Hello, crypto fan! This article will give you our honest review of a European Crypto Robo-Advisor: CryptoSimple. Cryptosimple allows users to create an automated crypto-only investment portfolio according to their risk profile.

The business model is similar to the traditional Robo-Advisors that invest in Equity and Fixed Income securities. Still, it only focuses on cryptocurrencies and has a relatively hefty price tag.

Cryptosimple was created in 2021 and launched the mobile app in July 2022, which put us on hold since there is no clear indication of how reliable the platform usability, security and customer support might be or how the company will behave in a future market turmoil.

That’s CryptoSimple in a nutshell! If you want to find out what our research team has to say after carefully analysing CryptoSimple, keep reading!

Overview

Cryptosimple was designed for people who want to gain exposure to cryptoassets without worrying about which exchanges/wallets to choose and which cryptocurrencies to invest in. In simple terms, if you do not want to handle investing in crypto yourself, CryptoSimple presents a solution for you by creating a diversified crypto portfolio per your financial goals.

Highlights

| 🗺️ Supported Countries | European Union |

| 💰 Fees | ~1.32%-1.80% (per year) |

| 🎮 Explore (Demo) Account | Yes |

| 📈 Portfolio Rebalancing | Yes |

| 💵 Minimum Deposit | €20 (bank transfer) |

| 📍 Investment Instruments | Cryptocurrencies |

Their platform is straightforward to get used to, but you will find it only on your mobile phone. A platform version where you can log in through your PC is unavailable.

After answering their risk profile questionnaire, you will get one of the three portfolios constructed by Cryptosimple, which, oddly or not, you can change afterwards.

The fee structure is transparent and easy to understand. Each subsequent pricing plan will offer additional features. If you deposit over €100k, you even have access to a dedicated team of advisors. Compared to traditional Robo-Advisors, the fees applied are high, which may deter long-term investors.

The French regulator (AMF) authorises the company to operate as a Digital Asset Service Provider (DASP). However, this license does not entail any Investor Protection Scheme if something goes wrong with Cryptosimple (or any other crypto exchange), which means that if Cryptosimple goes bust, no independent authority will guarantee that you will have your assets back.

Overall, we encourage you to explore the platform with a pinch of salt since it is recent and still has a long way to go before it proves itself a trustworthy crypto platform.

Pros and cons

Pros

- Automated portfolio management

- Minimum deposit of €20

- Recurring deposits (only by debit/credit card)

- Rebalancing

- No deposit/withdrawal fees

- Earnings from staking reinvested

Cons

- No Desktop or Web platform versions

- High management fees

- Very recent platform (not enough track record to assess reliability)

- Difficulties in withdrawing money

- Customer support response time is too long

Investment platform

The platform is very straightforward and user-friendly. It does have a “modern” look and feel and only includes the relevant tools for a robo-advisor. The menus are where you expect them to be, and no customisation options exist.

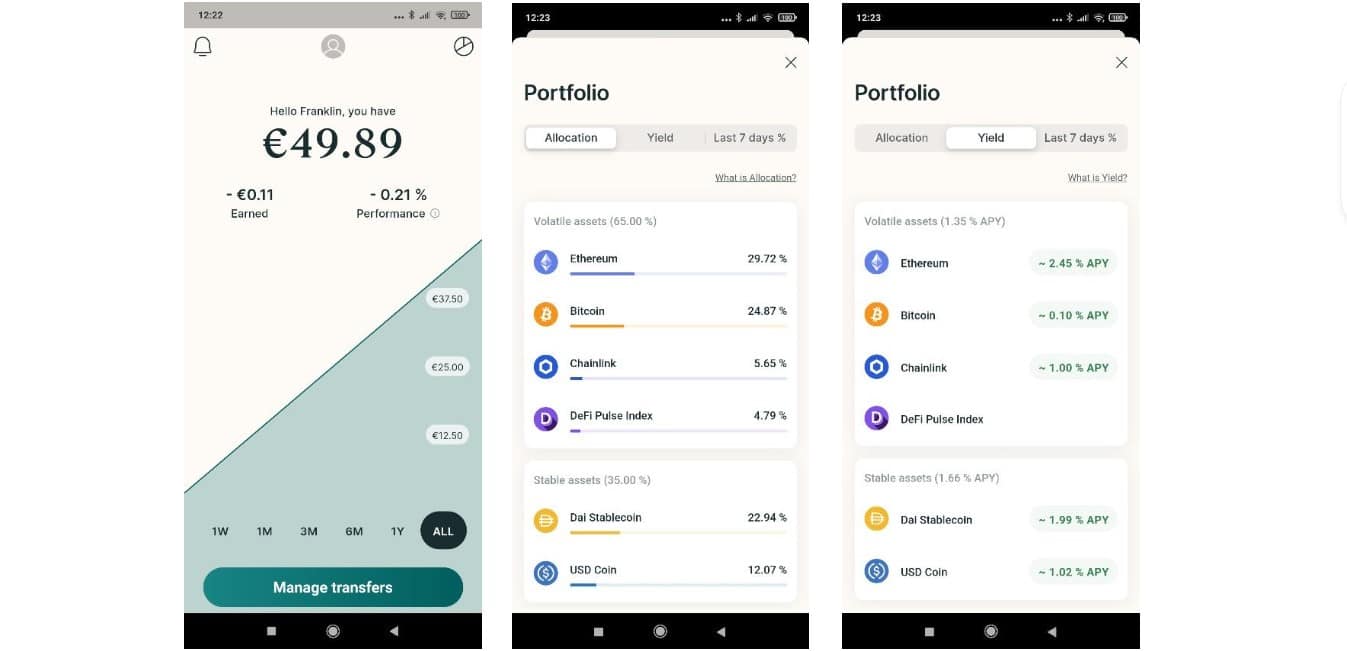

Immediately after authentication, you will see your current balance along with absolute and relative performance measurements, plus a graph of your portfolio evaluation. By clicking on the top-right “pie chart” symbol, you are redirected to the second image (see below), where you will find your current, complete portfolio allocation. If you tap “Yield”, you will be presented with the annual percentage yield (APY) you will earn for staking each currency.

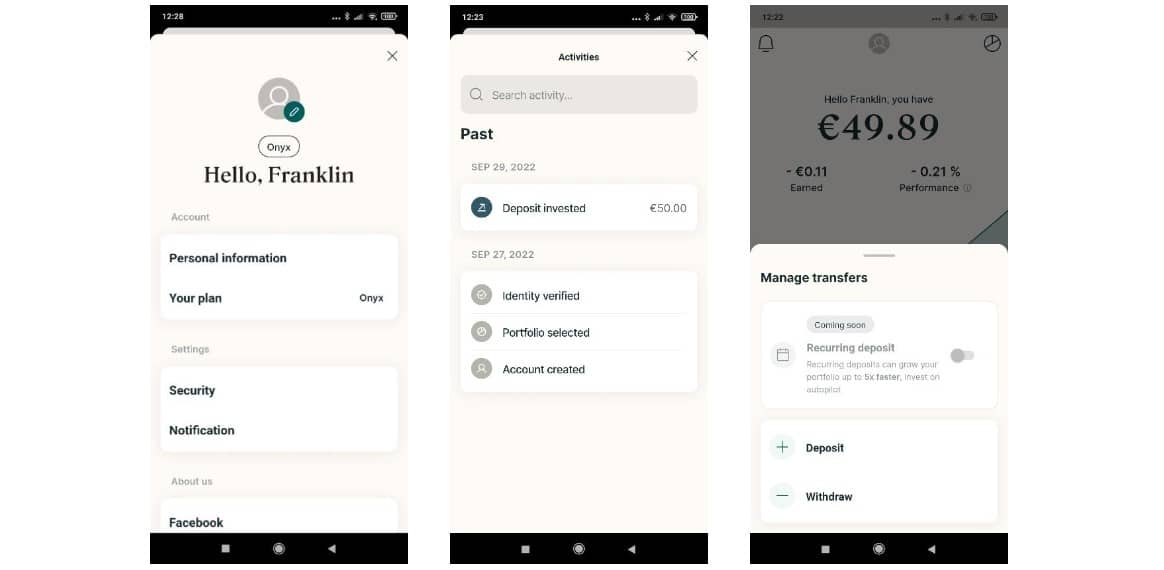

Regarding account information, by tapping in the top middle human figure, your account details will pop up. Among other things, you can check your personal information and your current pricing plan. If you want to check past deposits/withdrawals, you can also do so by clicking on the top-left side of your dashboard (the bell icon). Additionally, regarding deposit/withdraws, you can only do it manually by tapping “Manage Transfers” or set-up a recurring deposit schedule.

While exploring the platform, we noticed that the account value does not change in real time. Two hours after the first investment, our account balance remained at “€49.89”. We tried to get an answer from CryptomSimple concerning the time intervals used to update the account balance, but we did not get a reply until the publish date of this review. This brings an additional issue since you never know how much you will get by withdrawing your money.

Finally, as opposed to a traditional broker, if you want to withdraw your money, you will not need to sell your assets first and then ask for a withdrawal. You just ask for a withdrawal, and everything will be done simultaneously.

Investment portfolios

Cryptosimple claims a “tailored” made portfolio, but in truth, only three sets of portfolios are provided: Conservative, Balanced and Growth. The portfolio allocated to you will depend on your risk tolerance, investment goals and time horizon.

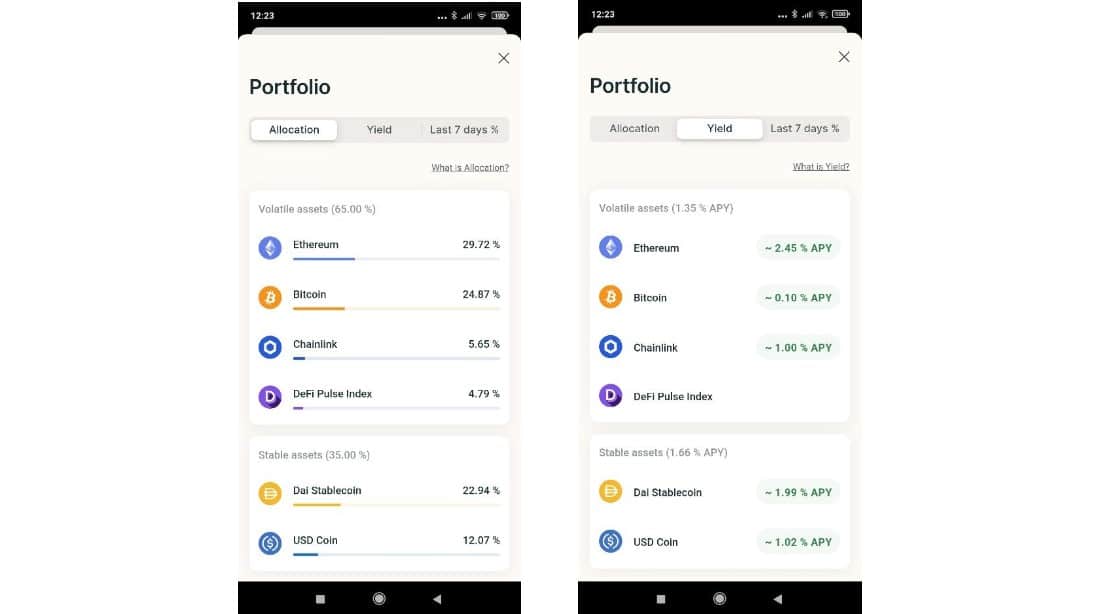

Each one will invest in a combination of “volatile assets”, which may include Bitcoin, Ethereum, Chainlink and DeFi Pulse Index and “stable assets” comprising Dai Stablecoin, USD Coin and EURS.

- Conservative: 10% volatile assets and 90% stable assets.

- Balanced: 35% volatile assets; 65% stable assets.

- Growth: 65% volatile assets; 35% stable assets.

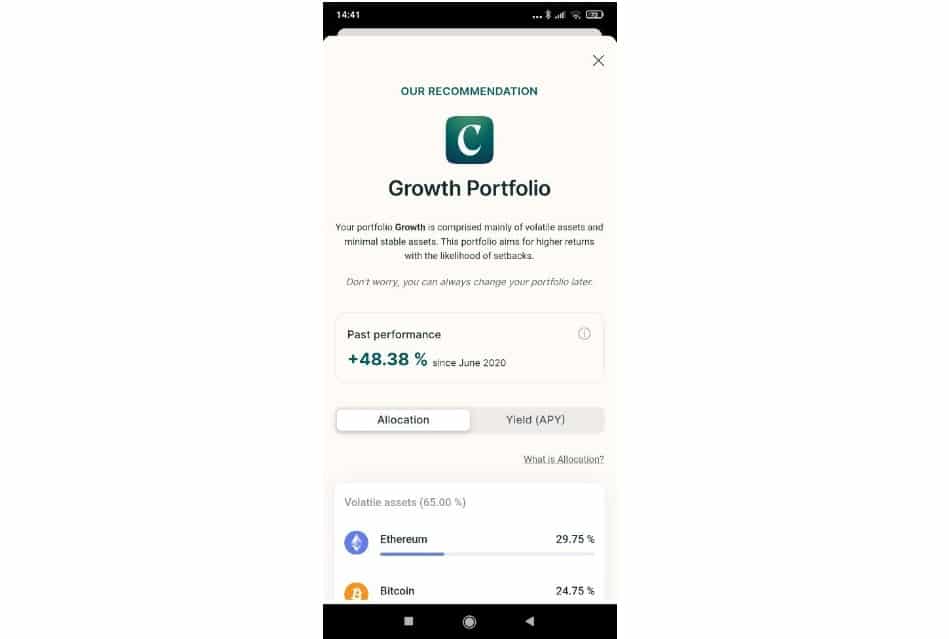

When we opened an account, the portfolio attributed to us was the Growth Portfolio:

Cryptosimple gives you a clear picture of each cryptocurrency’s allocation in volatile and stable assets. In addition, it also gives you the “Yield” you are generating for automatically staking each cryptocurrency. This return is called Annual Percentage Yield (APY), and it is the rate of interest you earn on a portfolio over a year (including compounded interest).

Cryptosimple uses the Modern Portfolio Theory, initially designed for use in traditional financial markets, to construct their crypto portfolios. It demonstrated that a rational investor can diversify his or her investments (reduce volatility) without sacrificing returns. In our view, using this economic theory in the crypto space is quite puzzling. First of all, we believe the portion of systematic risk (non-diversifiable) is much higher than the idiosyncratic risk (diversifiable risk). Secondly, crypto assets have extremely low historical data (for example, USD coin was only launched in September 2018) Third, how do you calculate an expected return for a crypto asset?

Besides, it states that “Passive Investing (auto-deposit), which tracks the market over time with a diversified portfolio, has been proved to be the most reliable strategy to increase your money over the long term, outperforming active investing 96% of the time”. We find that sentence misleading since it is out of context. That sentence refers to actively managed funds vs passively managed funds in the traditional financial markets. It does not compare active crypto funds vs passive crypto funds. Further sources of information would be needed for a proper assessment by all participants.

Finally, despite the fact that past performance does not guarantee future results, you can still check the performance history of the three strategies under “Past Performance” on this page. At least, it gives an idea of how volatile your portfolio might be going forward.

Fees

The fee structure is plain vanilla. Cryptosimple offers three pricing plans: Onyx, Gold, and Emerald. Your plan will depend on your balance amount and will give different benefits:

- Onyx: €0-€10k. With monthly fees of 0.15% => ~ 1.80%/year

- Gold: €10k-€100k. With monthly fees of 0.13% => ~ 1.56%/year

- Emerald: +€100k. With monthly fees of 0.11% => ~ 1.32%/year

Safety and reliability

Since the 26th of October 2021, CryptoSimple has been registered as a Digital Asset Service Provider (DASP) by the French Financial Markets Authority (AMF), which allows them to operate across the European Union.

As stated on their website, an AMF license is only related to “Digital asset custody, Buying or selling digital assets in a currency that is legal tender and Exchanging digital assets for other digital assets”. It is also fully compliant with the European regulations and Directive 2018/843 on Anti-Money Laundering and Combating the Financing of Terrorism.

However, you need to be aware that no Investor Protection Scheme protects crypto assets because they are not considered securities, and the company itself is not offering financial services. So, if Cryptosimple goes bankrupt, you will have no recourse to the out-of-court complaints procedure and, consequently, may lose all your investments.

Cryptocurrencies still act in a grey area. As such, it opens space for uncertainty regarding regulatory oversight or the existence of any investor protection scheme.

Customer support

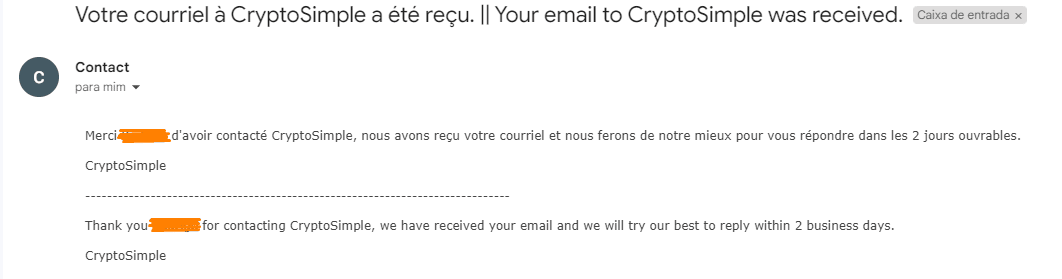

The company states on their website that they offer “24/7 Customer Support”:

However, we sent them an anonymous e-mail on a Friday, and there was still no reply on Sunday. We also noticed that their automatic response acknowledging our contact states very clearly: “(…) we will try our best to reply within 2 business days” (our bolding).

As of the updated date of this review (more than one year after the first contact), we haven’t gotten a reply from the customer support team.

Account opening

To open an account, you first need to download their mobile app (Available on Android and iOS). There is no way of signing up through your PC.

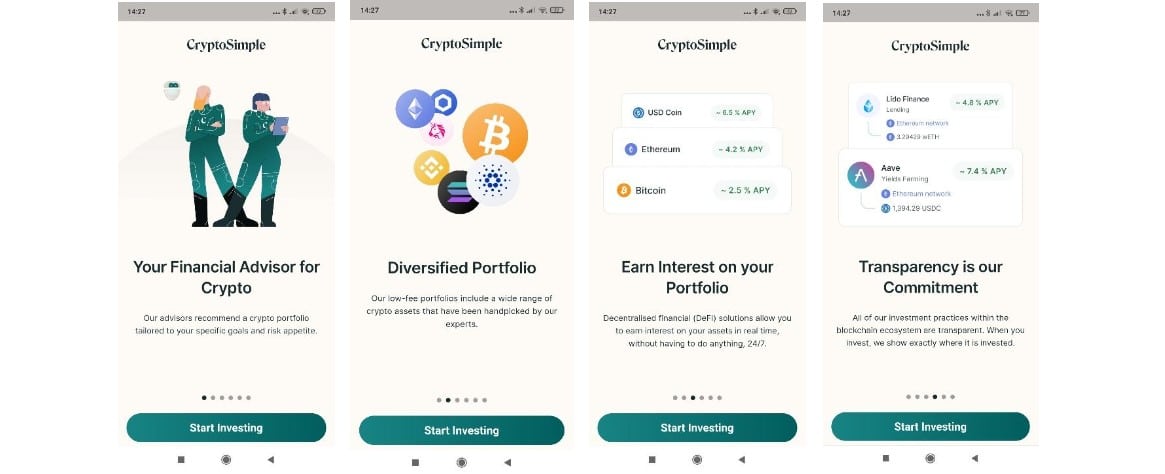

Cryptosimple starts by giving you an overview of what you will find in their app:

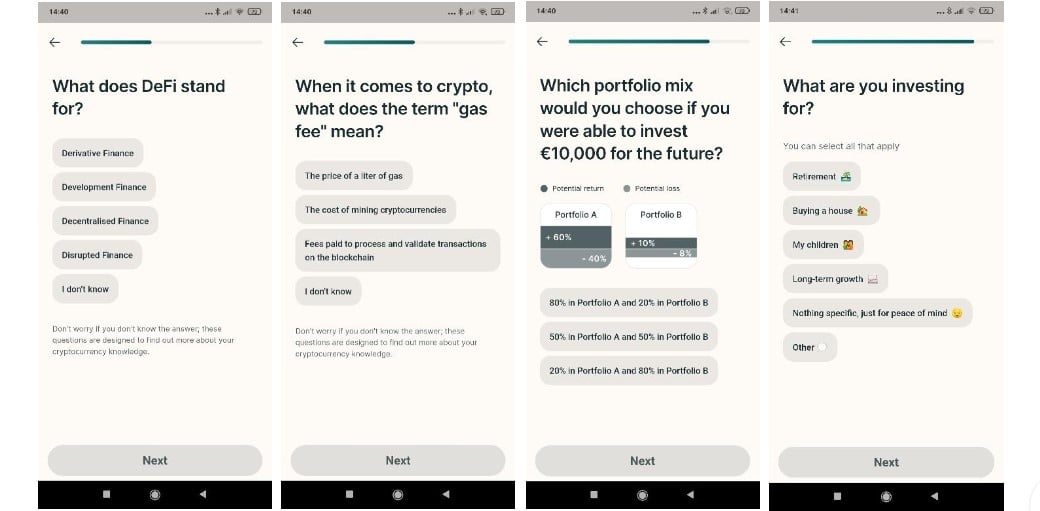

Once you tap “Start Investing”, you will be asked to “create an account” (note: you can see how the app works before signing up by tapping “Explore mode”), and then a set of questions will appear as part of their risk profile evaluation (a sample):

This was our recommended portfolio:

Looking carefully, you will notice the following sentence in grey italic: “Don’t worry, you can always change your portfolio later”. We know that your outcome might not be what you were looking for, but we also believe the questionnaire to access your risk profile should be taken seriously. As such, being able to change your portfolio afterwards may discredit the questionnaire itself.

After setting up the account, we decided to deposit €50 through a regular bank transfer:

As soon as the money arrived (it took us two business days), it was automatically invested in our investment portfolio type showing a slight initial loss of €0.11:

We also decided to test to withdraw all our money from our account, and we found some difficulties. Our first try was on a Sunday, but we weren’t able to do it because after tapping “confirm withdraw” in the last step (4th image), the app simply stop responding multiple times.

On the following day (Monday), we tried again to withdraw all our money. The confirmation e-mail went to the spam folder and took some minutes, but it finally worked. We found it an unpleasant experience because cryptocurrencies are traded on a 24/7 basis, and we were expecting a similar withdrawal period. So, if there was a significant down or up move during the weekend, we could not sell our positions.

Finally, our withdrawal amount arrived in our account in two business days (Wednesday).

Supported countries

CryptoSimple only accepts residents in the European Union. They have further planned to expand to the UK and US but have no defined date yet.

The company claims that you can still register on their website and be notified when the app becomes available in a currently restricted country. Nonetheless, we have actually tried using a VPN from such a country and found no place/information on where to register.

The bottom line

The Cryptosimple moat aims to make crypto investing accessible, transparent, and secure. Some people want to gain exposure to cryptocurrencies but do not want to do the due diligence by themselves since it may be overwhelming and time-consuming, particularly for beginners.

Since the platform does almost everything automated, you will not need to constantly check your portfolio and, as a result, have peace of mind. However, these features come with a cost that, in the long run, may materially impact your overall return. So, your final judgment will be determined by what you value most: your journey or the final destination.

We hope you got some valuable insights from the company from our review!