White label trading platforms offer customizable, ready-made solutions that save businesses time and money while enabling a fast market entry.

This article explores their benefits, available options, and how to choose the right provider for your needs.

Whether you’re a startup or an established firm, the right white label platform can be a game-changer. Read on to discover top platforms and key features to consider.

What is a white label trading & investment platform?

White label investing platforms are software solutions that enable businesses to offer stock trading services to their customers under their own brand and identity without needing to develop the technology and infrastructure in-house.

These platforms provide a comprehensive suite of tools and features that allow businesses to create a seamless trading experience for their clients, allowing them to focus on what they do best: onboarding clients, marketing, and providing added value services such as research. By leveraging a white label platform, you can eliminate the hassle of managing IT infrastructure, software development, and hosting and instead, focus on growing your customer base and enhancing their trading experience.

Best white label trading & investment platforms providers

Interactive Brokers

An established brokerage firm that offers a wide range of financial instruments and global reach. Its white label solution is easy and fast to implement and targets professional advisors and brokers.

Saxo Bank

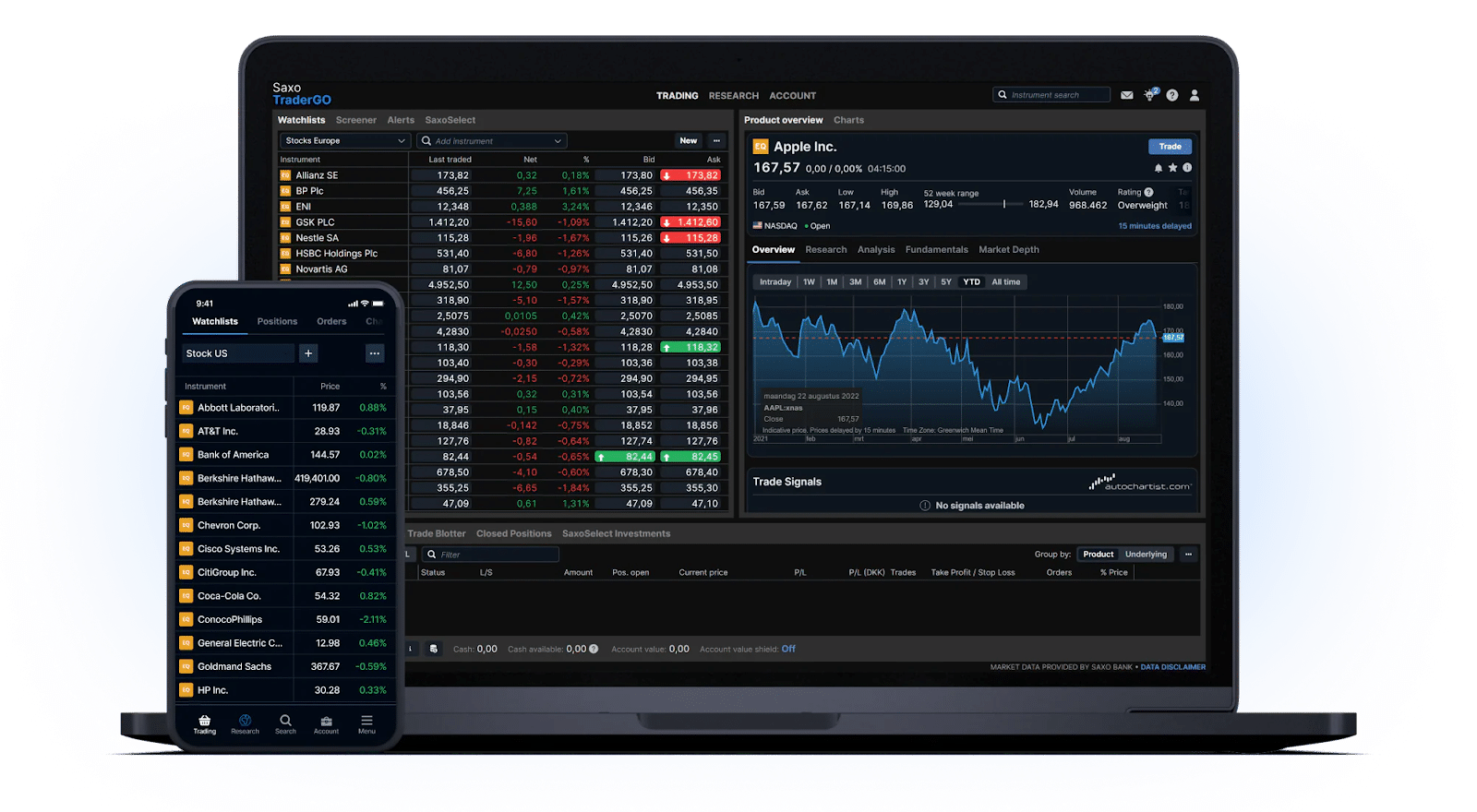

A full-service investment bank with over 20 years of white labelling experience that provides advanced trading tools. They provide off-the-shelf and customised solutions to licensed financial institutions.

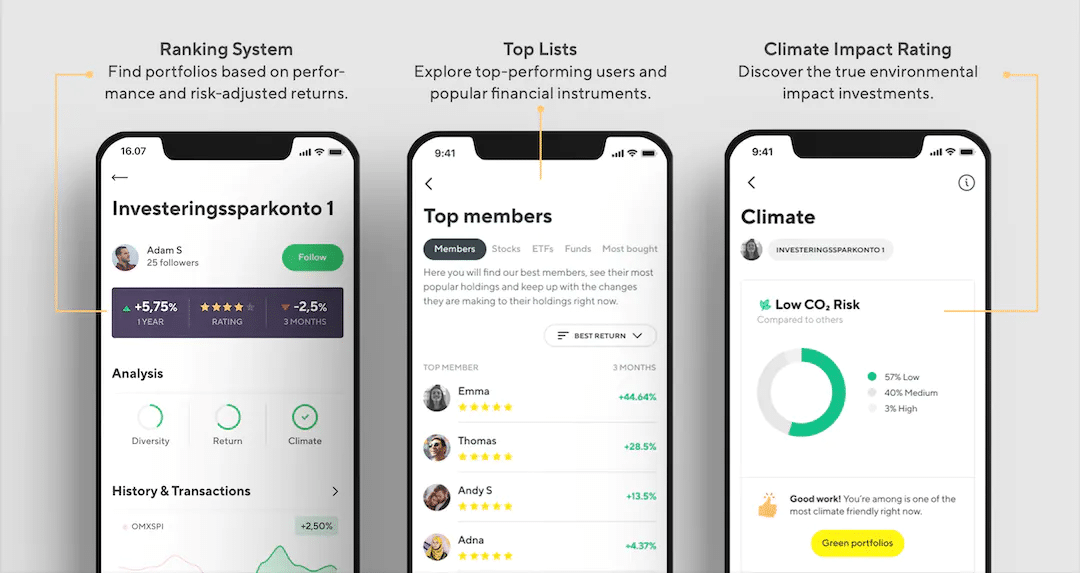

Stock Republic

Offers a white label investing app focusing on social investing and community engagement. Their fully customisable solution allows you to build a profitable platform that aligns with your brand and caters to your specific requirements and preferences.

ETNA

A tech company that provides stocks, ETFs, mutual funds, and options trading platforms with API integration, direct market access, and advanced customisation. It is a great choice for startups or firms targeting professional clients, as it offers a wide range of features and a professional (+ user-friendly) interface.

CMC Connect

An international brokerage firm that provides institutional clients with a white label trading platform with advanced charting tools and focuses on CFD trading. Operational integration can be completed in weeks, allowing clients to expand their offerings quickly.

To ensure a comprehensive evaluation, we will assess these platforms based on several criteria, including:

- User interface and experience: We will evaluate the platform’s usability, intuitiveness, and overall user experience. A well-designed and user-friendly interface is essential for smooth navigation and efficient trading.

- Range of trading features and functionality: We will examine the platform’s available trading tools, order types, charting capabilities, market analysis features, and other functionalities that enhance the trading experience. A diverse set of features can cater to different trading strategies and preferences.

- Level of technology and customisation: We will analyse the technological infrastructure of the platforms and consider the customisation options available, such as branding, layout adjustments, and the ability to tailor the platform to specific trading needs.

- Support and customer service: We will evaluate the level of support and customer service provided by the platform in addition to the availability of ongoing technical support.

Best white label trading & investment platforms compared

| Platform | Interactive Brokers | Saxo Bank | Stock Republic | ETNA | CMC Connect |

| Trading instruments | Stocks, ETFs, Options, Futures, Forex, Commodities, Bonds and Funds | Stocks, bonds, CFDs, Forex, futures, and options | Stocks | Stocks, ETFs, mutual funds and options | Forex, Cryptocurrencies, CFDs on Stocks, ETFs, Commodities and Indices |

| User interface | Professional | Professional | User-friendly | User-friendly and Professional | Professional |

| Desktop app | Yes | Yes | No | No | Yes |

| Web platform | No | Yes | No | Yes | No |

| Mobile app | Yes | Yes | Yes | Yes | No |

| Technical support | 24/7 | 24/7 | Not disclosed but available | Not disclosed but available | 24/5 |

| Integration APIs | Yes | Yes | Yes | Yes | Yes |

| Charting tools | Advanced | Advanced | Basic | Advanced | Advanced |

| Estimated deployment time | 2-3 weeks | Few weeks to months | Few weeks | Few weeks | Few weeks |

| Customization | Intermediate | Limited | Advanced | Advanced | Intermediate |

| White label demo availability | No | No | Yes | Yes | No |

#1 Interactive Brokers

Interactive Brokers at a glance

Interactive Brokers is widely recognised as one of the leading online brokerage firms, and its white label offering further solidifies its position as a top choice for trading and investment solutions. Interactive Brokers’ white branding feature allows businesses, such as brokers and professional advisors, to customise their trading platforms and reporting systems with their own logos and company information and establish a strong brand identity using the IBKR platform. This includes the Trader Workstation (TWS) platform, one of the best trading platforms, Client Portal, a registration system, statements, portfolio analysis, and other tools.

The platform offers access to a wide range of global markets, enabling trading on over 150 markets in 33 countries and 26 currencies, including equities, options, futures, forex, and fixed income. This extensive market coverage enables businesses to cater to the diverse needs of their clients and provides ample opportunities for investment and trading strategies.

Interactive Brokers’ white label solution is backed by its advanced trading technology, which includes robust order management systems, risk management tools, and real-time market data. These features ensure businesses can offer their clients seamless and efficient trading experiences. The platform also supports algorithmic trading, allowing businesses to automate trading strategies and execute trades at optimal prices and speeds.

The white branding program offered by Interactive Brokers caters to three types of users: Registered Advisors, Fully Disclosed Brokers and Non-disclosed Brokers. Each user type has variations in the available customisation options. Registered Advisors, for instance, can white brand emails sent to customers, the TWS Users’ Guide, and the contract database on the IBKR website. However, certain footnotes or legal notes cannot be modified, and agreements like the IBKR Customer Agreement remain unchanged. Fully Disclosed Brokers and Non-disclosed Brokers enjoy greater flexibility in their white branding options.

IBKR also provides brokers with free client relationship management tools, full white branding capabilities, assistance in creating custom websites, flexible client management options, and dependable client onboarding processes. Brokers can manage user access rights, implement adaptable fee structures, automate fee administration, and employ dynamic fee management with electronic invoicing.

While the specific cost of the white branding fee is not disclosed, it can vary based on the level of customisation required and the unique needs of each broker. To get an accurate quote, contact Interactive Brokers and discuss your requirements with their team. Due to the firm’s deep liquidity pools and low-cost trading infrastructure, they offer a competitive pricing structure that allows businesses to offer their clients competitive commission rates and tight spreads. This affordability factor attracts traders and investors and helps businesses maintain a competitive edge in the market.

The application review process typically takes 2-3 weeks, and it is worth noting that they require a minimum funding of $10,000 into the account, which will be applied towards the first five months of commissions.

#2 Saxo Bank

Saxo Bank at a glance

62% of retail CFD accounts lose money.

Saxo Bank, a well-known Danish investment bank, has developed a robust and comprehensive white label program that allows businesses to provide their own branded trading and investment platforms to their customers. It primarily caters to institutional clients, such as banks, brokers, family offices, and fund managers, as well as External Asset Management (EAM), Independent Asset Management (IAM), and Independent Financial Advisory (IFA). Currently, they provide services to over 200 banks and brokers, as well as 300+ financial intermediaries.

One of the standout features of Saxo Bank’s white label solution is its global market access. Businesses utilising this solution gain access to a staggering 71,000+ instruments across margin and cash products. This includes a vast array of financial instruments, such as stocks, with over 23,500 stocks from major markets like New York, Hong Kong, London, and more. Additionally, they provide exposure to 5,900+ government and corporate bonds, 17,400+ mutual funds, 7,000+ ETFs covering various sectors, and even crypto ETFs and ETNs tracking popular cryptocurrencies like Bitcoin and Ethereum. Their solution also offers leveraged products and managed portfolios, where you can target clients with various investment preferences and risk appetites.

Saxo Bank offers a white label solution that provides businesses with the following:

- A pre-launch project management team to help configure and implement the solution.

- Both off-the-shelf solutions and tailored packages to meet specific business needs.

- The full value chain of trading and investment, from execution to post-trade services.

- Daily account management and operational support.

- 24/7 IT maintenance.

- The flexibility to customise and integrate their platforms.

- Professional-grade trading through SaxoTraderPRO.

- Web, mobile, and tablet trading via SaxoTraderGO.

- Intuitive investment on SaxoInvestor.

- Read-only portfolio oversight on SaxoPortfolio.

- Tailored multi-asset liquidity via FIX API.

- Seamless integration into existing systems through REST OpenAPI.

The platform also includes Microsoft Cloud for full scalability and security, real-time redundancy, and incident management.

On the downside, while they do provide a demo for users to explore the features of all the platforms, they do not offer a demo for administrators to see how the solution works from their perspective.

#3 StockRepublic

StockRepublic at a glance

Stock Republic is a software company that provides white label social trading platforms for financial institutions. op-tier banks have used the platform in 5 different markets, with thousands of users, including well-known European investing and trading platforms such as Interactive Investor and Comdirect. Their solution is fully customisable, allowing you to build a profitable platform that aligns with your brand and caters to your specific requirements and preferences. This level of customisation ensures that users have a unique and personalised trading experience.

The white label app offers powerful investment insights and portfolio perspectives. The built-in portfolio analysis provides users with a comprehensive evaluation of their holdings, including risk diversity, return, climate analysis, and ratings. These data-driven insights allow them to make informed investment decisions and improve their trading strategies. The experience can be anonymous, allowing users to create profiles, access personalised feeds, participate in group discussions, and communicate through real-time messaging features without revealing their identities. This creates a safe and secure environment while maintaining privacy.

Stock Republic’s white label app is designed to comply with regulations, ensuring that it meets all legal requirements. Stock Republic takes care of the engineering process, providing guided onboarding and best-in-class customer support. This frees up your team from the development burden, ensuring a seamless integration of the white label app into your existing infrastructure. This comprehensive support ensures a smooth implementation process and ongoing technical assistance. The app can be launched within weeks, facilitating a quick and efficient implementation process.

Stock Republic offers detailed guides on social trading compliance and its framework. Their guide, “Buy vs. Build for Social Trading Applications,” examines aspects to consider when building or purchasing social trading functionality. It covers resources, time to market, support, technology, compliance, costs, and more. You can expect similar assistance when you contact them and schedule a demo.

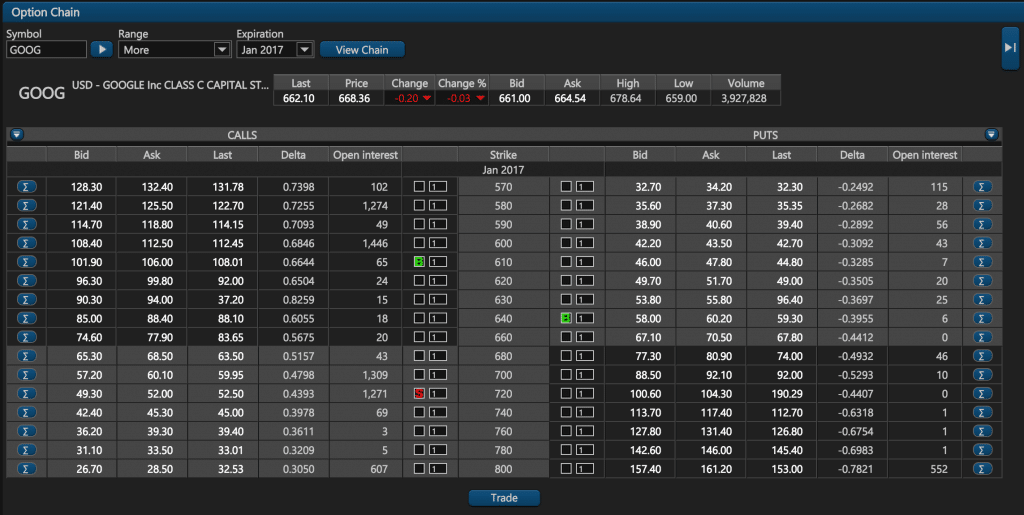

#4 ETNA

ETNA at a glance

ETNA is a leading technology firm that offers a range of cutting-edge software solutions for capital markets. One of their flagship products is the ETNA Web Trading Platform, a white label solution that enables broker-dealers and fintech firms to provide their clients with a world-class trading experience. Moreover, they offer a white label mobile stock trading app that enables brokers and digital wealth management firms to launch online investing from mobile devices within days.

The ETNA Web Trading Platform is a lightning-fast HTML5 trading platform that can be accessed from any device with a web browser. It offers a seamless trading experience without the need for downloads or installations. Their highly customisable mobile trading app can be integrated with existing investment management and trading infrastructure. The result is a synchronised appearance with powerful functionality that meets the needs of self-directed investors.

The white label solution offers a personalised trading experience with drag-and-drop dashboards, widgets, and third-party integrations. It supports multiple monitors, real-time market data, and customisable watchlists. It also provides Level II market depth data, giving traders access to a time-stamped history of all transactions. Users have the ability to customise order routing execution, which can be based on asset classes, and designate eligible accounts or order types for customised order routing. This is ideal if you are willing to launch a Direct Market Access (DMA) trading platform.

The platform offers various order types, from simple trader orders to sophisticated conditional orders. In addition to stocks, the platform includes advanced options trading capabilities, such as option chains with implied volatility and Greeks. Multi-leg options trading is also supported, making the platform a comprehensive solution for options traders.

ETNA Web Trading Platform offers a comprehensive solution for wealth management firms and broker-dealers, integrating news, content, and analytics from various sources to create customised trading dashboards without requiring programming skills. The platform provides responsive customer support, with a dedicated team available to assist with any questions or issues, and features a comprehensive documentation portal and knowledge base with tutorials, user guides, and technical documentation. In addition, ETNA’s platform includes a digital account opening and funding API, which streamlines the client onboarding process and enables wealth management firms and broker-dealers to open investment accounts digitally from web or mobile trading apps, with built-in KYC and risk management tools for automated compliance, thereby eliminating the need for manual paperwork and allowing clients to start trading faster.

#5 CMC Connect

CMC Connect at a glance

Founded in 1989, CMC Group is a leading global provider of online retail financial services, which includes a dedicated institutional offering. In addition to being a broker, CMC offers a white label solution that provides a comprehensive suite of services designed to help startups and businesses succeed in the financial markets. Their white label solutions target clients in Europe, the UK, Australia, and the Middle East.

CMC Connect offers three solutions to help businesses maximise revenue in financial markets:

- White Label allows businesses to brand their trading platform with their own name and logo while leveraging CMC Markets’ advanced technology and infrastructure.

- Grey Label is a neutrally branded platform for regulated entities to introduce or trade on behalf of their clients. It has a native mobile app, a streamlined client application process, and the ability to trade on clients’ behalf.

- Introducing Broker program allows regulated brokers to introduce customers to CMC Markets’ desktop and mobile platforms in return for remuneration.

One of the main advantages of partnering with CMC Connect is its global market access and multi-asset liquidity provision. They offer a wide range of tradable instruments across multiple asset classes, including: 66+ spot FX pairs, 12,000+ CFD stocks from more than 20 countries, 80+ futures, and 1,000+ options, in addition to commodities, treasuries, and equity indices. This means you can offer your customers diverse investment opportunities that meet their unique needs and preferences.

Another significant advantage of partnering with CMC Connect is their liquidity provision, as you gain access to deep liquidity pools, ensuring efficient execution of trades even during volatile market conditions. They also offer professional services to assist you throughout the implementation journey, and after going live with consultation and ongoing support, they provide 24/5 responsive assistance.

CMC Connect’s white label solution boasts an advanced trading platform available on desktop, tablet, and mobile devices. The platform offers a customisable and intuitive interface designed to cater to the needs of experienced retail traders. It provides access to industry-leading charting packages with over 100 technical indicators and drawing tools, facilitating in-depth technical analysis. Additionally, the platform offers innovative trading tools such as client sentiment analysis, pattern recognition scanners, and advanced order execution features like boundary orders, guaranteed stop-loss orders, trailing stops, and more. Including comprehensive market news and analysis from reputable sources, such as Morningstar and Reuters, further enhance the trading experience.

CMC Connect follows a well-defined partnership process to ensure a smooth and efficient collaboration with its clients. The process includes the following steps:

- Understanding Your Needs: CMC Connect’s business development team will engage with you to discuss your requirements and create a tailored solution that best suits your needs.

- Legal Agreements & Due Diligence: CMC Connect will proceed with the necessary legal agreements and due diligence requirements, including signing a Non-Disclosure Agreement (NDA) and finalising the legal agreements.

- Testing & Integration: CMC Connect will work with your chosen technology provider or existing internal setup to ensure seamless integration, typically through an API connection.

- Ongoing Support: CMC Connect’s dedicated relationship manager will provide ongoing support to ensure that their solutions continue to meet your business needs.

Factors to Consider When Choosing a White Label Trading & Investment Platforms Platform

When choosing a white label trading and investment platform, there are several key factors to consider when choosing a provider:

- Security: The provider should offer a secure platform and have a good track record of protecting customer data.

- Reputation: The provider should have a strong reputation in the industry, with a proven track record of stability, reliability, and customer satisfaction. Research their client base and check for references to ensure they have a history of success.

- Market access: The provider should provide access to a large range of markets. Ensure that the markets your clients are interested in are available on the platform.

- Pricing: The platform should be affordable and offer good value for money.

- Support: The provider should offer good customer support and be responsive to your needs. Ideally, they should provide 24/7 technical support.

Once you have carefully selected a set of service providers based on the aforementioned factors, the next step is to examine the technical features they offer. By evaluating these features, you can choose a provider that best meets the needs of your potential customer base. Here are some key technical considerations to keep in mind when selecting a white label provider:

- Flexibility in customisation: Look for a provider that offers a high degree of customisation, allowing you to personalise the trading platform with your own logo, colours, and other visual elements.

- Scalability: The platform should be scalable so that you can grow your business without switching platforms.

- Integrations: The platform should be able to connect with other software you use, such as accounting software or CRM software. Some white label providers offer similar services as part of their package.

- Documentation and training: The platform should have clear and comprehensive documentation to help users learn how to use it, and the provider should offer training to help your employees become familiar with the platform.

- User experience and platform functionality: The platform should be easy to use and navigate, with a clear and intuitive interface that makes it easy for clients to execute trades and manage their portfolios.

By selecting a platform that offers these features, you can give your clients a top-notch trading experience that meets their needs and helps you build a successful investing and trading business.

What is the cost of establishing a white label trading & investment platforms?

The cost of establishing a white label trading and investment platform can vary depending on several factors, such as the provider, the level of customisation, and the features included. Here are some general cost considerations:

- Setup fees: White label platform providers typically charge a setup fee, depending on the complexity of the platform and the level of customisation required.

- Monthly fees: Providers may charge a monthly fee for using their platform. This can start at a few hundred dollars per month and increase depending on the number of users, the volume of trades, and other factors.

- Customization costs: If you want to customise the platform to fit your brand or add specific features, you may need to pay additional development costs.

- Integration costs: These fees may apply if you want to integrate the platform with other systems, such as your own back-end systems or third-party services.

- Ongoing costs: In addition to the initial setup and monthly fees, there may be ongoing costs associated with maintaining the platform, such as software updates, security patches, and customer support.

Conclusion

In conclusion, white label trading and investment platforms offer a unique opportunity for businesses to establish themselves in the financial industry. With the rising demand for digital trading and investment solutions, these platforms provide a cost-effective and efficient means for businesses to tap into this lucrative market.

Our analysis has highlighted the top performers in this space, with Interactive Brokers, Saxo Bank, Stock Republic, ETNA, and CMC Connect emerging as the leading options. Each of these platforms offers a distinct set of features and benefits, catering to various business needs and requirements.

Ultimately, selecting a provider that offers transparent pricing and comprehensive services is essential to help you manage costs. Make sure to inquire about all of the fees and services included in the package, as well as any additional costs that may arise, and check the key factors that affect your users’ experience. It is also a good idea to check if a demo is available so that you can experience the platform firsthand.

FAQs

What is a white label trading and investment platform?

A white label trading and investment platform is a software solution that allows businesses to create their own branded trading and investment platforms without developing the technology and infrastructure from scratch. The platform is designed to be customised with your branding, logo, and brand colours. You can choose from variouspre-built templates or work with a provider to create a custom design. The platform typically includes a range of features, such as trading tools, charting software, and real-time market data.

What are the benefits of using a white label trading and investment platform?

The main benefits of using a white label trading and investment platform are:

- Cost-effectiveness: White label platforms are typically much more affordable than developing a platform from scratch.

- Time-efficiency: White label platforms can be up and running in a matter of weeks, compared to the months or even years it can take to develop a platform from scratch.

- Expertise: White label platforms are typically developed by experienced trading and investment professionals, so businesses can be confident that they are using a platform that is reliable and secure.

- Ability to focus on your core business: You can avoid the distraction and complexity of developing and maintaining the platform, so you can focus on your core competencies, such as onboarding clients, conducting research, and providing other services.

Can I integrate the platform with other systems?

Yes, many white label trading and investment platform providers offer APIs and integrations with other systems, such as CRMs, back-office systems, and third-party trading platforms.

How long does it take to implement a white label trading and investment platform?

Implementation times can vary depending on the provider and the complexity of your requirements. Some providers offer rapid deployment options that can have you up and running in a matter of weeks, while others may require several months for a more customised implementation.