Hello, fellow investor! We will review Nextmarkets to help you find out whether it is the right investment platform for you!

On the downside, the spreads are above average, the distinction between shares and CFDs is not clear, and commission-free trading only applies to orders above €250 (below that, a €1 fee is charged).

Nextmarkets is an innovative neobroker with a substantial presence in Europe. In March 2021, it received a $30 million in series B funding round. The company has seen massive growth in transaction volume and number of users.

Overview

Founded in 2014, Nextmarkets is a European commission-free trading platform with offices in Cologne, Lisbon, and Malta.

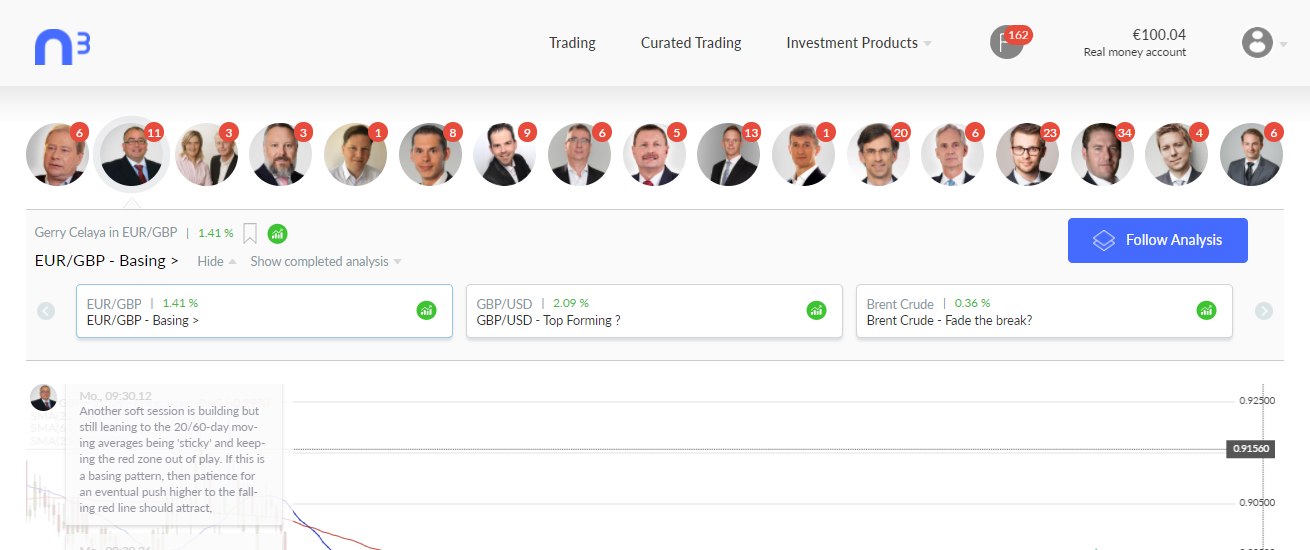

The idea is to make investing accessible to everyone through different offerings (including a Nextmarkets business account, in case you have a company). You have the traditional “do-it-yourself” brokerage service (stocks, ETFs,…), and it also hosts professional investors, the so-called “coaches”, who generate up to 300 curated investment ideas for users every month, free of charge and in real-time.

The drawback of the latter is that you only get technical analysis and no fundamental one, so it does not give a complete picture of the investment idea. Here is a screenshot of an investment idea:

To access the Coaching and CFDs services, you need to “upgrade” your account (free of charge) to Nextmarkets Pro (a legal formality to make sure you are aware of the risks involved).

From here, you will be able to follow coaches manually or automatically, trade with or without leverage, trade outside market hours, and even achieve 1.25% p.a. in your “parked” money (more info on the Money Market CFD), allowing you to profit from the potentially rising interest rates in the US whilst compensating them for the negative interest that is currently being offered in the Euro Zone.

You will also have access to your trading activities’ quarterly and annual reports within your dashboard. These documents summarise what you have previously done to help you figure out how your strategy has been working so far.

The support team is available to reply to your trading inquiries through its contact form, e-mail address ([email protected]) or a phone call. In the Web version, you do not get the same information so quickly. That’s why we show a print screen of the mobile app:

Highlights

| 🗺️ Supported countries | +30 countries |

| 💰 Stocks and ETFs fees | Free of charge |

| 💰 CFDs fees | Low |

| 💰 Currency conversion fee | 0% |

| 💰 Inactivity fee | €/$/£0 |

| 💰 Withdrawal fee | €/$/£0 |

| 💵 Minimum deposit | €/$/£0 |

| 📍 Products offered | Stocks, ETFs and CFDs |

| 🎮 Demo account | Yes |

| 📜 Regulatory entities | MSFA |

Pros and cons

Pros

- Zero commission trading for all asset classes (orders above €250)

- No custody, inactivity and deposit/withdrawal fee

- Fast account opening process (less than 5 min)

- No minimum deposit

- No currency conversion fee

- Good customer support

- Demo Account

Cons

- €1 commission per order below €250

- The web platform is a little “buggy”

- No clear distinction between real shares and CFDs

- Spreads are above average

- No fundamental data

- No educational materials

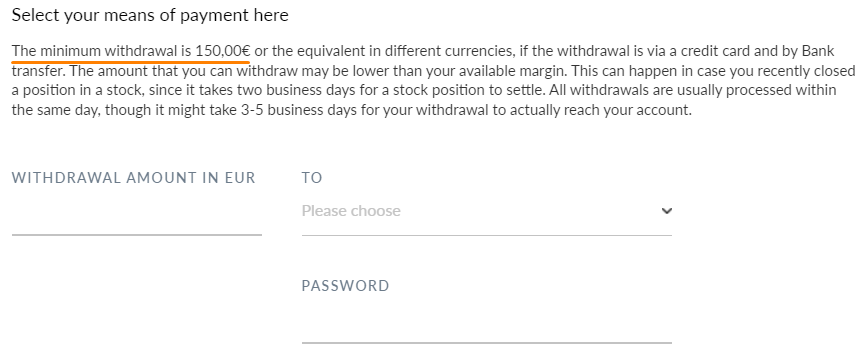

- The minimum withdrawal is €150

Account opening

We have opened an account at Nextmarkets, and the process was smooth. You just have to follow the given steps, and you are on your way to starting investing (it’s that simple!).

After registering, you will instantly see all the relevant documents regarding fees, best execution policy, general terms and conditions and more in your inbox (you will notice a notification in your dashboard). We recommend you download those files and save them on your PC to consult later if needed.

Deposit and Withdrawal

As a final step to start trading, you are required to make a deposit and choose the way you want to do it. You can deposit to your EUR or GBP accounts (whatever is your base currency) in more than 30 currencies with no fx fees on the Nextmarkets platform!

So, you can deposit in USD, and Nextmarkets will automatically convert it to EUR or GBP with no additional charges. We opted for a manual deposit directly in EUR, and it arrived in only one business day (even faster than what it says in the image below: “2 to 3 days”). You will receive an e-mail from Nextmarkets confirming that your deposit has arrived in your account.

There is no minimum deposit, but please note that there is a minimum withdrawal amount of €150 (read below) and a €1 commission for trades under €250 (see “Fees” section). So, we recommend a minimum deposit of €250.

Five days after opening our account, we received a phone call from the customer support team asking if we had any doubts about the web and mobile trading platforms. Usually, low-cost brokers do not take this action, so we were positively surprised.

After deciding to withdraw, please make sure that you plan to do it on amounts above €150 since it is impossible to withdraw lower amounts. Besides, the withdrawal process should occur using the same method as the one chosen during your deposit.

Trading platform

Nextmarkets offers two options for your investing activities: a web and a mobile platform. We have explored both, and we found that the desktop version seemed a little “buggy” (you need to refresh the page very often), while the mobile app worked very well.

For instance, our trade did not instantly appear on the “open positions” tab in the web version after opening a position, but it did in the mobile app. We could not close the same position on the web version, so we had to close it on the mobile app. We highly believe they should upgrade their web platform.

The features available in the two versions are also different. The mobile app is more customisable than the web version. You can add a profile picture, subscribe to a newsletter, define what notifications you want to receive, and even select which start screen you prefer when opening the app (trading, curated investment, portfolio or financial products).

You can easily between the demo and the real trading accounts. On your account settings, you will notice “coach infos”. As you explore, you will observe that some of the coaches descriptions are in German, while others are in English.

In the mobile app, you can set price alerts for the investment assets you have on your watchlist. We did not find that feature in the web version.

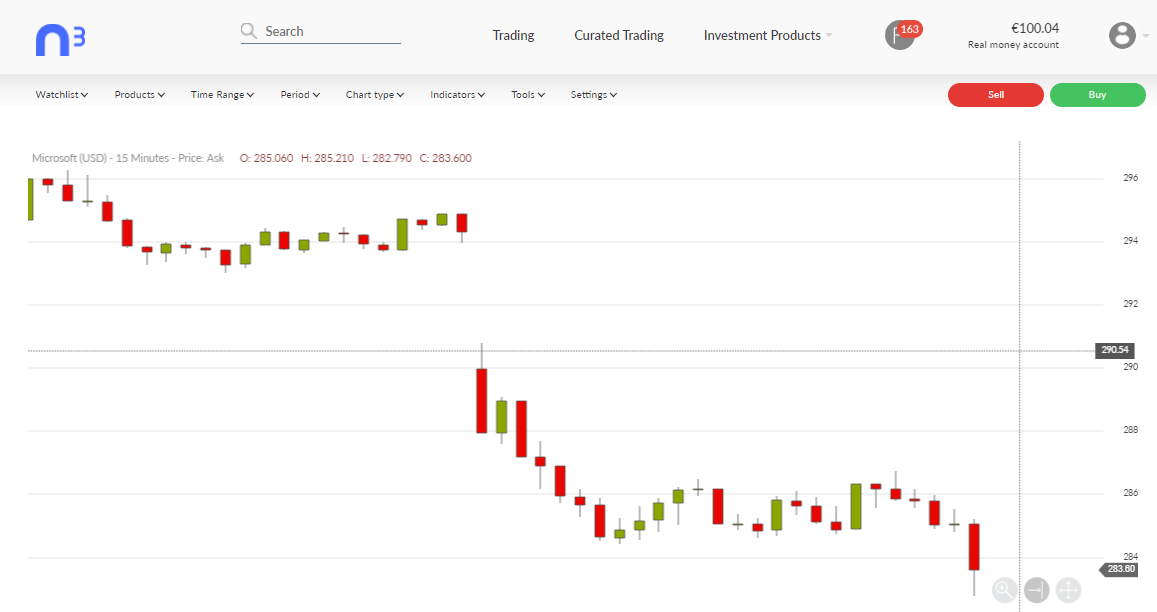

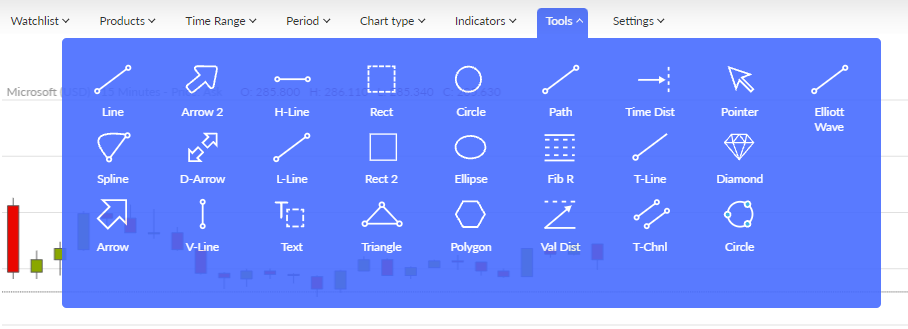

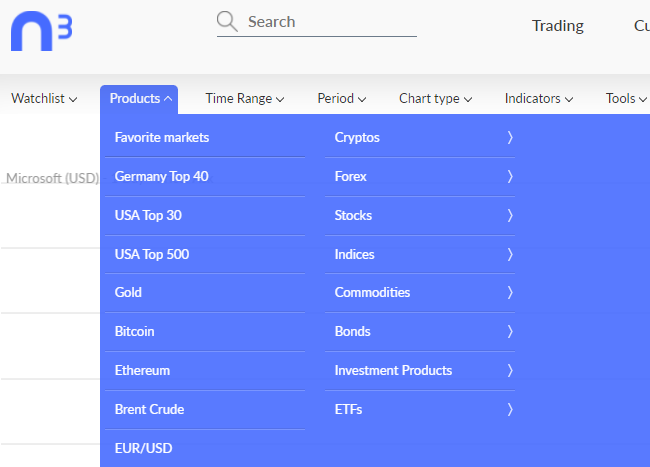

You will notice that Nextmarkets promotes a helpful set of technical analysis tools such as chart types (line, candles, OHLC,…), indicators (SMA, RSI, MACD) and drawing tools (line, arrows, Elliot Wave,…). You can see this as soon as you open your trading platform and in the Nextmarkets’ “coaches” since most use technical analysis.

Finally, you have three types of orders:

Market order: You define the number of shares, and it executes at the best available price.

Limit order: You define not only the number of shares, but also the maximum price you are willing to buy/sell any security.

Stop order: You set the number of securities to buy/sell and define a price that will activate your order to buy or sell at the best price in the market.

Products & markets

Nextmarkets offers the following asset classes: shares, ETFs, and CFDs on shares, ETFs, indices, forex, bonds, cryptocurrencies, and commodities.

As of this writing, Nextmarkets includes over 7,000 shares and 1,000 ETFs. However, other asset classes are still limited. In crypto, you only have access to Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. In precious metals, you can trade Copper, Gold, and Silver. Within Bonds, you only can trade the 10-year German bonds.

You might be confused by reading “shares” and then “CFDs on shares”. Do not worry. We have got your back!

When you use any broker to trade, you should verify what you are transacting. You may be buying the “real thing” or an instrument that mimics it (CFDs). The exposure will be similar if you don’t use CFDs with leverage (if you do, you will have additional costs for using borrowed money).

When we say the “real thing”, we mean a real stock, for instance. So, you have a piece of the company. When trading real assets, Nextmarkets uses Börse München (Getten), a stock exchange in Munich, Germany:

When trading CFDs, Nextmarkets acts as a “market maker”, as defined within MiFID II. In other words, when you place an order in a CFD, you are trading a derivative with Nextmarkets (you do not have direct market access like in a real stock). This means that the company is taking the other side of the transaction, exposing you to counterpart risk.

However, CFD brokers (not only Nextmarkets) are advised to hedge their clients’ trades not to get market exposure and to eliminate conflict of interest. Otherwise, it would be good for them if you lost your money.

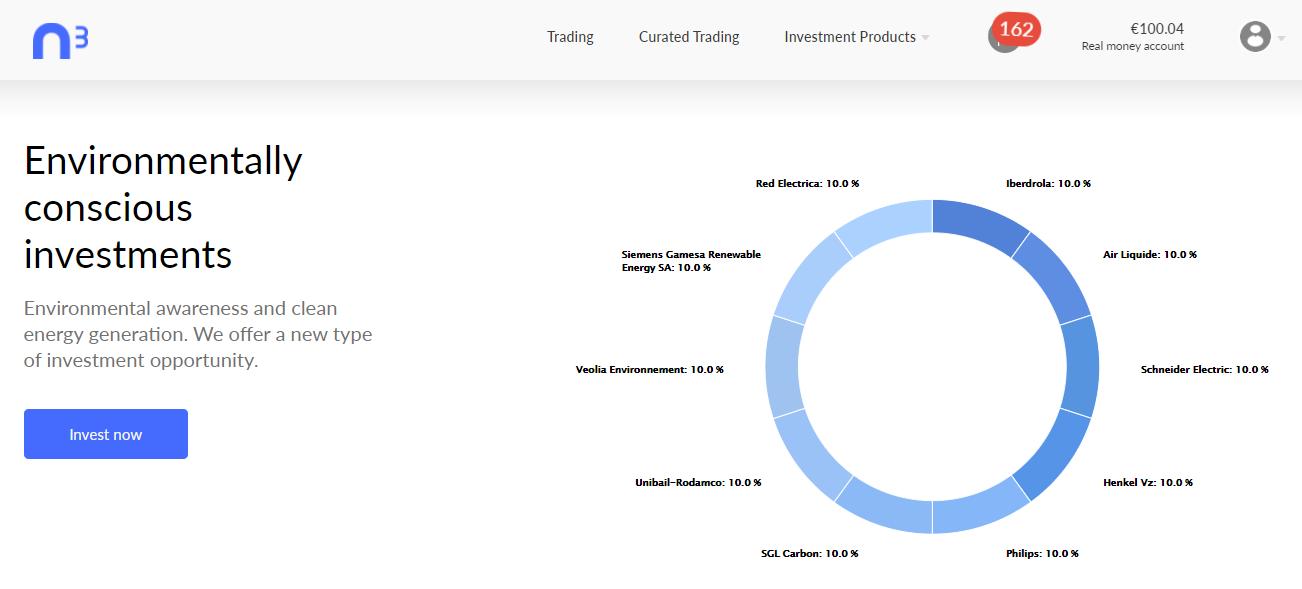

You also have “Investment Products”, which are a set of CFDs baskets:

Using “Green CFD” as an example, you have the option to gain exposure to sustainable investing through a diversified basket which gives you a cost advantage compared to ETFs because you have no management or transaction fees:

Fees

Nextmarkets has been created on a zero-commission basis, which means there will be no direct costs: no deposit/withdraw charges, no inactivity cost, no custody fees, and, you guessed it, no commission on trades.

However, it only applies to orders above €250, meaning that you have to, at least, invest that amount in any asset not to get charged by Nextmarkets. If you give an order below €250, you will be charged a €1 commission:

When you trade assets in another currency (e.g. USD) rather than your base account (EUR), you could be subject to currency conversion fees. Still, Nextmarkets charges no currency conversion fee (see page 8).

Actually, we decided to dig a little further and check investing.com at the exact time when we placed the order, and the EUR/USD was at 1.1714, which matches the rate we got (100.54$/85.83€ = 1.171385).

How does Nextmarkets make money, then?

Nextmarkets follows a unique cost structure in trading fees: an “all-inclusive model”. So, it means that every typical trading fee in CFDs, like the overnight fees (interest paid on money borrowed when you use leverage), is included in the spreads, the difference between the bid and ask prices. The price you see on investing.com or finance.yahoo.com – a constantly changing price – is the price settled in the last trade. It is not the same as saying you will be buying or selling at that price.

You will notice that the price you have to look to buy (ask price) will be higher than the one you see to sell (bid price). So, if you wanted to buy and sell instantly, you would have a loss.

Nextmarkets receives parts of it through rebates from the markets on which the transactions are executed (payment for order flow) and the full spread if you trade CFDs with them. The larger the spread, the more money it makes.

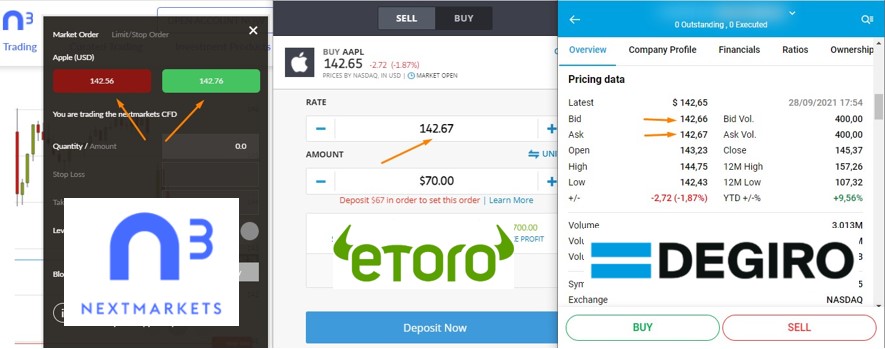

The following image shows that for Apple, on the 28th of September, the spread was higher for Nextmarkets than eToro or DEGIRO, two of its competitors. If you wanted to buy Apple, you would pay $142.76, whereas, in eToro and DEGIRO, you would pay $142.67.

Note: The image was taken on the 28th of September, 2021. This is just an example. Market conditions, asset types and other factors may dictate higher or lower spreads at any given time. So, do not look at our analysis and suppose it will be this way all the time.

Besides, it charges other fees for services you will unlikely need, such as a document for balance confirmation (€25), participation in a general meeting (€25 – it only applies for real shares), customer order instruction by e-mail or letter (€5).

Safety and regulation

Nextmarkets Trading Ltd, the legal name of Nextmarkets, is registered in Malta and, consequently, authorised and regulated by the Malta Financial Services Authority (MFSA) as a financial services company. As such, Nextmarkets is part of the Investor Compensation Scheme, a fund created to protect you if Nextmarkets goes bankrupt and cannot fulfil its obligations. In practice, you would be paid 90% of your money and assets subject to a maximum of €20,000.

Moreover, Nextmarkets does not operate a deposit-taking business. This means it cannot hold your funds. The customers’ money is held in a trust account with Barclays with statutory deposit insurance that covers amounts up to €100,000 per investor. A similar process is applied with your assets: they’re segregated from the company’s balance sheet (still protected up to €20,000).

Finally, as Nextmarkets Trading Ltd is a private company (not listed on a stock exchange), it is not required to publish its financial statements, so there is no public scrutiny. It lacks transparency on that side. Nonetheless, we feel safe with its business model since they only operate as a financial intermediary.

Supported countries

Currently, Nextmarkets accepts new customers from the following countries:

- Austria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Gibraltar

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- South Korea

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Mexico

- Monaco

- Netherlands

- Norway

- Poland

- Portugal

- Serbia

- Slovakia

- Slovenia

- South Africa

- Spain

- Sweden

- Switzerland

- Turkey

The company is growing rapidly, so we are expecting to witness additional countries being added. So, if your country does not appear here, please take a final look at Nextmarkets’ website to make sure!

Bottom line

The choice of a trading platform is never easy. You need to consider fees, customer support, products offered, safety, and more. Some people even create accounts with multiple brokers to get the most out of each one.

Concerning Nextmarkets, we believe that it is a good choice for all kinds of investors: from beginners to advanced investors. You have commission-free trading and no currency conversion fees (both are uncommon in other brokers). The mobile app is superb, but the web platform is still in an “old” stage.

With the Demo Account, you can easily explore the platform and decide if it is the right platform for you!

Disclaimer

Investing in financial products involves taking risks. Your investments may increase or decrease in value, and losses may exceed the value of your original investment. Past performance is not an indication of future results.