Hello, fellow investor! We will review Uphold to help you determine whether it is the right crypto platform for you.

Uphold is well-suited for people seeking exposure to cryptocurrencies with low spread costs and a straightforward interface.

Be aware that our review is based on the perspective of a European user. Despite talking about other regions outside the European Economic Area (EEA), some features/products may or may not apply to you.

That’s Uphold in a nutshell! Here’s what we’ll cover:

Overview

Founded in 2015, Uphold is a “multi-asset digital money platform” already available in over 180 countries across 150+ currencies, both fiat and crypto. Its simplicity and easy-to-use platform make it particularly convenient for beginners looking to get their hands on crypto for the first time.

In addition to crypto trading, it also allows you to stake cryptocurrencies which may enhance your future returns. The expected annual percentage yield (APY) will vary from crypto to crypto, but you should expect higher interest in higher volatile assets.

You can follow relevant news by signing up for their “Daily Newsletter”. It will help you be up-to-date on the crypto market and get insights into new trends emerging.

Uphold publicly shows its reserve status through several tiers as a transparency measure. This transparency is also reflected in their service fees because the price you see before you trade (including the spread fee) is the price you pay when you trade.

As stated in the introduction, Uphold services vary according to the website version you are accessing. The most obvious difference is within the product offering since you will find no stocks or precious metals in the “English EU” (European Union) and “English UK”.

Highlights

| 🗺️ Supported Countries | Worldwide (exceptions apply) |

| 💰 Fees | 0.25%-2.95% |

| 🎮 Demo Account | No |

| 💵 Minimum Investment | $/€/£10 |

| 📍 Investment Instruments | Metals and cryptos |

Pros and cons

Pros

- Slick and modern trading platform

- Allows to transfer your crypto to an external crypto wallet

- 0% commission

- No withdrawal or deposit fees

- Low spreads (0.80% to 1.25%)

- High level of business transparency

Cons

- Stocks, Metals, debit cards and automated trading are not available in some regions (including EEA)

- Uphold is not regulated as a bank or any other financial institution (Crypto assets are not under any investor protection scheme)

- Limited number of cryptocurrencies when compared to bigger exchanges

- You are not the direct owner of any listed security (Stocks, metals,…)

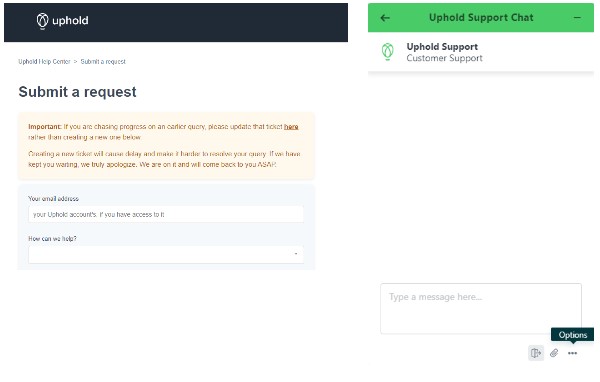

- Limited customer support

Platform

Uphold trading platform is very intuitive and straightforward. Any beginner will quickly get used to it within the first five minutes (the same goes for the mobile version).

You can create a watchlist for crypto or other available assets, check the history of your trading activity and keep an eye on the market price of all the available assets to trade (cryptocurrencies, equities, utilities tokens, fiat and metals).

While you navigate through the platform, your total balance is always displayed as well as the “Anything-to-Anything” trading feature, which lets you transact crypto-to-crypto. Plus, it allows you to specify the value of a crypto-to-crypto trade in your local currency (e.g. when you’re buying €100 worth of Bitcoin using Ethereum).

Uphold allows you to place up to 50 limit orders simultaneously to mitigate price volatility. So, imagine you are unsure whether to buy €1,000 worth of Bitcoin, Ethereum or Solana. You can define which price you would be willing to buy each of those currencies and set a limit order for the three cryptos simultaneously (€1,000 per order, €3,000 in total). The order that touches your limit price first will be executed, and the others are cancelled (unless you put more money into your account).

Those looking for more advanced order types or charting tools will want to look elsewhere.

Products

Uphold offers trading in three asset classes: stocks, cryptos and metals, plus a debit card and automated trading.

However, not all clients have access to the full range of products. You can only buy stocks (45+), precious metals (Gold, Palladium, Platinum, Silver and Universal Gold), have access to a debit card and automated trading in some jurisdictions (“English Global and US” and “Spanish Global”). Still, cryptocurrencies are available for all clients.

Cryptocurrencies

Sending and receiving any crypto requires a wallet (paper, hardware, web, mobile or desktop). Uphold provides you with a wallet as a safe and convenient way to store your funds. According to the company, “Around 90% of our crypto is held in cold storage”, meaning that it is practically immune to cyberattacks.

Besides, the wallet has other uses, such as making payments to vendors, sending money to friends, and instantly converting your bitcoins into local currencies and other cryptocurrencies.

Socially responsible investing

Can you combine sustainable investing with reasonable returns? Uphold believes so! It has created Universal Carbon (UPCO2), the world’s first tradable carbon credit token and Bitcoin Zero, the cleanest form of Bitcoin. Through these instruments, you can contribute to reducing the carbon footprints since each token is “backed” by a standards agency verifying that one tonne of carbon has been averted by an audited rainforest project.

Socially Responsible Investing (SRI) through UPCO2 is a “bet” from Uphold, so investors should be aware that, by now, UPCO2 token can only be sold on the Uphold platform. Until it expands to other exchanges, you should expect lower levels of liquidity, which may result in unfavourable spreads and unexpected price movements.

Staking

To clarify, staking is locking up crypto holdings to obtain rewards or earn interest.

Uphold allows you to earn an expected annual percentage yield (APY) of up to 14%. Although it sounds good, you will likely get a much lower APY because the 14% only applies to Injective (INJ) and immediately drops in other crypto assets. For instance, by staking Solana, you can only earn an estimated APY of 5.5%.

Be aware that: “If you reside in a country other than Australia, Canada, Mexico, New Zealand, South Africa, South Korea, Switzerland, or the United States, and you do not opt in to the Staking Program, you acknowledge and agree that Uphold may stake any Eligible Assets you hold on the platform in its own name and retain for itself any rewards earned” (our bolding).

Staking rewards are subject to a 15% fee, but the APYs displayed on its website are already taking into account that fee, so there is no need to calculate what is left for you.

The negative side of staking involves having your coins locked for some time in which you cannot transfer, exchange or withdraw. This period is typically set at up to 30 days but may be longer.

Staking Ethereum (ETH) is subject to slightly different rules. ETH may not be unstaked until the Ethereum network upgrades to version 2.0. Uphold does not control when this may happen, which may never happen (you cannot transfer, exchange or withdraw it). However, Uphold is willing to allow ETH to unstake depending on the activity of other participants in the staking program. For this purpose, Uphold charges a 2% fee.

Fees

Uphold does not charge deposit or withdrawal fees. Still, it is not a free platform. Like most exchanges, Uphold displays the current mid-market price on its charts. However, when you purchase or sell digital currencies, you will notice a slight difference between the price you can buy (ask price) and the price you can sell (bid price). That difference is called “Spread” and is Uphold’s primary revenue source.

Here are some of the platform crypto spreads:

- Bitcoin and Ethereum: 1.4%-1.6%

- Most Stablecoins and major market FX: 0.25%

- Altcoins: 1.9% – 2.95%

To check all the crypto spreads, please consult Uphold service fees page.

Prices are locked in pre-trade, and there are no hidden fees between the “Preview” and “Transact” (the price you see is the price you pay).

Other spreads may apply depending on your region offering:

- Precious metals: 3%

- Fiat currencies: 0.20% between major national currencies such as EUR, USD, and GBP.

- US equities: 1% (for after-hours trading, a small spread may be added – based on the stock’s volatility).

Safety and reliability

In Legal terms, cryptocurrencies still act in a grey area since they are not considered securities (financial assets). As such, it opens space for uncertainty regarding regulatory oversight or the existence of any investor protection scheme.

For EEA residents, Uphold is a provider of crypto services in Lithuania and is not regulated as a bank or any other financial institution.

At the top right corner of your homepage screen, you notice that Uphold acts in five different jurisdictions through which you will open an account depending on your country of residence, namely:

- “English global”: Uphold Europe Limited – Reg No. 09281410, Registered Office: London, England

- “English EU”: Uphold Lithuania UAB, registry code 305967101, Registered Office: Vilnius, Lithuania

- “English UK”: Uphold Europe Limited (Uphold) registered with the Financial Conduct Authority (FCA) under the FCA’s Temporary Registration Regime for crypto asset firms. When purchasing, selling and/or holding cryptoassets, you will not have access to the Financial Services Compensation Scheme (FSCS) if the company goes bankrupt

- “English US”: Uphold HQ Inc. NMLS ID No. 1269875, Registered Office: 530 5th Ave., Ste 3A, New York, NY 10036.

- “Spanish Global”: Uphold Europe Limited, Reg No. 09281410, Registered Office: London, England

When you visit Uphold.com, you are automatically redirected to the appropriate website defined by your IP.

You need to be aware that any Investor Protection Scheme does not protect crypto assets because they are not considered securities, and the company itself is not offering financial services. So, in the event of a complaint relating to crypto assets services, you will have no recourse to the out-of-court complaints procedure of the Bank of Lithuania.

Nevertheless, Uphold makes an effort to minimize the lack of regulatory security felt by a user because it custodies the crypto assets in either your Uphold Account or a segregated custody account controlled and secured by Uphold (we tried to know precisely what entity was making the custody, but no information was found). You are the beneficial owner of your crypto assets at all times.

Additionally, according to the “International Equities User Agreement”, you are not the direct owner of any individual listed security (stocks, metals,…) and you will not be the holder of record, or entitled to any voting rights due to your purchase (you are just given “economic interest”). Uphold International Equities has no investor compensation scheme in case something bad happens to it.

Finally, Uphold is committed to compliance by being a FinCEN Registered Money Services Business (MSB) in the United States, it is registered as a “cryptoasset firm” with the FCA for Anti-Money Laundering (AML) purposes and complies with the Money Laundering, Terrorist Financing and Transfer for Funds. Also, it works as an EMD Agent of Optimus Cards UK Limited, a regulated firm by the FCA.

Supported countries

The number of supported countries (180+) is much higher than the ones which are not supported, so we will state only the regions where you won’t be able to open an account:

Europe – list of restricted countries:

- Albania

- Azerbaijan

- Belarus

- Bosnia and Herzegovina

- Bulgaria

- Crimea

- Croatia

- Georgia

- Germany

- Kosovo

- Moldova

- Montenegro

- Netherlands

- Romania

- Russia

- Serbia

- Slovenia

- Ukraine

Asia – list of restricted countries:

- Bangladesh

- China

- Indonesia

- Iraq

- Myanmar

- North Korea

- Turkmenistan

- Vietnam

- Yemen

Africa – list of restricted countries:

- Burundi

- Congo (Democratic Republic)

- Congo (Republic)

- Equatorial Guinea

- Guinea-Bisseau

- Kenya

- Libya

- Somalia

Oceania – list of restricted countries:

- American Samoa

North America – list of restricted countries:

- Haiti

- Venezuela

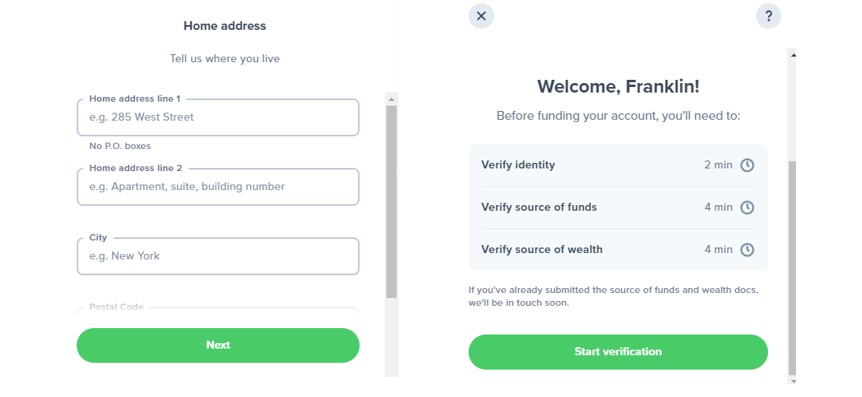

Account opening

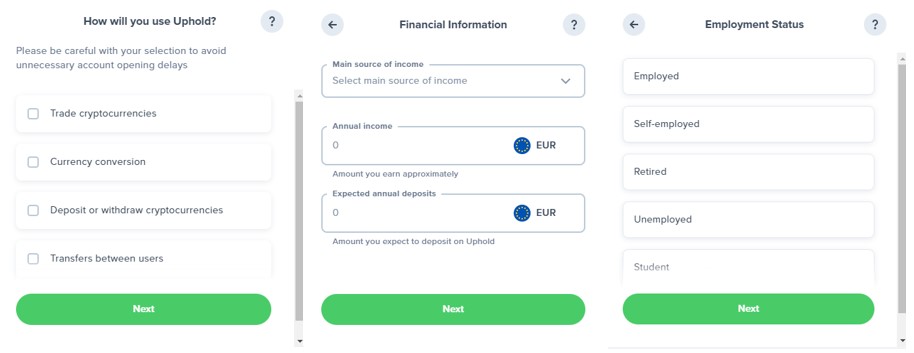

Opening an account took us five to ten minutes, longer than expected, because we did not have the proper documents on hand (our bad), namely the ID, source of funds and source of wealth documents. You will provide the following information during the initial sign-up process: email address, password, country of residence, and nationality.

Besides, other questions about yourself will be asked, such as your investment objectives, employment status and financial information.

Once you’ve submitted your information and read Uphold’s terms of service, you’ll receive a verification email. After verifying your email address, you can begin using your account.

Uphold offers three deposit methods: debit card, bank account* and sending crypto from an external wallet.

*Please note that deposits from bank accounts are only available in the UK, Europe & US.

Bottom line

Uphold acts in a competitive landscape. The number of crypto exchanges has dramatically increased, and the market seems to have followed a similar pace. Uphold has managed to participate in the growing pie.

From our experience, we noticed a long time to verify our account thoroughly, but after it, everything went smoothly. The platform does its job, the market prices of the different assets are clearly displayed and the process of depositing and withdrawing money takes a few days with no additional charges.

As always, it is a good idea to research different crypto exchanges and compare options before you sign up.