Equity Crowdfunding is a modern way to invest in companies and start-ups that are not listed in the stock market or publicly traded. Before equity crowdfunding, investing in these projects was confined to big investors and companies. As in other areas, the internet came to democratize the investment industry and allow small investors to invest in start-ups or firms which they believe will generate good proft in the future or are part of good causes.

What exactly is Equity Crowdfunding?

It as a process in which a group of people invest their funds in companies that are not listed in the stock market or publicly traded, in exchange for equity.

The main difference between equity-based crowdfunding and others is in Equity crowdfunding, the person who invests in the business is evidently a part of the company & hence would be profitable when the company makes profits but might incur losses as well in case the company doesn’t do good business.

How do I invest in a company through Equity Crowdfunding?

The best way to invest in any start-up through equity crowdfunding is to use an online equity crowdfunding platform. There are lots of equity crowdfunding platforms available in the market. Each platform offers different projects looking for funding, and provides all the information regarding those same projects.

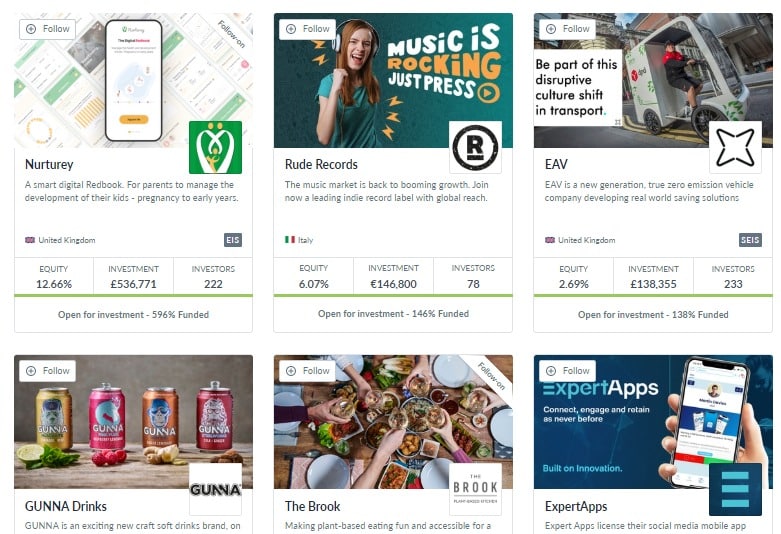

Here is an example of some of the startups you can invest in through Seedrs, by the time this article was wrote:

You just have to choose the equity crowdfunding platform that better fits your needs, feel up your personal information and bank details, and you are all set to open your investment account and invest in the startup which you believe will succeed.

What are the Pros and Cons of investing through Equity Crowdfunding?

Pros

- Very easy to start investing

- Available for anyone, regardless of the size of your bankroll

- Investors can maintain a well-diversified portfolio

Cons

- Low liquidity: Despite this, some platforms now even have a secondary market, where you can trade your securities after the campaign has finished, if you don’t want to wait for an IPO or for the company to be sold.

- High risk.

What’s the best Equity Crowdfunding platform?

When choosing the equity crowdfunding platform that better suits your needs, some important variables to consider are:

- Investment opportunities;

- Fees charged;

- Liquidity;

- Support provided;

- Security and regulation.