In the world of ETFs, simplicity is often key. Whether you’re a seasoned investor or just starting, choosing the right fund can make all the difference.

Two popular options are VWCE and IWDA, both offering broad market exposure with unique characteristics. But which one fits your investment strategy?

In this article, we’ll break down their key differences, performance data, and help you decide which ETF aligns with your financial goals. Let’s dive in!

Overview

| ETFs | VWCE | IWDA |

| Asset Manager | Vanguard | Blackrock |

| Replicated index | FTSE All-World index | MSCI World index |

| AUM (in millions) | EUR +16,50 B | EUR +80,00 B |

| Inception Date | 07/2019 | 09/2009 |

| Fund Currency | USD | USD |

| Replication | Physical | Physical |

| TER | 0.22% p.a. | 0.20% p.a. |

What are the VWCE and the IWDA?

VWCE

The VWCE ETF, whose full name is “Vanguard FTSE All-World UCITS ETF USD Accumulation,” is a Vanguard fund replicating the FTSE All-World index. This fund was launched in July 2019 and, as of March 2025, has Share Class Assets totaling ~$16 billion.

This ETF performs an optimized physical replication of the index, taking a significant sample of its entire composition. The VWCE portfolio has ~3,600 stocks out of the ~4,200 that compose the index.

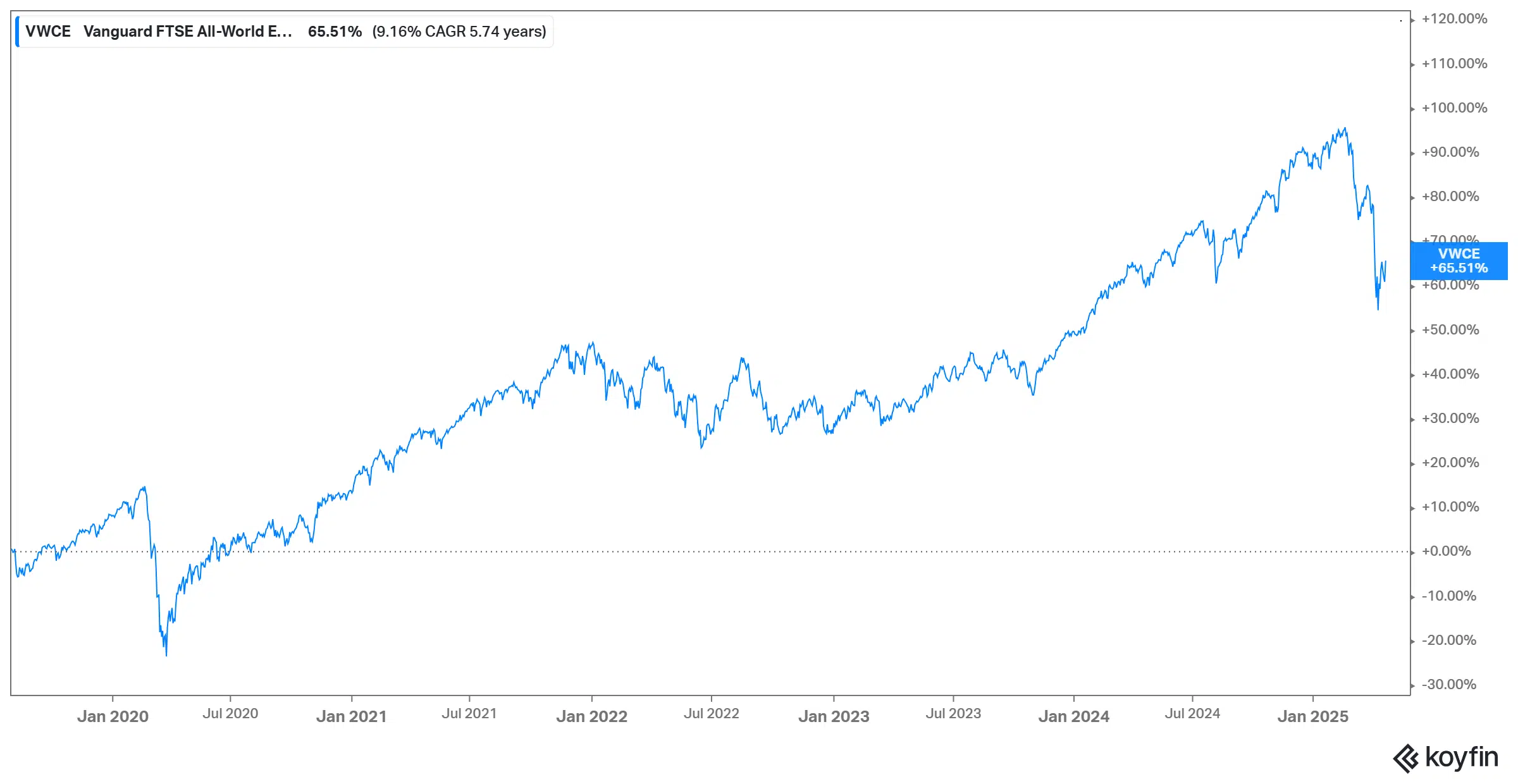

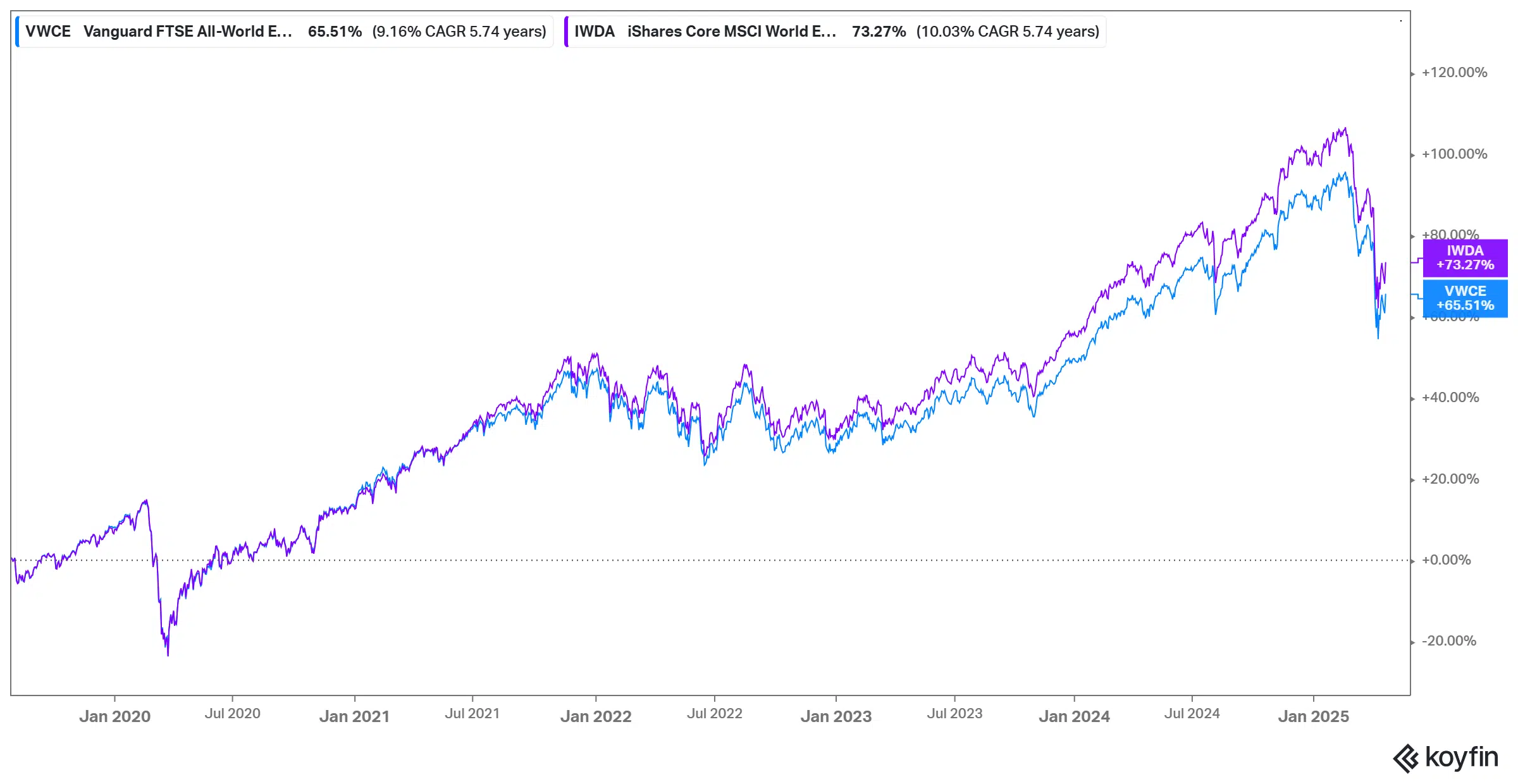

Since its launch, the cumulative return until April of 2025, has been +65.51%:

IWDA

The IWDA ETF, whose full name is “iShares Core MSCI World UCITS ETF USD (Acc),” is a Blackrock fund whose benchmark is the well-known MSCI World Index. This fund, launched in September 2009, is one of the largest in the market, with an AUM of over 80 billion euros.

IWDA’s replication is physical, taking positions corresponding to the benchmark’s portfolio using actual securities.

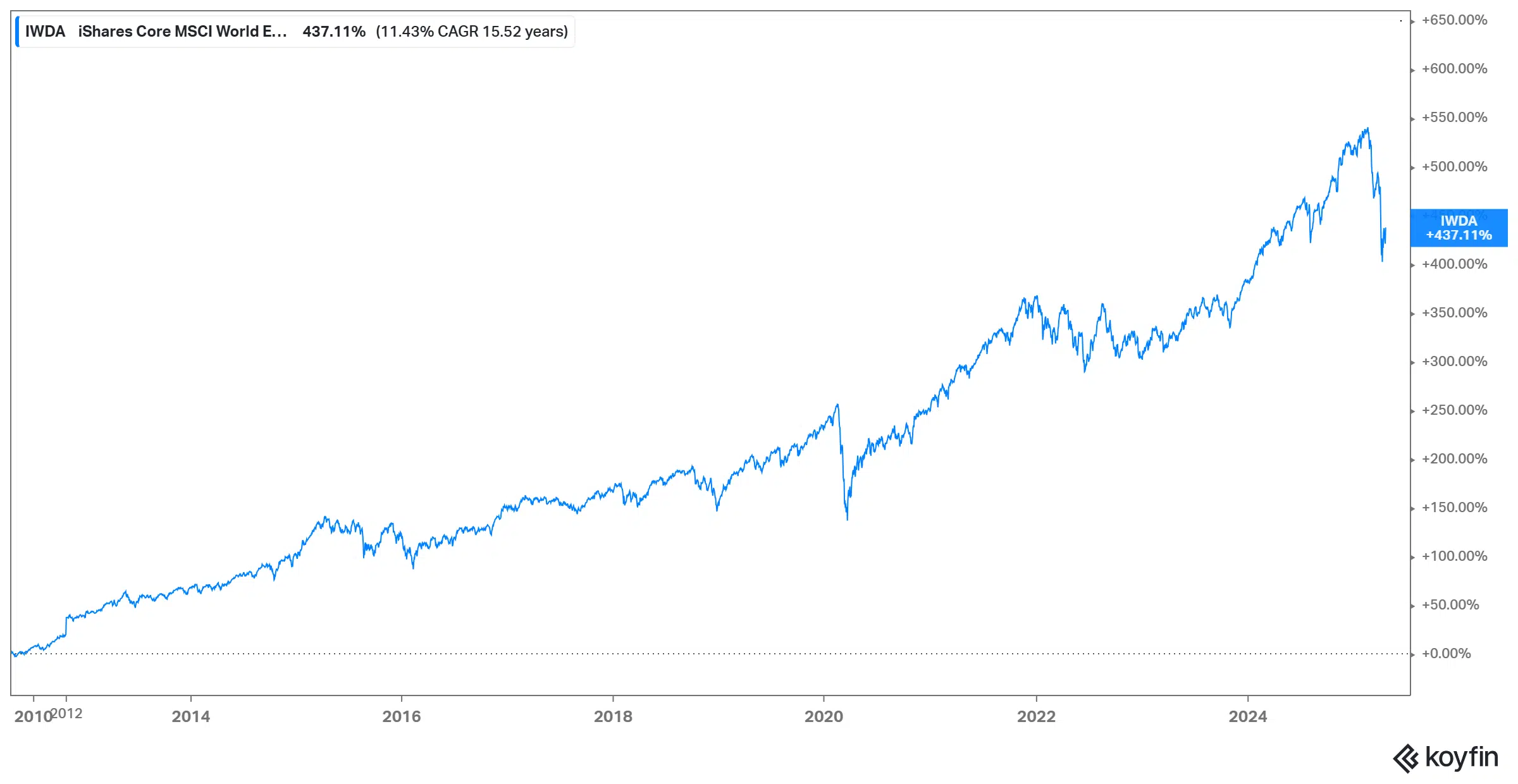

The ETF started in September 2009, and at the close of April 23, 2025, it accumulated a return of +437.11%.

We now move on to the comparative study between VWCE and IWDA, in which we will take into account different aspects, namely:

| Performance: | Regarding the performance of the two funds, during the same period (from July 2019 to the present), the most profitable was the IWDA. |

| TER: | IWDA has a lower TER ratio. That makes it the cheapest fund |

| Portfolio structure: | The style of the stocks is similar. However, the VWCE ETF has more presence in Asia, while the IWDA is more concentrated in the USA |

IMPORTANT: Before starting the comparison, note that we are discussing two ETFs whose benchmarks differ. That is why we will not be able to point out a winner and a loser since it would be necessary for both funds to work on the same benchmark.

Geographic distribution

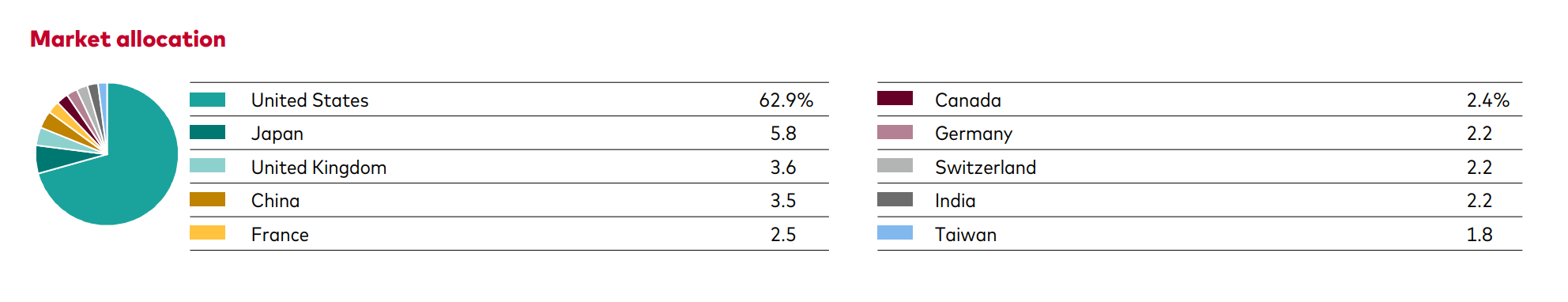

VWCE

For VWCE, the geographic allocation is led by the United States, accounting for 62.9% of the portfolio. Japan follows as the second-largest country with 5.8%. Other notable regions include the United Kingdom (3.6%), China (3.5%), and France (2.5%).

Below is VWCE’s top 10 geographic breakdown by percentage (factsheet):

IWDA

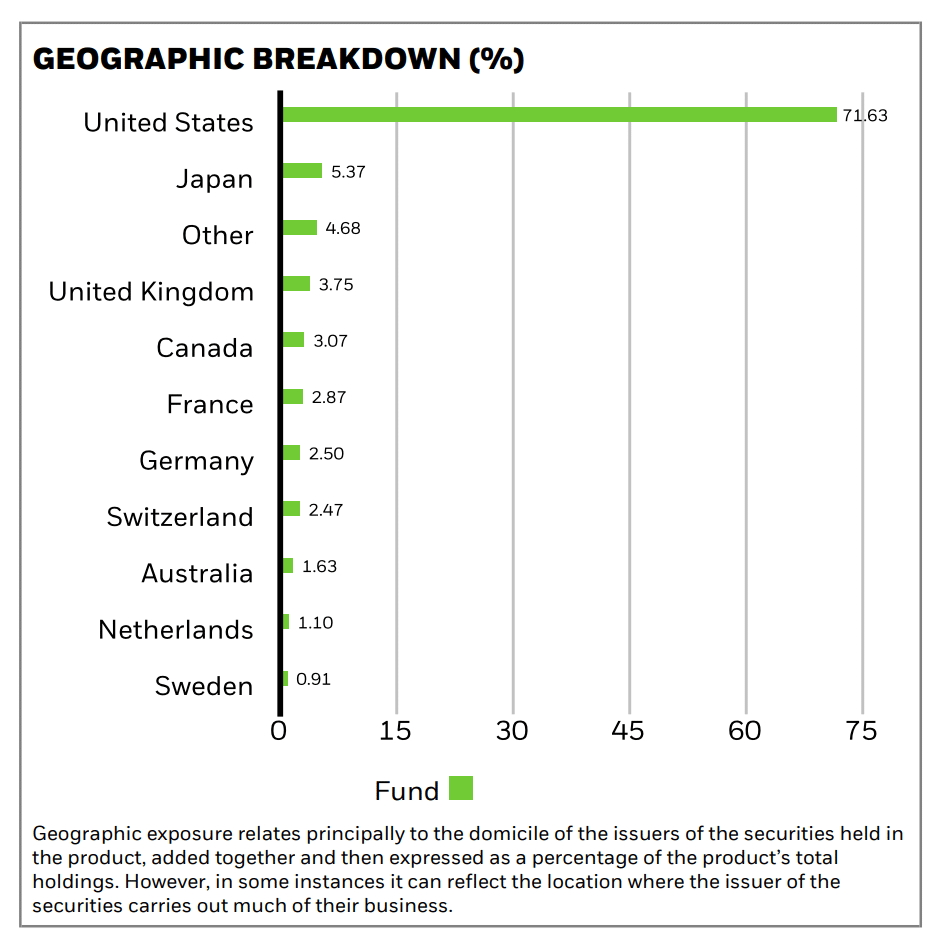

For IWDA, the geographic distribution shows that 71.63% of the portfolio is allocated to the United States, with Japan as the second-largest country at 5.37%. Other notable allocations include the United Kingdom (3.75%) and Canada (3.07%).

Below is IWDA’s top 10 geographic breakdown by percentage (factsheet):

Sector diversification

Both VWCE and IWDA are broadly diversified across similar sectors, with Information Technology leading the way in both portfolios. Other key sectors such as Financials, Consumer Discretionary, and Industrials hold comparable weightings between the two funds.

Below is a breakdown of the sector allocations for VWCE and IWDA:

| Sector (weights) | VWCE | IWDA |

| Information Technology | 26.50% | 23.42% |

| Financials | 16.30% | 17.25% |

| Consumer Discretionary | 13.60% | 10.14% |

| Industrials | 13.10% | 11.02% |

| Health Care | 9.90% | 11.04% |

| Consumer Staples | 5.20% | 6.44% |

| Energy | 4.3% | 4.12% |

| Communication Services | 2.9% | 7.87% |

| Basic Materials | 2.9% | 3.34% |

| Utilities | 3.0% | 2.67% |

| Real Estate | 2.3% | 2.27% |

Note: The weights listed in the table refer to March 2025.

Portfolio structure

When comparing the number of holdings, VWCE offers broader exposure with ~3,600 stocks, covering both developed and emerging markets. On the other hand, IWDA holds around ~1,400 stocks, focusing solely on developed markets.

While it may seem odd that VWCE holds more stocks despite being a younger fund, the reason lies in its inclusion of emerging markets, which adds a greater number of constituents to its portfolio compared to IWDA’s developed market focus.

Top 10 holdings

| VWCE | IWDA | ||

| Stocks | Weights | Stocks | Weights |

| Apple Inc | 4.2% | Apple Inc | 4.88% |

| Microsoft Corp | 3.6% | Nvidia Corp | 3.88% |

| Nvidia Corp | 3.2% | Microsoft Corp | 3.87% |

| Amazon.com Inc | 2.3% | Amazon.com Inc | 2.63% |

| Alphabet Inc (Class A) | 2.1% | Meta Platforms Inc (Class A) | 1.84% |

| Meta Platforms Inc | 1.6% | Alphabet Inc (Class A) | 1.32% |

| Berkshire Hathaway Inc | 1.2% | Alphabet Inc (Class C) | 1.14% |

| Broadcom Inc | 1.0% | Tesla Inc | 1.09% |

| Tesla Inc | 0.9% | Broadcom Inc | 1.09% |

| JPMorgan Chase & Co. | 0.9% | Berkshire Hathaway Inc | 1.04% |

Note: The weights listed in the table refer to March 2025.

Performance

We will start with the comparative performance of the two ETFs. As the VWCE is younger than the IWDA, we will take the reference in the date of the former.

In the chart, we can see that the performance of IWDA (in purple) surpasses that of VWCE (in blue). Over the same period (from July 2019 to April 2025), IWDA shows a return of 73.27%, while VWCE remains at 65.51%.

However, it’s important to remember that past performance does not guarantee future results, and these returns may not be sustained over time.

TER (Total Expense Ratio)

The TER is the indicator that refers to all the fees incurred by an ETF, so the lower rate is better.

The TER in the case of the IWDA is 0.20% p.a., while in the case of the VWCE, it is 0.22% p.a. In principle, we could consider that the IWDA would be better because it is cheaper, but here we must clarify that the nature of each ETF influences its cost.

Thus, the IWDA invests in securities of developed countries, where costs are efficient, and currency dispersion is little. On the other hand, the VWCE ETF invests in developed and developing countries, so the fees are necessarily higher as it does not have standardized rates and works with many more currencies.

Risk factors

While the VWCE and IWDA strategies offer a diversified way to invest, it’s important to understand the associated risks that could affect your investment.

-

Market risk and global exposure

Both VWCE and IWDA invest solely in equities, meaning they are subject to market volatility. If global stock markets decline, your investment will also experience losses. To mitigate this risk, you might consider diversifying into other asset classes, such as bonds or real estate.

-

Currency risk

Although both VWCE and IWDA are quoted in EUR on European exchanges, their underlying assets are mostly denominated in USD. As a result, fluctuations in the USD/EUR exchange rate can affect your returns. A weakening U.S. dollar can reduce your gains when converting back to EUR, even if the funds perform well.

-

Inflexibility in asset allocation

With VWCE and IWDA, you are tied to their respective indices. If you prefer greater control over specific regions or sectors, these ETFs may limit your flexibility in portfolio management.

Cheapest brokers to invest in VWCE and IWDA

Now that you know the key differences between VWCE and IWDA, it’s time to take the next step and choose the best broker to invest with. To help you make an informed decision, we’ve evaluated and highlighted 5 top European ETF brokers below, each offering unique benefits for different types of investors.

Here’s a look at the top five ETF brokers in Europe and why they might be the right fit for your investment journey:

| Broker | ETF Fees | Minimum deposit | Number of ETFs |

| eToro | $0 (other fees apply) | $50 (varies between countries) | 300+ |

| Interactive Brokers | Varies by exchange with tiered pricing: 0.05% of Trade Value (min: €1.25, max: €29.00) | €/$/£0 | 13,000+ |

| DEGIRO | £/€0 (in some ETFs, + a €/£1 handling fee), plus an annual £/€2.50 connectivity fee | €/£1 | 200+ |

| XTB | $/€/£0 | €/$/£1 | 100+ |

| Lightyear | No Lightyear execution fees for ETFs – other fees may apply) | €/$/£1 | 150+ |

Disclaimer: Investing involves risk of loss.

Bottom line

In conclusion, both VWCE and IWDA are solid options for global equity exposure. VWCE includes both developed and emerging markets, offering broader diversification. IWDA, by contrast, focuses solely on developed markets and has delivered higher returns.

So, VWCE vs IWDA: which ETF is better for you?

If you’re seeking exposure to emerging markets, VWCE might be a suitable option. For developed markets and recent higher returns, IWDA could be a better option. Ultimately, the decision should align with your financial goals.

If you require additional guidance or have further questions, please don’t hesitate to contact us. Best of luck on your investment journey!