What is the difference between VUSA and VOO? These are two ETFs that, despite having different tickers, replicate the same index, the S&P 500. Their difference lies in their structure (currencies, expense ratios, taxes…) and their target investors (VUSA targets mainly European/UK investors, and VOO targets primarily US investors).

VUSA is traded in EUR, GBP, and CHF, exposing investors to currency fluctuations in these currency pairs, which can impact returns. On the other hand, VOO is an ETF only traded in U.S. dollars (USD). The same provider, Vanguard, offers both ETFs.

Throughout this article, we will address all the relevant topics so you can make an informed investment decision.

VUSA vs VOO compared in a nutshell

Our team has compiled all the information discussed throughout the article into a table, so that it can be easier for you to observe the differences and make a decision.

| ETF | VUSA | VOO |

| Index Tracked | S&P 500 | S&P 500 |

| Fund Manager | Vanguard | Vanguard |

| AUM | +$35,000 M | +$570,000 M |

| Exchanges* | XPAR, XSTU, XMUN, XMEX, XMIL, XFRA, XAMS, XLON, XSWX, XETR | NYSE |

| Fund Currency** | USD | USD |

| Dividend Distribution | Distributing | Distributing |

| Expense Ratio | 0.07% | 0.03% |

* In some exchanges, the ticker for the ETFs may be different, such as in the case of VUSA on the London Stock Exchange, where it is listed as VUSD – ticker that is traded in USD dollars.

** Fund currency is the reporting currency. Still, you can trade VUSA in other currencies, such as EUR, GBP and CHF.

Index tracked

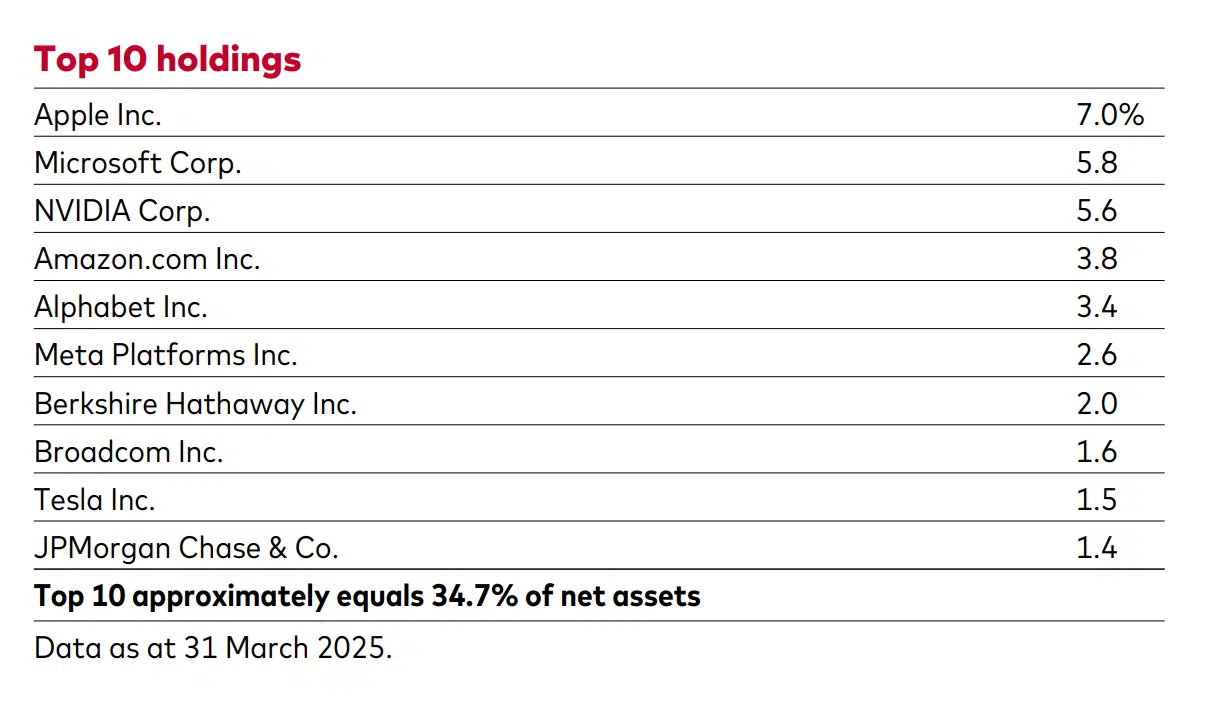

Both VUSA and VOO are ETFs replicating the S&P 500 index, which tracks the performance of 500 large-cap companies in the United States. According to the information from the fund provider, both ETFs have identical holdings, containing the same stocks in the same proportions.

Both VUSA and VOO use physical replication as their ETF construction strategy. This means that the fund manager acquires the assets that comprise the ETF’s benchmark index, the S&P 500 Index.

AUM

VUSA was launched in May 2012, whereas VOO was introduced in September 2010. Due to this additional two-year head start and its listing on the US exchange, VOO boasts significantly higher assets under management (AUM) compared to VUSA (As of April 2025).

| ETF | VUSA | VOO |

| AUM (millions) | +$35,000 | $570,000 |

Another reason for VOO’s larger AUM is its broader international appeal. Unlike VUSA, which is primarily tailored to the European market to comply with UCITS regulations, VOO is designed to be more international in scope. As a result, it also attracts investors from outside of Europe, expanding its reach and potential investor base.

Exchanges

VOO is listed and traded on the New York Stock Exchange (NYSE). On the other hand, VUSA, a European ETF, can be traded on several exchanges, so our team has compiled all the information regarding the various tickers and currencies on different exchanges into a table.

| Listing | Trade Currency | Ticker |

| Euronext Paris | EUR | VUSA |

| gettex | EUR | VUSA |

| Stuttgart Stock Exchange | EUR | VUSA |

| Borsa Italiana | EUR | VUSA |

| Euronext Amsterdam | EUR | VUSA |

| London Stock Exchange | USD | VUSD |

| London Stock Exchange | GBP | VUSA |

| SIX Swiss Exchange | CHF | VUSA |

| XETRA | EUR | VUSA |

Currency

Both ETFs, VUSA and VOO, have US dollars (USD) as their fund currency. However, the specific tickers listed can be traded in different currencies depending on the country of the respective exchange. The VUSA is a European ETF traded on various European stock exchanges (Frankfurt, Amsterdam,…) primarily in EUR, CHF, and GBP. On the other hand, VOO is an American ETF traded in its fund currency, USD dollars.

VUSA and VOO are unhedged ETFs, meaning they do not use currency hedging strategies. As a result, you are exposed to currency risk (USD) when investing in these ETFs. Fluctuations in exchange rates between the ETF’s underlying currencies and your base currency can impact the overall returns of your investment.

Distribution

Both VOO and VUSA follow a distributing ETF strategy, providing regular dividend payments quarterly. This common feature is appealing to investors interested in receiving consistent income from their investments.

Fund domicile

VUSA is domiciled in Ireland, whereas VOO is domiciled in the US. Investing in Irish-domiciled ETFs like VUSA can benefit from a lower dividend withholding tax than US-domiciled ETFs.

| ETF | VUSA | VOO |

| Dividend Withholding Tax | 15% | 30% |

If you’re not a US resident, investing in VUSA, domiciled in Ireland, can be advantageous.

Non-resident aliens may face a 30% dividend withholding tax on US-domiciled ETFs like VOO. However, thanks to the tax treaty between Ireland and the US, VUSA investors benefit from a reduced 15% withholding tax on dividends from US stocks.

Total expense ratio

Besides the fees you pay to your broker when trading ETF shares, there’s another cost called the total expense ratio (TER). It’s a fee charged by the fund manager to cover the expenses of running the ETF. VUSA charges a TER of 0.07%, while the VOO charges a TER of 0.03%.

| ETF | VUSA | VOO |

| TER | 0.07% | 0.03% |

The TER is shown as a percentage of the total amount of money in the fund and is charged daily according to its Net Asset Value (NAV) in the TER daily proportion. For instance, if it was 0.50% and you had $10,000 invested in the ETF, you would pay $50 as expenses for that year – adding all trading days (for simplicity, we consider the ETF didn’t move during this period).

Diversification

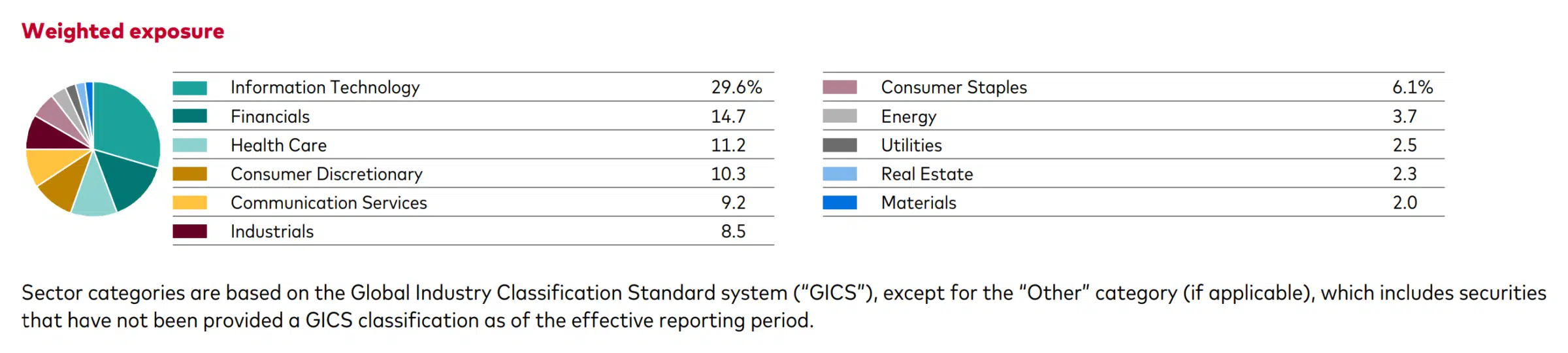

As an investor, it’s important to note that both VUSA and VOO, as ETFs tracking the S&P 500 index, primarily focus on the U.S. stock market and its constituent companies. This means that its geographic diversification is concentrated in the United States. Consequently, both VUSA and VOO offer limited exposure to international markets or companies outside the U.S. However, most companies sell their products internationally, so you don’t only have exposure to the US. You can explore this topic in our article “Stocks: What is Your Real Country/Currency Exposure?”.

Both VUSA and VOO ETFs diversify their holdings across various sectors of the economy, including technology, healthcare, financials, consumer discretionary, industrials, and so on. This reduces your exposure to sector-specific risks and promotes a balanced investment approach.

Cheapest brokers to invest in VUSA and VOO

Now that we’ve gone through the differences between the two ETFs, it’s time to investigate which broker is best to invest in. We have already done that work by analysing the most important features of different ETF brokers and putting together a list of 4 ETF brokers.

Here you have the list of the 4 ETF brokers and the advantages of each one of them:

- eToro: Best for social trading

- Interactive Brokers: Best for the largest ETF offering

- Public.com: Best for commission-free investing and access to an investor community

- InvestEngine: Best for expert-managed portfolios

| Broker | ETF fees | Minimum Deposit | Number of ETFs | Regulators | Country |

| eToro | $0 (other fees apply) | $50 (varies between countries) | 300+ | FCA, CySEC, ASIC | Available worldwide (exceptions apply). |

| Interactive Brokers | Free for US investors; Up to USD 0.0035 per stock (min: USD 0.35) for international investors | €/$/£0 | 13,000+ | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB | Available worldwide (exceptions apply). |

| Public.com | $0 for US-listed stocks and ETFs during regular market hours; $2.99 per trade during extended hours for non-premium members | $0 | 200+ | SEC, FINRA | Available in the UK and the USA. |

| InvestEngine | 0%-0.25% | £100 | 500+ | FCA | Available in the UK. |

| Broker | VUSA | VOO |

| eToro | ✘ | ✔ |

| Interactive Brokers | ✔ | ✔ |

| Public.com | ✘ | ✔ |

| InvestEngine | ✔ | ✔ |

Conclusion

In conclusion, both VOO and VUSA are popular ETFs that offer investors exposure to well-established markets, but they have significant differences worth considering.

VUSA is a European-domiciled ETF, providing investors with potential tax advantages due to lower dividend withholding tax rates under the Ireland-US tax treaty. On the other hand, VOO is a US-domiciled ETF traded on the New York Stock Exchange (NYSE), which may be more suitable for US residents or investors seeking a higher level of liquidity and trading volume.

Regarding expense ratios, VOO boasts a slightly lower expense ratio at 0.03% compared to VUSA’s 0.07%. While this may seem like a marginal difference, it can impact long-term returns, especially for investors with larger portfolios. Both ETFs follow a distribution strategy, providing regular dividend payments every quarter.

Ultimately, the choice between VOO and VUSA depends on individual preferences, investment goals, and tax implications.