We will dedicate this article to the study and analysis of two leading ETFs managed by the same firm, Vanguard. VWCE and VWRL replicate exactly the same index (FTSE All-World Index) and are present in many investment portfolios, although they have “minor” differences.

In a nutshell, the key difference between VWCE and VWRL is that VWCE is an accumulating ETF (reinvests the dividends back into the ETF). At the same time, the VWRL is a distributing ETF (dividends are paid periodically to investors).

We will work on the main characteristics of these ETFs, looking not only for aspects such as costs or Tracking-Error but also those that have to do with the composition of its portfolio or its performance in recent years.

Key Data

| ETF | VWCE | VWRL |

| Asset Manager | Vanguard | Vanguard |

| Replicated index | FTSE All-World index | FTSE All-World Index |

| AUM (in millions) | EUR +15,000 m | EUR +15,000 m |

| Inception Date | 07/2019 | 05/2012 |

| Fund Currency | USD | USD |

| Replication | Physical | Physical |

| TER | 0.22% p.a. | 0.22% p.a. |

| 3 yr Tracking Error | 0.09 | 0.09 |

VWCE Vs. VWRL at a glance

| Performance | From July 2019 to the present, the total gross performance has been equal |

| Tracking Error | The TE is exactly the same in both funds: 0.09%. |

| TER | Once again, we see that the data coincide, the expenses are identical |

| Portfolio Structure | Because they index to the same benchmark, they share the same portfolio structure |

| Risk Statistics | For the risk/return analysis, VWCE and VWRL have the identical result |

Comparison: VWCE vs. VWRL

We begin with the comparative study between VWCE and VWRL. The metrics we are going to evaluate are the following:

- Performance

- Tracking Error

- TER

- Portfolio Structure

- Risk Statistics

As stated at the beginning of the article, both ETFs are part of the same fund. That means the metrics are going to be the same. Therefore, we introduce a new factor: the share class.

Share class: different dividend policies

The first point is dedicated to the share class. This point intends to show how each class treats the income received by the fund (via coupon or dividends) and whether it is distributed to shareholders.

The VWCE is an accumulating ETF. Then, all income received via dividends reinvests in the fund’s assets (stays inside the ETF). As a result, the value of the ETF increases by the compounding rate effect.

On the other hand, the VWRL is a distribution ETF. All income received via dividends is paid directly to the shareholders.

Therefore, with VWRL, we have a product that provides periodic income, while with VWCE, we got a vehicle better designed to generate long-term capital.

Another point to take into consideration when choosing between VWCE and VWRL is the tax treatment. In many countries, distributed dividends are taxed. Thus, it becomes more beneficial to invest in an accumulating ETF to postpone taxes and benefit from compound interest.

Performance

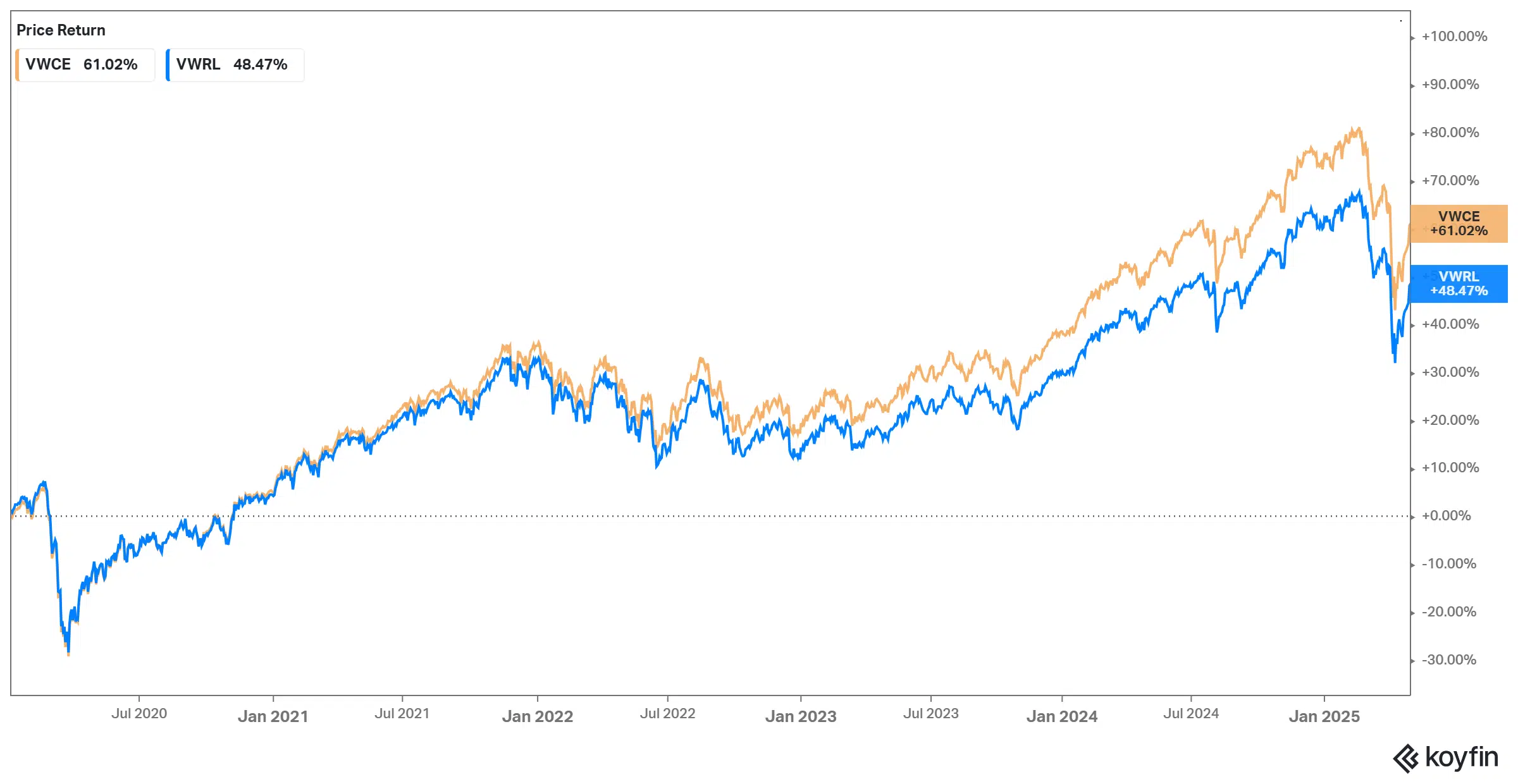

We will now look at the comparative performance of the two ETFs. The time reference is from the younger one (VWCE), released in July 2019.

In the chart, we can see that the performance of VWCE has been higher than VWRL. The reason is that when dividend payments are realized, you have what is called the “ex-dividend date”, which reduces the price of the ETF by the same amount of the dividend paid (don’t forget that distributing dividends means taking money from the ETF to you, so that adjustment must be made). In VWCE (orange line), the performance amounts to 61.02%, while in VWRL (blue line), the performance is 48.47%.

If both ETFs reinvested their dividends, the performance would be the same.

Tracking Error (TE)

The Tracking Error is one of the indicators in determining the effectiveness of ETF replication. It measures the difference between the index and the fund through its standard deviation. The closer it is to zero, the better the replication.

Being the same fund (with different share classes), the two ETFs obtain a TE of 0.09.

TER (Total Expense Ratio)

The TER is the indicator that refers to most fees incurred by an ETF (does not include transaction costs at the fund level). Because the fees impact performance, the lower, the better.

TER Ratio is the same in both cases: 0.22%. We see that no additional charges apply for distributing the dividends.

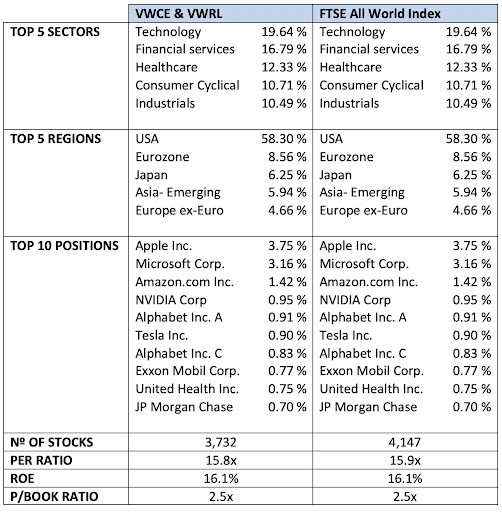

Portfolio Structure

The next step is a portfolio comparison. As VWCE and VWRL share the same investments and weightings, we believe that it would be interesting to study the portfolio relative to the benchmark.

The main difference between these two ETFs and their benchmark is that the former takes a selection from the total stocks in which the index invests (also called “optimized sampling”). This measure affects the P/E, lowering it by one-tenth in the case of ETFs.

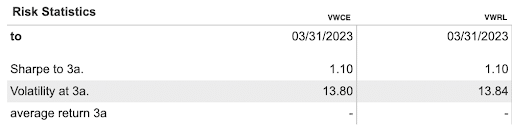

Risk Statistics

We close the analysis by talking about risk statistics. First, the Sharpe ratio, which determines the return obtained per volatility point, is 1.10 over three years in both cases, as expected.

Therefore, we can conclude that both options provide the same benefit at equal risk.

What is VWCE?

VWCE is the ticker from “Vanguard FTSE All-World UCITS ETF USD Accumulation,” an ETF managed by Vanguard Group, which replicates the FTSE All-World index.

The VWCE ETF performs physical and cumulative replication. In other words, the ETF buys assets identical to those of the benchmark index, doesn’t pay dividends, and reinvests the income received.

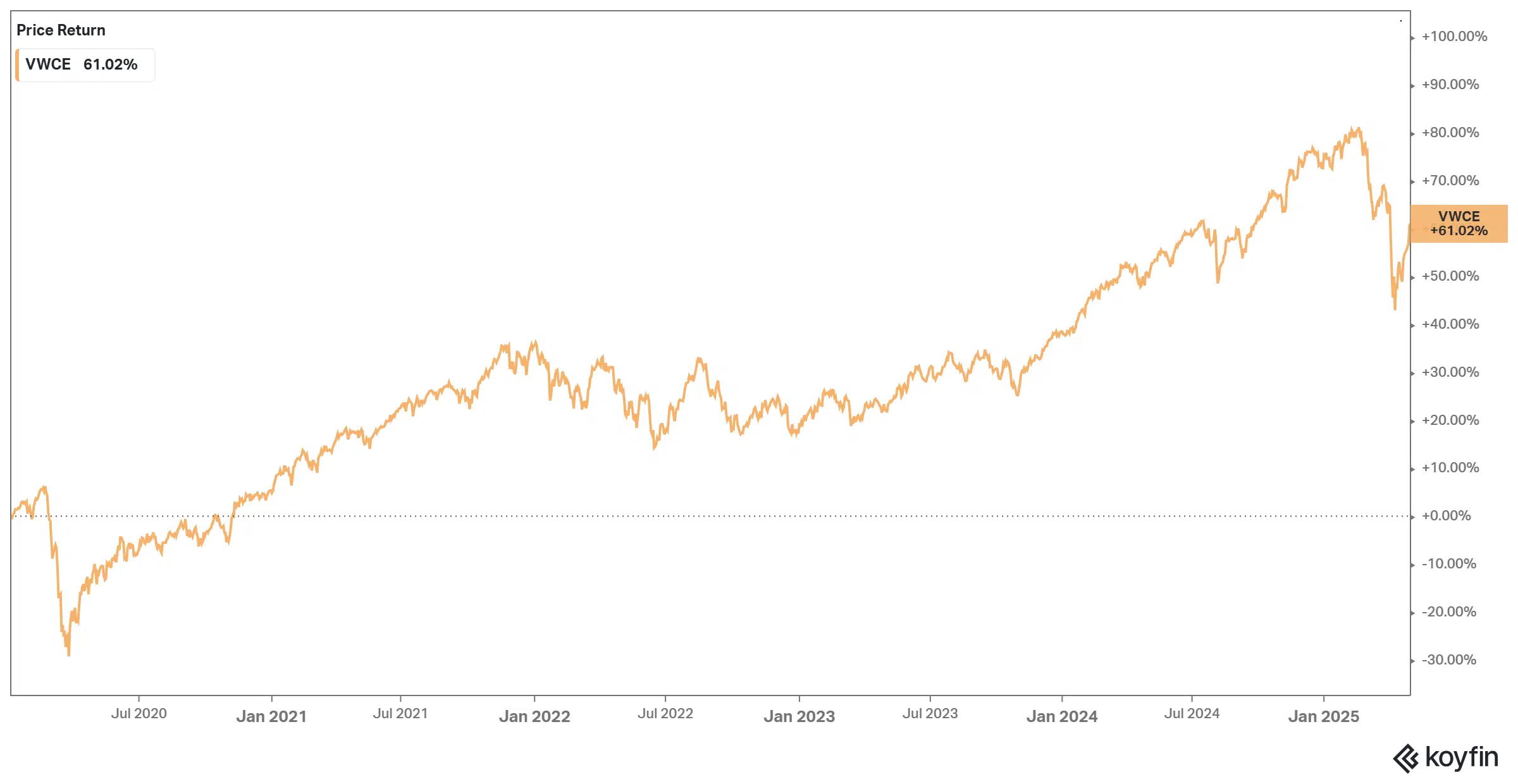

As of May 8, 2025, the VWCE portfolio has 3,625 stocks. Since its launch, the cumulative return until the close of May 8, 2025, has been +61.02%:

What is VWRL?

VWLR is the ticker from “Vanguard FTSE All-World UCITS ETF USD Distribution,” and again is managed by Vanguard Group. Unlike what we saw with VWCE, this is a distribution class ETF, which means it distributes periodic dividends. Payments happen in March, June, September, and December, and the historical yield is 1.98%.

About the Index

The index benchmarked by both ETFs is an index issued by FTSE, called the FTSE All-World Index. Composed of hundreds of large and mid-cap companies in developed and emerging markets.

This index was launched in June 2000 and covers 98% of the world’s investable market capitalization.

Portfolio sample

With the VWCE & VWRL ETFs, you can invest in companies such as NVIDIA, Amazon.com, Tesla, Alphabet, Exxon, Apple, or JP Morgan. The technology and financial sectors are the most heavily weighted in their portfolios.

In terms of geographic distribution, the USA dominates, followed by Japan and the United Kingdom.

About the Investment Manager

Vanguard Group manages these ETFs. Founded in 1975 by the legendary John Bogle, this company is a global player in passive investing. Vanguard has more than 20,000 employees worldwide, and its total assets under management amount to $7.6 trillion, being the second largest asset manager in the world.

This manager characterizes by offering hundreds of funds at lower cost and with excellent replication of its benchmark.

Cheapest brokers to invest in VWCE and VWRL

If you think these ETFs might be a good fit for your investment portfolio, you must know where to find them. Below we have prepared a selection of online brokers who facilitate your task with the best market conditions.

| Broker | ETF fees | Available ETFs | Minimum deposit | Other fees |

| DEGIRO | €1 (in selected ETFs) or €2 (in the remaining) | +200 | €0.01 | Currency exchange fees and spreads. |

| IBKR | 0.05% of Trade Value | +13.000 | €0 | Spreads. |

| Trading 212 | 0% | +200 | €10 | Spreads. |

Disclaimer: Investing involves risk of loss.

Conclusion

Summarizing our comparative analysis, we can say that we face two excellent ETFs that provide different benefits using the same portfolio.

If you want a product that will give you significant capital appreciation over the long term, choose the VWCE ETF. As an accumulation class, it takes maximum advantage of compound interest.

On the other hand, if you prefer a product that provides periodic income while your capital grows, VWRL will be your best option.