What is the difference between SPX and SPY? These are two widely recognised financial assets associated with the S&P 500 index. Despite having distinct tickers, these assets are frequently compared due to their significant similarities and differences.

SPX refers to the S&P 500 index itself, which tracks the performance of the 500 largest publicly traded companies in the US. In contrast, SPY is an ETF designed to track the performance of the S&P 500 index. While SPX serves as a benchmark, SPY is a tradable asset that aims to track the index’s movements closely.

Another key difference is how dividends are handled. While SPX, as an index, does not distribute dividends (and it is a price index), SPY, being an ETF, can distribute dividends to its shareholders.

Throughout this article, we will address all the relevant topics so that you can make an informed investment decision.

What is SPX?

The SPX ticker symbol represents the S&P 500 index, an index that you should be familiar with if you’re interested in the US stock market. It consists of 500 of the largest publicly traded companies in the country, covering a wide range of industries and sectors. As a widely recognised benchmark, the SPX assesses the overall performance of large-cap stocks in the US.

It’s important to note that the SPX itself cannot be directly traded like individual stocks or ETFs. Instead, it is a reference point for various financial instruments such as futures, options, and other derivatives.

The composition of the SPX is periodically adjusted to reflect changes in the market and ensure it accurately represents the largest US companies. Each company’s weight in the index is based on its market capitalisation, which is the total value of its outstanding shares.

What is SPY?

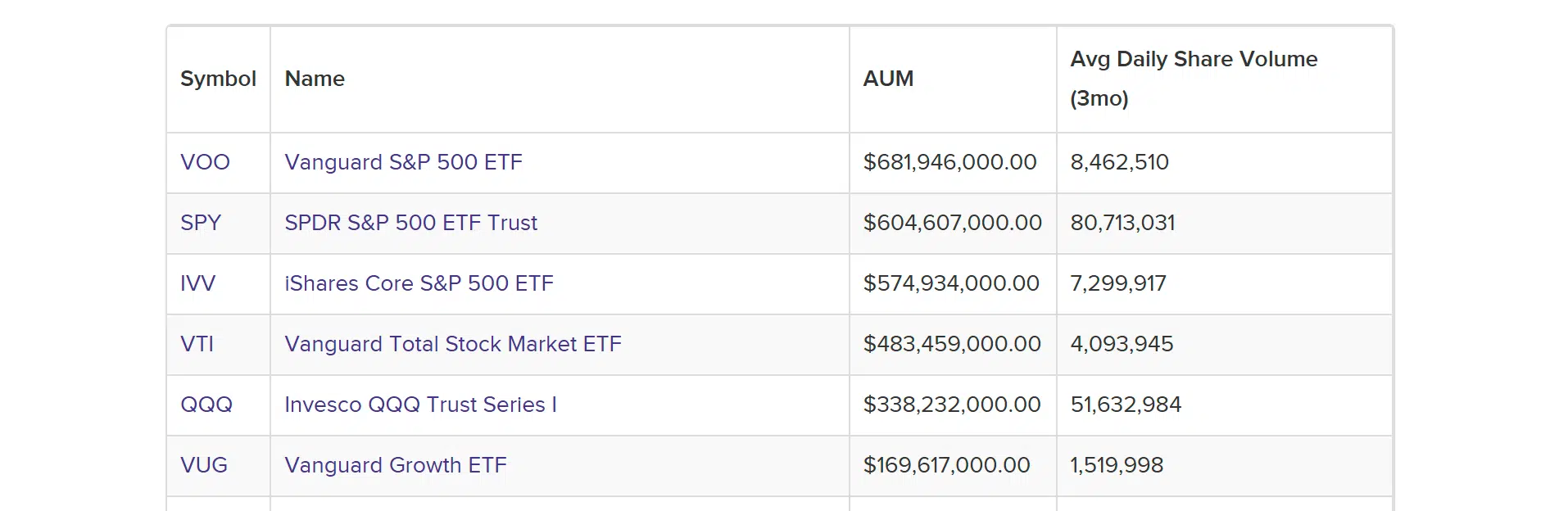

SPY is an ETF (Exchange-Traded Fund) that tracks the performance of the S&P 500 index. The ticker symbol “SPY” is used to represent this specific ETF. SPY is one of the most popular, heavily traded ETFs and the largest in the world:

Unlike SPX, SPY can be directly traded on the New York Stock Exchange (NYSE) without the need for derivative financial products. By purchasing shares of the SPY ETF, you can easily gain exposure to the S&P 500 index. The performance of SPY aims to closely track the movements of the underlying index.

From now on, we will conduct a more detailed analysis of this ETF, addressing various points that may be important for you as an investor to make an informed decision.

SPY – Index Tracked

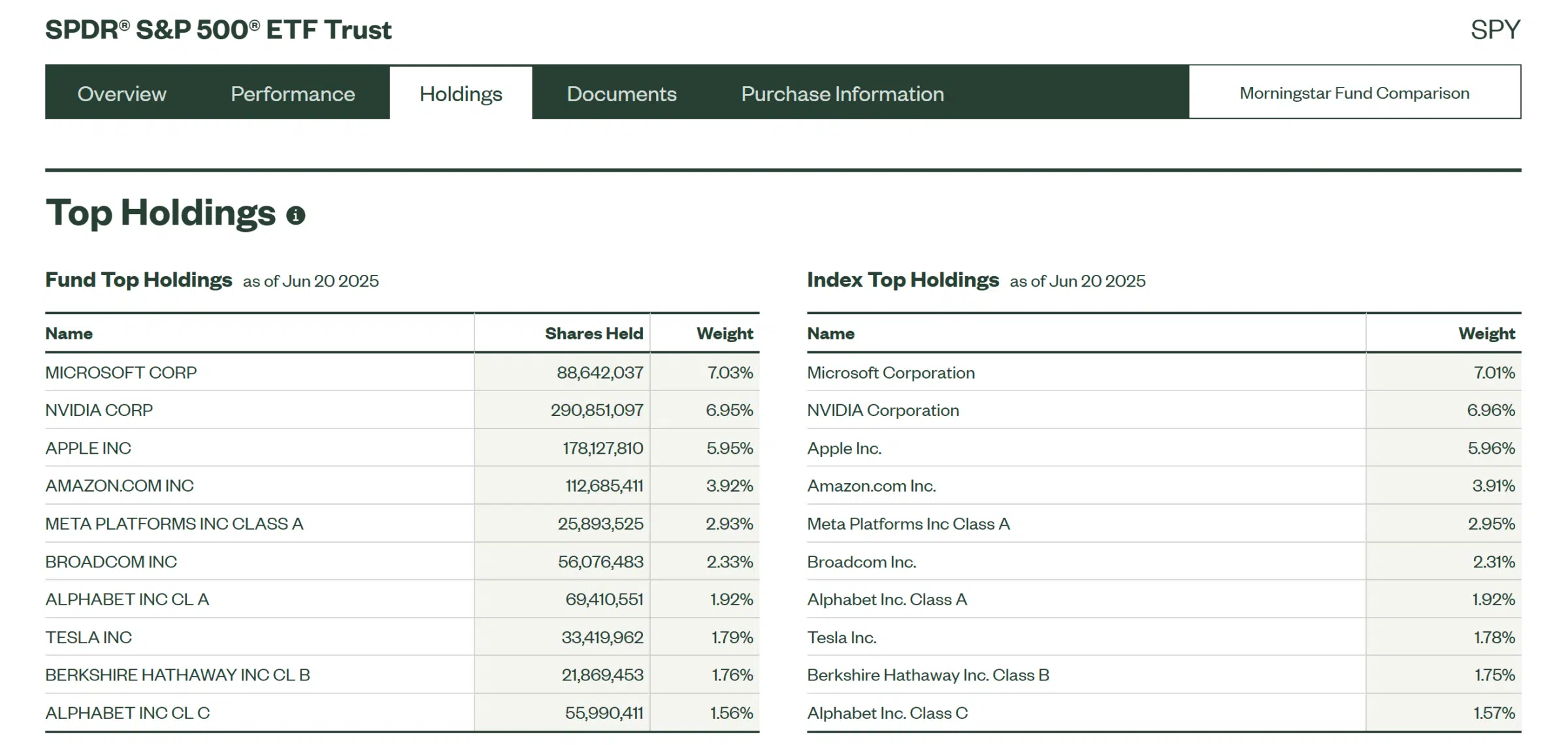

SPY replicates the S&P 500 index, which tracks the performance of 500 large-cap companies listed in the United States. Based on information from the State Street Global Advisors (SSGA) website, SPY holds the same stocks in approximately the same quantities as the S&P 500 index.

SPY utilises a methodology called full replication to track the performance of the S&P 500 index. This means that the ETF holds all of the constituent stocks of the index in the same proportions as they are represented in the index.

SPY vs SPX – Performance

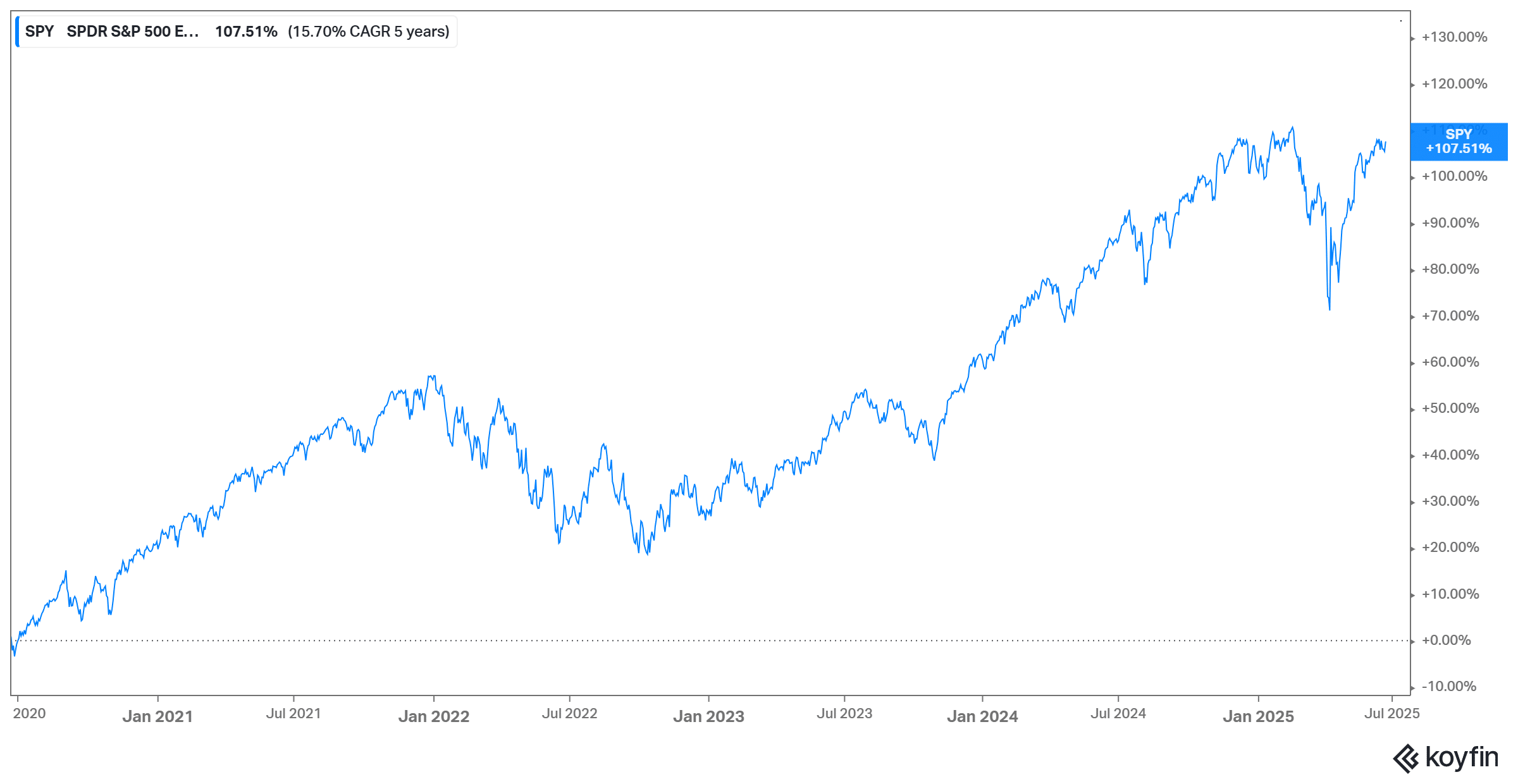

To analyse the historical performance of this ETF, our team conducted a simulation where, ten years ago, you would have invested $10,000. This simulation provides insights into the historical profitability of the SPY ETF versus the SPX index.

In the last ten years, SPY’s performance has been very close to SPX (As of March 20245:

| ETF | SPY (%) | SPX (%) |

| 1 Year | 8.23% | 8.25% |

| 3 Year | 8.92% | 9.06% |

| 5 Year | 18.44% | 18.59% |

| 10 Year | 12.36% | 12.50% |

If you had invested $10,000 in SPY ten years ago, you would have ~$32,000 today, as of June 2025. This simulation assumes the reinvestment of ETF dividends. Please note that this simulation does not account for income taxes.

SPY – Exchange and Currency

SPY is listed and traded on the New York Stock Exchange (NYSE). As an investor, you can buy and sell SPY shares on the NYSE during regular trading hours.

It’s important to note that SPY is denominated in U.S. dollars (USD). This means that the underlying assets and transactions of the ETF primarily occur in USD.

| Exchange | Listing Date | Trading Currency | Ticker | CUSIP | ISIN |

| NYSE ARCA EXCHANGE | Jan. 22, 1993 | USD | SPY | 78462F103 | US78462F1030 |

SPY – Distribution

SPY is a distributing ETF with a quarterly distribution schedule. Essentially, it distributes dividends quarterly to shareholders. The dividends distributed by SPY are typically derived from the dividends paid by the constituent companies of the S&P 500 index. As a distributing ETF, SPY dividends are subject to taxation in the year you receive them as an investor.

SPY – Total Expense Ratio

Besides the fees you pay to your broker when trading ETF shares, there’s another cost called the total expense ratio (TER). It’s a fee charged by the fund manager to cover the expenses of running the ETF. The SPY charges a TER of 0.0945%.

| ETF | SPY |

| TER (%) | 0.0945 |

The TER is shown as a percentage of the total amount of money in the fund and is charged daily according to its Net Asset Value (NAV) in the TER daily proportion. For instance, if it was 0.50% and you had $10,000 invested in the ETF, you would pay $50 as expenses for that year – adding all trading days (for simplicity, we consider the ETF didn’t move during this period).

SPY – Diversification

As an investor, it’s important to note that SPY, as an ETF tracking the S&P 500 index, primarily focuses on the U.S. stock market and its constituent companies. This means that its geographic diversification is concentrated in the United States. Consequently, SPY offers limited exposure to international markets or companies outside the U.S. However, most companies sell their products internationally, so you don’t only have exposure to the US. You can explore this topic in our article “Stocks: What is Your Real Country/Currency Exposure?”.

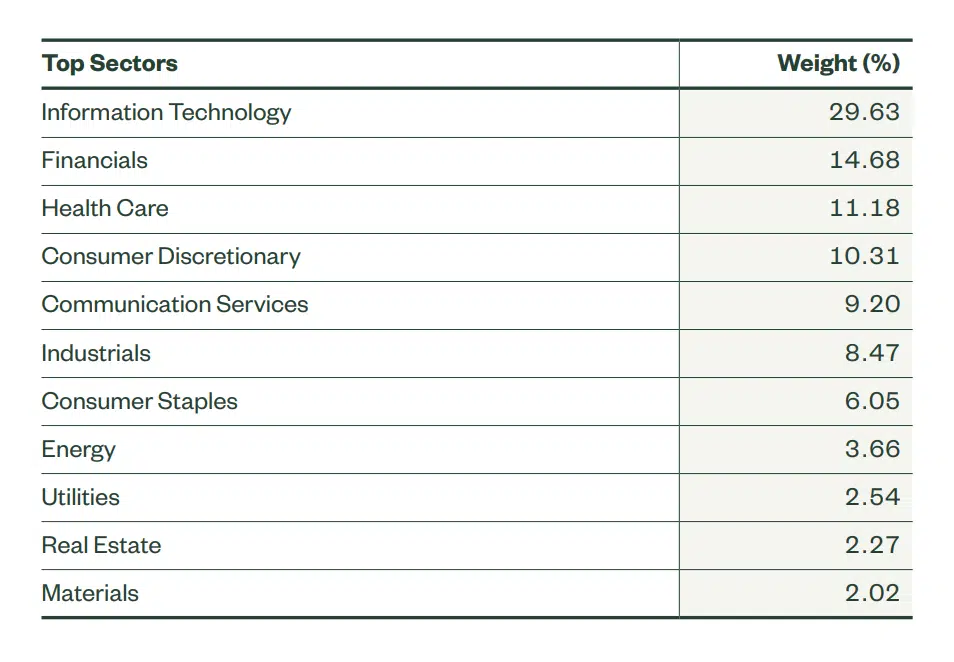

SPY ETF diversifies its holdings across various sectors of the economy, including technology, healthcare, financials, consumer discretionary, industrials, and so on. This reduces your exposure to sector-specific risks and promotes a balanced investment approach.

Cheapest brokers to invest in ETFs

Now that you know you can only invest in SPY (not directly in SPX), it’s time to choose the best broker to move forward with your investment. That’s why we collected all this information, evaluated the most important features of different ETF brokers, and compiled a list of the 4 ETF brokers available in the US, Canada and other countries.

Without further delay, here are four ETF brokers and why you should consider them:

- Interactive Brokers: Best for the largest ETF offering

- eToro: Best for social trading and commission-free ETF investing

- Public.com: Best for low-cost ETF trading

- Questrade: Best for Canadian residents

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

| Broker | ETF fees | Minimum Deposit | Number of ETFs | Regulators | Available Countries |

| Interactive Brokers | Varies by exchange with tiered Pricing:0.05% of Trade Value (min: €1.25, max: €29.00) | €/$/£0 | 13,000+ | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB | US, Canada and other countries worldwide |

| eToro | $0 | $50 (varies between countries) | 300+ | SEC, FINRA, FCA, CySEC, ASIC | US and other countries, except Canada |

| Public.com | $0 | $0 | 45+ | FINRA and SIPC | US |

| Questrade | *$0 ($0.01 selling costs) | $1,000 | 1,800 | CIRO and CIPF | Canada |

*At Questrade, you can choose from 2 base currencies: USD (United States Dollar) and CAD (Canadian Dollar), which share the same symbol ($).

Conclusion

In summary, SPX represents the S&P 500 index and cannot be directly traded, while SPY is an ETF that tracks the S&P 500 and is tradable on the New York Stock Exchange (NYSE).

SPY offers direct tradability and dividend distribution. Both focus on the U.S. stock market, with limited international exposure.