Real estate crowdfunding is a new way to invest in commercial real estate, and it has exploded in popularity in recent years. Crowdfunding can be a lucrative type of real estate investment, but it isn’t right for everyone. With that in mind, this article will focus on what real estate crowdfunding is, how it works, as well as how to choose the best European real estate crowdfunding platforms.

What exactly is Real Estate Crowdfunding?

In a nutshell, real estate crowdfunding is a way to invest in properties using small amounts of capital from several individuals. This is mostly done through crowdfunding platforms that bring together sponsors and investors.

Real estate crowdfunding requires two parties: the sponsor and a group of investors. The sponsor scouts out the property and raises the funds needed for acquiring and managing its daily operations. The investors, on the other hand, provide most of the financial equity needed (the investors usually put in around 80-95% of the financial equity required, while the sponsor shells out around 5-20%).

The sponsor then distributes the profits among the investors on a monthly or quarterly schedule, depending on the agreement. Since properties usually appreciate over a period of time, investors may obtain better rents or larger profits once the property is sold to the market.

Before the advent of real estate crowdfunding platforms on the internet, crowdfunding required that an investor have access to a network of trustworthy partners and a profitable deal they can buy shares of. As such, meeting interested parties with limited connections can be challenging.

Thankfully, real estate crowdfunding has enabled average investors to raise money for big projects easily by connecting them with like-minded individuals who share similar goals.

Real estate crowdfunding has also made property investments more accessible by providing investors a wealth of information about each project for informed decision-making. Lower investment minimums also level the playing field, allowing more people to participate.

Another key benefit of crowdfunding is the ability to diversify your portfolio with long-distance real estate investing: you can invest in multiple properties at once at different geographical regions where demand is growing!

How does Real Estate Crowdfunding work?

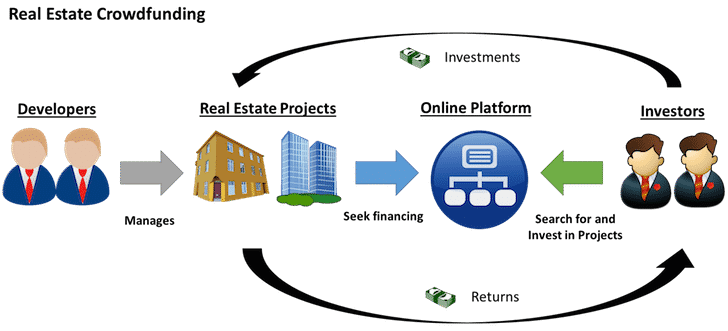

Real estate crowdfunding is a transaction between a Sponsor, who sources, develops, and manages a real estate project and a group of investors. The image below clearly explains the real estate crowdfunding process:

There are three key players in any crowdfunded real estate investment opportunity.

- First, the sponsor is the individual or company that identifies, plans, and oversees the investment itself. The deal’s sponsor will facilitate the purchase of the asset, arrange for any contractors or other needed work, arrange financing, and take responsibility for the eventual sale of the property. Deal sponsors generally contribute some of the project’s funding themselves and are also entitled to a certain share of any profits they earn for the deal’s investors.

- Second, the crowdfunding platform is where the sponsor finds investors to raise the necessary capital for a project. Think of the platform as the middleman between investors and sponsors. The platform will ensure a deal meets certain standards, advertise deals to potential investors, guarantee that investors meet the requirements for investment, and deal with regulatory issues. The platform will also collect investors’ funds on behalf of the sponsor.

- Finally, the investor contributes some of the deal’s required capital in exchange for a share of any profits the deal produces. An investor may get some sort of income distributions and/or be entitled to a proportional payout from an eventual profitable sale.

Here’s a simplified example of how this might work: Let’s say that an experienced real estate developer – the sponsor, identifies an office building that is outdated and lacking modern amenities — and is only 50% occupied — for sale at a price of 5 million EUR. After a thorough analysis, the sponsor determines that they can invest 3 million EUR in renovations and improvements, lease up vacant space, and triple the property’s rental income. Not only that, but once occupancy is stabilized in three or four years, the building will also have a market value of 12 million EUR, at which time the sponsor will sell the property.

However, although the opportunity requires 8 million EUR in capital between the purchase and renovations, the sponsor can only obtain bank financing for 5 million EUR, and only has 1 million EUR of their own capital to contribute. So, they choose to list the deal on a crowdfunding platform and offer the other 2 million EUR as equity in the project to investors.

Benefits of Real Estate Crowdfunding

1. Accessibility

Traditionally, the real estate market has seemed like something of a closed book, inaccessible to non-professionals. This was down to high costs, admin issues, and geography-based constraints. With advancing technology and the development of the internet, remote real estate investing has opened up new opportunities for those looking to invest with lower amounts of capital.

The real estate invetment market is now far easier to access because real estate crowdfunding platforms are very easy to use. Property investment was previously notorious for involving lengthy paperwork and maze-like legislation, but real estate crowdfunding platforms now handle all of this for you, meaning that the investor only needs to worry about actually investing money and enjoying their returns.

Anyone with a computer can now invest in real estate and earn returns that are likely to be higher than what they would get with a bank.

2. Lower capital requirements

Before crowdfunding, investing in a property required large amounts of capital to cover the upfront costs. This is due to the fact that the financial burden was entirely on you, you’re the only one investing, so you have to cover all the expenses. The only other viable option was REITs (Real Estate Investment Trusts), but these were not ideal because the investor had little control over what properties were chosen for investment and little to no knowledge about the management of the properties. Real estate crowdfunding has removed these high costs, and investors can now invest just a few thousand Euros into a property.

3. Geographic diversification

In the past, if you were buying or investing, you had to be at least familiar with your target area, usually with physical access to it, otherwise you’d have had no idea what you are investing in. This is no longer the case. European real estate crowdfunding platforms now allow you to browse and invest in properties in other countries within Europe, while also providing any information you might need on the local market and regulations.

4. Information

One thing that also used to characterize real estate investment, before Crowdfunding, was insider knowledge but the evolution of the internet is all about democratizing information and the online real estate sector is no different. Information that was previously withheld from the public by professional property investors is now readily available, and in some cases even provided by the real estate crowdfunding platform itself.

5. Speed and efficiency

Bureaucracy and paperwork used to plague the real estate sector. This means investment would take months to finalize. This timeframe has been reduced dramatically because of the fact that all real estate crowdfunding transactions are done entirely online.

How To Choose The Best Real Estate Crowdfunding Platform

1. Be meticulous

Before taking the plunge, know that each platform is different – some may fit your goals better than others. Practice informed decision making by identifying each platform’s strengths and weaknesses. Pay very close attention to the length of operation, track record, return performance, number of deals, management credentials, and company funding.

2. Be Partial Towards Vetted Deals

A platform that vets investments is better than one that does not. There are crowdfunding sites that go through great lengths in protecting their investors by underwriting, evaluating, and structuring their investments. Other websites, on the other hand, only work as a matchmaker.

Would you rather investigate and analyze a sponsor’s business plan on your own, or would you prefer having a corporate underwriting team guide you?

3. Look Out for Sites Partnered With a Registered Broker-Dealer

Sites partnered with registered broker-dealers are more official – they have eyes doing due diligence on every transaction, making sure that marketing materials are balanced and fair. Try honing in on these websites whenever possible.

4. Make Sure Interests Are Aligned

When sponsors put in financial equity into a deal, they are more likely on pushing through with their business plans. It is for this reason that some platforms structure their investments so that sponsors shell out money alongside their investors. In the same way, some platforms also negotiate a “promote” interest, where sponsors receive higher returns only when their investors have been issued a base amount.

5. Consider Liquidity

In real estate, timing is everything. Properties have varying liquidity schedules, and there are unique return profiles for every investment. Know full well how long you’re going to be locked into a deal when making your investment decisions.

6. Study the Risks

There are risks associated with every investment. While investing is a great way to diversify your holdings, you must also consider diversifying your risk. See how your potential returns weigh against your projected risk to determine if equity investments or debt investments are better for you.

Final Thoughts

Real estate crowdfunding is a new way to invest in commercial properties. It allows everyday investors to put their money to work in ways that have been the domain of the wealthy. Specifically, that’s single-asset commercial real estate. Few people could invest in a high-rise apartment community before crowdfunding came along.

Crowdfunded real estate deals have the potential for excellent returns, but there’s a lot you should know before considering them for your portfolio.

Share your thoughts about the European real estate crowdfunding market with us at [email protected].