The question of much money you can make copying other traders on social trading platforms is interesting, and it’s something that a lot of people are wondering. You’ve certainly seen people online bragging about the returns they make from copy trading. People throw around numbers like anywhere from 100% to 1,000% per year. However, how likely is that to happen in the real world?

Can you make a living from social trading?

The truth is that, yes, you can make a living from social trading. However, if you don’t have much money to start with, it will be difficult. It’s, therefore, prudent to be realistic and not expect instant riches.

Trading is easy over the SHORT-TERM. Anyone can get lucky and show fantastic returns over a few weeks or months, and if they extrapolate their returns over a year, it may come out at a few hundred per cent. And when they then show those returns to new traders on social trading platforms, many unsuspecting traders decide to get on the train and let this seemingly genius trader make trades on their behalf.

Over the LONG-TERM, however, trading is far from easy. In fact, it’s tough to generate even low double-digit returns consistently over many years.

Even the most famous investors in the world, such as the legendary stock investor Warren Buffet, has only generated about 20% per year on average since starting his career in 1965. And still, he is now a billionaire and widely considered “the world’s greatest investor.” Here is a table with Buffet’s returns through Berkshire Hathaway, broken down by decade:

What is the return on Social Trading?

Now, we will discuss a trader as a study case. As you can see in the image below, his returns have varied quite a bit, from slightly positive in the first five months of the year to much more profitable in the second half of the year. Additionally, this trader also had one month of negative returns, which is not uncommon in trading.

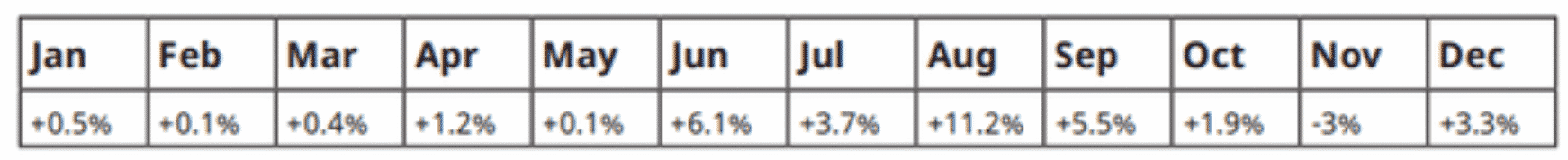

And here are the exact corresponding returns for each month:

As you can see, if you add up all the numbers, this trader’s total profit for the year was 31%. And among all the months, only August resulted in double-digit returns of more than 10%. For all the other months, returns mostly ranged between 0 and 5%.

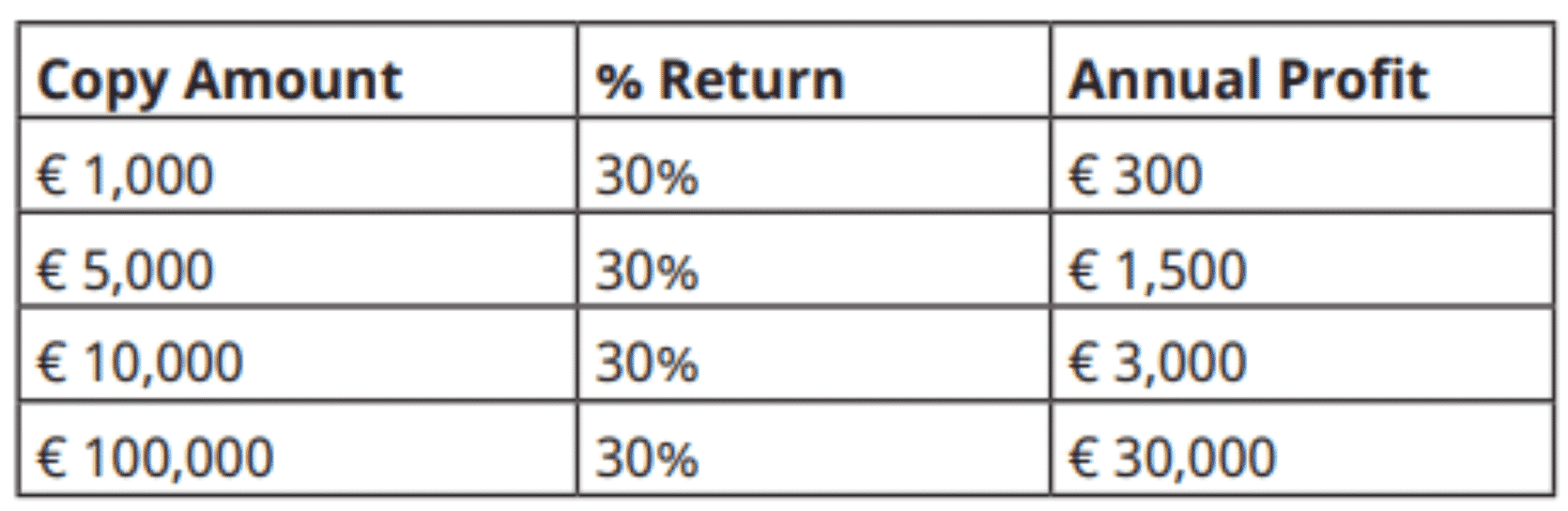

This means that if you had copied this trader with € 1,000 from your account, you would have made between € 0 and € 40 per month. Over the entire year, you would make € 310, given this trader’s annual return of 31%.

Could you live off of that? Well, probably not. But what you can do is to start small and let your trading account grow organically year after year. And who knows, maybe one day you will have an account size large enough to make a living from? Below are a few more examples to help you get an idea of what different account sizes can mean in terms of your profit potential:

Past performance is not indicative of future results, and that’s why there are no guarantees in investing. The same happens in copy trading. The goal is to detect which traders have a higher probability of repeating what they’ve accomplished in the past and effectively managing your team.

Bottom line

- Like any other investment, you won’t become rich overnight! Copy Trading involves risks, including capital loss, even when following and/or copying or replicating top-performing traders.

- Anything above 60–70% annual returns is tough and probably down to luck or taking huge risks. Set realistic expectations: we challenge you to show us any copy trader with 5+ years of consistent 20%+ returns.

- A realistic expectation is to get 5% to 15% annual returns from copy trading. Beware that this is a good return and requires a good understanding of this market.

- The returns depend on the capital you invest. Obviously, 5% of 1000€ isn’t the same as 5% of a 100,000€ investment. Remember only to risk capital you don’t need. This money shouldn’t risk your financial stability.

- While returns are more appealing than fixed/term deposits or buying government debt, so are the risks. Also, because the risks are higher, copy trading is a lot more regulated.