European investors have increasingly turned to high-dividend ETFs as a way to generate passive income while maintaining exposure to equity markets. In early 2026, one of the biggest asset managers, Franklin Templeton, launched a US dividend ETF across Europe.

These ETFs focus on companies with strong balance sheets, consistent dividend histories, and attractive yields, providing a potential cushion in volatile markets.

According to Reuters, “global funds that invest in dividend-paying stocks are drawing strong flows, following two years of tepid investor demand, as investors seek assets with a stable income while they navigate geopolitical and economic tensions”.

But what about in Europe? Could high-dividend ETFs offer the same stability and income potential for European investors? Let’s explore.

If you prefer to watch our video, feel free to do so:

What are the best high-dividend ETFs for European investors?

First of all, high-dividend ETFs based in the US are not available in Europe.

European investors must look for UCITS-compliant ETFs, which are typically domiciled in Ireland or Luxembourg.

These ETFs are available through major European brokers, including Freedom24, Interactive Brokers, and XTB, all of which are regulated by European entities such as the CySEC, the Central Bank of Ireland (CBI), and the KNF.

Based on data from JustETF, the following high-dividend ETFs stand out for European investors (ordered by assets under management):

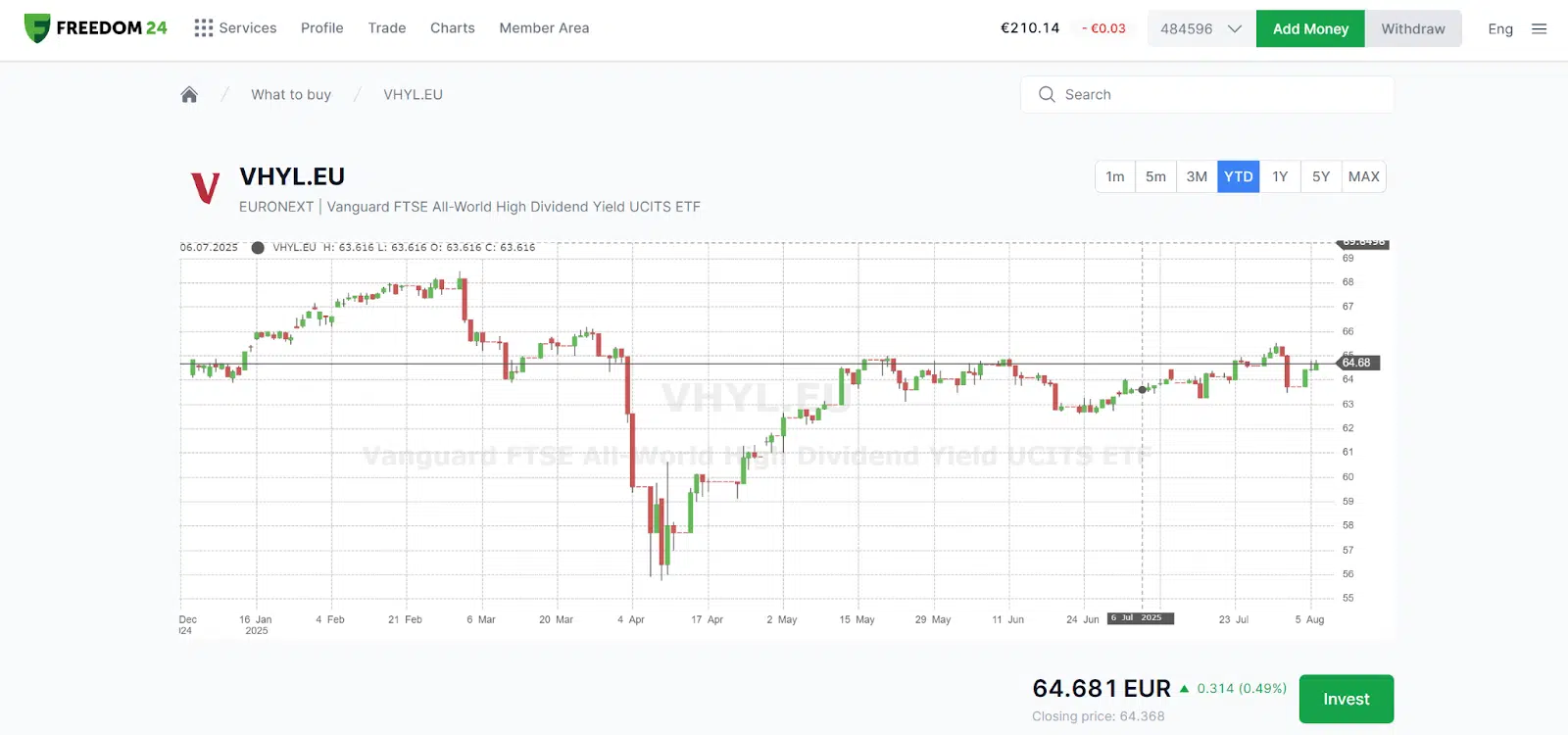

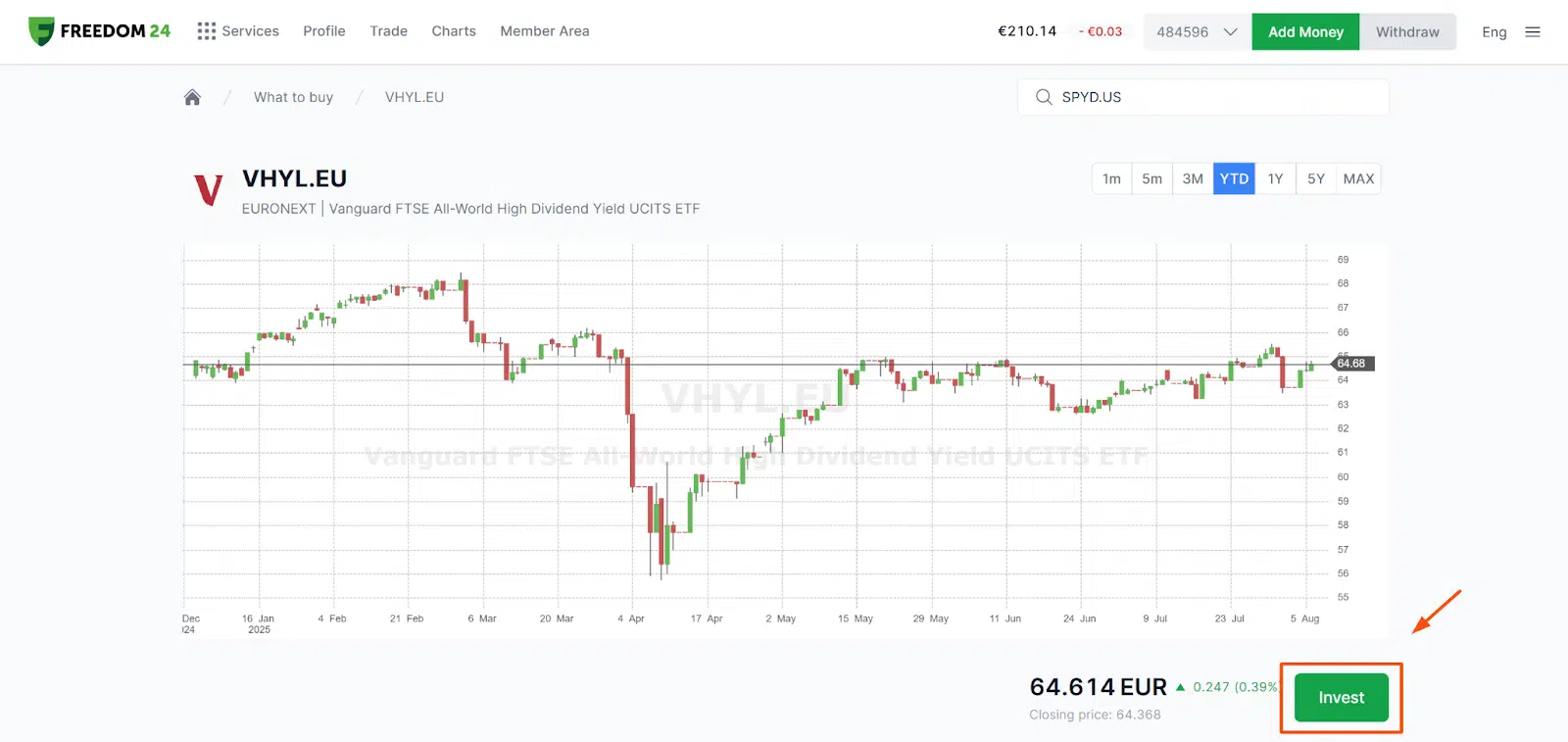

1. Vanguard FTSE All-World High Dividend Yield UCITS ETF (VHYL)

- ISIN: IE00B8GKDB10

- Ticker: VHYL

- Sector: Global Equities (high dividend)

- Yield: ~3.3% (as of September 2025)

- TER: 0.29%

- Replication: Physical

- Assets under management: +€6 billion

- Payout frequency: Quarterly

- Key feature: Global diversification with a tilt towards value and high dividend stocks

Source: Freedom24.com

VHYL offers exposure to a diverse portfolio of global dividend-paying companies. Ideal for those who want global diversification while maintaining a steady income stream.

For more information on this ETF, you can check its official factsheet.

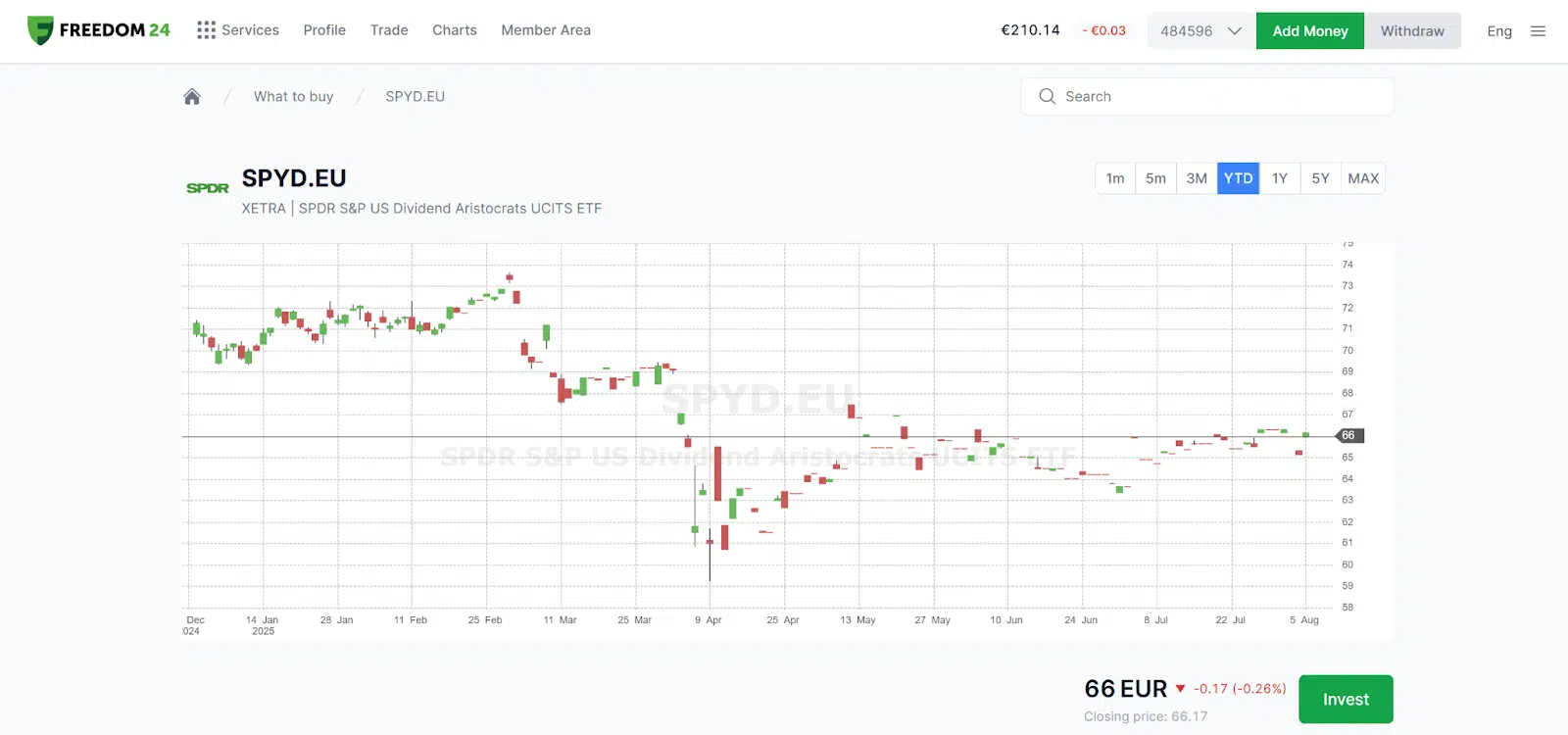

2. SPDR S&P U.S. Dividend Aristocrats UCITS ETF (SPYD)

- ISIN: IE00B6YX5D40

- Ticker: SPYD

- Sector: U.S. equities — Dividend Aristocrats

- Yield: ~2.92% (as of September 2025)

- TER: 0.35%

- Replication: Physical (full replication)

- Assets under management: +€3 billion

- Payout frequency: Quarterly

- Key feature: Focused on U.S. companies with at least 20 consecutive years of dividend increases, offering quality exposure and steady income in USD.

Source: Freedom24.com

It’s well-suited for European investors seeking exposure to reliable U.S. dividend payers. The focus on companies with at least 20 consecutive years of increasing dividends provides a quality filter, but total return may lag growth-oriented funds. Currency exposure to USD adds both risk and diversification potential.

For more information on this ETF, please refer to its official factsheet.

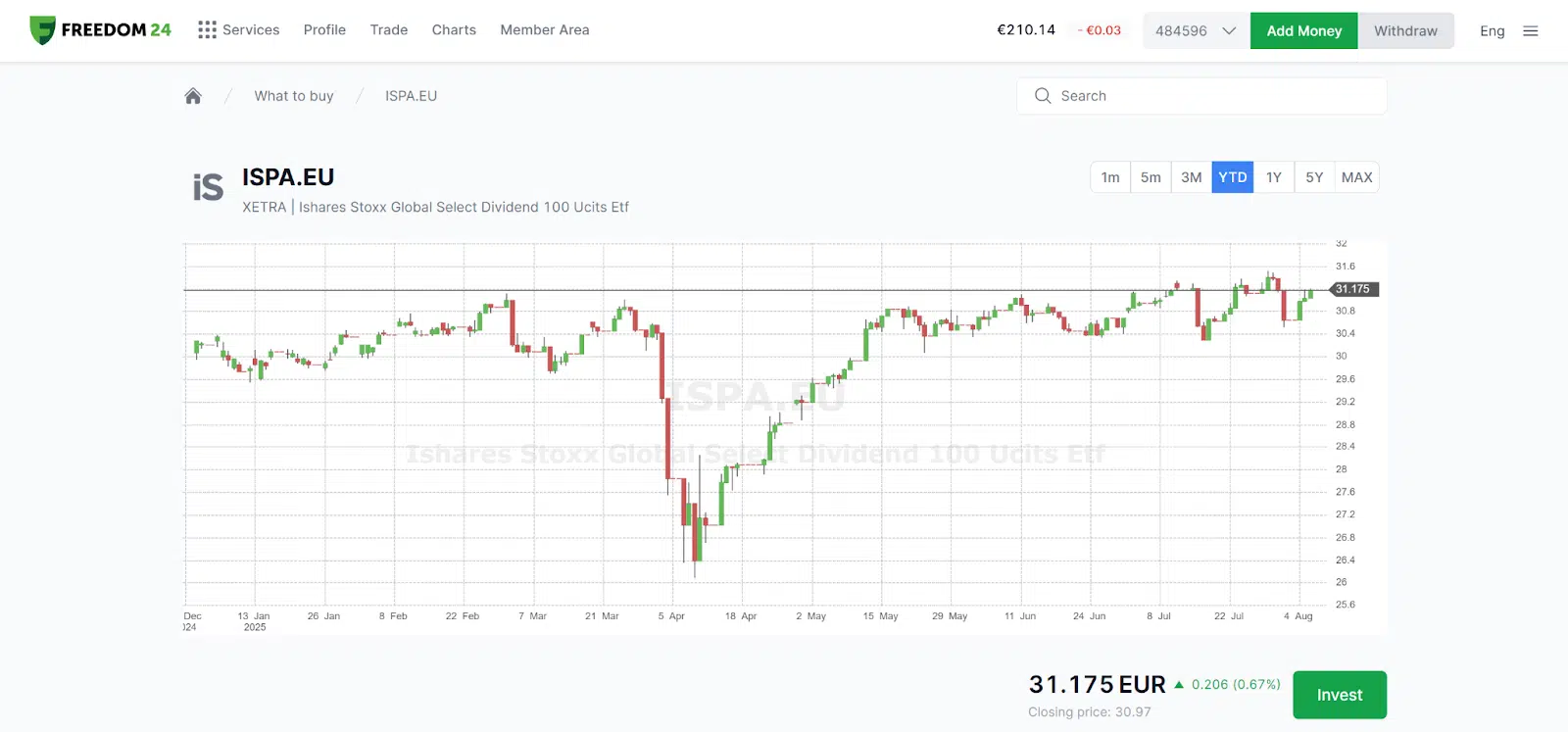

3. iShares STOXX Global Select Dividend 100 UCITS ETF (ISPA)

- ISIN: DE000A0F5UH1

- Ticker: ISPA

- Sector: Global high-dividend equities, Dividend Aristocrats from developed markets (100 companies)

- Yield: ~4.7% trailing 12‑month dividend yield (as of September 2025)

- TER: 0.46% p.a.

- Replication: Physical (full replication)

- Assets under management: +€2.9 billion

- Payout frequency: Distributing, up to 4x per year (often annually or quarterly)

- Key feature: Provides diversified exposure to high‑dividend companies across Europe, North America, and Asia-Pacific, selected for dividend stability and low payout ratios

Source: Freedom24.com

This ETF is designed for investors seeking global diversification with a focus on stable dividend-paying companies. It screens for firms with sustainable payout ratios, ensuring that high yields come from financially solid businesses.

For more information on this ETF, you can check its official factsheet.

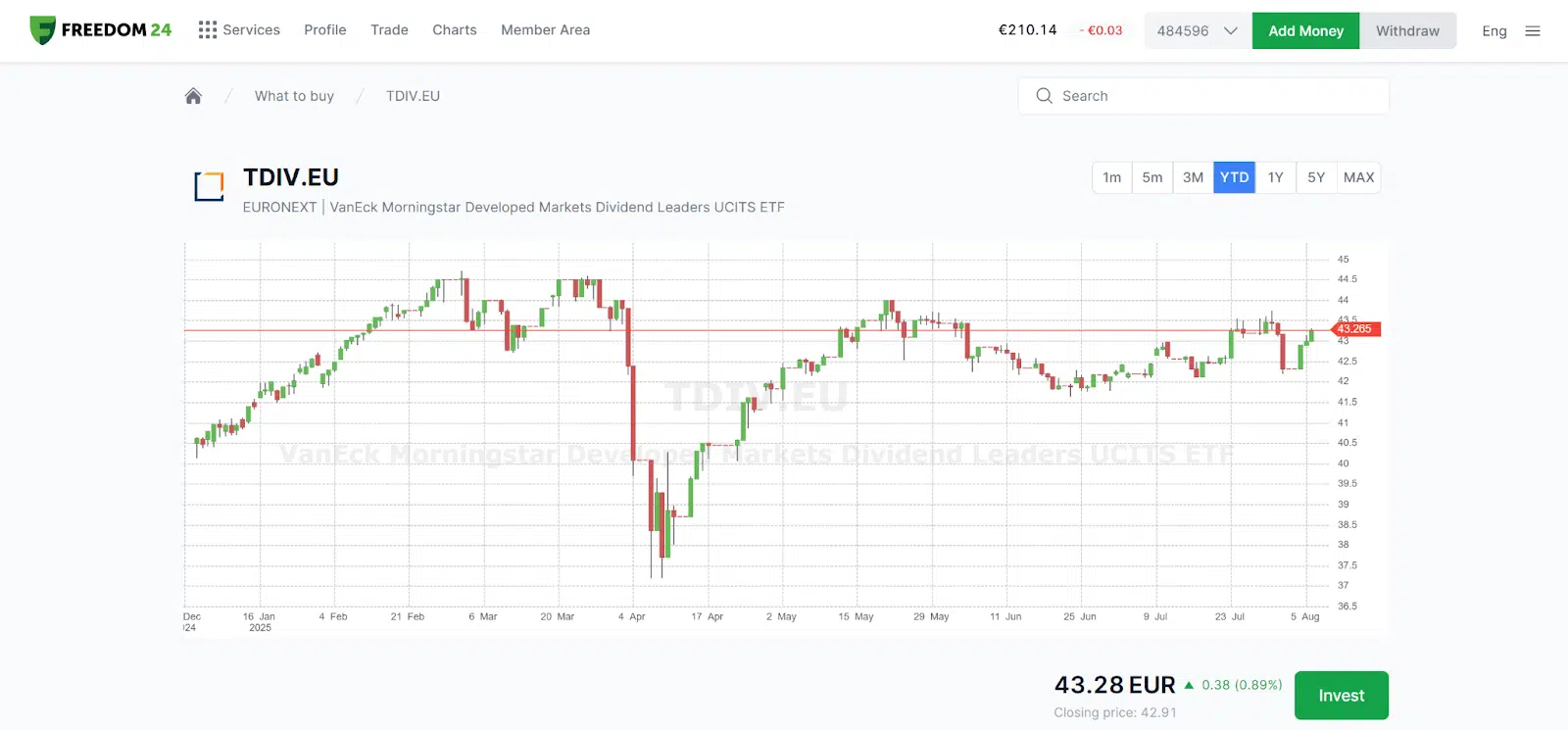

4. VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF (TDIV.EU)

- ISIN: NL0011683594

- Ticker: TDIV (Amsterdam listing)

- Sector: Global high‑dividend equities (developed markets)

- Yield: ~4.1% trailing 12-month dividend yield (as of September 2025)

- TER: 0.38% p.a.

- Replication: Physical (full replication)

- Assets under management: +€2.8 billion

- Payout frequency: Quarterly distributions

- Key feature: Filters for global developed-market firms with consistent, sustainable dividend records. ESG-screened companies selected for dividend resilience and attractive yields. Broad global diversification in a single ETF.

Source: Freedom24.com

It distributes income quarterly in EUR and is suited for income-oriented investors seeking global diversification with strong quality filters.

For more information on this ETF, you can check its official factsheet.

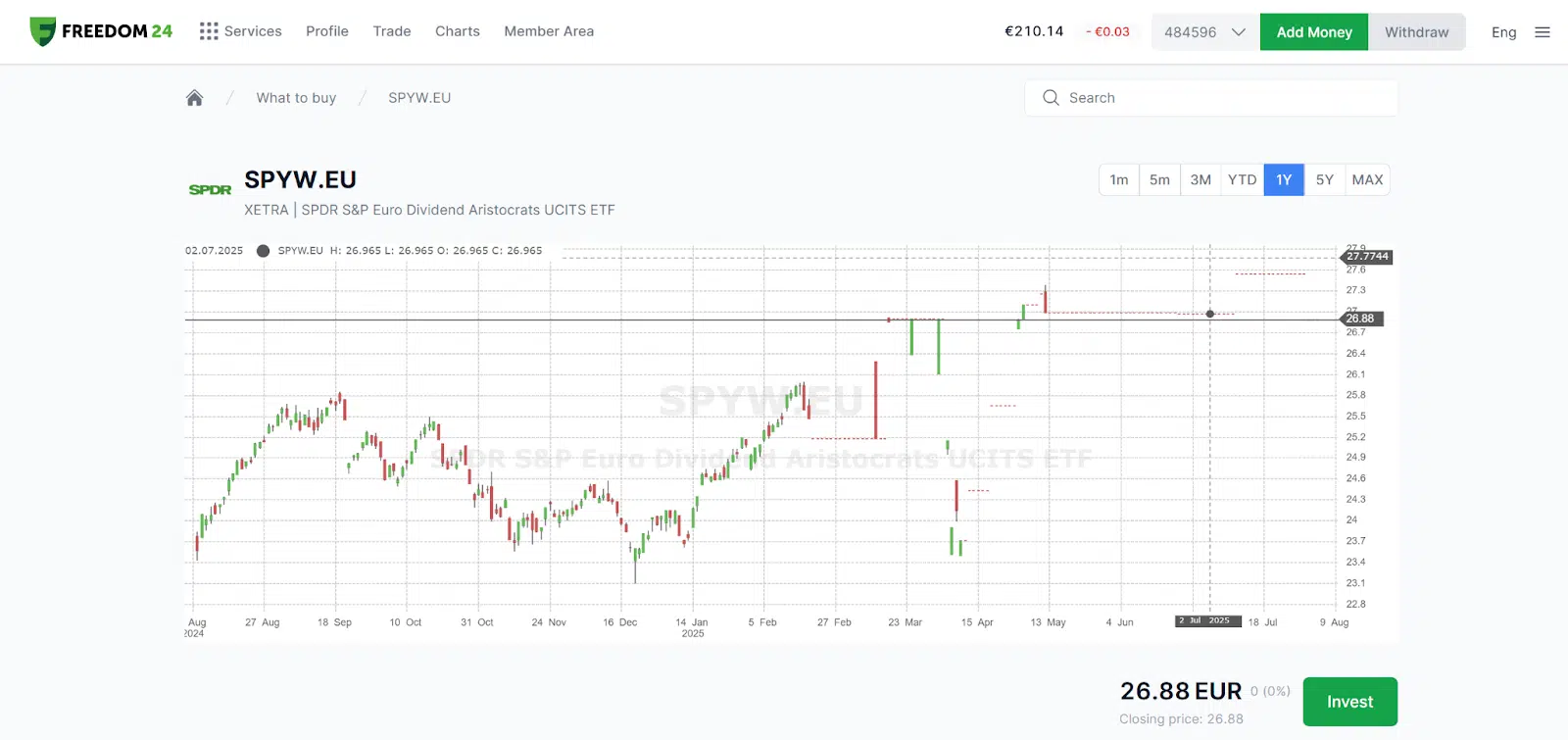

5. SPDR S&P Euro Dividend Aristocrats UCITS ETF (Dist)

- ISIN: IE00B5M1WJ87

- Ticker: SPYW

- Sector: Eurozone dividend aristocrats (Top 40 companies with at least 10 consecutive years of increasing or stable dividends)

- Yield: ~4.23% (as of September 2025)

- TER: 0.30% p.a.

- Replication: Physical (full replication)

- Assets under management: ~€1.24–1.25 billion

- Payout frequency: Semi‑annual (paid twice a year)

- Key feature: Focuses on dividend consistency among Eurozone companies; offers reliable income while maintaining quality exposure across financials, utilities, and industrials.

Source: Freedom24.com

High Dividend European ETFs compared

| ETF Name | Yield (Approx.) | TER | AUM |

| Vanguard FTSE All-World High Dividend Yield UCITS ETF (VHYL) | ~3.3% | 0.29% | €6B+ |

| SPDR S&P U.S. Dividend Aristocrats UCITS ETF (SPYD) | ~2.92% | 0.35% | €3B+ |

| iShares STOXX Global Select Dividend 100 UCITS ETF (ISPA) | ~4.7% | 0.46% | €2.9B+ |

| VanEck Morningstar Developed Markets Dividend Leaders (TDIV) | ~4.1% | 0.38% | €2.8B+ |

| SPDR S&P Euro Dividend Aristocrats UCITS ETF (SPYW) | ~34.23% | 0.30% | €1.24B |

How to invest in a high dividend ETF (Step by step)

The process of investing in a high dividend ETF is identical to that of investing in any other ETF or stock. Following our previous example, we will use Freedom24, a CySEC-regulated broker, to illustrate the process (new users get 20 free shares when signing up).

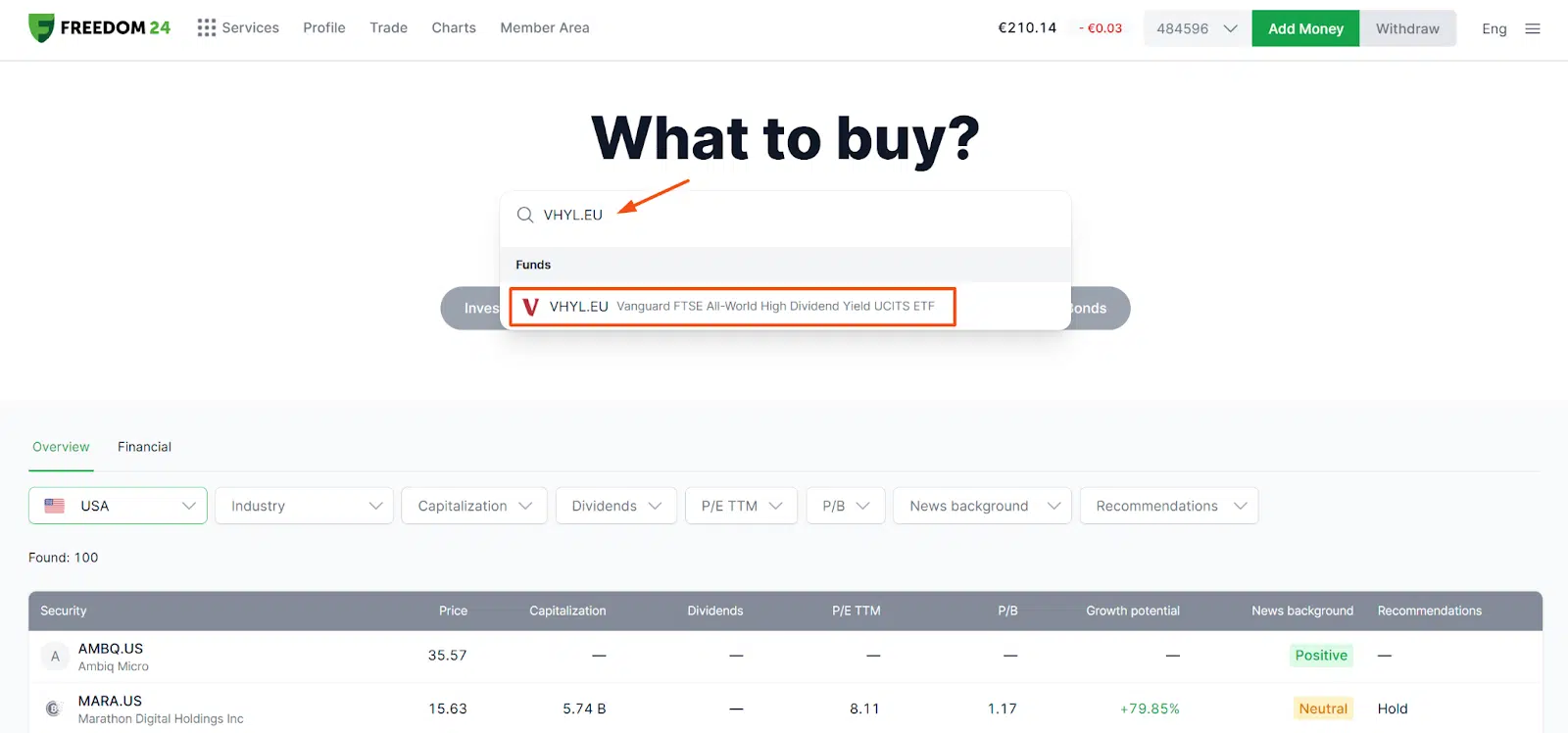

Step 1: Search for the dividend ETF

Let’s go for the “VHYL”:

Step 2: Select the first ETF and click “Invest”:

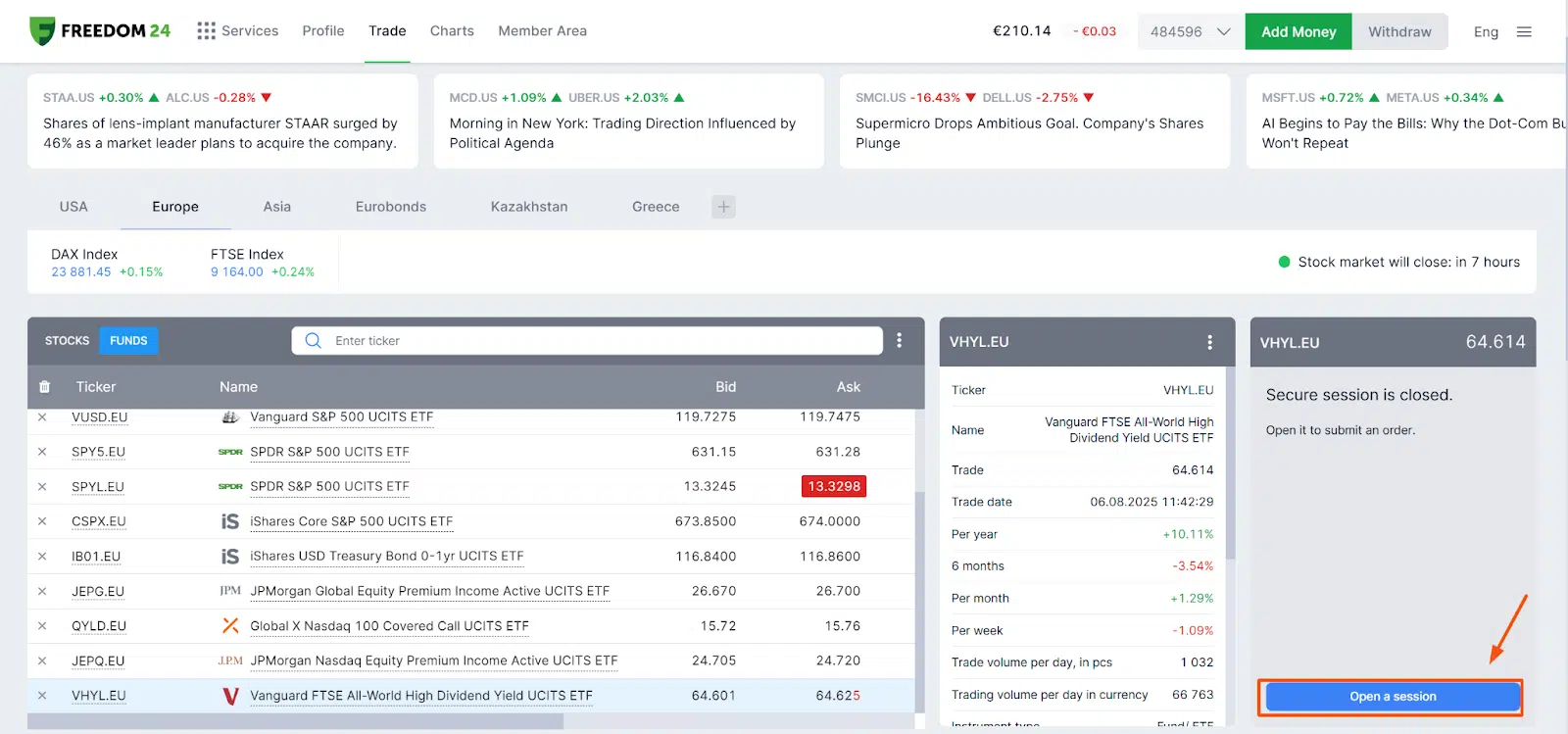

Step 3: Open a session

After clicking “Invest”, you will be redirected to the “Trade” window. Now, you will need to click on “Open a session” and follow the security steps (you will need to open the Freedom24 app on your mobile phone and use the QR code scanner within the app).

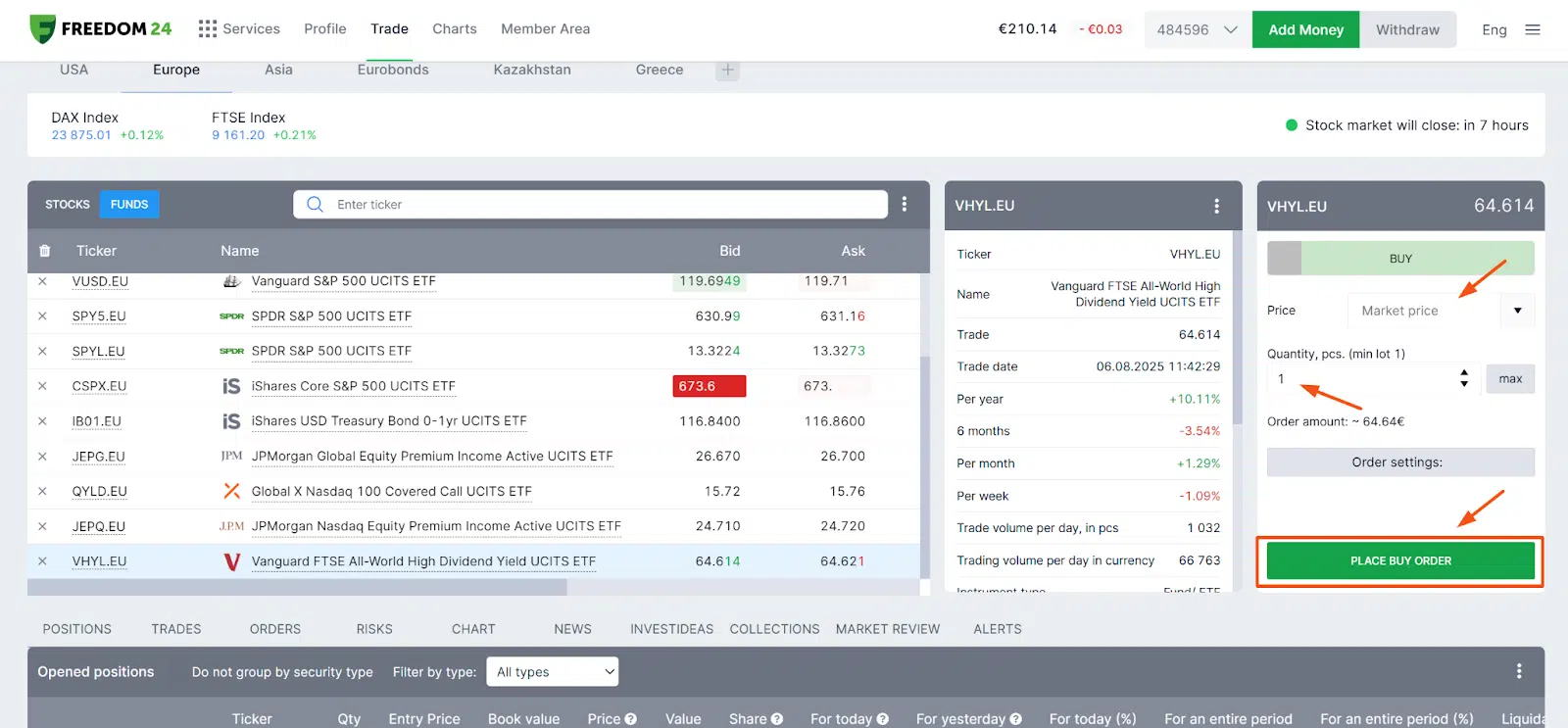

Step 4: Place a buy order

Define the amount you want to buy (1 share in our case) and the order type (We went for “market price”). Then, click “PLACE BUY ORDER”:

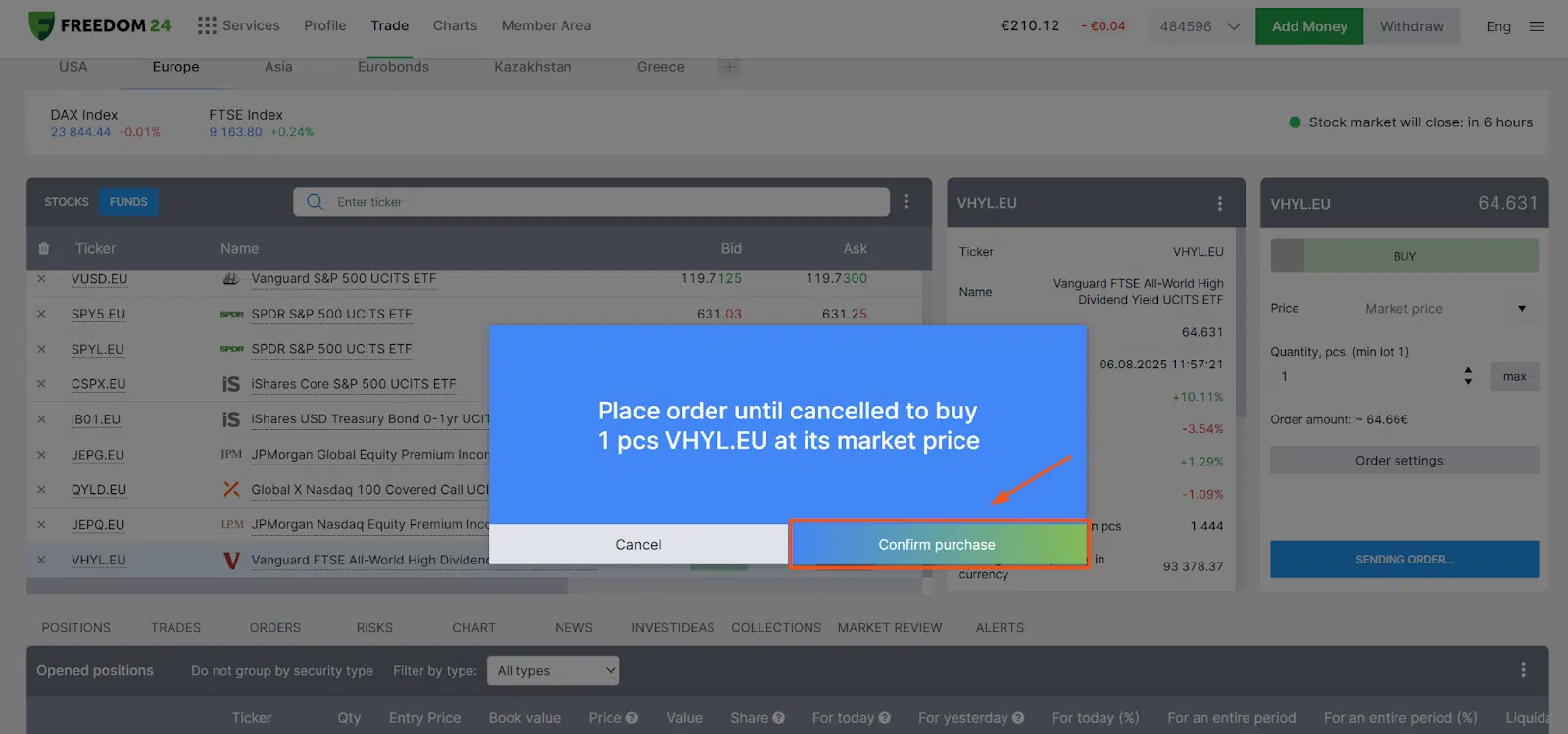

Step 5: Final trade confirmation

Just click on “confirm purchase”:

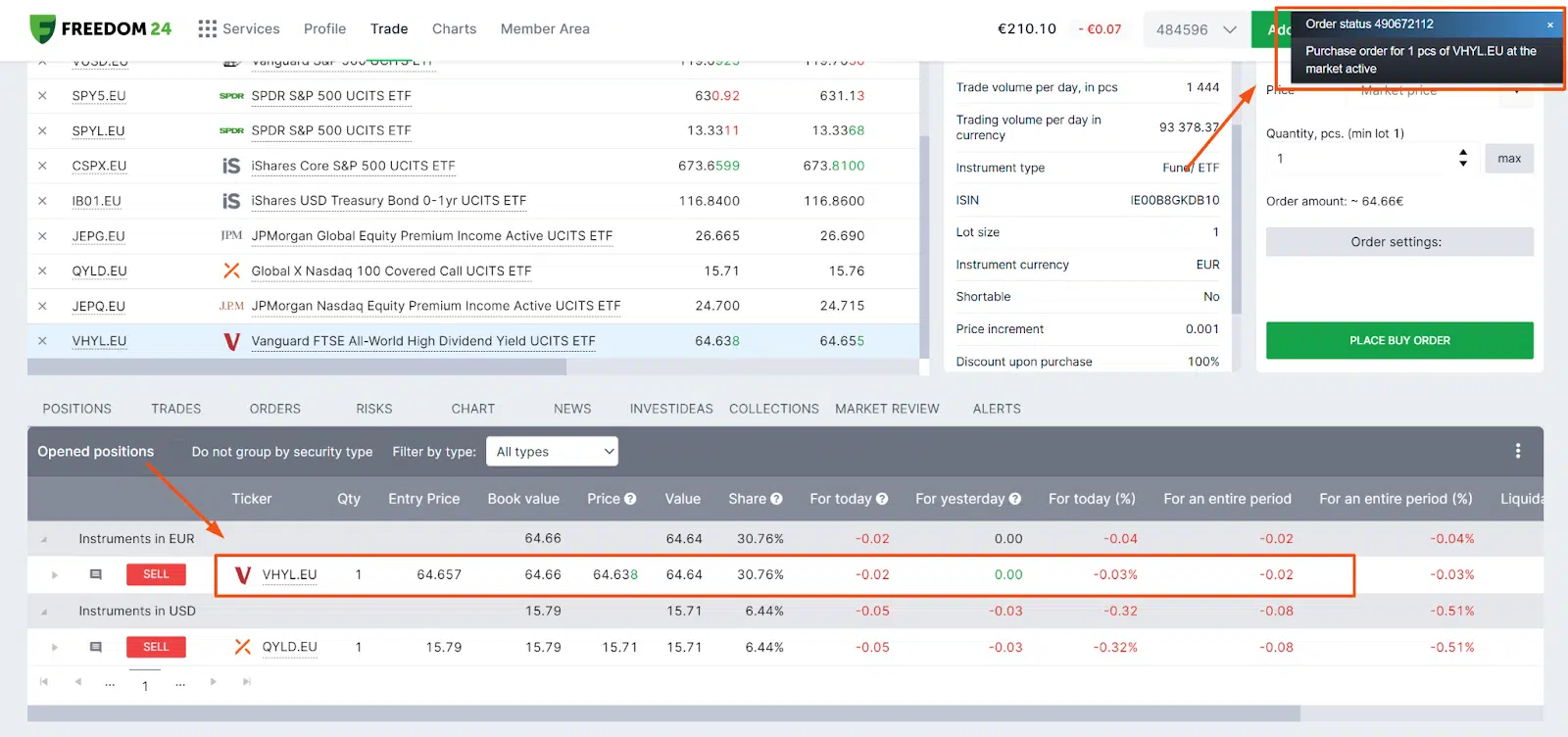

Step 6: Your order has been fulfilled, and it is in your portfolio:

What is a high-dividend ETF?

A high-dividend ETF invests in companies with above-average dividend yields. These ETFs can include stocks from various sectors such as utilities, financials, and consumer staples – industries known for steady cash flows and strong shareholder returns.

Unlike growth-oriented ETFs, high dividend ETFs focus on income generation, making them ideal for income-focused investors, or anyone seeking portfolio stability.

Why don’t all ETFs pay dividends?

Not every ETF provides dividend payments because some of them follow assets that don’t generate regular income (such as growth-oriented stocks, commodities, or specific thematic indexes).

Additionally, certain ETFs are designed with a focus on capital growth rather than income distribution. In these cases, any income received is automatically reinvested into the fund to increase its overall value. These are called accumulating ETFs.

Accumulating vs. distributing ETFs

When selecting a dividend ETF, it’s important to distinguish between the two main types:

- Distributing ETFs: pass dividends directly to investors, typically on a monthly, quarterly, or yearly basis.

- Accumulating ETFs: reinvest dividends back into the fund, increasing the price per share over time.

Distributing ETFs tends to be the preferred choice for investors seeking regular income. Accumulating ETFs, on the other hand, are often used for long-term portfolio growth and, in some jurisdictions, may offer favourable tax treatment.

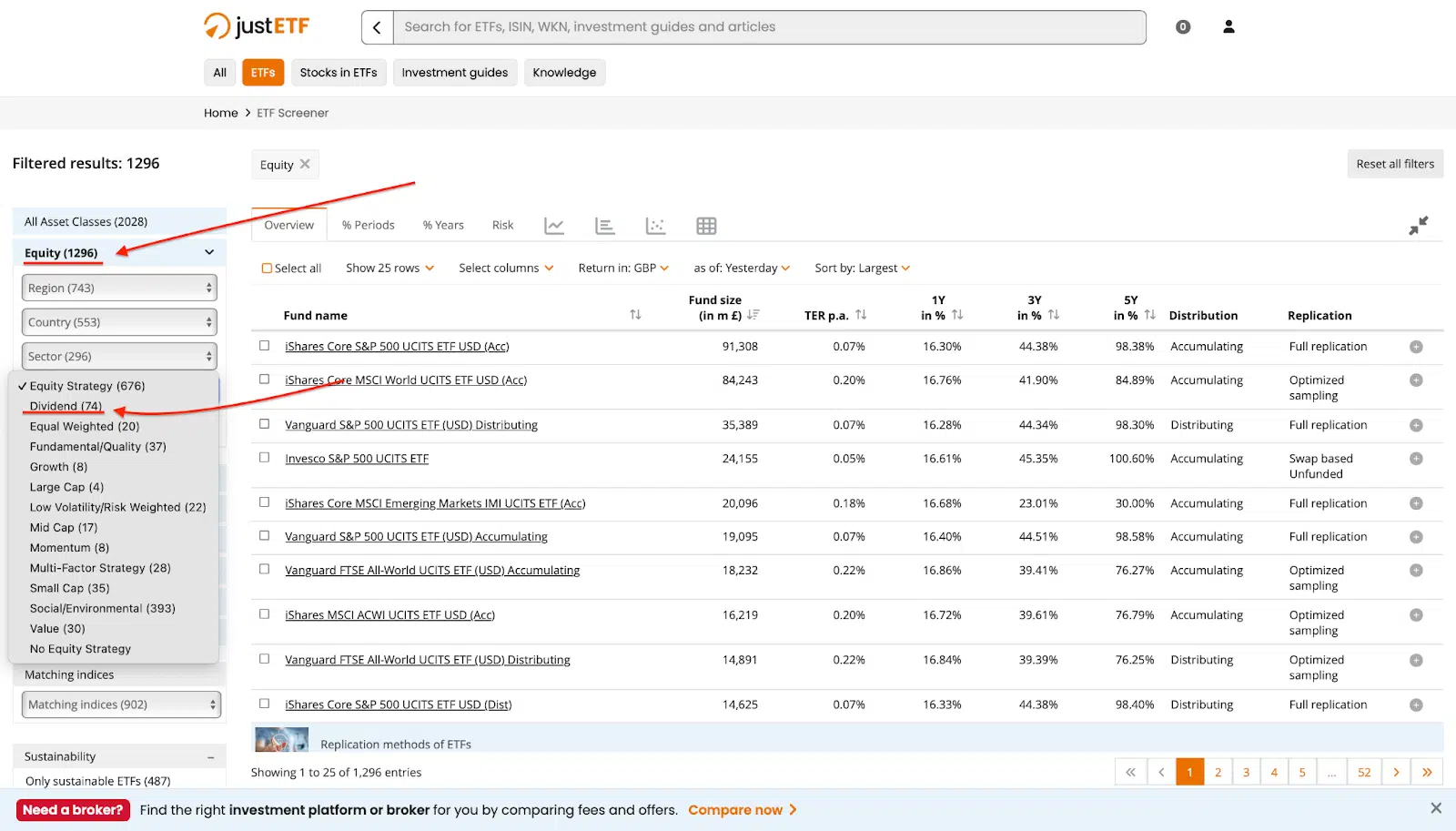

How to find and compare other dividend ETFs using JustETF

Interested in exploring other options? With JustETF, it’s pretty easy.

Go to the JustETF screener page and filter by:

- “Equity” (asset class)

- Then, choose the “Equity Strategy” – “Dividend”.

Here is a screenshot:

Here you can find and compare different high-dividend ETFs based on performance, yield, costs, and size.

Bottom line

High-dividend ETFs offer European investors a practical way to generate consistent income while maintaining broad market exposure. By focusing on companies with strong financial fundamentals and reliable dividend histories, these funds can bring stability to a portfolio, even during uncertain market conditions.

Whether you opt for global options like VHYL and TDIV, or more regionally focused choices such as SPYW, the right ETF depends on your investment goals, risk tolerance, and tax situation.

If you’re ready to start, regulated brokers like Freedom24 make it straightforward to add these ETFs to your portfolio and benefit from steady dividend income.