Hello, fellow investor! We will give you an honest review of Bitpanda!

On the downside, the stocks, ETFs and commodities are offered through derivatives, so you do not have real asset ownership (explained below). Plus, there is no investor compensation scheme involved.

If you want actual ownership of stocks/ETFs or if you prioritize ultra-low fees for crypto, there may be more suitable options (eToro, Coinbase, etc).

In terms of safety, Bitpanda is a financial services provider overseen by the Austrian Financial Market Authority (FMA) and Federal Financial Supervisory Authority (BaFin) in Germany.

That’s Bitpanda in a nutshell. Keep reading if you want to find out what our research team has to say after carefully analyzing this broker!

Overview

Bitpanda is an Austria-based fintech company rapidly growing from a crypto-focused platform to a multi-asset broker. Since its inception in 2014, it has aimed to make investing in digital assets simpler, more secure, and more accessible.

By 2025, Bitpanda reached a user base of over 6 million clients, and it has broadened its product offerings to include stocks, ETFs, precious metals, and a variety of cryptocurrencies, all managed through an intuitive platform that appeals to novice and experienced investors.

Their product offering includes stocks, ETFs, cryptocurrencies (including 2x leverage), crypto indices, precious metals and commodities. You can earn up to 30% APY on Staking rewards using your cryptocurrencies.

You also have access to a Bitpanda VISA card, which allows you to spend your cryptocurrency, metals and stocks. You will initially face a cost of €9.90 for the card shipment and withdraw charges above a certain threshold. Besides, there are no monthly account fees, and you can earn 0.5% to 2% cashback per transaction.

Besides, you can earn interest on your uninvested fiat money: up to 2.59% for BEST VIP on EUR; up to 4.05% for BEST VIP on USD; up to 4.24% for BEST VIP on GBP, as of March 2025.

Finally, if you are a business owner and want to invest your company money, Bitpanda offers a business account.

Highlights

| 🗺️ Supported countries | Europe and the United Arab Emirates; exceptions include the UK |

| 💰 Crypto fees | 0.99% on average (ranges between 0.00% to 2.49%); It is displayed before each trade |

| 💰 Stocks and ETFs fees | 0% |

| 💰 Gold fees | 0.5% when buying, and 1% when selling. |

| 💰 Custody fee | 0% |

| 💵 Minimum deposit | €10 (€25 for saving plans) |

| 💵 Minimum amount to trade | €1 |

| 📍 Products offered | Stocks, ETFs, cryptocurrencies (including 2x leverage), crypto indices, precious metals and commodities |

| 📜 Regulatory entities | FMA, BaFin |

Pros and cons

Pros

-

Multi-asset offering, all in one place.

-

Beginner-friendly platform

-

Fractional shares

-

Licensed in Austria and regulated across various EU countries

- Automated investment tools, including savings plans

Cons

-

Bitpanda fees on crypto trades can be higher in volatile market conditions

-

Mostly limited to European countries

-

Advanced analysis found only on Bitpanda Fusion

-

Customer support can take several days to reply

-

Stocks and ETFs are offered as derivatives, so you don’t actually own the assets

- There’s no investor compensation scheme available for investors

Trading platform

Bitpanda offers two main platforms: the standard Bitpanda platform (ideal for beginners) and Bitpanda Fusion (geared towards experienced traders).

Standard platform

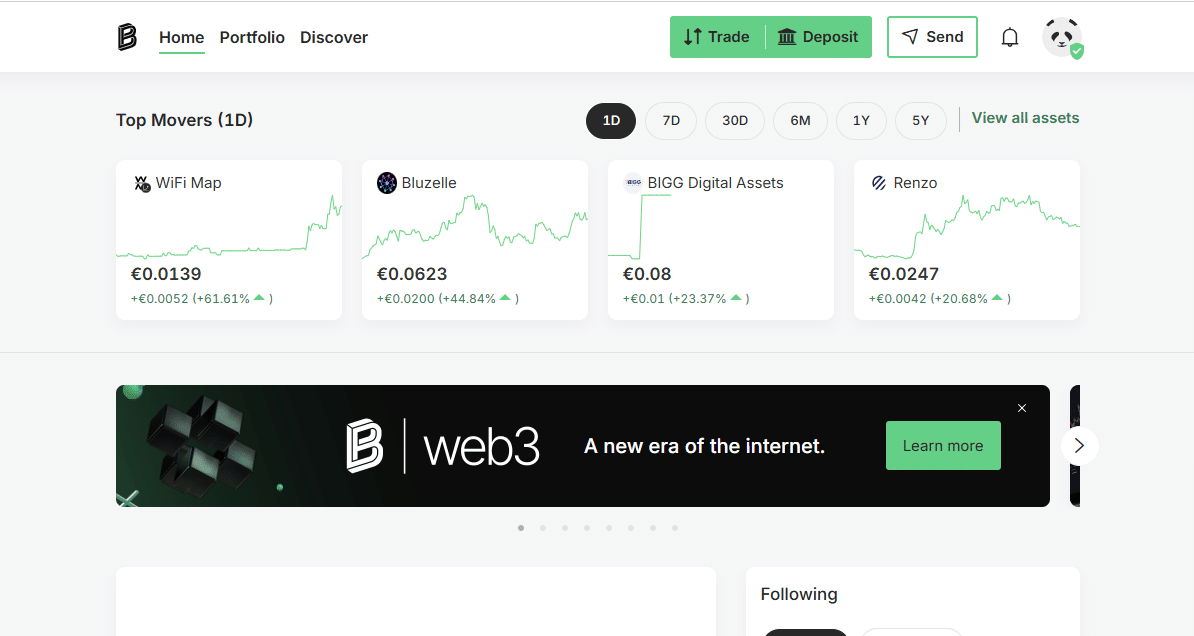

As soon as you log in, you will face this dashboard:

The interface is intuitive, which makes it an easy-to-understand portfolio overview. All the essential features like “Trade”, “Deposit”, or “Send” are readily available at first sight.

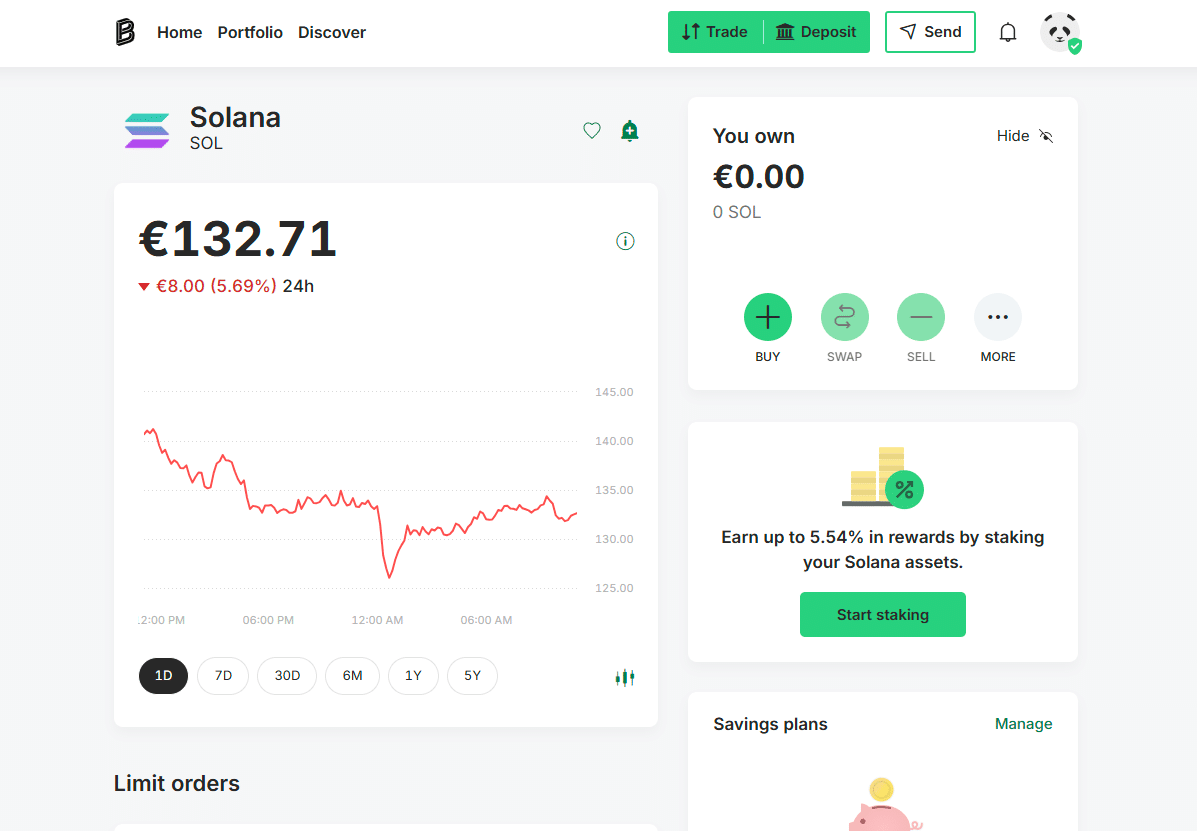

Once you search for a specific coin, Solana in our example, You can quickly notice the “buy/sell” buttons, the amount you own (if that’s the case) and the performance of the cryptocurrency in the last 24h:

The mobile app for iOS and Android apps mirrors the platform’s simplicity, enabling trading on the go. Main features:

- Instant trade: Swift trades, but at a slightly higher spread.

- Savings plans: Set up recurring buys in any supported asset.

- Price alerts: Push notifications for specific price thresholds.

- Bitpanda card integration: Manage spending limits and track transactions directly.

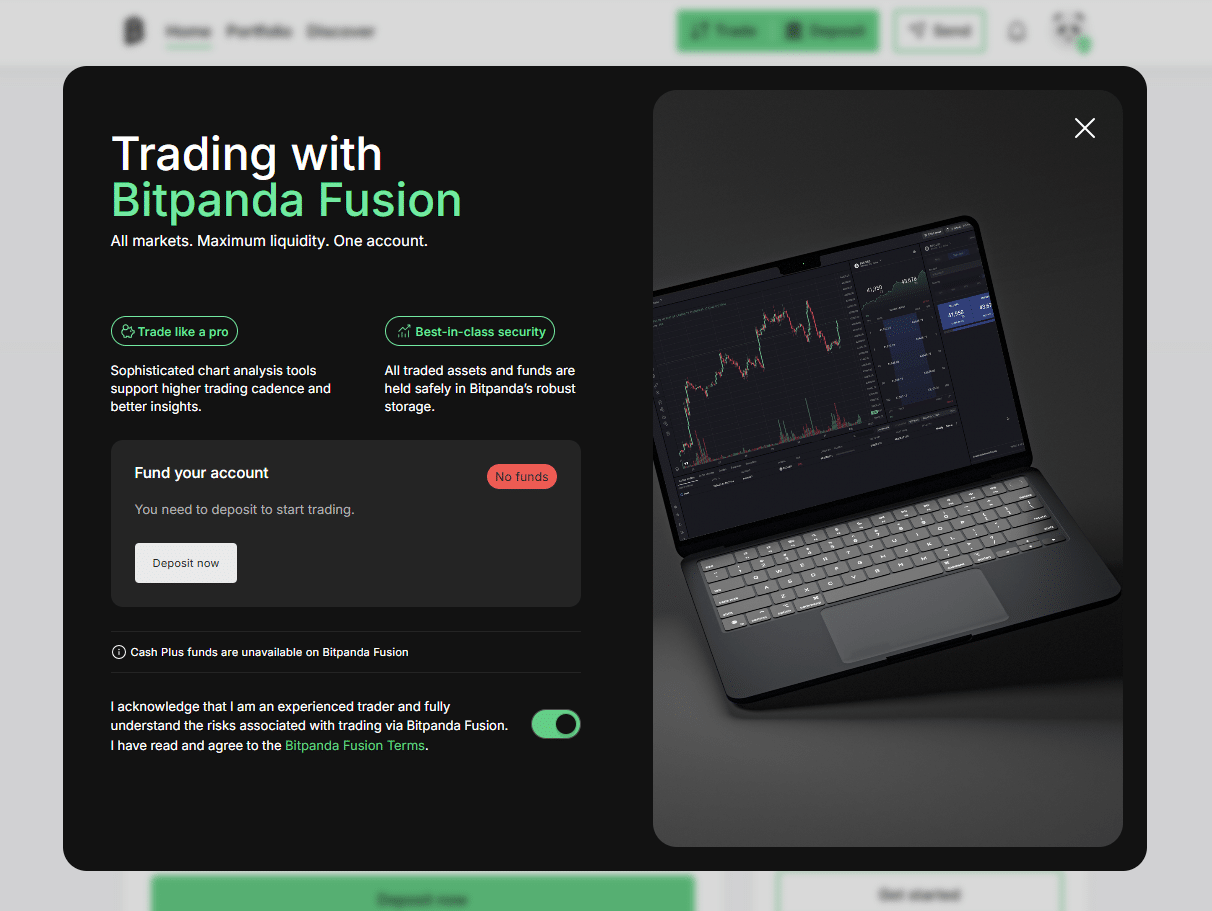

Bitpanda Fusion

What sets Bitpanda Fusion apart from the standard platform is the following:

- Advanced charting tools: Real-time charting, indicators, and technical analysis features.

- Order types: Market, limit, and stop-limit orders (OTC trades may be offered for large volume).

- Lower fees & spreads: Competitive pricing for active traders and higher-volume trades.

- API access: Custom trading bots or algorithmic strategies can be integrated.

Overall, the platforms complement each other: beginners typically start on the standard Bitpanda environment, while advanced traders and institutional investors often opt for Bitpanda Fusion (previously known as “Bitpanda Pro”).

Products and markets

Bitpanda’s diversified product lineup covers multiple asset classes:

- Crypto: Over 100 crypto assets, including top coins (BTC, ETH, SOL) and a rotating list of trending altcoins.

- Stocks & ETFs (CFDs): Real-time trading on popular equities and exchange-traded funds.

- Precious metals: Gold, silver, palladium, and platinum, enabling users to diversify into hard assets.

- Crypto indices & savings plans: Automated or recurring investments to help build long-term portfolios with minimal effort.

- Commodities: Invest in oil, natural gas, aluminium, wheat and more

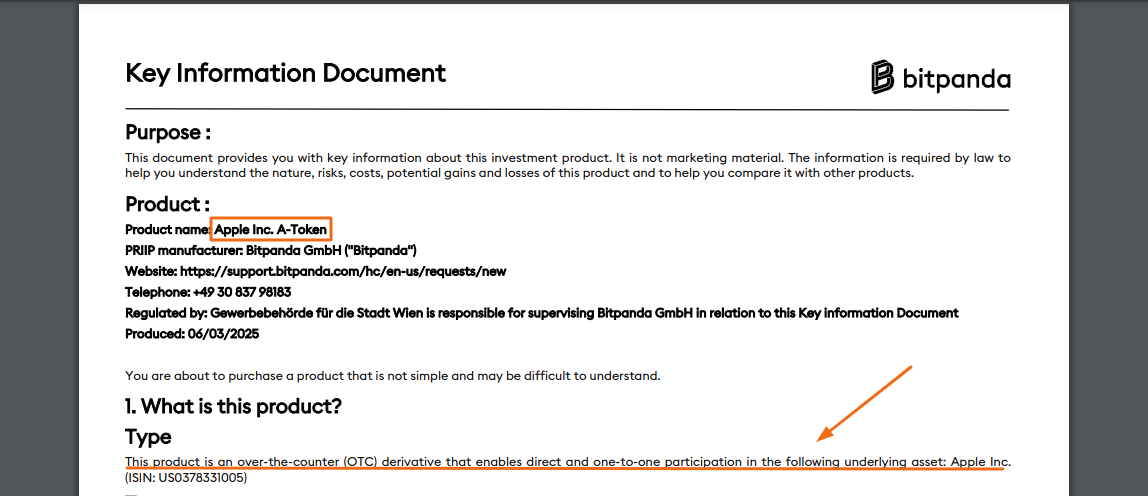

Please note that for stocks, ETFs, and commodities, you are investing in an over-the-counter (OTC) derivative that does not give you real asset ownership.

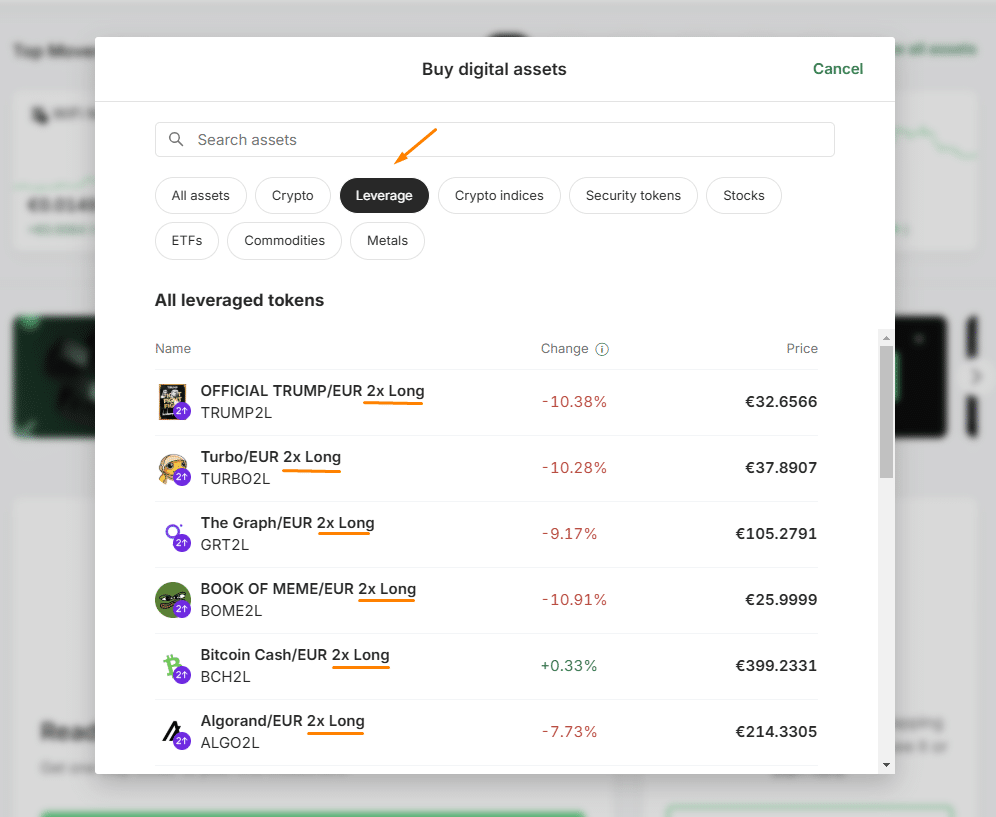

For crypto, you have the option to trade with leverage (up to 2x):

Please note that Bitpanda leverage is structured as a Contract for Differences (CFDs). You gain exposure to the EUR price movements of a specified crypto asset without owning the underlying asset. Find this article on CFDs vs Shares.

The same can be said about their Stocks and ETFs. These products are offered as “Bitpanda Stocks”, which are derivative agreements that allow you to participate in the price movements of certain underlying financial instruments (e.g. stocks or Exchange Traded Funds). Bitpanda Stocks cannot be traded on stock exchanges or other trading venues.

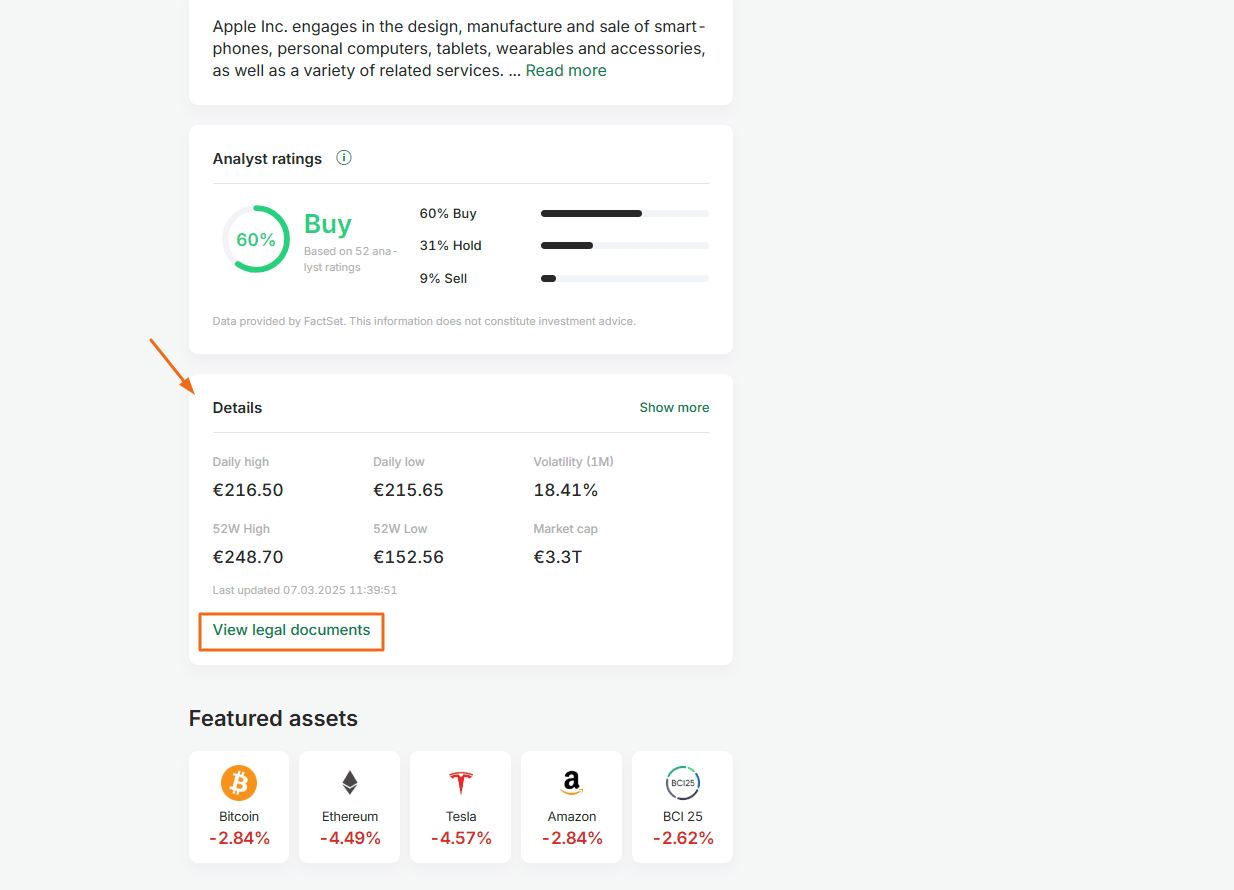

So, you do not have real asset ownership of your stocks and ETFs investment. As an example, search for “Apple”, go to the “Details” section and select “View legal documents”:

Then, scroll down and select “Key information document”, you will notice that you are investing in an over-the-counter (OTC) derivative and not a real share of Apple:

Fees

Bitpanda employs a transparent fee structure, though costs can vary between the standard platform and Bitpanda Fusion.

Standard platform fees

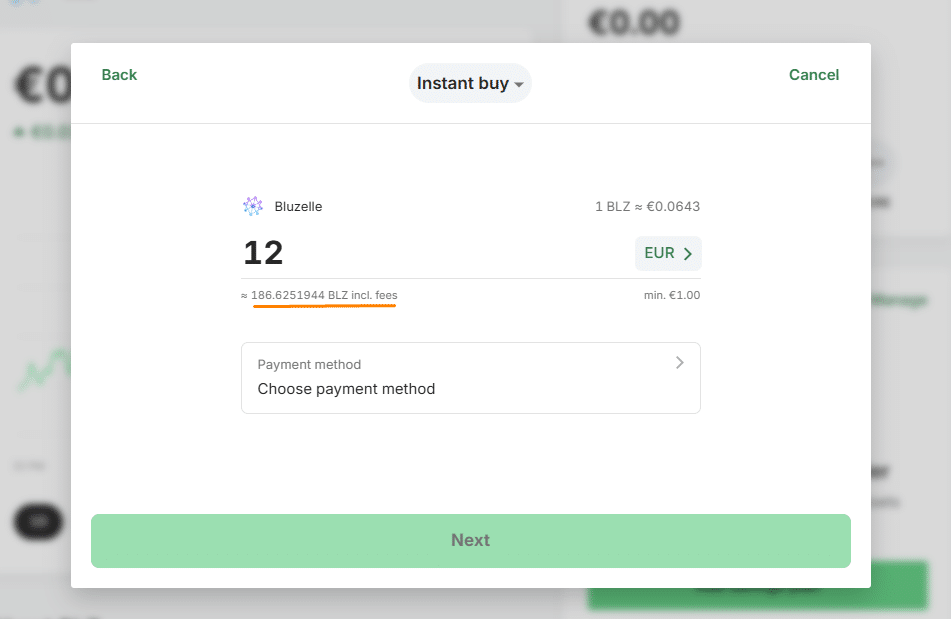

- Cryptocurrencies: Typically around 0.99%, but the effective spread may be higher during periods of market volatility. To provide more transparency regarding trade fees, we have updated our trade summary. You can now see the exact fee applied to each trade, which ranges from 0.00% to 2.49%.

- Stock and ETF trades: no commissions (spreads apply)

- Metal Trades: Fees around 0.5% to 2.50% depending on the specific metal and market conditions.

- Gold: a premium of 0.5% of the amount you buy, and 1% of the amount you sell.

- Silver: a premium of 2.5% for buying and 2% for selling.

- Platinum: a premium of 2.5% for buying and 2% for selling.

- Palladium: a premium of 2.2% for buying and 1.8% for selling.

Bitpanda Fusion fees

- Maker/taker model: Lower trading fees for “makers” (limit orders that add liquidity) and slightly higher for “takers” (market orders that remove liquidity).

- Volume-based discounts: Traders with high monthly volumes enjoy reduced fees, sometimes below 0.1%.

So, as explained in this detailed article, Bitpanda earns its money through spreads, the difference between the purchase price (ask) and sell price (bid) of an asset. The spread is also based on the market conditions of the underlying asset and can change during the day. Some Influencing factors can be the liquidity of the underlying stock or ETF, as well as the time of day or the volatility of the underlying stock or ETF.

Safety and regulation

Is Bitpanda safe? Bitpanda is a financial services provider overseen by the Austrian Financial Market Authority (FMA), and Federal Financial Supervisory Authority (BaFin).

The company operates based on various VASP registrations, as well as MiFID II, E-Money and PSD II licences amongst all our core markets. The Bitpanda Group diligently follows European law and regulations, and Bitpanda Payments GmbH possesses a payment service provider licence under PSD2, recently becoming an E-Money Institute. Our stringent user verification processes are also fully compliant with AML5.

According to Bitpanda, your investments are physically backed and held by a custody bank, which keeps them safe and reduces counterparty risk.

Nonetheless, there is no investor compensation scheme involved, which means that if Bitpanda goes bankrupt, you may lose all your money. Plus, Bitpanda is the sole counterparty to payment claims arising from OTC products. Therefore, as the counterparty to financial derivative contracts, you are exposed to the risk that we may not be able to fulfil our obligations under the financial derivatives contracts, up to and including a total loss (e.g., insolvency).

Supported countries

These are the supported countries:

- Åland Islands

- Andorra

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Faroe Islands

- Finland

- France

- Germany

- Greece

- Greenland

- Guernesey

- Holy See (Vatican City State)

- Hungary

- Iceland

- Ireland

- Isle of Man

- Italy

- Jersey

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Monaco

- Norway

- Poland

- Portugal

- Réunion

- Romania

- San Marino

- Serbia

- Slovakia

- Slovenia

- Spain

- Svalbard and Jan Mayen

- Sweden

- Switzerland

- Turkey

- Turkish Republic of Northern Cyprus

- United Arab Emirates

Residents of the United Kingdom (UK) are not allowed to open an account.

Users residing in Switzerland are unable to invest in ETFs.

Account opening

To open an account is pretty simple. First, you need to click “Sign-up” on the homepage:

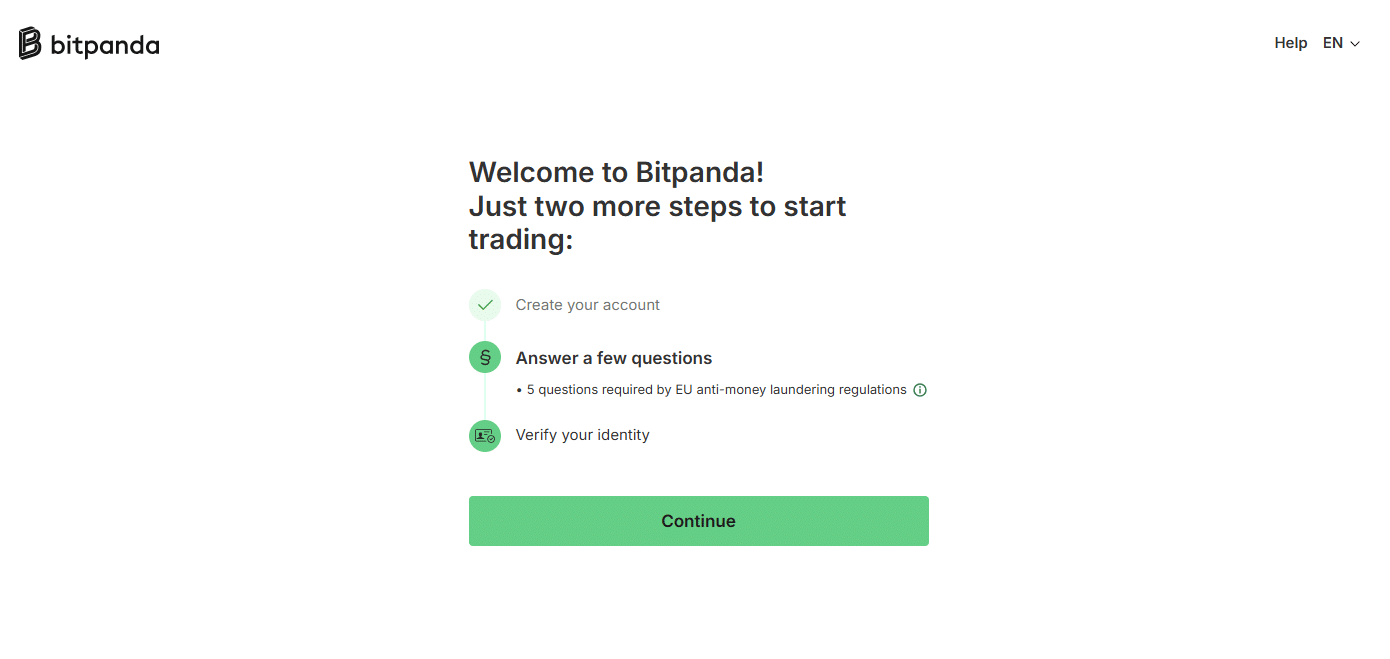

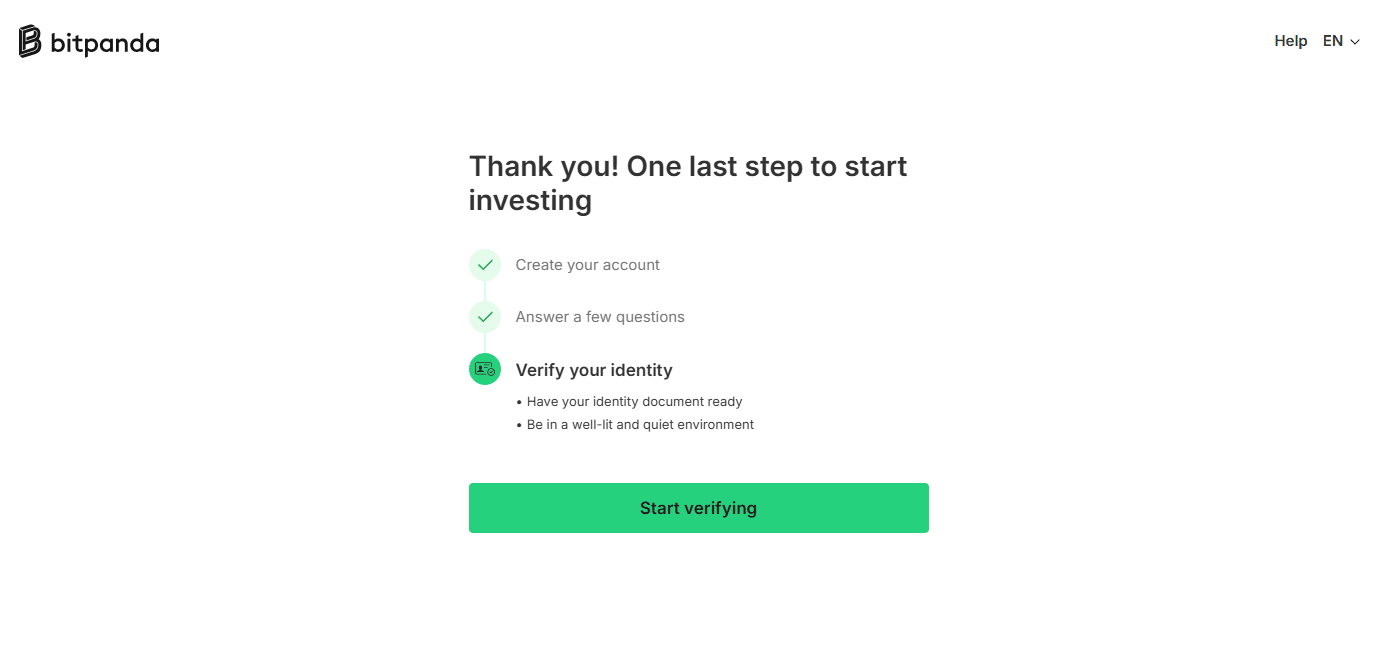

Second, you just need to follow the steps presented here:

This includes validating your identity (Video or photo-based ID verification), which typically takes a few minutes.

After doing it, you just need to wait up to 30 minutes to get fully verified and start investing. In my case, it only took around 5 minutes.

Alternatives to Bitpanda

At Investing in the Web, we analyse over 100 investment platforms, and here are some valid alternatives to Bitpanda:

- eToro: You can trade crypto for a 1% fee and real stocks and ETFs. The minimum deposit starts at $50, and in some countries, it also offers a debit card.

- Coinbase: American crypto exchange founded in 2012 with over 100 million users. It offers access to over 250 cryptocurrencies, and it charges between 0.50% and 1.50% per trade.

Bottom line

Bitpanda has evolved from a primarily crypto-focused exchange to an all-in-one multi-asset broker, catering to diverse investor profiles.

Please note that it is based on crypto and OTC products, which do not give you real asset ownership in some products. For this reason, it is not advised for long-term investors but for traders to speculate on the price movement of the assets.

While fees might be slightly higher than some crypto-only exchanges, the convenience and comprehensive feature set arguably offset these costs for many users.

Disclaimer

This review is for informational purposes only. Always conduct your own research or consult a financial advisor before making any investment decisions. Regulatory frameworks and platform features can change rapidly—ensure you verify all details directly on Bitpanda’s official website.