In this article, we will compare two of the most reputable ETFs in the market: Invesco’s QQQ and State Street’s SPY.

Many investors are interested in adding them to their portfolios, looking for attractive returns. However, although both have excellent performance, the composition and characteristics of each one differ.

Our study will address issues such as track record, Total Expenses Ratio (TER), portfolio detail, or return/risk indicators. With all this information, you will have the tools to make the most appropriate investment decision for your needs.

Key data

| ETF | QQQ | SPY |

| Asset manager | Invesco | State Street |

| Replicated index | Nasdaq 100 | S&P 500 |

| AUM (in millions) | USD +240,000 m | USD +490,000 m |

| Inception date | 10/1999 | 01/1993 |

| Fund currency | USD | USD |

| Replication | Physical | Physical |

| TER | 0.20% p.a. | 0.09% p.a. |

| 3 yr Tracking Error | 0.03 | 0.04 |

Source: Morningstar & Market Insider

QQQ vs SPY at a glance

| Performance: | Taking the observation date from October 1999 (inception date of QQQ) to April 2024, QQQ has outperformed SPY in cumulative return. Dividends included. |

| TER: | With a TER of 0.09%, the ETF with the lowest costs is SPY. In the QQQ, commissions soar to 0.20%. |

| Portfolio structure: | Both ETFs are primarily U.S.-weighted, although they allocate up to 2% to companies outside the United States, according to the stock selection of their respective benchmarks. |

| Risk statistics: | Regarding the risk/return analysis, SPY performs better than QQQ on a three-year basis. |

Comparison: QQQ vs SPY

To evaluate and compare QQQ and SPY, we will consider the application of the following analytical metrics. These are objective data, which guarantees you the impartiality of the results.

- Performance

- TER

- Portfolio Structure

- Risk Statistics

Finally, the last section will discuss the dividend policy of each fund, as both are distribution-class ETFs.

Performance

Let’s start by reviewing ETF performance. The younger of the two would be the QQQ ETF, launched in October 1999. We will base our comparison on performance from then through April 23, 2024.

Including dividends, the QQQ performance was +626.80%, and the SPY was +264.76%. Then, we should consider the QQQ ETF as the clear winner in this metric.

TER (Total Expense Ratio)

As you know, the TER is the indicator that includes all costs of the ETF, excluding transaction fees. Since it is directly involved in the outcome of our investment, our ETF must have the lowest possible TER.

Then, TER amounts to 0.20% in the case of QQQ, while in SPY, it is only 0.09%. If you want to pay less for your financial investment, SPY is the ETF for you.

Portfolio structure

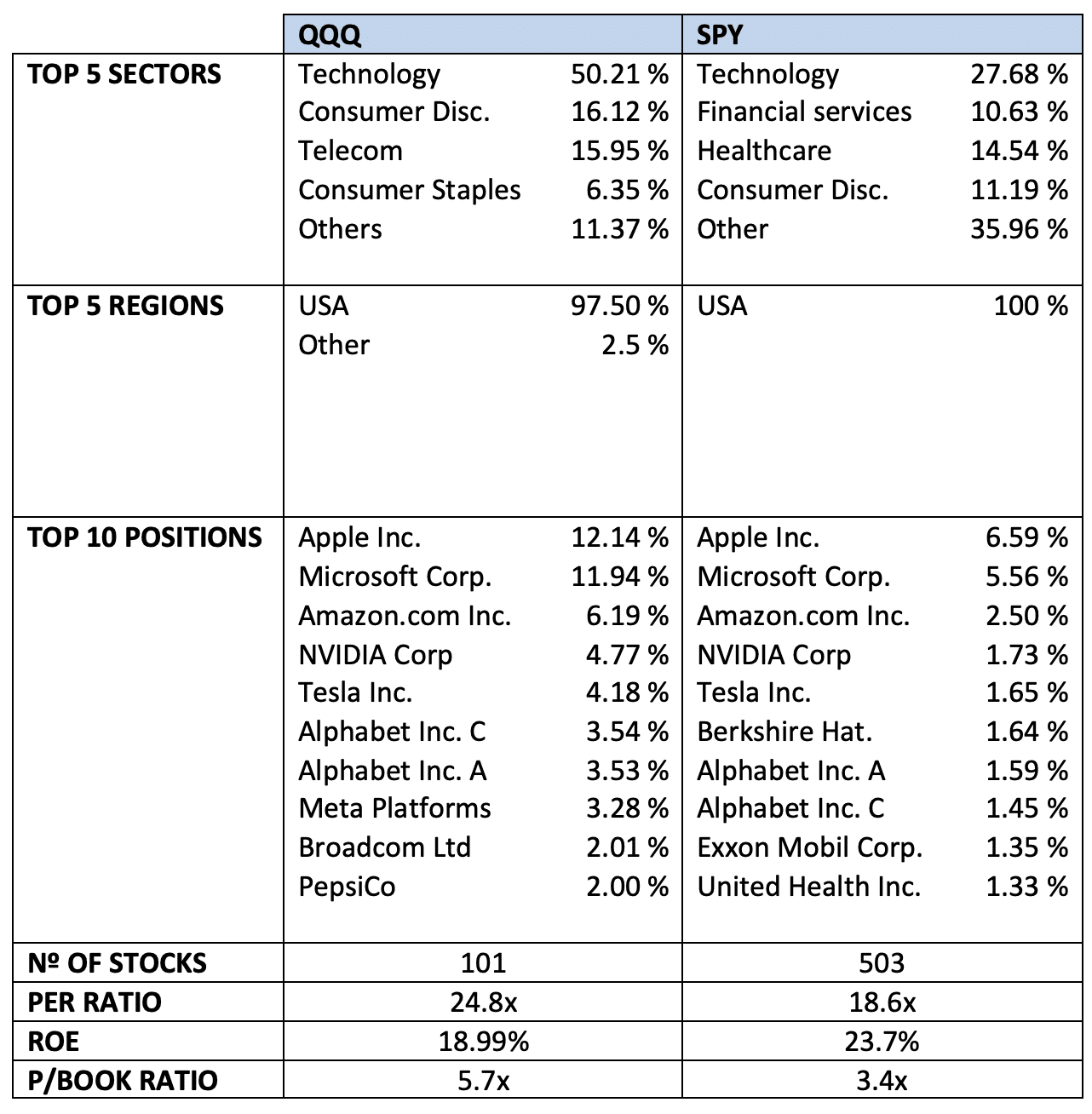

Although both funds invest primarily in the United States, their indexes differ. The QQQ is benchmarked to the Nasdaq 100 index, while the SPY follows the S&P 500 index.

According to the P/E and price-to-book ratio, the SPY portfolio is cheaper than the QQQ portfolio. Then, the long-term growth potential would be higher in the first case.

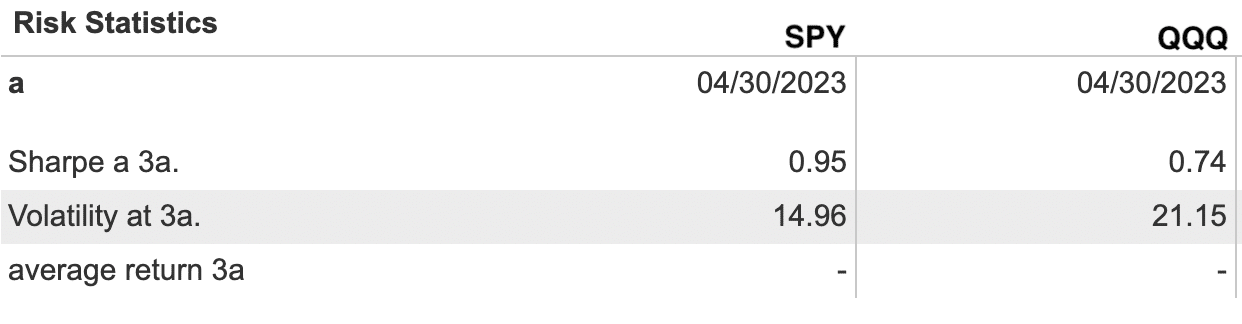

Risk statistics

Measured by the three-year Sharpe Ratio, this indicator provides the return obtained for each point of volatility. The result is 0.95 for the SPY and 0.74 for the QQQ. Therefore, the ETF with the best risk/return is the SPY. It generates higher profits for equal volatility.

Dividend policy

Close the metrics by talking about the dividend policy. We will take the yield distributed and the payment frequency. Both QQQ and SPY distribute quarterly dividends. The main difference is the yield. The QQQ ETF has a current dividend yield of around 0.61%, while SPY has 1.39%.

Therefore, it seems clear that SPY wins on this metric comparison.

What is QQQ?

The name QQQ is synonymous with Technology. Undoubtedly, this is one of the biggest names in ETF investment, with an enviable track record and hundreds of thousands of investors trusting it. As explained by its investment manager, Invesco, the QQQ is the 2nd most traded ETF in the U.S. (based on the average daily volume traded). The QQQ is also available in a UCITS version for European trading, whose ticker is the EQQQ.

QQQ’s performance has been spectacular. Including dividends, this ETF achieved a revaluation of +626.80%.

About the Index

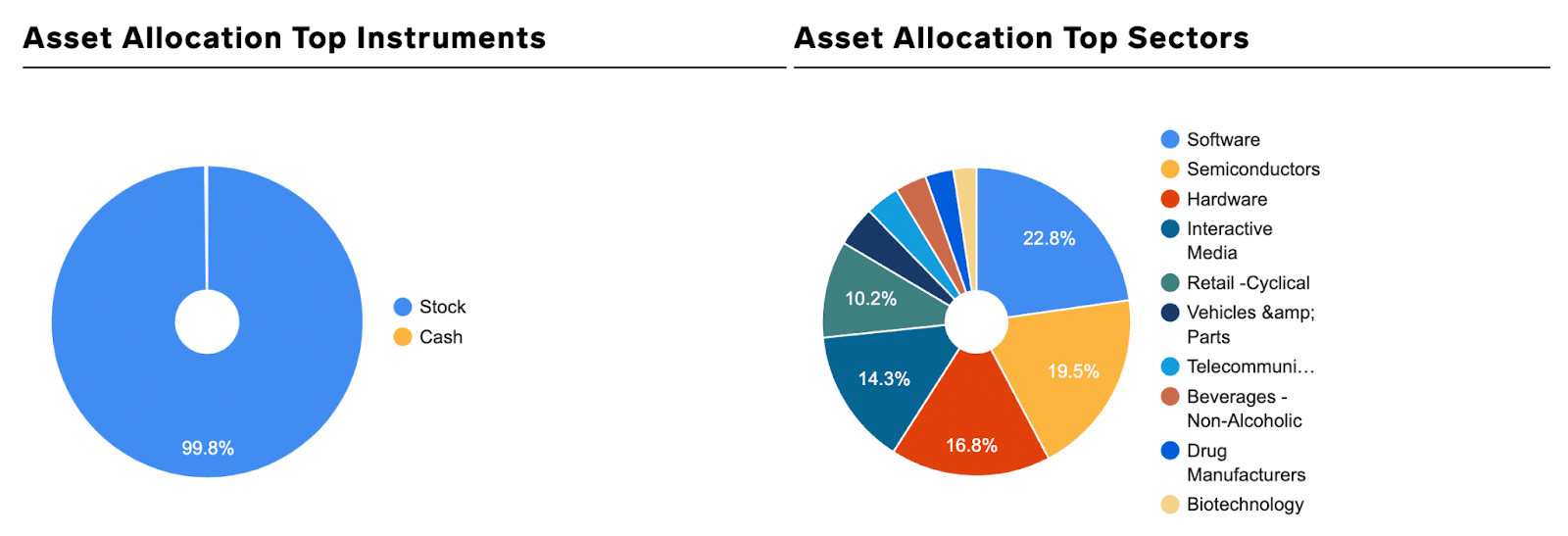

Sectors like Technology, telecommunications, and biotechnology heavily weigh in this index. It differs from the S&P 500 index mainly because it has no financial companies.

The Nasdaq 100 index was created in 1985 and is known as the “US Tech.” The composition of the index is reviewed annually.

Portfolio sample

If you decide to invest in QQQ, you will have access to the world’s leading technology companies. The portfolio includes names such as Apple, Meta Platforms, Microsoft, or Tesla, although you can find other well-known names such as PepsiCo.

By geographical distribution, the US dominates with 97.5%, and the remaining 2.5% distributes among other developed economies.

About the investment manager

The QQQ ETF manager is Invesco, an independent US investment management firm headquartered in Atlanta with branches in 20 countries. It has 1,4 trillion dollars in assets under management, spread across more than 500 funds and ETFs.

In addition to QQQ, Invesco is known for managing ETCs such as the Invesco Physical Gold and mutual funds such as the Invesco Pan European Equity Fund.

What is SPY?

When we talked about the QQQ, we said we were looking at a best-seller in the sector, but with the SPY ETF, we are directly facing the genesis.

Launched in 1993, SPY was the first ETF listed on stock exchanges. Nowadays, it is the largest, most traded, and most liquid ETF in the entire world. In Europe, SPY markets in UCITS mode as SPY5.

The SPY is a distribution-class ETF with a quarterly frequency, the current dividend yield for SPDR S&P 500 ETF as of April 23, 2023, is 1.35%.

Since the inception date, the cumulative return, including dividends, has been +1,900%.

About the Index

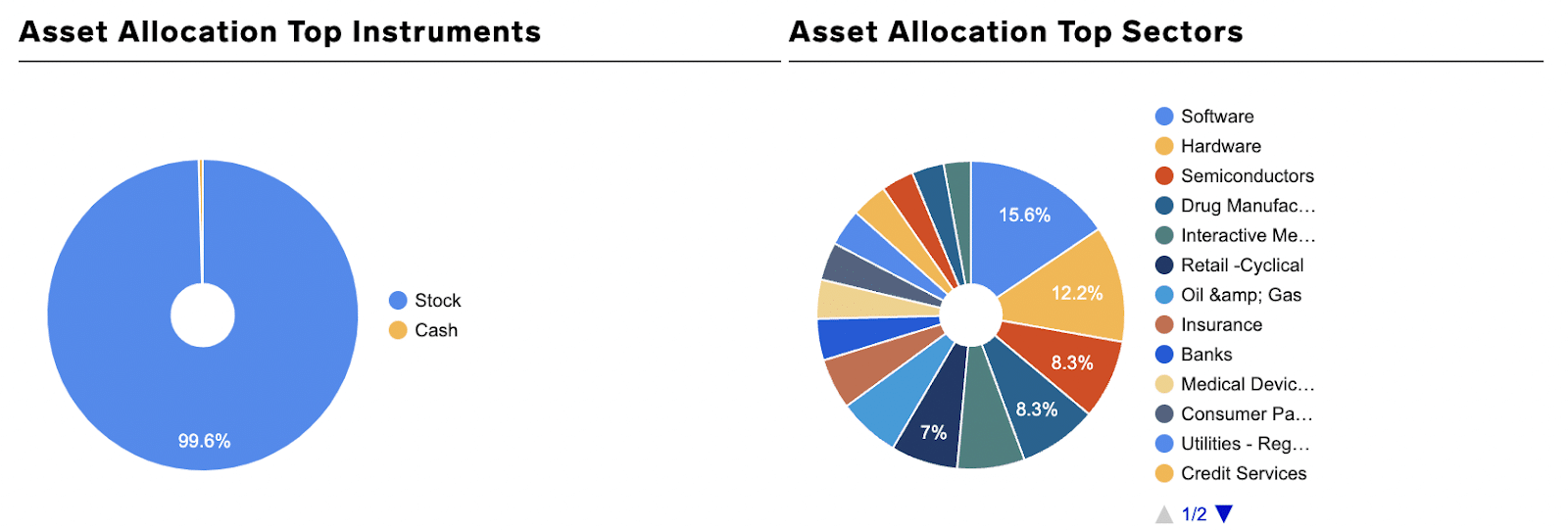

The benchmark of SPY is the S&P 500 Index, an index managed by Standard & Poor’s. Launched in 1957, the Index covers nearly the entire market capitalization through 500 companies (actually, 503).

It comprises large-sized company stocks in the US and provides comprehensive coverage of the national economy.

Portfolio sample

Investing in SPY gives you access to leading US companies, mainly in the technology and healthcare sectors. You will find names such as United Health, Exxon Mobil, Apple, Amazon, or Alphabet, among many others.

With the exception of a few individual stocks, the majority of the assets are based in North America.

About the investment manager

The SPY opens the group of the so-called SPDRs, the ETF division created in the 1990s by State Street. Along with Vanguard and Blackrock, State Street is one of the world’s largest asset managers, with $4.9 trillion in total AUM.

State Street is also one of the oldest financial institutions in the world, founded in 1792.

Cheapest brokers to invest in QQQ and SPY

To make your investment in these exceptional ETFs, we selected the best online brokers according to our requirements for quality, speed, product offering, and cost optimization.

| Broker | ETF fees | Available ETFs | Minimum deposit | Other fees |

| DEGIRO | €0 (in selected ETFs) or €2 (in the remaining); + €1 external cost | +200 | €0.01 | Currency exchange fees and spreads. |

| IBKR | 0.05% of Trade Value | +13,000 | €0 | Spreads, currency exchange, etc. |

| Trading 212 | 0% | +200 | €10 | Spreads, currency exchange, etc. |

Disclaimer: Investing involves risk of loss.

Conclusion

Regarding the QQQ, we undoubtedly have an ETF that provides a higher return than its competitor with a lower tracking error.

On the other hand, the SPY offers us a better result in the return/risk performance. In addition, their costs are lower, offering us a high yield on dividend payments.

There is no clear winner, given that we analyze two of the best ETFs on the market. It will depend on your interest to opt for one product or another, although you can be sure that whatever your decision, you will be working with an ETF of the highest quality.