Hello, fellow investor! We will review NAGA to help you find out whether it is the right investment platform for you.

On the downside, their ETF offering is not crystal clear (real ETFs are mixed with CFDs on ETFs), and they have stopped offering commission-free real stock trading (see “Fees” section).

Founded in 2015, NAGA is a German fintech company created to give you easy access to the world of investment. It has been adopted by over 1,500,000 investors and allows you to trade 4,000+ Assets and Instruments worldwide, including stocks, ETFs, and CFDs on Forex, Shares, Indices, ETFs, commodities and futures. It offers social trading, a multi-currency account, a demo account, and several ways to deposit and withdraw your money.

In terms of safety, the NAGA platform is mainly operated by NAGA Markets Europe Ltd, authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC). However, if you sign up through NAGA Capital Ltd, which is authorised and regulated by the Financial Services Authority Seychelles (FSA), you will not benefit from investment protection (details explained below).

Moreover, as it is owned by The NAGA Group AG, a listed company on the Frankfurt Stock Exchange, it must publish its financial statements. This transparency gives us additional comfort.

That’s NAGA in a nutshell. Keep reading if you want to find out what our research team has to say after carefully analyzing NAGA.

Overview

NAGA is a German fintech company, a subsidiary of NAGA Group AG (listed on the Frankfurt Stock Exchange). It gives you investment access through two subsidiaries: “NAGA Markets Europe Ltd” and “NAGA Capital Ltd ” (more info below). From now on, we will mention it as “NAGA Europe” and “NAGA Capital”, respectively.

It enables you to trade for yourself and automatically follow other people’s trades (auto copy). The idea is to revolutionize the investment industry by providing access to the best market tools for everyone.

Through their various platforms (MT4, MT5, web version, and mobile apps), you have access to real stocks (only in NAGA Europe), and CFDs on Forex, shares, Indices, ETFs, crypto and commodities. Besides, its academy produces useful insights on the NAGA platform and trading in general. Occasionally, you may also watch webinars mainly on technical analysis.

NAGA, alongside eToro, is one of the few online platforms that allows searching and replicating other investors’ approaches/strategies. This feature is formerly known as Social Trading. It presents a feed where you will keep updated on what other traders are doing and general market news while engaging in the community and having the option to chat on NAGA messenger directly. It may be a great way to take advantage of other traders’ knowledge and automatically copy their trades, but it comes at a cost (See the “fees” section).

Please keep in mind that past returns of “top traders” are no guarantee of future performance and that there is the risk you are following/copying the trading decisions of possibly inexperienced traders who might just have been lucky for a while or traders whose financial situation may significantly differ from yours.

Concerning ETF trading, we find it hard to know if we are trading CFDs on ETFs or actual ETFs (real ownership).

As you can see below, besides “ETFs” there is no “CFD”, so you intuitively believe that it is a real asset. This is strange because NAGA differentiates between stocks (example: “Real Stocks USA”) and CFDs on stocks (example: “Stocks USA (CFD)”). So, why does it not follow the same approach in ETFs?

After selecting a random ETF, let’s say the “iShares MSCI EAFE”, you will notice the following small note: “You’ll trade 10 lots using 1.49% of your money”, implying that you will trade leveraged, so you are most likely to be investing through a CFD. Again, this is not crystal clear.

To open an account, you are advised to make a minimum deposit of €/$/£250 with no deposit charges. The process is smooth and fully digital.

After clicking “Get started” on the NAGA website, you will see what entity you are opening an account. Any person registering from the European Economic Area (excluding Belgium) and Switzerland will open their account through NAGA Europe. Example of trying to open an account from Portugal:

Highlights

| 🗺️ Supported countries | Worldwide |

| 💰 Stocks fees | €/$3 per side |

| 💰 Cryptos and CFDs fees | Medium |

| 💰 Currency conversion fee | 0% |

| 💰 Inactivity fee | €/$0 |

| 💰 Withdrawal fee | €/$0-5 based on your VIP Level |

| 💵 Minimum deposit | €/$250 |

| 📍 Products offered | Stocks (only in NAGA Europe), ETFs, and CFDs on Forex, Shares, Indices, ETFs, commodities and futures |

| 🎮 Demo account | Yes |

| 📜 Regulatory entities | NAGA Europe: CySEC; NAGA Capital: None |

Being under NAGA Global gives you more freedom because you can manage your money with fewer restrictions: “NAGA Capital Clients Leverage cannot exceed 1:1000” while “NAGA Markets clients leverage cannot exceed 1:30”.

Nonetheless, it dramatically increases the likelihood of losing money. A 1000x leverage means that a 0.10% price movement in any security will completely wipe you out (!), but you will not lose more than your invested capital since you still benefit from the “Negative Balance Protection”. In comparison, a 30x leverage translates to a total loss of money if the security moves against you by 3.33%.

NAGA offers you something unique in the brokers’ industry: a multi-currency account (EUR, USD, GBP, PLN, UST, and NGC – NAGA coin). In most brokers, you can only choose one base account. Usually, people choose their home currency, but you will not escape the currency conversion fee when you invest in assets in other currencies. You are not charged a currency conversion fee (see the screenshot in the “Fees” section).

However, if it did charge, you could avoid that. Actually, as an alternative, you could even use a low-cost currency conversion service to transfer money to NAGA, such as Wise (formerly known as TransferWise) or Revolut.

NAGA also offers a multi-currency NAGA MasterCard. Like any other credit/debit card, it allows you to manage your funds and even pay for goods and services directly with your trading profits.

From our experience, customer support has been quite good. Every time we messaged an assistant through the internal chat, we got a reply within 2/3h even through a phone call. Nonetheless, we know that customer service experience may differ widely, so be prepared to expect positive reviews and negative ones. The only way to certify its quality is by testing yourself.

NAGA has a 4.5-star classification in Trust Pilot, which puts you, as a potential investor, in a relatively pleasant position. However, from the negative reviews, we observe some constraints in withdrawals. Therefore, we highly suggest you know the withdrawal process (documents needed) to avoid a stressful situation.

Are you not comfortable yet with NAGA? Not a problem at all! You are allowed to open a Demo Account with $10.000 in virtual currency. So, please do whatever you want to get a taste of what you might expect from their trading platform.

Pros and cons

Pros

- Social trading feature (Automatically copy or follow other people’s trade)

- Wide range of financial products

- Multi-currency accounts: USD, EUR, GBP, PLN, UST, and NGC (NAGA coin)

- No currency conversion fee

- Modern and user-friendly Web and Mobile interfaces

- NAGA Mastercard

- NAGA Group AG is publicly listed company (ISIN: DE000A161NR7)

- Demo account

Cons

- No commission-free stock trading

- The “top-performing traders” may be disguised as “temporarily lucky”

- Offers primarily CFDs, which are high-risk instruments with no asset ownership

- Up to $5 in withdrawal fees

- No clear distinction between real ETFs and CFD ETFs

- Poor distinction between “NAGA Markets Europe Ltd” And “NAGA Global Ltd”

Fees

NAGA offers a quite expensive fee structure. Their revenues come mainly from spreads, commissions, copy fees, interest on margin lending (when you leverage a position), and other fees.

First of all, NAGA Europe offers trading on real stocks, that is, non-leveraged positions (not applicable to NAGA Global clients), but for a minimum of €/$3 per trade. We find these commissions high level when compared to its closest competitors.

Secondly, you will be charged a spread cost which is the difference between the bid and ask prices. You will mainly notice this expense on Forex, futures, cryptocurrencies, CFDs on indices, stocks, and commodities. The spreads are subject to changes depending on market conditions, so make sure to take a closer look at the bid-ask spread when placing an order:

Thirdly, you will encounter commissions in CFDs on stocks of €2.50. This expense is charged when buying and selling, so double those figures to have a closer value to what you will get.

Also, the feature of Social Trading comes at a cost. Every time a copied trade is closed, you will be charged a fixed fee of €0.99 whatever the outcome of your trade (with profit or loss). If the trade goes well, you will also be charged an additional 15% on the profit above €20. Look at the example provided by NAGA:

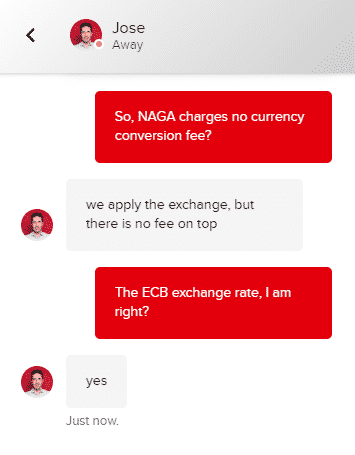

NAGA does not offer a document will all the costs involved, so it may be hard to find some charges. We took some time to figure out what was the currency conversion fee of NAGA without success. Given that, we decided to contact the support team directly, and, as you can see from the image, NAGA does not charge a currency conversion fee. It just applies the European Central Rate (ECB) exchange rate (no fee on top).

Last but not least, you need to consider other fees not directly related to the trading activity. For example, NAGA does not charge you a withdrawal fee. Still, you must withdraw a minimum amount of $50 or equivalent in other currencies.

In essence, the only way to avoid significant charges from NAGA is through a bank transfer. The part “from NAGA” is crucial to understand since additional fees may apply from intermediary and/or sender banks (not in control of NAGA).

Safety and regulation

NAGA Europe is fully supervised and regulated by the Cyprus Securities and Exchange Commission (CySEC). In addition, it is registered with several other financial authorities, such as the Financial Conduct Authority (FCA), BaFin, Consob, and CNMV, among other regulators in several countries where they operate.

NAGA Capital Ltd is authorised and regulated by the Financial Services Authority Seychelles (FSA), which still gives you negative investment protection and segregated client funds but no investor compensation fund.

Through its owner NAGA Group AG, NAGA is a publicly listed fintech company backed by a Chinese multi-billion fund FOSUN. Moreover, since their financial statements are displayed to everyone, it brings an additional layer of trust because we can follow their financial situation transparently, and that’s exactly what we have been doing.

Looking at the latest semi-annual report (June 2024) and as of the date of this article, we may observe a good financial position:

Finally, per the August 2018 restrictions in CFD trading by the European Securities and Markets Authority (ESMA), NAGA Europe (and Global) provides negative balance protection for Forex and CFD trading on a per-account basis, but only to retail clients from the European Union. What does that mean?

Imagine that you deposit €1,000 in your account and open a position with a 5:1 leverage. This increases your exposure to €5,000. If the market dropped 25%, you would lose €1,250 (25%*€5,000). As you can see, it is above your initial deposit of €1,000, meaning that you would owe €250 to your broker. With ESMA regulation, your account balance is automatically readjusted to €0, so you only lose your deposit (more info in ESMA and on page 3 of Risk Disclosure and Warnings Notice of NAGA).

Do you want to read a deeper analysis? Check out our dedicated article on investment protection (for EU investors)!

Supported countries

NAGA has an extensive list of countries accepted, including the Netherlands, France, Spain, Portugal, Italy, Ireland, Germany, Poland, Austria, Switzerland, Hungary, Czech Republic, Greece, Sweden, Norway, Denmark, Finland,… (only through their European subsidiary).

Please note that NAGA does not provide services to the USA, Japan, Canada, Belgium, Cuba, Iran, Iraq, Syria, North Korea, and others (see the footer of NAGA’s website).

Not available in your country? Please take a look at our list of online brokers available by country!

Disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.41% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results.