Apple is no longer just a provider of hardware products such as iPhones, iPads, iMacs, and Airpods. They provide a whole suite of ancillary services from entertainment to now even throwing their hand at banking.

In April 2023, Apple launched its high-yield savings account with an annual return of 4.15% to its U.S. customers. This generated a huge buzz among Apple enthusiasts; the new savings account drew in nearly $1 billion in deposits in the first 4 days alone.

Unfortunately, the Apple Savings Account is currently not available to European customers. To be eligible to open an Apple Savings account, you must be a U.S. resident with a valid, physical U.S. address. Apple has no official plans to extend the high-yield savings account or the Apple Card in Europe or elsewhere outside the U.S.

We think Wise has the closest product offering to Apple for European customers. With Wise, you earn 3.24% interest on your Euro balances and access to a card that can be linked to your Apple Pay account.

Why is the Apple Savings Account not available in Europe?

The Apple Savings Account is not available in Europe because this product’s financial viability is tied to the Apple Credit Card, which is also not available to European customers. In the US, you can only open an Apple Savings Account with an active Apple Card.

Apple faces a big challenge in rolling out these services in Europe due to the EU regulations limiting interchange merchant service fees. These limits are 0.2% for debit cards and 0.3% for credit cards. There are no such limits in the U.S.

It is not uncommon for retailers to be charged more than 3% interchange fees in the U.S. market, which makes the US market far more lucrative from Apple’s perspective. Many US retailers are, however, willing to accept these excessive rates due to the reputation of Apple customers being more valuable than the average customer.

So, if and when the Apple Card is launched in Europe, it is likely that the features and offers may be very different from what is being offered to US customers due to the fundamental differences between how each market operates.

Key features of High-Yield Apple Savings Account

There is no catch – that makes Apple’s High-Yield Savings account stand out for so many people. Usually, when a bank or any other institution is offering, what seems to be a great interest rate, some terms and conditions make it challenging to get the full benefit of the offer.

Here are some of the key features of Apple’s Savings Account:

- Interest rate of 4.15% APY

- Interest begins to accrue on the business day that Apple post your deposit to your Account

- No fees

- No minimum deposits

- No minimum balance requirements

- Maximum balance limit $250,000

- Account provided by Goldman Sachs

- Covered by FDIC insurance

Alternatives to the Apple Savings Account in Europe

| Bank/ Brokerage Firm/eMoney Institution | Interest Rate on Euro | Interest Rate on USD |

| Lightyear | 2.30% | 4.36% |

| Interactive Brokers* | IBRK Pro 1.214% | IBRK Pro 3.83% |

| Wise | 2.24% | 4.08% |

| Scalable Capital | 2.25% | n/a |

As of 02/05/2025.

*Both EUR and USD rates are dictated by the formula “(BM – 0.5%)”. Rates may change

Lightyear

- Interest rate on offer: 2.30% on Euro and 4.38% on USD balances (as of May 2025)

- Accepts deposits from Apple Pay: Yes, Apple Pay and Google Pay are among the accepted deposit methods.

- How often interest is paid: Interest is accrued daily and paid on the 1st of every month.

- Limitations: There are no restrictions or limits on the interest you can earn with Lightyear.

- Safety: Not covered by a deposit guarantee scheme, but safeguarding is in place for customer funds. While your funds are not covered by a conventional deposit guarantee scheme when you hold them with Lightyear, they do have to safeguard customer funds. Uninvested customer funds are stored separately from Lightyear’s business funds with regulated EU credit institutions and money market funds. The primary institutions where Lightyear holds uninvested customer funds are ABN AMRO Bank in the Netherlands and AS LHV Bank in Estonia, and in BlackRock money market funds rated AAA/mmf by Moody’s, S&P, and Fitch.

Co-founded by former Wise employees, Lightyear sets out to be a platform that allows you to invest your money globally without unnecessary barriers and with a simple, fair, and transparent pricing structure.

Lightyear is available in a large number of European countries, including Austria, Belgium, Cyprus, Croatia, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain, and the UK.

Disclaimer: Capital at risk. The provider of investment services is Lightyear Financial Ltd for the UK and Lightyear Europe AS for the EU. Terms apply: lightyear.com/terms. Seek qualified advice if necessary.

Interactive Brokers

- Interest rate on offer: The maximum interest rates on offer: IBRK Pro 1.214% on Euro balances and 3.83% on USD balances. It may change without prior notice.

- Accepts deposits from Apple Pay: No

- How often interest is paid: Accrued daily and paid monthly.

- Limitations: No interest paid on balances less than €10k.

- Safety: The level of protection you will receive for your money on deposit will vary from jurisdiction to jurisdiction.

The level of protection you will receive on your cash deposited with Interactive Brokers will vary a lot from jurisdiction to jurisdiction, this is something we covered in detail in a separate article if you are interested in learning more about your protections with IBRK and we also have a full review IBRK’s services if you want to dig a little deeper.

Interactive Brokers is a renowned online brokerage firm that offers individuals and institutions a wide range of investment and trading services.

In terms of the IBKR interest rates offering, IBRK offers different interest rates on each currency, from USD to ZAR.

Unfortunately, you won’t earn interest on your first €10k of your Euro cash balance with IBRK.

Accounts with a Net Asset Value (NAV) of USD 100,000 or more are paid interest at the full rate for which they are eligible. Accounts with NAV of less than USD 100,000 (or equivalent) receive interest at rates proportional to the size of the account.

This makes it more difficult to determine the interest rate you will receive. Still, Interactive brokers have a calculator you can use to try and estimate your interest earnings.

Wise

- Interest rate on offer: 2.24% on Euro and 4.08% on USD balances.

- Accepts deposits from Apple Pay: you can connect your Wise card to Apple Pay for mobile spending and top up your Wise Account with Apple Pay.

- How often interest is paid: at the beginning of the following month.

- Limitations: There are no restrictions or limits on the interest you can earn with Wise.

- Safety: Not covered by a deposit guarantee scheme, but safeguarding is in place for customer funds. As Wise declares on its website: “We are not a bank, which means we don’t lend out our customers’ money to people or businesses. This also means our payment services aren’t subject to the Belgian Deposit Guarantee Scheme.”

However, Wise does have some safeguards in place for customer funds on European accounts, which segregate customer funds into a mix of cash in leading commercial banks (JP Morgan Chase) and low-risk liquid assets (Money Market Funds with BlackRock and State Street).

These assets are held in segregated accounts separate from Wise’s funds. In addition to this protection, each customer is eligible for protection under the Estonian Guarantee Fund (GF) up to a value of €20,000 in Europe regarding assets that have been invested.

Launched in 2011, Wise is an eMoney business aimed at people who want to reduce the cost of making international money transfers. Among Wise’s product offerings is a bank account with over 40 currencies, a travel money card, and an international debit card.

One of Wise’s features is the ability to hold your funds in Cash, Stocks, or Interest. Wise will select an appropriate index fund and invest on your behalf when you hold your money in stocks.

If you switch your money to ‘interest,’ these funds will be invested in government-backed short-term loans and bank deposits. The interest earned is then passed on to you.

Scalable Capital

- Interest rate on offer: 2.25% on Euro balances.

- Accepts deposits from Apple Pay: No

- How often interest is paid: Interest is paid quarterly.

- Limitations: Only balances up to €100,000 will be eligible for interest, and to earn interest, you must sign up for a PRIME+ account.

- Safety: Not covered by a deposit guarantee scheme, but safeguarding is in place for customer funds

Scalable Capital was founded in 2014 and allows investors to independently trade stocks, ETFs, funds, cryptocurrencies, and derivatives.

To avail of the 2.25% interest offer, you must sign up for a PRIME+ account, which will cost you €4.99 monthly. You do get reduced trading and commission costs for this subscription fee, but depending on your overall level of deposits, the fees may outweigh the interest you earn.

From reading through Scalable Capital’s policies there is no reference to them being a member of a deposit guarantee scheme. They mention that some of the banks that choose to place your funds on deposit to earn yield, which can then be returned to you, are members of a deposit guarantee scheme, but this will only offer limited protection to your funds in the event of a default.

The growing importance of Apple’s ancillary services to its business model

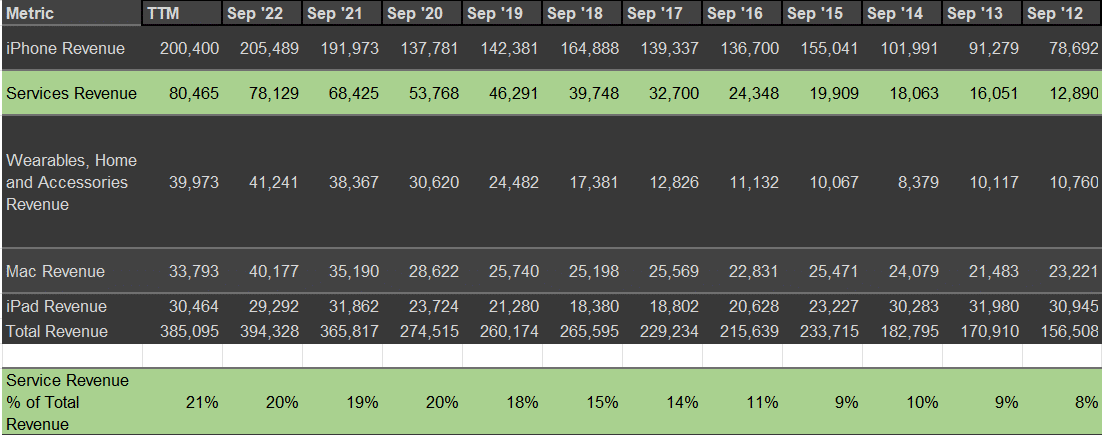

Over the past number of years, services have become a huge part of Apple’s business model. In 2012, services accounted for just 8% of Apple’s Revenue, but now account for over 21% of Revenue just 10 years later.

Among these services, Apple has:

- Apple Care

- Apple One

- Apple Pay

- Siri

- Facetime

- App Store

Final thoughts

While many of Apple’s great features, such as the Apple Card and Apple Savings account, are restricted to just US customers, we are not completely in the dark ages here in Europe.

As we have outlined in this article, many providers in Europe are competing with one another and offering ever-increasing rates on deposit accounts. This space is changing rapidly as banks, institutions, and brokerages try to keep pace with the regular rate changes by the ECB we have seen recently.

If you want to keep up to date with the latest offers on the market, make sure to bookmark investingintheweb.com.