Have you ever imagined that one day, you could have complete control of your finances in the palm of your hands? That’s a reality, and when looking for investing apps, you will not run out of options. Whether you are an Android or iOS user, you have a broad offering that can help you monitor asset prices, your overall portfolio, and trade!

What is the right one for you? It all comes down to your needs. We have selected some prominent investing apps that are best for specific asset classes and include other criteria, such as a user-friendly platform, a wide variety of order types, and good search functions.

Best Investing Apps in Europe for 2025

Disclaimer: Investing involves risk of loss.

Comparison of the best investing apps in Europe

| Broker | Minimum deposit | Products | US stock fees | Regulators |

| Interactive Brokers | €/$0 | Stocks, ETFs, Options, Futures, Forex, Commodities, Bonds and Funds | Tiered plan: $0.0035 per share (Min. $0.35; Max. 1% of trade value.) | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB |

| eToro | $50 (varies between countries) | Stocks, ETFs, Forex, Crypto, CFDs on Stocks, ETFs, Cryptos and Commodities. Social Trading, Copy Portfolios | $1 | FCA, CySEC, ASIC |

| DEGIRO | €/$/£1 | Stocks, ETFs, Investment Funds, Futures, Leveraged Products, Bonds and Warrants | €/£1 (+ €/£1 flat handling fee + connectivity fees) | AFM and DNB |

| XTB | €/$0 | Stocks, ETFs, Forex and CFDs on Stocks, ETFs, Indices, cryptocurrencies and commodities | €0 (Up to €100.000 in monthly volume transactions) | FCA, KNF, CySEC, DFSA and FSC |

| inbestMe | €5,000 (€1,000 for Spanish investors) | ETFs and Index Funds | Not Applicable | CNMV |

| Lightyear | €/£/$1 | Stocks, ETFs, and MMFs | 0.10%, up to $1 max per order | EFSA and FCA |

Interactive Brokers at a glance

Founded in 1978 and publicly listed in NASDAQ (ticker: IBKR), Interactive Brokers is a global online broker with a strong capital position, conservative balance sheet, and automated risk controls.

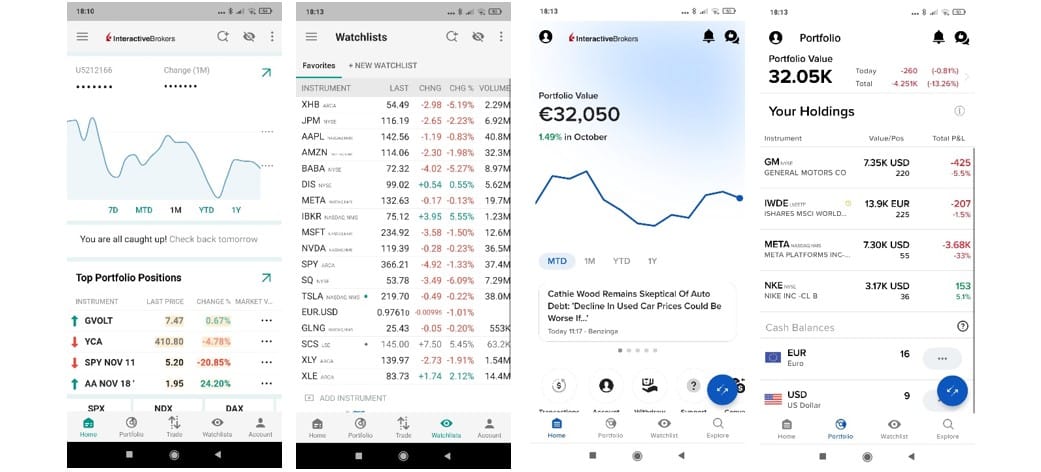

Interactive Brokers offers two separate mobile apps:

- IBKR Mobile: an advanced mobile trading app that gives you access to a wide range of products (stocks, options, mutual funds, ETFs, futures, bonds, and currencies) from 150 markets, EventTrader, Impact Lens, and a set of technical and fundamental tools.

- IBKR GlobalTrader: With a modern design, it focuses more on beginners and investors who do not require active trading. You can only trade stocks, ETFs, and options, plus basic features like deposit/withdraw money, fractional shares, and currency conversion.

On the downside, Interactive Brokers’ fee structure is quite complex, and the broker doesn’t offer commission-free trading. However, when considering FX fees, narrower spreads, and the stock loan program, Interactive Brokers’ clients still get significant savings compared to most brokers.

Want to know more about Interactive Brokers? Check our Interactive Brokers Review.

eToro at a glance

61% of retail CFD accounts lose money.

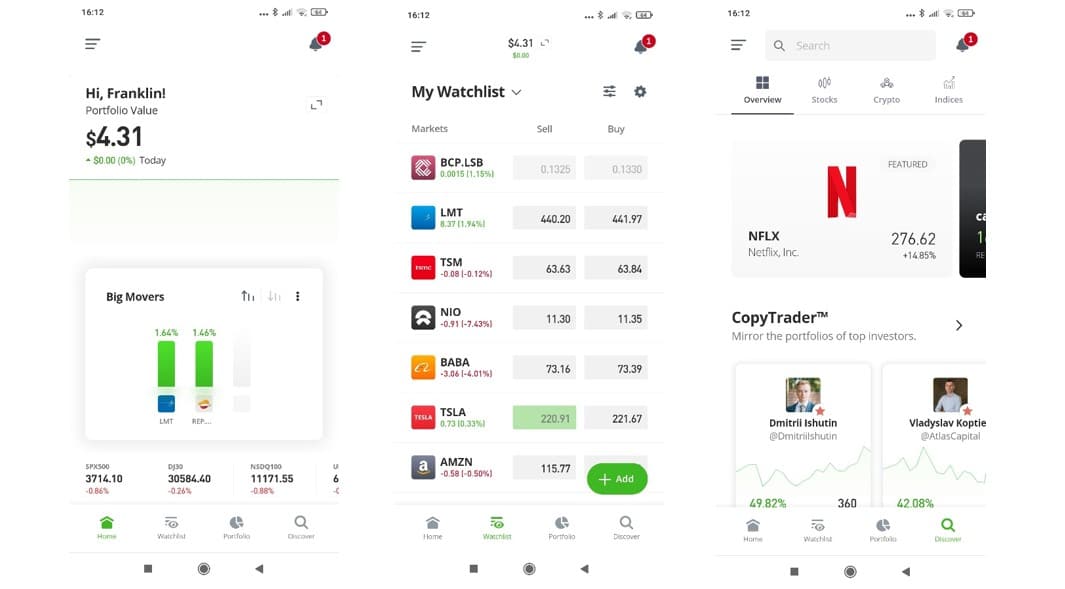

eToro is a multi-asset platform and the leader in social trading with no number two platform in sight! With over 30 million users worldwide, it lets you copy other people’s trade, invest in smart portfolios, or invest for yourself in ETFs with 0% commissions (other fees apply), plus cryptos and a bunch of CFDs in several asset classes. Besides, US, EU and UK stocks have a commission of $1 per trade.

eToro mobile app offers the same features as their web version but on a smaller screen. It “shrinks” everything into an intuitive mobile app. You can construct and monitor your portfolio (3,000+ financial assets available), check for alert notifications, follow other investors, deposit/withdraw money, and contact customer support.

eToro is regulated by top-tier financial authorities like the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

On the downside, it charges a 5$ commission per withdrawal, and you may incur spreads and overnight fees if you leverage your positions through CFDs.

If you are interested, please read our eToro Review.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

DEGIRO at a glance

Investing involves risk of loss.

Founded in 2013, DEGIRO is a low-cost brokerage firm available in 15 European countries. With over 2.5 million users, the innovative platform has become widely known for being a good execution platform without deposit/withdrawal fees and with a list of commission-free ETFs (external costs apply).

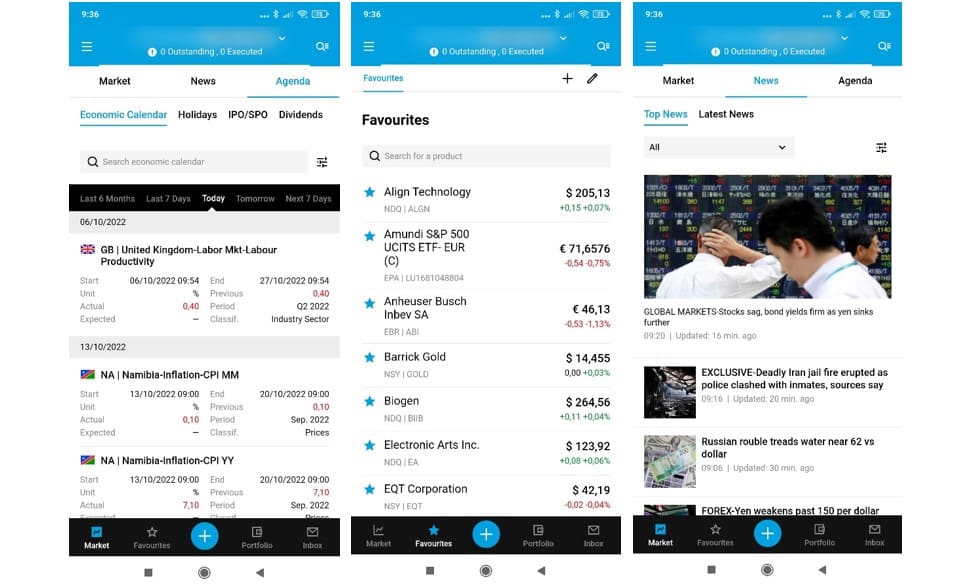

The DEGIRO mobile app is an excellent complement to the web version. The app offers a decent mobile experience with a valuable search bar, a good portfolio summary, and a broad overview of market events and live news.

Some of its flaws are the absence of significant fundamental research, a €/£2.50 connectivity fee, and missing pricing alerts.

Regarding security, DEGIRO is the Dutch branch of flatexDEGIRO Bank AG (a German-regulated bank). It falls under the German Investor Compensation Scheme, compensating losses from non-returned assets up to 90% (with a maximum of €20,000). Furthermore, any money deposited on a DEGIRO Cash Account with flatexDEGIRO Bank AG will be guaranteed up to €100,000 under the German Deposit Guarantee Scheme.

Still any doubts? Go through our DEGIRO Review!

XTB at a glance

69-80% of retail CFD accounts lose money.

Established in 2008, XTB is a well-known online broker with a presence in over 13 countries. It has two trading platforms (xStation 5 and xStation Mobile), a diverse range of tradeable instruments, exceptional customer service, and many free educational materials.

xStation Mobile is a premier application for charts and technical analysis, with the ability to apply numerous indicators like moving averages, volume and pivot points. Navigation is simple, with an intuitive order placing for any asset class.

On the negative side, XTB has a limited product portfolio, and it charges a €10 monthly inactivity fee (after 1+ year with no activity plus no deposit in the last 90 days), which may jeopardize investors looking for long-term investments.

You can check our XTB review for more insights.

inbestMe at a glance

inbestMe is a Robo-Advisor that allows you to build a customized portfolio based on your financial objectives and risk tolerance. It is fully automated and even offers tax-loss harvesting (tax efficiency). It charges a maximum management fee of 0.41%/year. Access to a human advisor is available for amounts above €100,000.

The inbestMe app is not particularly relevant when compared to the brokers’ app since you do not have the purpose of trading, following the news or set alerts. The main functions will be to deposit/withdraw and follow your current portfolio through your investment dashboard. Nonetheless, it is a smooth app, and in the palm of your hand, you check how your portfolio evolves.

You have four available ETF investment styles: inbestMe ETF, inbestMe ETFs Dynamic, inbestMe ETFs Value, and a Socially Responsible Investing ETF. You can start investing in this portfolio with a minimum of €/$5,000.

InbestMe is regulated and supervised by the CNMV (National Securities Market Commission), the body supervising and inspecting the Spanish securities markets. Your investments are protected up to €100,000 by FOGAIN, depending on which Interactive Brokers account is opened (€20,000 for IB Ireland and up to $500,000 for the IB United States).

Lightyear at a glance

Terms apply, seek guidance if necessary. When you invest, your capital is at risk.

Lightyear is an emerging investing app in Europe. Its user-friendly and well-designed mobile trading platform features an efficient search function and neatly organised asset groups. It’s available for both Android and iOS. One drawback compared to the web platform is that the mobile app is only available in English.

In the mobile app, you are prompted to choose a 4-digit PIN to secure your app. One notable feature of the mobile app is that it allows you to use biometric data (Face ID or fingerprint) to log in.

You can find a search bar at the top and essential information, such as the announcement “You’re earning interest”, “Popular this week” or “Discover”. These sections are further divided into Stocks and ETFs, serving as a collection of “Trending Assets” on the platform for the current week. The Lightyear mobile app offers Market, Limit, and recurring orders, just like the web trading platform. However, it’s essential to note that compared to competitors such as Interactive Brokers, the order choices are somewhat limited.

Lightyear operates under the regulations of Estonia and the UK authorities. Lightyear Europe is directly regulated by the Estonian Financial Supervision Authority (EFSA) -4.1-1/31. In the UK, Lightyear UK Ltd, which is authorised and regulated by the Financial Conduct Authority.

Disclaimer: Capital at risk. The provider of investment services is Lightyear Financial Ltd for the UK and Lightyear Europe AS for the EU. Terms apply: lightyear.com/terms. Seek qualified advice if necessary.

Bottom line

To summarize here’s the list of “Best Investing Apps in Europe”:

Understanding the need for a sound investment journey is crucial. Knowing the proper app to perform that task is also essential! We understand that the information concerning investing apps is dispersed online, so we hope our suggestions give you a clear path on which one may suit your needs.

Remember that this article should not be construed as investment advice but should be considered information only. Investors should do their own research and due diligence regarding the services and opportunities best suited for their risk tolerance.

FAQs

What is an investment app?

An investment app is a mobile application available in Android, iOS and other operating systems that allows you to access your investments without the need to login into the desktop version of any investment platform. Most investment platforms develop their own trading apps for customers to use.

What is the best trading app?

As much as we would like to give a straight answer, there is no “correct” one. What are you looking for? Trade ETFs, Stocks, a mix of both? Do you value educational materials? Is good customer support non-negotiable for you? It all depends on your personal preferences.

Is it recommended for beginners?

Yes, since it allows you to check your overall portfolio and live news and, in some apps, even gives you access to educational videos. Still, beware that an app-based trading platform can induce overtrading. The power of investing in the palm of your hand sounds appealing, but it can harm you if you don’t use it wisely.

How much money do I need to open an investment app?

Go to the Play Store, Apple Store or any similar app store, search for the app you are looking for, download it and simply follow the instructions after clicking sign-up.

How do I open an account with an investment app?

Go to the Play Store, Apple Store or any similar app store, search for the app you are looking for, download it and simply follow the instructions after clicking sign-up.

What assets can you trade on investing apps?

It will depend on your investment app/platform. Generally, you can trade a wide range of financial products, such as Stocks, ETFs, Options, Cryptocurrencies, Funds, and CFDs on Indices, commodities and currencies.

Are investing apps safe?

Yes! Most mobile apps require authentication through two-factor authentication and other layers of security such as fingerprint and face ID. Plus, any regulation and investor compensation scheme applicable to the broker also includes their mobile app.