Hedge funds rely heavily on prime brokers as they offer crucial services such as managing risks, providing access to financial instruments, and facilitating trades. That’s why selecting the most appropriate prime broker is fundamental for any hedge fund.

In this article, we’ll take a closer look at the best prime brokers for hedge funds in 2025. We’ll explain what a prime broker is, how to choose the right one for your needs, and provide an in-depth review of the solutions available in the market. By the end of this article, you’ll better understand what to look for in a prime broker and which providers are worth considering for your hedge fund.

What is a Prime Broker?

A prime broker is a specialized financial institution that provides a range of services to institutional clients, with a particular focus on hedge funds. These funds employ complex investment strategies to generate higher returns for their investors and rely on prime brokers to access liquidity and efficiently move capital. Prime brokers are integral to the functioning of financial markets, as they assist hedge funds in implementing their strategies, managing risks, optimising returns, and expanding their businesses. Prime brokers charge fees and commissions based on the volume and complexity of their client’s transactions in exchange for these services.

Some of the key services offered by prime brokers to hedge funds include:

- Intermediary Services: Prime brokers act as intermediaries between hedge funds and other counterparties, such as large institutional investors, enabling hedge funds to access liquidity and execute trades efficiently.

- Cash Management: They offer cash management services to manage the cash flows of hedge funds on a large scale, including cash sweep accounts, foreign exchange, and money market funds.

- Custodial Services: Prime brokers typically provide custodial services, which involve holding securities and other assets on behalf of their clients to ensure safekeeping and proper accounting.

- Trade Clearing and Settlement: Hedge funds use prime brokers to facilitate the clearing and settlement of trades to simplify reporting and operations further.

- Securities Lending: Prime brokers offer securities lending services that allow hedge funds to borrow securities from other large investors. The borrowed securities are used for various purposes, such as short selling or hedging.

- Leveraged Transaction Execution: They facilitate leveraged transactions by providing lines of credit to amplify the investment returns of hedge funds.

- Risk Management: Prime brokers provide risk management services, including daily risk and performance analysis, using partnerships with third-party risk management service providers.

- Capital Introduction: They facilitate capital introduction by connecting their clients with potential investors from the prime broker’s asset management and private banking clients.

- Research Services: Prime brokers offer hedge funds access to premium research services to inform their investment strategies and decisions.

Now, let’s have a look at some of the top prime brokers for hedge funds.

Best Prime Brokers for hedge funds

Interactive Brokers

A top prime broker that provides a wide range of services, including trading, clearing, custody, reporting, and securities financing, to hedge funds. It offers a complete one-stop solution that integrates with the IBKR Trader Workstation.

Goldman Sachs

Goldman Sachs’ Marquee platform is a comprehensive digital marketplace for institutional investors that provides hedge funds with cross-asset tools and services to manage their portfolios more effectively.

Saxo Bank

A leading provider of prime brokerage and execution services to hedge funds, offering multi-asset execution, integrated custody, clearing, and post-trade services across a wide range of markets and instruments.

IG

With more than 45 years of experience in the trading industry, IG provides institutional prime services, offering synthetic, custody, trading, and financing solutions to a diverse range of clients, including hedge funds.

UBS

A globally-renowned financial institution with over 150 years of experience providing clients with financial services. The bank offers customized prime brokerage services to hedge funds, including daily management of accounts, technology solutions, and access to market data and research through the UBS Neo platform.

1# Interactive Brokers

Interactive Brokers at a glance

Interactive Brokers is a well-established prime brokerage firm that offers innovative and technology-driven services to its clients. The company has been in the business for over 44 years and has executed trades for its clients on more than 150 market centers in 33 countries, giving it a unique competitive advantage in today’s rapidly changing markets.

As one of the Top Prime Brokers, Interactive Brokers offers a wide range of services, including trading, clearing, custody, reporting, and securities financing, to hedge funds. The company is focused on delivering cost-sensitive solutions that provide real advantages to institutions through around-the-clock global service coverage and a strong balance sheet that ensures customer fund protection and consistent performance.

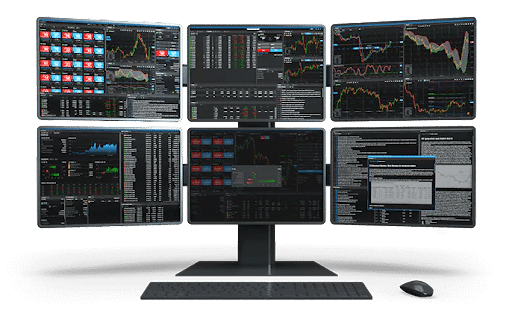

One of the main benefits of Interactive Brokers’ prime brokerage services is the IBKR OMS, a complete one-stop solution that integrates with the IBKR Trader Workstation (TWS). This fully integrated OMS/EMS setup is ideal for institutions looking to reduce costs and improve productivity, as it offers order management, trading, research, and risk management, operations, reporting, compliance tools, clearing, and execution, all as part of the complete platform. The IBKR OMS is also customizable and can be used within a current multi-broker setup.

The IBKR OMS offers a comprehensive range of features at highly competitive prices, making it a valuable choice for customers. The monthly minimum IBKR commission is $2,500, and an additional $100 is charged per month for each linked executing broker. This includes 25 terminals, with an extra $100 per month for each additional terminal, with no installation fees or term commitment. Furthermore, regular commission charges are applied to all orders routed through IBKR, offsetting the monthly minimum.

Interactive Brokers also offers securities financing services that combine deep stock availability, transparent stock loan rates, global reach, dedicated support, and automated tools to simplify the financing process. The company also provides margin financing, the ability to take up trades from other brokers, along with corporate actions and customer service.

Hedge funds can benefit from Interactive Brokers’ Hedge Fund Marketplace, an online capital introduction program that allows hedge funds that use IBKR as their principal Prime Broker to market their funds to IBKR clients, including Accredited Investors. This program provides hedge funds access to a sophisticated and high-net-worth client base and allows them to raise capital efficiently, making it an important tool to reach potential investors and grow their assets under management.

Additionally, Interactive Brokers provides a range of powerful trading technology and tools to help hedge funds manage their assets and succeed in their trading strategies. These tools include trading platforms, order types and algorithms, API solutions, sophisticated risk management, fractional trading, reporting and & analytics, and several other advanced trading tools. Moreover, the company offers a Soft Dollar Commission Program, which gives hedge funds the flexibility to offset the costs of purchasing approved research products and services.

Interactive Brokers offers two different fund account structures, Multiple Fund and Allocation Fund accounts, to help investment managers set up different structures to meet their needs. Accounts are accepted from citizens or residents of all countries except those on the US Office of Foreign Asset Controls’ sanction list or other countries determined to be higher risk.

Finally, Interactive Brokers provides detailed video tutorials for each step of the process and has a dedicated sales team for institutional investors in every geographic region, ensuring that hedge funds have access to the support and guidance they need to optimize their use of the platform and make the most of their investments.

2# Goldman Sachs

Goldman Sachs at a glance

Goldman Sachs is a leading provider of prime brokerage services to hedge funds. The firm offers a range of customized solutions that are tailored to meet the unique needs of each client. Its prime brokerage platform provides hedge funds with access to a comprehensive suite of services, including financing, securities lending, margin financing, trade execution, clearing, and reporting.

Marquee is Goldman Sachs’ digital marketplace for institutional investors, offering a range of cross-asset tools and services to help hedge funds manage their portfolios more effectively. It provides unparalleled access to global markets, enabling hedge fund managers to execute a wide range of investment strategies with greater speed, efficiency, and transparency. With Marquee, hedge funds can access the tools and insights they need to make informed investment decisions, monitor their portfolios in real-time, and maintain liquidity while building their businesses.

One of the key benefits of Marquee is its management tools, which include products and services to support cash, locate, report, and trade oversight. For example, the platform offers cash management tools that enable hedge funds to move cash rapidly and seamlessly, with careful and transparent oversight in place. This includes initiating multiple outgoing wire transfers, incoming receipts, and cash journals simultaneously, customize and share views, upload multiple payments/receipts, instructions, or journals, and approve transactions with just two clicks.

Another feature of Marquee is its trade management tools, which provide a consolidated view and enhanced functionality for managing trades. Hedge funds can enter trades matched status, make trade amendments, and monitor activity on an intraday basis, with access to enhanced trade data, including settled trades and US and international trade matching, featuring customizable and savable views. Additionally, Marquee offers a vast library of market content and rich analytics exclusively for the hedge fund industry, including in-depth Prime Analytics data on hedge fund performance and positioning metrics. Overall, Marquee provides hedge funds with the tools and insights they need to manage risk, maintain liquidity, and build their businesses with greater speed, efficiency, and transparency.

Goldman Sachs also offers a Capital Introduction team that connects hedge fund clients with leading institutional investors worldwide. The team provides pre-marketing consultation and introduction programs and organizes investor events and conferences. Moreover, the firm’s clearing expertise provides clients a platform to execute and settle transactions on over 97% of global equities and derivatives exchanges. Lastly, the firm’s Consulting Services team offers hedge fund managers support in launching, building, and managing their businesses, providing budgeting and cash flow projection, real-estate sourcing strategies, vendor analysis, talent sourcing strategies, and more.

3# Saxo

Saxo at a glance

62% of retail CFD accounts lose money.

Saxo offers an extensive range of prime brokerage and execution services to hedge funds, covering all types of strategies. This means that hedge funds can execute their strategies from a single margin account, covering over 70,000 instruments, reducing complexity and costs. Saxo provides multi-asset execution and integrated custody, clearing, and post-trade services to allow hedge funds to access real-time risk management, financing, and clearing across multiple asset classes.

Saxo is trusted by over 200 banks and brokers and 400+ financial intermediaries. It provides 24/5 expert service, allowing hedge funds to access senior sales traders, expert market analysts, and personal relationship managers who can provide strategic guidance and support. Additionally, Saxo provides 24/7 IT maintenance, constantly monitoring IT systems for continuity management.

Hedge funds can trade across a wide range of markets and instruments, including Forex, CFDs, stocks, ETFs, FX options, listed options, futures, bonds, and mutual funds. Saxo offers access to over 190 FX spot pairs and 130 forward outrights, 9,000+ CFDs across stocks, indices, FX, commodities, and bonds, and over 22,000 stocks on 50+ exchanges globally. Hedge funds can also access 7,300+ ETFs and ETCs, plus ETNs on cryptocurrencies, puts and calls on 40+ FX vanilla options, and 3,100+ equity, index, and futures options on metals, energy, and rates.

What sets Saxo apart from other prime brokers dedicated to hedge funds is the ability to quickly launch a Singapore-domiciled Variable Capital Company (VCC) vehicle. This provides hedge funds with greater operational flexibility and other advantages of the VCC structure. Saxo provides accelerated onboarding to the VCC structure and supports funds looking to expand from managed account structures into a fund structure.

Saxo provides execution with tier 1 liquidity sourced from multiple global venues. Hedge funds can execute multiple strategies across global macro, event-driven, CTA, systematic traders, long-only and long-short equity. Saxo also provides a gateway to China’s capital markets, allowing hedge funds direct electronic access to Chinese bonds and stocks.

Finally, Saxo’s technology helps hedge funds access and execute across global capital markets through its multi-asset prime brokerage and execution services, proprietary platforms, and connectivity and APIs. The award-winning, multi-device SaxoTraderGO partners seamlessly with SaxoTraderPRO, providing a fully customizable, professional-grade platform. With access to 70,000+ instruments across all asset classes and a suite of risk-management tools, hedge fund managers can benefit from powerful tools and features to trade, invest, or hedge from a single platform and account.

4# IG

IG at a glance

70% of retail CFD accounts lose money.

IG provides institutional prime services to a diverse range of clients, including hedge funds. With more than 45 years of experience in the trading industry, IG is a reputable company listed on the London Stock Exchange (LSE) and part of the FTSE 250 companies. Since 2006, IG has been offering prime brokerage services, catering to the specific needs of institutional clients.

IG’s focus is on building long-term partnerships with its clients, offering synthetic, custody, trading, and financing solutions. The company provides web-based and mobile platforms engineered for speed, stability, and resilience, processing around 15 million trades per month and providing access to more than 40 global financial markets. IG’s proprietary platform, L2 Dealer, enables Direct Market Access (DMA) execution using native, synthetic, and algorithmic order types supported by Tier 1 bank smart order routing (SOR) technology. The platform also provides a professional-grade trading experience, allowing clients to manage both synthetic and cash trading and schedule end-of-day reports for delivery via SFTP. Additionally, IG supports third-party trading access via FIX, MT4, API, and Bloomberg EMSX.

IG’s extensive liquidity and diverse range of assets offer clients ample opportunities to execute trades across a broad spectrum of asset classes. These include access to over 17,000 equities, more than 80 major, minor, and exotic currency pairs with 24-hour liquidity, a wide selection of commodities, with no fixed expiries on 31 key markets such as metals, energies, and softs, and over 30 major and niche indices, with 24-hour dealing available on 26 key markets.

Clients receive comprehensive support throughout their relationship with IG Prime Services. The company has a dedicated technical development team that works to ensure seamless integration between IG’s systems and the clients’ systems in the shortest possible time. Its technical experts are available around the clock, and a dedicated account manager is assigned to each client.

Hedge funds, in particular, can benefit from IG’s world-class execution technology and multiple external venues, with access to multiple liquidity venues and IG’s proprietary professional platform. Clients can also benefit from customizable reporting through IG’s web-based back-office application, providing complete visibility of their accounts in real-time. Multiple trading platforms, including fast and intuitive desktop and mobile platforms, are also available, as well as algorithms like VWAP, TWAP, Percentage of Volume, Pegged, Implementation shortfall, and Target close instructions.

5# UBS

UBS at a glance

UBS is a globally recognized financial institution that has been providing services to clients for over 150 years. The bank offers a wide range of financial services to private, institutional, and corporate clients, including prime brokerage services to hedge funds. It has built a reputation for providing high-quality services focusing on successful client outcomes.

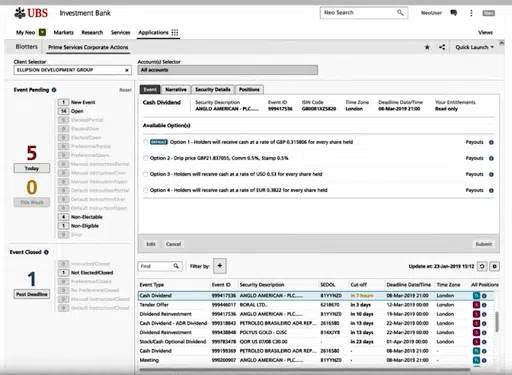

UBS offers a comprehensive suite of prime brokerage services to hedge funds tailored to their financial objectives. The services include access to dedicated specialists in accounting, margin, operations, swaps, and securities lending who work closely with hedge funds to provide a customized service. This includes the daily management of their accounts and customized technology solutions, as well as access to market data, experts, trading insights, and research through the UBS Neo platform.

UBS Neo offers institutional investors access to the equities offering of UBS through a single platform, which includes Cash Equities, Equity Derivatives, Prime Brokerage, and Equity Financing Services. The platform provides differentiated content, portfolio management tools, and reporting and analysis capabilities to help investors make informed investment decisions. UBS Neo’s offering also includes a range of advisory services that cover different locations, assets, and sectors.

In addition, UBS Neo provides Transaction Cost Analysis tools that offer detailed statistics and visualizations to help investors monitor and analyze their cash trading performance. The platform also offers Smart search, follow, alerts, market snapshots, custom view, and charting tools, enabling investors to stay in touch with the markets, companies, and stocks of interest quickly and easily. Finally, UBS Neo’s Global Financing Services provides asset managers access to a network of clearing and settlement, securities lending, cash management, and reporting capabilities, all in one place.

Factors to consider when choosing a label provider

Choosing a prime broker is an essential step for institutional investors, especially for hedge funds. It’s important to keep in mind several factors before making a final decision. Here are some critical factors to consider:

- Reputation: The prime broker’s reputation is one of the most important factors to consider. It’s crucial to investigate the broker’s history, regulatory compliance record, and financial stability. Selecting a broker with a good reputation can ensure reliable and trustworthy services.

- Services offered: Prime brokers provide a range of services, including financing, custody, and trading. Before selecting a broker, it’s important to ensure that the broker offers the specific services you require. For instance, the ability to trade in particular markets, access to research, or customized reporting.

- Technology and infrastructure: Prime brokers depend heavily on technology to offer their services. Investors should evaluate the broker’s technology infrastructure, including trading platforms, risk management systems, and connectivity options. A broker with a reliable and efficient technology platform is likely to offer better service and execution.

- Counterparty risk: Prime brokers act as intermediaries between investors and markets. Investors should evaluate the counterparty risk associated with the broker, including their creditworthiness, capitalization, and balance sheet strength.

- Pricing: Prime brokers charge fees for their services, including commissions, financing rates, and other charges. Investors should compare pricing structures across brokers to find the best value for money.

- Customer support: Prime brokers offer customer support to their clients, including technical support, account management, and access to research. It’s essential to evaluate the quality and responsiveness of the broker’s customer support to ensure that you receive the support you need.

- Regulatory compliance: Prime brokers are subject to regulatory oversight in the jurisdictions they operate. Investors should verify that the broker is regulated and licensed by the relevant authorities and is compliant with relevant regulations.

Other resources

If you’re still unsure which alternative to choose, feel free to explore our website, as well as our Youtube channel, where we dive into the best brokers in several regions, as well as provide step-by-step guides on how to invest in some of these platforms.

If you’re still unsure, feel free to contact us or just book a meeting with us.

Conclusion

In conclusion, launching a new hedge fund can be a daunting task, but appointing an experienced prime broker can make the process easier and provide valuable support for the fund’s future growth. A prime broker can offer a range of services that can make the process of setting up a new hedge fund easier while also becoming a long-term partner in the fund’s growth. They can also provide valuable advice on how to avoid costly mistakes, making them a crucial part of a hedge fund manager’s team. Additionally, a prime broker’s capital introduction service can help fund managers raise capital more efficiently by connecting them with the right investors at the right time.

Our article has provided an overview of the top prime brokers for hedge funds. We have highlighted the key features of each broker and the services they offer. While each prime broker has its own unique strengths and advantages, the decision ultimately depends on the specific needs and goals of the fund manager.

Prime Brokers for hedge funds FAQs

What is a prime broker, and why do hedge funds need one?

A prime broker is a financial institution that offers hedge funds various services, including trade execution, financing, and custody services. Hedge funds require a prime broker to access financial markets, manage their assets, and assist with administrative tasks.

How many prime brokers should a hedge fund have?

Typically, hedge funds have at least two prime brokers – one large and one mid-sized. Having multiple prime brokers can offer diversification, access to a broader range of services and counterparties, and negotiating power in terms of pricing and terms.

Can hedge funds negotiate pricing and terms with their prime brokers?

Yes, hedge funds can negotiate pricing and terms with their prime brokers, particularly if they have significant assets under management or generate a substantial trading volume. It’s vital for hedge funds to comprehend the pricing models and fee structures of various prime brokers and negotiate terms that align with their business requirements.