Every decision you make in your life is based on a set of irrefrangible principles. You know that when you buy a house, you are sure that the right to private property will not be put into question as written by the Universal Declaration of Human Rights. You are also aware that if you make a business deal and the other party does not fulfil its commitment, you can resort to the courts.

The same applies to financial services. You need trust to invest your hard-earned money. Without it, your capital would probably be under the couch. That’s why regulation has such an essential role in protecting you from events you have no control over. In other words, investors should make informed decisions and feel confident that they are adequately protected if something goes wrong.

What are investment protection, balance protection, and negative balance protection?

When you invest your money through an online broker, several measures and policies are put in place to protect investors and guarantee a safer and more transparent environment.

Apart from data protection, account security measures for preventing hackers from accessing your account, or improper use of your data, there are also protection measures to ensure that your investments are still protected if something goes wrong with the online broker itself.

Here are the three primary measures you should be aware of:

- Investment Protection: Designed to safeguard all the securities you are invested in (stocks, bonds, CFDs). It is also known as the “Investor Compensation Scheme”, and the final purpose is to protect retail investors (people like you and us) from the insolvency of your financial intermediaries (ex: eToro, DEGIRO, XTB and more).

- Balance Protection: It refers to the cash you have in your online broker. In most cases, the “investor Protection Scheme” includes both the “Investment” and “Balance”, but since we find brokers who offer this side protection, we found it helpful to include them.

- Negative Balance Protection: This means that you can’t lose more money than what you deposit in your account. This protection is adequate for people who use leverage to invest (CFDs). Example: You invest €1000 in a position that gives 5x exposure. Your total investment is €5000, from which only €1000 is yours (€4000 is borrowed). So, If the market drops 25%, you would lose 1250€ (25%*5000€). As you can see, it is above your initial deposit of 1000€, meaning that you would owe €250 to your broker. With ESMA regulation, your account balance is automatically readjusted to €0, so you only lose your deposit (more info here).

Some companies go even further with other protection measures such as eToro’s investment insurance to prevent clients from their own insolvency and Misconduct case.

The European Securities and Markets Authority (ESMA)

In the European Union (EU), the European Securities and Markets Authority (ESMA) is the organism that contributes to the stability of the EU’s financial system by trying to provide the necessary guidelines for a high level of harmonized protection for investors. It ensures you are alerted to any investment that may not suit your needs and risk profile and that your interests are firmly at the centre of any financial institution’s business model.

In combination with other European Supervisory Authorities (the European Banking Authority and the European Insurance and Occupational Pensions Authority), ESMA promotes supervision convergence between several financial entities within the EU.

In summary, these are its two primary purposes:

- “It ensures the consistent treatment of investors across the Union, enabling an adequate level of protection of investors through effective regulation and supervision”;

- “Secondly, it promotes equal conditions of competition for financial service providers”.

Still, it does not pay you if your online broker commits fraud, administrative malpractice or operational errors. That’s where the next section comes into action!

Investor protection in Europe

The Directive 97/9/EC of the European Parliament, established in 1997, widely known as the Investor Compensation Scheme Directive, forces every EU country to create at least one Investor Compensation Scheme (ICS) and ensure minimum protection of €20,000 per institution and investor.

So, whatever EU country you read this article from, you do not need to worry about your money if you have less than €20,000 invested (warning: it excludes crypto-assets).

A practical example

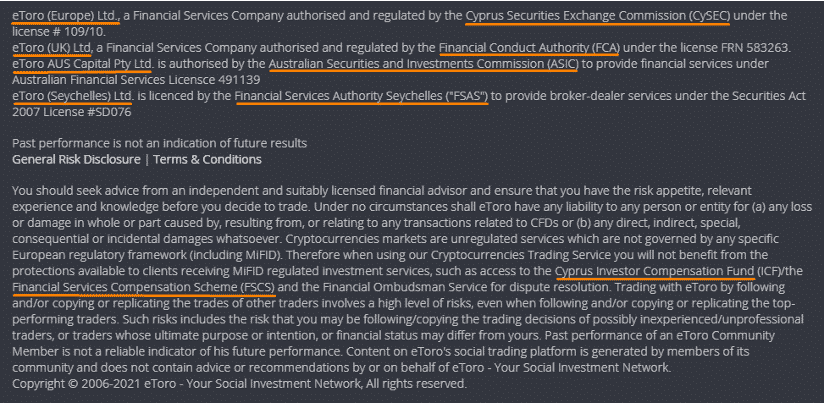

For the sake of simplicity, let’s use, as an example, eToro, a social trading platform with over 35 million users worldwide. If you go to its footnote, you will notice the following text:

Quite complex, right? Let’s decompose piece by piece! As you can observe, eToro works in several jurisdictions. If you are an EU investor, you will be under the “eToro (Europe) Ltd” subsidiary, which means that the regulatory body that safeguards eToro’s activity is the Cyprus Securities Exchange Commission (CySEC). As a UK investor, you will be asked to create an account under the “eToro (UK) Ltd” subsidiary. In this case, the regulator to look for would be the Financial Conduct Authority. Therefore, when signing up with any online broker, ensure what subsidiary you are opening an account with!

Now, let’s imagine you are a German Investor, and eToro goes bust. At this stage, it enters the Cyprus Investor Compensation Fund (ICF), and this vehicle should pay you your money lost. eToro (Europe) Ltd is a member of ICF, an entity designed for the Clients of Cyprus’ regulated investment firms, so you are eligible for a maximum compensation of up to €20,000. This coverage applies to each investor against only one ICF member, irrespective of the number of accounts (and currency). If you have two accounts in eToro, you will be entitled to €20,000 for both accounts. BUT, if you have two accounts with two different brokers, you will be protected up to €20,000 in each account (€40,000 in total, but not in combination).

Here’s a summary of the Investment protection of some European ICS:

| Financial Regulator | Investor Compensation Scheme | Country-based | Max. Protection Amount |

| Cyprus Securities Exchange Commission (CySEC) | Cyprus Investor Compensation Fund (ICF) | Cyprus | €20,000 |

| Financial Conduct Authority (FCA) | Financial Services Compensation Scheme (FSCS) | UK | £85,000 |

| German Financial Supervisory Authority (BaFin) | The German Investor Compensation Scheme | Netherlands | €20,000 |

The table only includes entities that have wider exposure (supervise brokers with clients from several countries). For instance, each EU country has its own Investor Compensation Scheme (ICS). If you are Italian and decide to invest in a broker based in Portugal, you will be under Portuguese supervision (CMVM). In that case, the ICS would protect your money up to €25,000.

Everyone talks about diversification in investments, but diversification in the platform you use to invest might also be handy! The risk is small, but it is still there.

What about balance (cash) protection?

First, it is crucial to know the structure of each broker. The majority puts the invested money in the same bucket as the cash amount (money “parked” in your account). So, in the case of CySEC, if you have €15,000 in ETFs and €3,000 in cash, the €20,000 protection covers both amounts.

However, there are cases where it does not happen in that way. In DEGIRO, your invested capital is protected up to €20,000. Still, your cash amount is protected up to €100,000 by the Deposit Guarantee Scheme of EDB (a German entity that regulates banks) because the money held is deposited in a German Bank – Flatex AG – that bought DEGIRO).

Does a broker’s bankruptcy automatically mean a 100% loss?

Not necessarily. A broker only acts as an intermediary that deposits your ETFs, shares or another financial instrument in a custodian bank or creates a separate entity (called Special Purpose Vehicle), making sure the creditors of any broker do not claim your assets.

Given that, what would happen in practice is that you would have to wait (it can take months or years) for the financial authorities to know what belongs to you and allow you to transfer those assets to another broker. If eToro went bust, clients would have their share of the segregated money investments returned, minus any administrators’ costs from handling and distributing these funds. If things always worked like this, the protection amount would be only a formality.

However, we know that frauds occasionally happen, like when a Turkish CEO of a crypto exchange decided to flee from its country, leaving 400,000 users empty-handed[1]. Events like this are practically impossible to predict and, as such, difficult to get away from. You never know how companies are internally managed, so everyone in the financial markets must accept that risk as part of the game.

Nonetheless, to not be caught off guard, we would advise not to invest more than €20,000 in a single broker. We bet you will sleep better with that arrangement.

[1] This was just an example. As of May 2023, if you invest in crypto assets, you will NOT benefit from the protections available for EU-regulated investment services, such as access to the Cyprus Investor Compensation Fund (even if CySEC or any other regulator supervises your broker).

Final thoughts

We all know that from time to time, problems will arise in the financial markets. It is not a matter of “if” but “when”. The only thing we can do is use the tools at our disposal and not be materially affected by those circumstances.

In addition, you also need to be prepared for what might follow after any bankruptcy. When using a broker with its activity based in a foreign country, you would need to solve any issues through the courts of that country and not your domestic courts. In practice, you would probably have to pay a lawyer to represent you there.

Finally, this article is not meant to scare you! It is to make sure you are fully aware of your investment surroundings!

Be safe out there!