978 and surviving multiple financial crises, the Interactive Brokers’ major advantage is its reputation. It is also publicly listed on the NASDAQ exchange (ticker: IBKR), making it a bit more regulated than other platforms.

Other significant advantages of using Interactive Brokers are its wide selection of financial products from over 150 markets, solid trade execution (IB SmartRouting), and support for 24 currencies in its account. There are also 100+ currency pairs available for exchange.

Some downsides of using Interactive Brokers are its complex fee structure, lengthier than average registration and fund deposit processes, and limited commission-free trading (only available for US investors). However, the last point is largely mitigated by using narrower spreads and lower FX fees than some of its competitors.

Speaking of the fee structure, there are two distinct plans to choose from – Tiered and Fixed, with the former fees depending on the trade volume. The fees also vary across different markets. You can see the full fee structure here.

The Interactive Brokers Trader Workstation (TWS) platform offers many basic and advanced features, such as a demo account, watch lists, alerts and monitoring in real-time, advanced technical analysis tools, and more. One of the downsides of the platform is that the learning curve can be steep for beginners, even with the provided educational materials.

The IBKR GlobalTrader mobile app is a much more intuitive choice for beginner investors, offering stocks, ETFs, and options trading in a more user-friendly format. Other app features include automatic currency conversions, fractional shares (only for US stocks), and more.

Overall, Interactive Brokers is a good choice for beginners and advanced investors looking for a secure broker and access to a large variety of financial instruments. If you need more info, feel free to check out our more detailed review of Interactive Brokers.

Pros

- Low commissions on US stock trading

- No monthly inactivity fee

- The broadest product and markets range in the brokerage industry

- Demo account

- Excellent reputation (founded in 1978)

- Extensive research and Education tools

- Has a modern mobile trading app to trade Stocks, Options and ETFs, ideal for novice investors, IBKR GlobalTrader.

- Offers interest on uninvested cash balances

Cons

- Complicated and lengthy account opening process (but fully online)

- Steeper learning curve for beginners

- Website is difficult to navigate

- Interactive Advisors (Robo-advisor feature) is only available for US customers

Trading 212 at a glance

When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Founded in 2004, Trading 212 claims the title of the first-ever commission-free broker in both the U.K. and Europe. As of 2025, it has amassed over 4 million users with over €4 billion in assets under management.

It offers two distinct account types:

- Trading 212 Invest: Commission-free stocks and ETFs;

- Trading 212 CFD: CFD trading only.

The Trading212 Invest account has been rapidly gaining popularity with beginner investors especially, and with good reasons:

- The minimum deposit is just €1;

- Commission-free stocks and ETFs trading is available (along with fractional shares);

- A very simple platform (both registration and trading).

The platform is also available in 100+ countries, but that list does not include the U.S. and Canada. The account opening and fund depositing process is one of the simplest ones out there. Trading is also easy and intuitive on the platform. There are virtually zero fees for the end user when depositing funds by bank transfer and trading stocks or ETFs.

It is important to note that Trading 212 can offer commission-free trading primarily due to its share lending program, which is mandatory for Trading 212 users. In a nutshell:

- Trading 212 holds the right to lend your shares to a third party (borrower);

- This doesn’t affect your ability to trade the shares, receive dividends, etc.

- Trading 212 has to always hold collateral in the form of US Treasury Bonds that is equal to or more than 102% of the value of the shares lent.

However, that doesn’t mean there are no fees on Trading 212. Some of the fees that Trading 212 charges are;

- 0.7% for deposits by debit/credit card (it’s free up to the first €2,000);

- 0.15% (Trading 212 Invest) or 0.50% (Trading 212 CFD) currency exchange fees;

- Overnight fees on CFDs.

You can see the fee structure in more detail here for Trading 212 Invest and here for Trading 212 CFD.

For those of you who are thinking about joining Trading 212, you can even claim a free share now when you sign up by following this link. After you verify your identity and fund the account, be sure to include promo code “IITW” to claim free shares worth up to €100.

All in all, Trading 212 is a good solution for beginners who want to buy-and-hold US stocks and ETFs. It is actually a white label of Interactive Brokers (Trading 212 uses Interactive Brokers as their custodian).

If you need more info, feel free to check out our more detailed review of Trading 212.

Pros

- Commission-free Real Stocks and ETFs trading (other fees may apply. See terms and fees)

- AutoInvest & Pies feature

- Fast and easy account opening process

- Demo account

- Top Tier Regulators

- Free fractional shares worth up to €100

- High interest on uninvested cash

Cons

- Limited product portfolio (no Options, Bonds, Mutual Funds or Futures)

- No relevant Fundamental tools

- 0.15% of Foreign exchange fees

DEGIRO at a glance

Investing involves risk of loss.

Founded in 2013 in the Netherlands, DEGIRO became one of the most popular European brokers, with over 2.8 million customers. It is also amongst the largest publicly traded companies in Germany, and it even secured a banking license.

DEGIRO is perhaps best known for its low fees and wide selection of financial products. There are no deposit or withdrawal fees, as well as inactivity fees. Low cost ETF trading is also available for selected list of ETFs found here.

One of the cons of using DEGIRO is that bank transfers are the only deposit method available.

DEGIRO’s fee structure is fairly simple and includes:

- A €/£1.00 commission per trade for US, Canadian and local stocks;

- A €/£1.00 handling fee;

- A €/£2.50 connectivity fee per exchange;

- Fixed currency conversion fee of 0.25%.

Other fees on different exchanges:

- Irish exchanges: €/£2.00 commission;

- EU, UK., and Turkish exchanges: €/£3.90;

- Australian, Hong Kong, Japanese, and Singapore exchanges: €/£5.00.

Another thing to remember is that leveraged products for U.S. exchange-listed stocks are limited. If you want to trade options and futures, Interactive Brokers or Saxo Bank are probably more suitable choices.

If you need more info, please check out our more detailed review of DEGIRO.

Pros

- ETF Core Selection list (external fees apply)

- User-friendly web and mobile app

- Wide range of investment options

- Education material: Investor’s Academy and Investing with DEGIRO

- Low overall commission structure

- No account opening, inactivity, or withdrawal fee

Cons

- 0.25% currency conversion fee (charged if you deposit or invest in a different currency than your base currency)

- €/£1 flat handling fee (charged in most transactions)

- €/£2.50 of connectivity fee (paid annually), per exchange where you’re invested

- Does not offer Forex, CFDs, and Cryptos

- No ISA account (for UK residents)

- Low-quality customer support

- No interest paid on cash balances

Plus500 at a glance

82% of retail CFD accounts lose money.

Founded in 2008, Plus500 is a trading platform best known for its CFD trading wide choice and low fees through its Plus500 CFD account. However, it also offers stocks (physical shares) in its Plus500 Invest account.

The company is also listed on the London Stock Exchange and is available in over 50 countries.

The web platform (WebTrader) offers an intuitive interface with access from multiple devices, including a mobile app. There is also a demo account option to test the features and trade with virtual funds.

Plus500 offers accounts in 16 different currencies (including USD, EUR, and GBP, to name a few). There is also a currency conversion fee (up to 0.7% of the trade’s realized net profit and loss) and a $10 monthly inactivity fee (following three months of not logging in to the platform).

Plus500 CFD fees come mainly from the buy/sell (Bid/Ask) spread, which varies across different instruments. When using Plus500 Invest, each trade has a fee, depending on the exchange you’re using. It is as low as 0.006$ per share for US stocks but can be significantly higher for EU stocks (the minimum is between €2 and €6 per trade).

Find more details about Plus500 CFD fees here and Plus500 Invest fees here.

If you need more info about this platform in general, feel free to check out our more detailed review of Plus500.

Pros

- Acessible and responsive platform

- Low spreads

- No dealing commissions

- Demo Account

- Top-tier regulators

Cons

- No ETF offering

- Inactivity fee ($10 per month after no login activity in 3 months)

- High overnight funding fees

- Very little research and education provided

Saxo Bank at a glance

62% of retail CFD accounts lose money.

Founded in 1992, Saxo Bank has been in business longer than all of the brokers on this list except Interactive Brokers. It is known for its wide variety of financial products (over 60,000), access to a large number of market exchanges (over 120), and a large number of base currencies (18).

Saxo Bank has, more than anything, been trying to appeal to the professional investor. It has done so by offering advanced tools, such as its integration with the Trading View charting platform. The apps SaxoTraderGO and SaxoTraderPRO have also been tailored to professional users.

Maybe that’s why Saxo Bank has one of the highest initial deposit requirements in the industry. These can vary wildly depending on your residency, starting from £500 for the UK and €2,000 for most European countries. It is important to note that Saxo Bank is not available in some big global markets outside the EU, such as the US, Japan, or Australia, to name a few.

Saxo Bank also offers three account levels: Classic, Platinum ($200,000 minimum), and VIP ($1,000,000 minimum), each with its own fee structure. Saxo Bank charges between 0.03% and 0.08% (min. $1) on US stocks and ETFs.

The fee structure is fairly complex, and there are also some additional fees to be aware of. Just to name a few of the most common ones:

- Custody fees: between 0.09% and 0.15%;

- Inactivity fee (with no login in 6 months): €100;

- Currency conversion fees: between 0.25%.

It is best to select the desired financial product from their website and see the full fee structure. In a nutshell, Saxo Bank is tailored to the professional investor and is not recommended to the average investor, mostly due to its higher-than-average fees.

Pros

- Excellent research materials

- Outstanding trading platforms (SaxoTraderPRO and SaxoTraderGO)

- Extensive range of investment products

- Long track record

- Supervised by worldwide top-tier regulators

Cons

- High minimum deposit (varies between countries)

- Fees higher than average

- Fee structure is complex

- Does not accept US residents

Bottom line

To summarize, here’s our list of eToro Alternatives:

- Interactive Brokers: Best global broker overall

- Trading 212: Best for commission-free stocks and ETFs

- DEGIRO: Best European broker for commission-free ETFs

- Plus500: Best for CFD trading

- Saxo Bank: Best broker for experienced traders

When choosing a broker, you have to define your priorities. Some brokers offer a wider choice of financial products and advanced trading tools, while others (like eToro) offer lower fees and more intuitive platforms. Needless to say, each broker has its pros and cons. There is no such thing as a broker that fits everyone’s needs.

We hope we helped you in choosing your broker with this article.