This article compares two prominent Vanguard ETFs: VWRL and VUSA, both of which have garnered significant interest from investors. We will delve into the specifics and unique features, providing the necessary information to determine the best fit for your needs.

In short, VUSA focuses on the North American market, using the S&P 500 index as a reference, while VWRL has a global focus through the FTSE All-World index.

We’ll explore various aspects, including portfolio composition, return/risk profiles, and the Total Expense Ratio (TER), a vital indicator that quantifies the cost of investing in different ETFs.

Lastly, we’ll highlight that both products are distribution-class ETFs specifically designed for investors seeking regular quarterly income.

Key data

| ETF | VUSA | VWRL |

| Asset manager | Vanguard | Vanguard |

| Replicated index | S&P 500 | FTSE All-World Index |

| AUM (in millions) | EUR +32,000 m | EUR +15,000 m |

| Inception date | 05/2012 | 05/2012 |

| Fund currency | USD | USD |

| Replication | Physical | Physical |

| TER | 0.07% p.a. | 0.22% p.a. |

Source: Morningstar

VWRL vs VUSA at a glance

| Performance: | Regarding performance, the VUSA has outperformed the VWRL in cumulative returns. Observation date from May 2012 to April 2024 |

| TER: | VUSA is the ETF with the lowest costs. Less than half compared to VWRL. |

| Portfolio structure: | The VUSA focuses exclusively on the U.S. equity market, while the VWRL has a global portfolio. |

| Risk analytics: | For the risk/return analysis, VUSA performs better than VWRL |

Comparison: VWRL vs VUSA

The comparative research between VUSA and VWRL will be done by evaluating, in each case, the following metrics.

- Performance

- TER

- Portfolio Structure

- Risk Statistics

As these products are distribution-class ETFs, we will also introduce a section about the dividend policy of each one.

Performance

Now, let’s look at the comparative performance of the two ETFs. Both were created in May 2012, so we take the historical record since then.

Including dividends, the VUSA performance was +446.40%, and the VWRL was +269.94%. The first ETF obtained a much better result than the VWRL, so we consider it a clear winner in this metric.

TER (Total Expense Ratio)

The TER includes most of the fees incurred by an ETF (excluding transaction costs), so it is in your interest to keep its value as low as possible. The lower the commissions the product carries, the higher the expected final returns.

The TER ratio is 0.07% for VUSA and 0.22% for VWRL. Therefore, considering only the fees, you should get a better result working with the former since the commissions you pay are much lower.

Portfolio structure

The benchmark of each ETF is different, which means that the composition will be different. VUSA focuses on the North American market, using the S&P 500 index as a reference, while VWRL has a global focus through the FTSE All-World index.

Although the top ten stocks mostly overlap, the VUSA portfolio is significantly smaller than the VWRL. We can also observe that overall the VWRL portfolio is cheaper according to P/E and Price/Book Ratio. In principle, this implies that the long-term growth potential would be higher.

Risk statistics

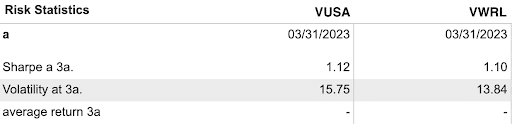

We follow the analysis by talking about risk statistics. First, we look at the return obtained per point of volatility, as measured by the Sharpe Ratio, and it is 1.10 over three years for VWRL and 1.12 for VUSA.

We can conclude that, despite having higher volatility (15.75 vs. 13.84), VUSA offers us a higher return relative to the risk assumed; that’s why it presents a higher sharpe ratio.

Dividend policy

The dividend policy discusses two essential aspects: yield and payout frequency. The first refers to annualized profitability in percentage terms, while the second is the number of times you receive dividends during the year.

The distribution frequency is quarterly in both cases. However, we see differences in the dividend yield. The VWLR has a current dividend yield of 1.90%, while, in the VUSA, the figure drops to 1.40%.

Looking at Dividend Policy, the VWRL would be better than the VUSA.

What is VWRL?

VWLR is a distribution class ETF managed by Vanguard Group, whose full name is “Vanguard FTSE All-World UCITS ETF USD Distribution.” This ETF replicates the FTSE All-World index. Dividend payments are in March, June, September, and December.

On the other hand, the accumulated return since the inception of this ETF (May 2012), including dividends, has been +269.94%.

About the Index

The benchmark is the FTSE All-World Index, composed of hundreds of large- and mid-cap companies selected from developed and emerging countries. This benchmark allows the ETF to reflect the overall performance of the world economy.

Launched in June 2000, the index covers 98% of the world’s investable market capitalization through 4,292 stocks.

Portfolio sample

With the VWRL ETF, you can invest in companies such as Apple, Amazon.com, NVIDIA, Tesla, Alphabet, Exxon, or JP Morgan. The most heavily weighted sectors are technology and finance.

By geographic distribution, the USA dominates with 62.2%, followed by Japan (6.3%) and the United Kingdom (3.6%).

What is VUSA?

VUSA is another distribution class ETF managed by Vanguard Group, and its full name is “Vanguard S&P 500 UCITS ETF”. This ETF replicates the famous S&P 500 index, considered the most important in the world. Dividend payments are distributed in March, June, September, and December.

Moreover, since May 2012, the cumulative return since the inception of this ETF, including dividends, has been +446.40%.

About the Index

VUSA’s benchmark is the S&P 500 Index, managed by Standard & Poor’s. The Index comprises large-sized company stocks in the US. It provides comprehensive coverage of the national economy.

Launched in 1957, the Index covers nearly the entire market capitalization through 500 companies.

Portfolio sample

If you invest in VUSA, you will have access to companies such as Microsoft, Apple, Amazon.com, United Health, Tesla, or Berkshire Hathaway. The technology and healthcare sectors are the most heavily weighted in the portfolio.

Since it references an exclusively North American index, the geographic distribution will be entirely in the United States.

About the investment manager

These ETFs are managed by Vanguard Group, a company with more than 20,000 employees worldwide and +$7.5 trillion in assets under management. It is considered to be, after Blackrock, the second-largest fund manager in the world.

It stands out from its competition thanks to products that offer excellent replication at a very low cost.

Cheapest brokers to invest in VWRL and VUSA

Below, we have prepared a selection of online brokers where you can find either of these two ETFs to invest with maximum guarantees.

| Broker | ETF fees | Available ETFs | Minimum deposit | Other fees |

| IBKR | 0.05% of Trade Value | +13,000 | €0 | Spreads, currency exchange, etc. |

| Trading 212 | 0% | +200 | €10 | Spreads, currency exchange, etc. |

| DEGIRO | €0 (in selected ETFs) or €2 (in the remaining); + €1 external cost | +3,000 | €1 | Spreads, currency exchange, etc. |

Disclaimer: Investing involves risk of loss.

Conclusion

Looking at the metrics alone, VUSA offers better attractiveness. Its performance is superior, its Sharpe ratio too, and it even has a lower cost and near-perfect replication.

However, VWRL has the advantage of offering a higher dividend yield and a more undervalued portfolio. If that is your interest, VWRL is your fund.

In closing, remember that we rely on objective criteria and numerical indicators, but the final decision to select one product or another is always yours.