The Schwab U.S. Dividend Equity ETF (SCHD) offers investors a straightforward method to gain diversified exposure to the U.S. dividend stock market.

However, due to regulatory restrictions, SCHD isn’t directly accessible to retail investors in Europe and the UK.

In this article, we will explore the availability of SCHD in Europe and the UK, alternative ETFs, and guidance on how to invest in these alternatives.

Why SCHD isn’t directly available in Europe & UK?

SCHD, a popular US-domiciled ETF, isn’t directly available to European and UK investors due to regulatory constraints under the EU’s Packaged Retail and Insurance-based Investment Products (PRIIPs) regulation.

This regulation requires that investment products marketed to retail investors in the EU must provide a Key Information Document (KID), which outlines the product’s features, risks, and costs in a standardized format. The PRIIP regulation aims to enhance transparency and protect retail investors by ensuring they have access to transparent and comparable information about investment products.

US-domiciled ETFs like SCHD do not produce these KIDs because US regulations do not mandate such disclosures. Consequently, these ETFs do not comply with PRIIPs requirements and are therefore inaccessible to ordinary retail investors on European investment platforms such as eToro, DEGIRO, Interactive Brokers, Trading 212, Freedom24 and Trade Republic.

Furthermore, SCHD is quoted in USD, while the European and UK equivalent ETFs are quoted in other currencies, such as the EUR and the GBP (explored below).

For further details, refer to the official documentation of the PRIIPs regulation provided by the European Union here.

Is there any workaround to invest in SCHD?

Investors in Europe and the UK looking to gain exposure to SCHD have some alternatives available. One is through Contracts for Difference (CFDs) on platforms like eToro. CFDs allow you to speculate on SCHD’s price movements without owning the underlying ETF physically. However, this approach comes with significant risks, including higher potential losses if leverage is used.

What are CFDs?

CFDs are financial instruments that enable traders to take positions on price changes in an underlying asset, like the Dow Jones U.S. Dividend 100 Index, without owning it. It contrasts with traditional investing, where ownership of the asset is required. To learn more about the differences between CFDs and investing in real assets, read our article: CFDs vs Shares: Understand the Differences.

Since no ETFs are available in the UK or EU that replicate the exact underlying index of SCHD (the Dow Jones U.S. Dividend 100 Index), another option is to consider alternative ETFs that track similar indices, providing broad exposure to the US dividend stock market for investors seeking regular income distributions.

How to buy SCHD ETF CFD on eToro

If you are a European or UK investor and you want to buy the SCHD ETF CFD on eToro, you need to:

a) Search for SCHD ETF CFD:

- In the eToro search bar, type “SCHD” or “Schwab US Dividend Equity ETF”.

- Select the SCHD ETF CFD instrument from the search results.

b) Open a trade:

- Click the “Trade” button on the SCHD CFD instrument page. It will open the order window.

c) Set your trade parameters:

- Amount or number of shares: Enter the amount of money you want to invest in or the number of shares;

- Leverage: Choose your desired leverage level (remember, leverage can amplify gains and losses);

- Stop Loss and Take Profit: Set these optional orders if you want to manage your risk. A stop-loss order automatically closes your trade if the price drops to a certain level, while a take-profit order closes it when the price reaches a specified target.

d) Execute the trade:

- Carefully review your order details to ensure they are correct.

- Click the “Buy” button to execute your buy order.

Best SCHD alternatives for European and UK investors

There’s no need to worry for EU and UK investors seeking exposure to the US stock market without taking on the high risk associated with CFDs.

We’ve compiled a selection of alternative ETFs that offer a secure and regulated way to tap into the US market’s potential while providing dividend distributions. While SCHD tracks the Dow Jones U.S. Dividend 100 Index, which evaluates the performance of U.S. stocks known for their high dividend yields and consistent dividend payments, there are UCITS-compliant funds in Europe and the UK that provide diversified exposure to dividend-yielding equities.

The following tables showcase some of the most popular options available for European and UK investors. The first table shows ETFs quoted in Euros, while the second one is in British Pounds.

SCHD Alternative ETFs in Europe (€EUR)

In Europe, one of the most popular SCHD ETF alternatives is the VHYL ETF, as it has the largest fund size. Below is a table with some of the leading European ETFs based on data from justETF.com:

| Name | Ticker | ISIN | Annual Fee (TER) | Replication Method | Use of Income | Fund Size (in €B) |

| Vanguard FTSE All-World High Dividend Yield UCITS ETF | VHYL | IE00B8GKDB10 | 0.29% | Physical | Distributing | €4+ |

| SPDR S&P US Dividend Aristocrats UCITS ETF | SPYD | IE00B6YX5D40 | 0.35% | Physical | Distributing | €3+ |

| Fidelity US Quality Income UCITS ETF | FUSD | IE00BYXVGX24 | 0.25% | Physical | Distributing | €1+ |

| iShares MSCI USA Quality Dividend ESG UCITS ETF USD | QDVD | IE00BKM4H312 | 0.35% | Physical | Distributing | €0,7+ |

| VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF | TDIV | NL0011683594 | 0.38% | Physical | Distributing | €0,7+ |

SCHD Alternative ETFs in the UK (£GBP)

In Europe, one of the most popular SCHD ETF alternatives is the VHYL ETF, as it has the largest fund size. Below is a table with some of the leading European ETFs based on data from justETF.com:

| Name | Ticker | ISIN | Annual Fee (TER) | Replication Method | Use of Income | Fund Size (in £B) |

| Vanguard FTSE All-World High Dividend Yield UCITS ETF | VHYL | IE00B8GKDB10 | 0.29% | Physical | Distributing | £3,5+ |

| SPDR S&P US Dividend Aristocrats UCITS ETF | USDV | IE00B6YX5D40 | 0.35% | Physical | Distributing | £2,5+ |

| Fidelity US Quality Income UCITS ETF | FUSI | IE00BYXVGX24 | 0.25% | Physical | Distributing | £0,9+ |

| iShares MSCI USA Quality Dividend ESG UCITS ETF USD | HDIQ | IE00BKM4H312 | 0.35% | Physical | Distributing | £0,6+ |

| VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF | TDGB | NL0011683594 | 0.38% | Physical | Distributing | £0,6+ |

How to buy SCHD UK equivalent (USDV) on Trading 212

If you’re looking to invest in an alternative to the SCHD ETF in GBP, the SPDR S&P US Dividend Aristocrats UCITS ETF (USDV) is a great option, as it is the ETF in GBP with the largest amount of investment.

Investors from other European countries would follow the same process, with the only differences being the ticker symbol and the currency of the ETF.

Below are the steps to purchase the USDV ETF on Trading 212 in the UK:

a) Search for USDV and select it:

- In the Trading 212 app, type “USDV” in the search bar;

- Select the SPDR S&P US Dividend Aristocrats UCITS ETF from the search results.

b) Review ETF details:

- Instrument details (ticker, ISIN, currency);

- Dividend details (ex-dividend date, dividend per share, payment date).

c) Open a trade:

- Click the “Buy” button on the USDV ETF page to open the order window.

d) Set trade parameters:

- Enter the number of shares you wish to purchase. Alternatively, you can choose to invest a specific amount of money. You can also set additional parameters such as market, limit, or stop orders as needed.

Note: If you invest an amount less than £55.783 (as shown in the example described in the image), it will result in a fractional share. Keep in mind that fractional shares on Trading 212 are handled through derivatives (CFDs).

Fractional shares cannot be traded on public exchanges and are illiquid and unrecognized outside the Trading 212 platform. You can only liquidate them by selling through Trading 212, and they cannot be transferred to another broker unless sold.

You can find more information on the Trading 212 website.

e) Execute the trade:

- Review your order details to ensure everything is correct. Click “Send buy order” to execute your purchase.

By following these steps, you can easily invest in the SPDR S&P US Dividend Aristocrats UCITS ETF (USDV) on Trading 212, gaining exposure to the S&P High Yield Dividend Aristocrats Index within a regulated framework suitable for British investors.

What to look for in an ETF (in GBP and EUR)?

When evaluating an ETF, it’s crucial to consider several factors to ensure it meets your investment goals and strategy. Here are the key points to keep in mind:

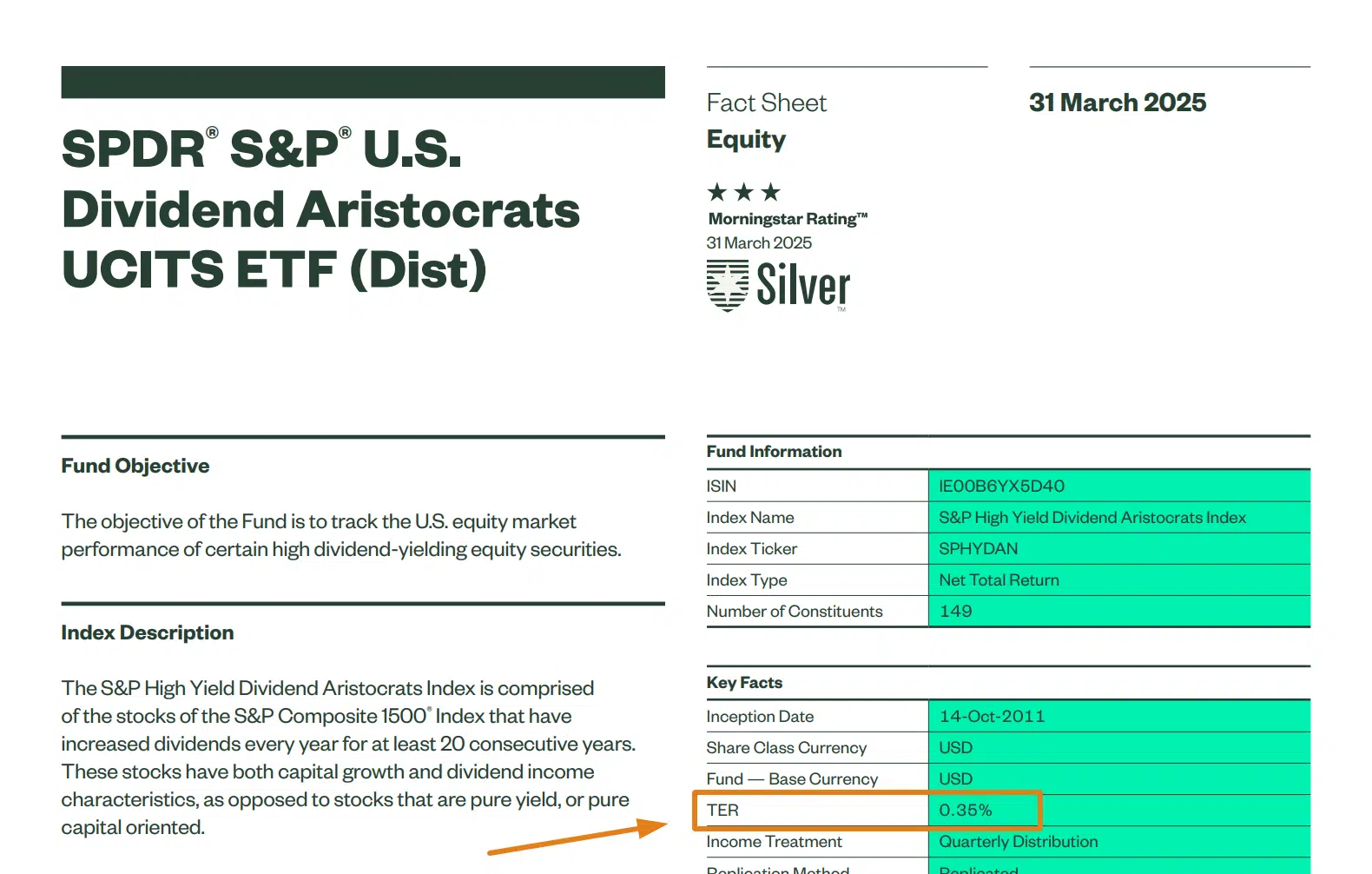

a) Fees

Management fees for ETFs can vary depending on the provider. These fees are often referred to as Ongoing Charges Figure (OCF) or Total Expense Ratio (TER), as is the case with State Street Global Advisors (SSGA).

Taking the SPDR S&P US Dividend Aristocrats UCITS ETF (USDV) fact sheet as an example, you can verify the TER is 0.35%:

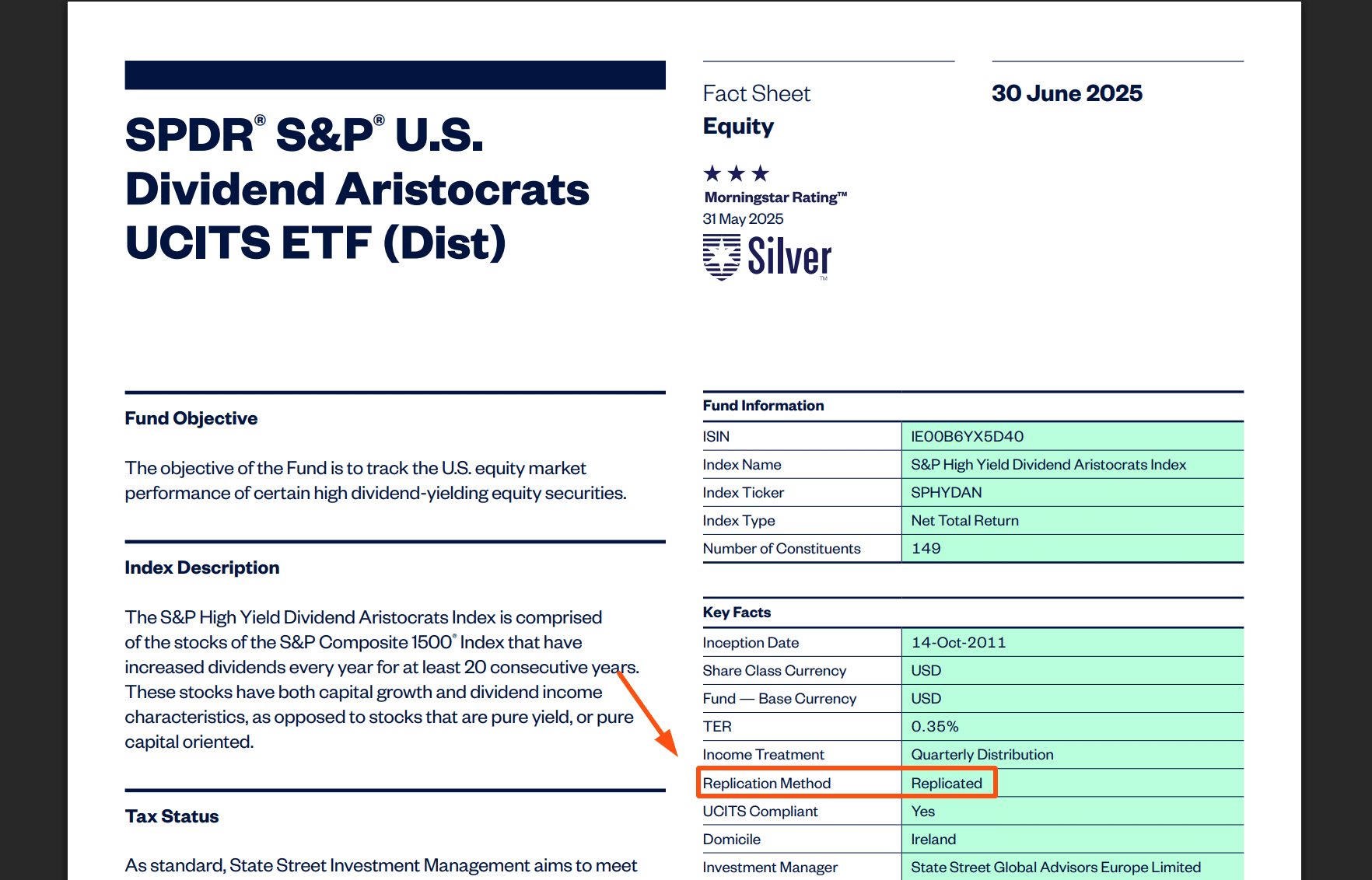

b) Replication method

ETFs can use different methods to replicate the performance of the MSCI World index:

- Physical Replication: This method involves holding the actual securities that comprise the index, providing direct exposure to it, and avoiding the complexities associated with derivatives.

- Synthetic Replication: This approach uses financial derivatives to replicate index performance, which can be more cost-effective but introduces counterparty risk if the derivative contracts fail.

The SPDR S&P US Dividend Aristocrats UCITS ETF (USDV) uses full replication, meaning the ETF contains all index components. This is also referred to as physical replication, holding the actual stocks of the S&P High Yield Dividend Aristocrats Index, which is generally preferred for its straightforward approach and transparency:

c) Use of income

ETFs handle income from underlying assets in different ways:

- Accumulating ETFs: These ETFs reinvest dividends from the holdings back into the fund, potentially boosting returns through compounding.

- Distributing ETFs: These ETFs pay out dividends to shareholders periodically, providing a regular income stream but potentially being less tax-efficient in certain jurisdictions.

The best choice depends on your individual preferences and financial goals. An accumulating ETF might be more suitable if you’re focused on long-term growth and reinvesting dividends. A distributing ETF could be a better fit if you need regular income.

The SPDR S&P US Dividend Aristocrats UCITS ETF (USDV) is a distributing ETF that pays dividends quarterly:

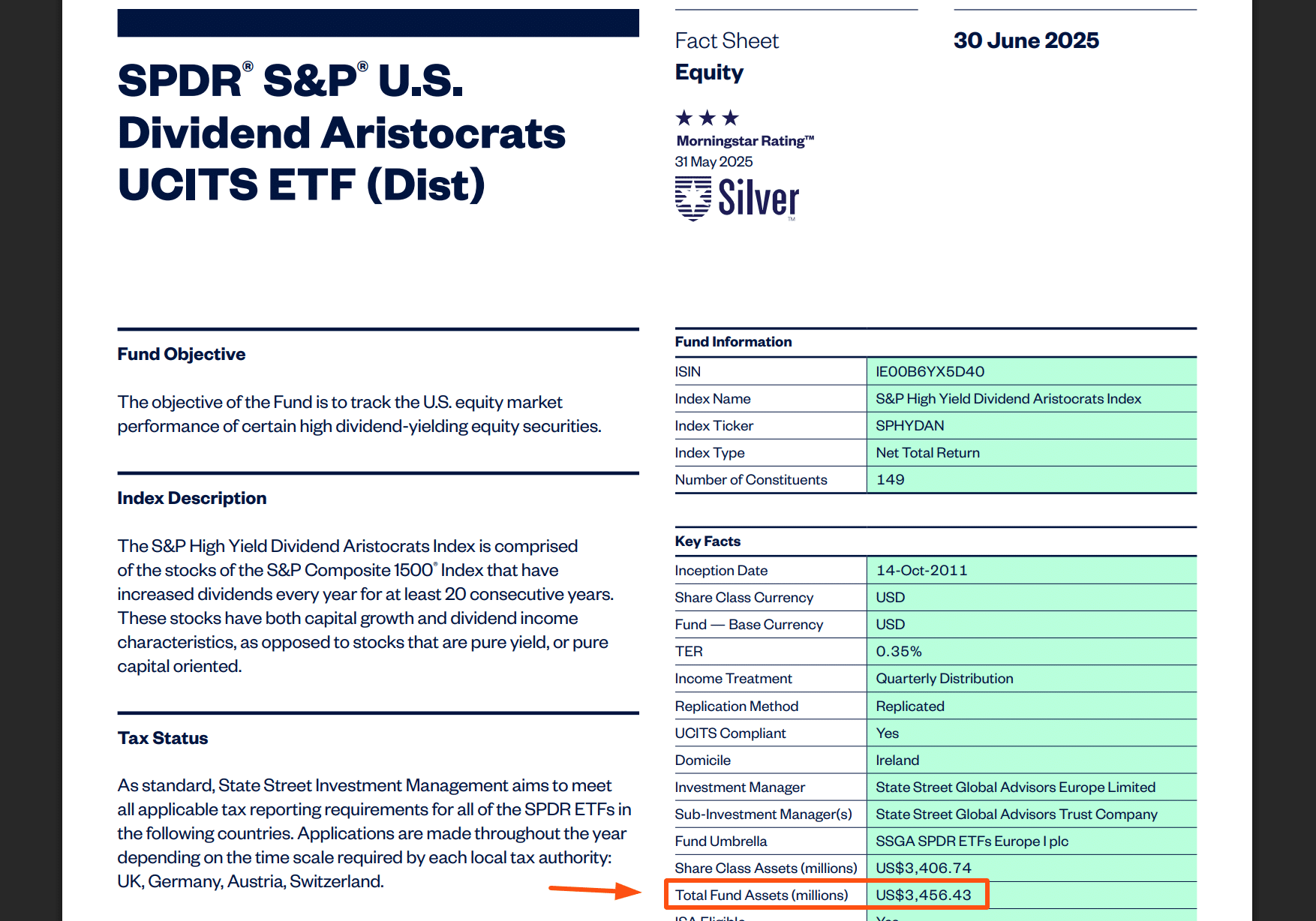

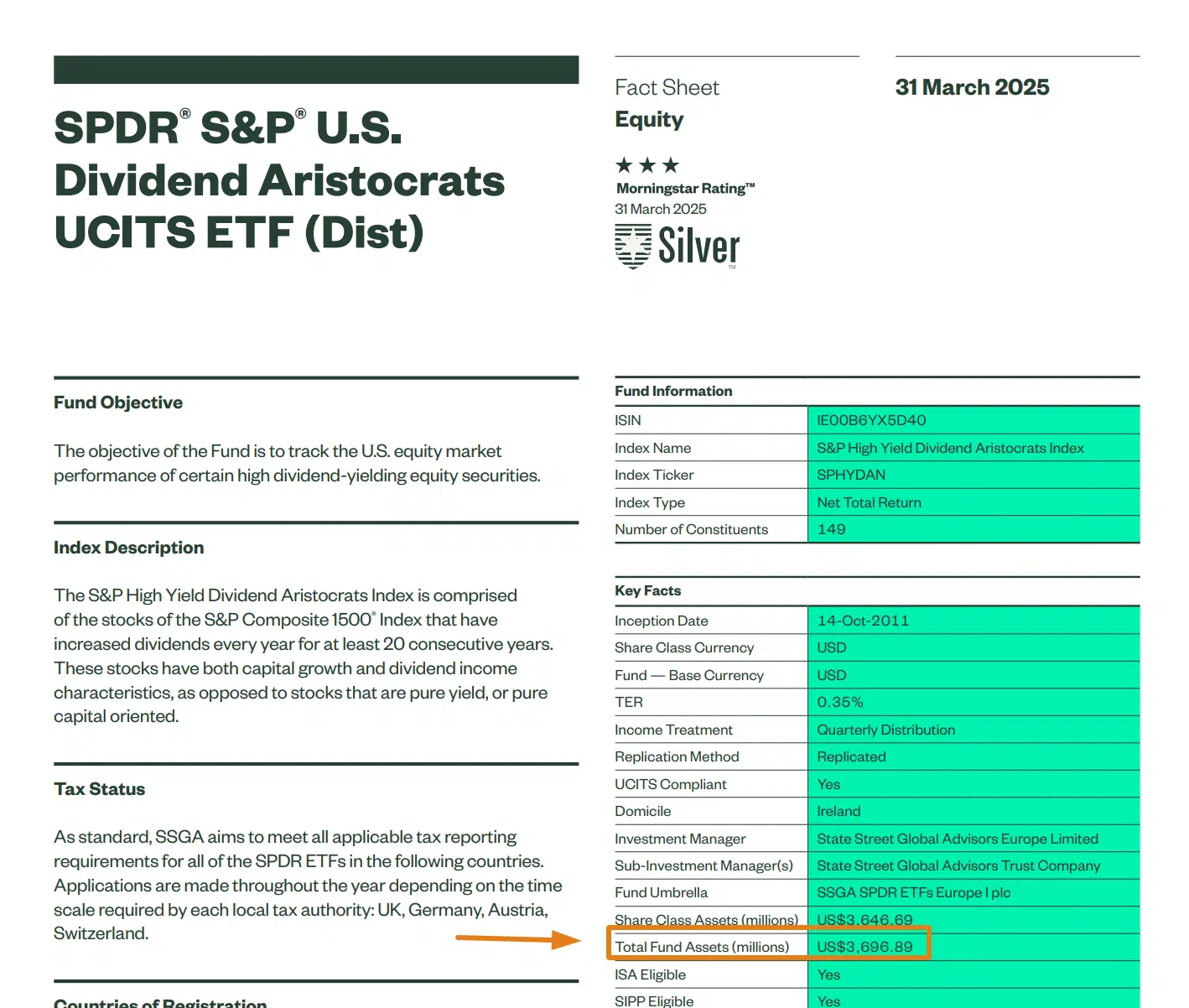

d) Size

The Net Asset Value (NAV) can be a factor to consider. Larger ETFs tend to have higher liquidity, meaning buying and selling shares is easier without significantly impacting the price.

USDV has a Net Asset Value of $3,456.43 million:

e) Currency

Another important aspect is the currency in which the ETF is denominated. ETFs can be listed in different currencies such as USD, EUR, or GBP. The currency denomination of an ETF can impact your investment in the following ways:

- Currency exchange risk: If the ETF is denominated in a different currency than your base currency, you may face currency exchange risks. For example, if you are a UK investor and the ETF is denominated in USD, fluctuations in the USD/GBP exchange rate will affect your returns;

- Transaction costs: Buying an ETF in a currency different from your base currency may involve additional transaction costs due to currency conversion fees;

- Convenience: Holding an ETF in your local currency (EUR for European investors, GBP for UK investors) can simplify your portfolio management and avoid the need for frequent currency conversions.

f) Currency hedging

Currency hedging can be an important consideration for European and UK investors. Some ETFs offer versions that hedge against fluctuations between the euro or pound and the U.S. dollar.

While hedging can provide stability in the short term, it may also come with additional costs and could potentially reduce long-term returns if the euro or pound strengthens against the dollar.

Looking to backtest your ETF portfolios?

If you are an EU citizen looking to backtest your ETF portfolios, check out our Portfolio Analyser. Our tool allows you to analyze your selected portfolios and obtain visual data and metrics to make informed decisions when comparing and evaluating EU-domiciled ETFs.

Bottom line

In summary, while SCHD isn’t directly accessible to European and UK investors due to regulatory constraints, many alternative ETFs offer similar exposure to the US stock market.

These UCITS-compliant funds adhere to EU regulations, ensuring transparency and investor protection. By understanding the specific features of these alternatives, including fees, replication methods, income treatment, currency, and fund size, investors can make well-informed choices that align with their financial goals.

Furthermore, SCHD is quoted in USD, so it might make sense for you to invest in an equivalent ETF quoted in your home currency, in order to avoid currency conversion fees, as well as currency risk.

For European investors, options such as the VHYL and SPYD provide benefits similar to those of SCHD within a compliant regulatory framework. British investors can access alternatives like the VHYL and USDV.

Platforms such as Interactive Brokers, DEGIRO, Trading 212, Freedom24 and Trade Republic offer access to these ETFs, making it convenient for EU and UK investors to engage with the U.S. market.

We hope this article has addressed your questions about the availability of SCHD in Europe and the UK.

Best of luck with your investments!

Disclaimer: Investing involves risk of loss.

FAQs

Is SCHD available on DEGIRO?

No, SCHD is not available for EU or UK investors on DEGIRO. However, DEGIRO does offer access to equivalent ETFs that track similar indexes and provide comparable investment opportunities.

Is SCHD available on eToro?

Yes, SCHD is available on eToro, but only through Contracts for Difference (CFDs). This means you can speculate on the price movements of SCHD without actually owning the underlying asset. Investors should be aware of the risks associated with trading CFDs, including the potential for significant losses.

Is SCHD available on Trade Republic?

No, SCHD is not available on Trade Republic. Investors may need to look for alternative ETFs that offer similar exposure and performance metrics within Trade Republic’s offerings.

Is SCHD available on Trading 212?

No, SCHD is also not available on Trading 212. Investors can explore other ETFs available on the platform that might offer similar benefits and align with their investment strategies.