The FTSE All-World and MSCI ACWI (All Country World Index) are both indices that aim to reflect the performance of worldwide markets. However, they differ in terms of how they cover different markets and the components they include.

Investing in these indexes through ETFs and index funds replicating the respective index’s performance is possible. Through these investment vehicles, the investor achieves diversification across a broad set of companies or assets represented by the index.

In a nutshell, the MSCI ACWI (All Country World Index) and FTSE All-World Index track the performance of companies from both developed and emerging markets worldwide, providing a comprehensive representation of global equity markets. The critical difference between the two indices is that the FTSE All-World excludes some smaller countries (such as Greece and Luxembourg) included in the MSCI ACWI.

MSCI ACWI vs FTSE All World compared in a nutshell

| ETF | FTSE All-World | MSCI ACWI |

| Inception Date | June 2000 | January 2001 |

| Markets | Developed and Emerging | Developed and Emerging |

| Number of Holdings | 4,228 | 2,558 |

| Top 5 countries | US, Japan, UK, China, France | US, Japan, UK, China, France |

| Top 5 sectors | Technology, Consumer Discretionary, Financials, Industrials and Health care | Technology, Financials, Health Care, Consumer Discretionary and Industrials |

| Top 5 constituents | Apple, Microsoft Corp, Amazon.com Inc, Nvidia Corp, Alphabet A | Apple, Microsoft Corp, Amazon.com Inc, Nvidia Corp, Alphabet A |

Overview of the FTSE All World vs MSCI ACWI

The FTSE All-World Index is a market-capitalization-weighted index* that represents the performance of large and mid-cap stocks from developed and emerging markets around the world. The index aims to provide investors with broad exposure to global equity markets.

MSCI ACWI is also a market-capitalization-weighted index that represents the performance of a mid-to large-cap index that measures the performance of 23 developed and 24 emerging markets.

The critical difference between the two indices is that the FTSE All-World excludes some smaller countries (such as Greece and Luxembourg) included in the MSCI ACWI.

* A market-capitalization-weighted index is a financial method that gives more importance to companies with a larger market value. This means that the performance of bigger and more successful companies will have a greater impact on the index’s value.

Country diversification

When it comes to country diversification, the FTSE All-World Index and the MSCI World Index have some differences.

| FTSE All World | MSCI ACWI | ||

| Country | Weight (%) | Country | Weight (%) |

| USA | 62.92% | USA | 64.55% |

| Japan | 5.78% | Japan | 4.85% |

| UK | 3.52% | UK | 3.39% |

| China | 3.50% | China | 3.24% |

| France | 2.46% | Canada | 2.78% |

| Other | 21.86% | Other | 21.20% |

Data as at 31 March 2025 | Source: FTSE Russel, MSCI

One way to potentially protect against volatility in any market is to build a global portfolio that includes both developed and emerging markets.

That’s precisely what these two indices aim to achieve. While these two indices are similar in size, they differ slightly in their weightings to various countries and regions.

The FTSE All-World Index aims to provide broad exposure to global equity markets by including stocks from over 50 countries, covering both developed and emerging markets, this results in a higher weighting of “other” countries, especially emerging markets. This means the index includes companies from a wide range of countries worldwide, offering investors a more comprehensive representation of global markets.

The MSCI ACWI also provides a broad exposure to global equity markets by including stocks from 23 Developed Markets and 24 Emerging Markets; it means that the MSCI ACWI Index offers a more balanced weightage between developed and emerging markets relative to the FTSE All-World Index, which is more concentrated in developed markets such as the United States, Japan, and the United Kingdom.

Sector diversification

| FTSE All World | MSCI ACWI | ||

| Sector | Weight (%) | Sector | Weight (%) |

| Technology | 26.50% | Technology | 23.37% |

| Consumer Discretionary | 14.26% | Financials | 18.06% |

| Financials | 13.78% | Health Care | 10.32% |

| Industrials | 13.05% | Industrials | 10.57% |

| Health Care | 9.11% | Consumer Discretionary | 10.64% |

| Consumer Staples | 6.31% | Communication Services | 8.16% |

| Energy | 4.66% | Consumer Staples | 6.29% |

| Materials | 3.77% | Energy | 4.16% |

| Communication Services | 3.00% | Materials | 3.62% |

| Utilities | 2.98% | Utilities | 2.69% |

| Real Estate | 2.30% | Real Estate | 2.12% |

Data as at 31 March 2025 | Source: FTSE Russel, MSCI

The top sectors (based on total market cap) of the FTSE All-World Index are shown in the chart above. The largest sector is technology, followed by consumer discretionary, and financials in third.

The top sectors (based on the total market cap) of the MSCI ACWI are shown in the chart above. The largest sector is technology, followed by financials, and health care in third.

We still see strong demand for products and services powered by technology such as semiconductors, cloud computing, and software – a big reason why tech companies top the charts in most index funds.

Financials is a top three sector, as many banks and insurers saw stock prices rise in the last few years. Banks benefit from rising bond yields and positive news on trade talks between countries.

Number of holdings

The MSCI ACWI captures large and mid-cap representation across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. With 2,757 constituents, the index covers approximately 85% of the global investable equity opportunity set.

In contrast, the FTSE All-World Index has even larger holdings, with 4,280 constituents. This index includes large and mid-cap stocks from the FTSE Global Equity Index Series, covering approximately 90-95% of the total market value.

Top 10 holdings

Our team has gathered the top 10 holdings of each index, so the table confirms that they are pretty similar. However, each stock’s weights in the respective index differ.

| FTSE All-World | MSCI ACWI | ||

| Stock | Weight (%) | Stock | Weight (%) |

| Apple Inc | 4.23% | Apple Inc | 4.40% |

| Microsoft Corp | 3.61% | Nvidia Corp | 3.49% |

| Nvidia Corp | 3.28% | Microsoft Corp | 3.49% |

| Amazon.com Inc | 2.31% | Amazon.com Inc | 2.37% |

| Meta Platforms Inc Class A | 1.63% | Meta Platforms Inc Class A | 1.65% |

| Alphabet Inc Cl A | 1.18% | Alphabet Inc Cl A | 1.19% |

| Broadcom | 1.00% | Alphabet Inc Cl C | 1.02% |

| Alphabet Inc Cl C | 0.98% | Tesla | 0.99% |

| Tesla | 0.93% | Broadcom | 0.98% |

| Berkshire Hathaway (B) | 0.91% | Berkshire Hathaway (B) | 0.93% |

Data as at 31 March 2025 | Source: FTSE Russel, MSCI

Availability of ETFs

As you may already know, you cannot directly purchase an index. You need to buy a fund that tracks that index. Two funds that can track an index include exchange-traded funds (ETFs) and index funds.

Our team has compiled a selection of ETFs replicating both indices, focusing on ETFs available on European stock exchanges such as gettex, Borsa Italiana, and Xetra.

FTSE All-World

| Name | ISIN | Ticker*1 | TER | AUM | Replication method | Use of income |

| Vanguard FTSE All-World UCITS ETF Distributing | IE00B3RBWM25 | VWRL | 0.22% | + EUR 9,5 M | Physical | Distribution |

| Vanguard FTSE All-World UCITS ETF (USD) Accumulating | IE00BK5BQT80 | VWCE | 0.22% | + EUR 6,60 M | Physical | Accumulating |

| Invesco FTSE All-World UCITS ETF Acc | IE000716YHJ7 | FWRA | 0.15% | + EUR 2,30 M | Physical | Accumulating |

| Invesco FTSE All-World UCITS ETF Dist | IE0000QLH0G6 | FTWG | 0.15% | + EUR 1 M | Physical | Distributing |

*1: All the tickers presented refer to the Italian stock exchange – except for the FTWG ticker, which is only available on the London Stock Exchange with the ticket FTWG. However, the same ETFs can be found on other European exchanges with different tickers.

MSCI ACWI

| Name | ISIN | Ticker*1 | TER | AUM | Replication method | Use of income |

| iShares MSCI ACWI UCITS ETF (Acc) | IE00B6R52259 | IUSQ | 0.20% | +EUR 6,300 M | Physical | Accumulating |

| SPDR MSCI ACWI UCITS ETF | IE00B44Z5B48 | ACWE | 0.40% | +EUR 1,900 M | Physical | Accumulating |

| Lyxor MSCI All Country World UCITS ETF – Acc (EUR) | LU1829220216 | ACWI | 0.45% | +EUR 790 M | Physical | Accumulating |

| SPDR MSCI ACWI UCITS ETF EUR Hedged (Acc) | IE00BF1B7389 | EACW | 0.45% | +EUR 470 M | Synthetic | Accumulating |

*1: All the tickers presented refer to the Italian stock exchange – – except for the IUSQ ticker, which is available on XETRA, gettex and the Stuttgart Stock Exchange. However, the same ETFs can be found on European exchanges with different tickers.

Performance

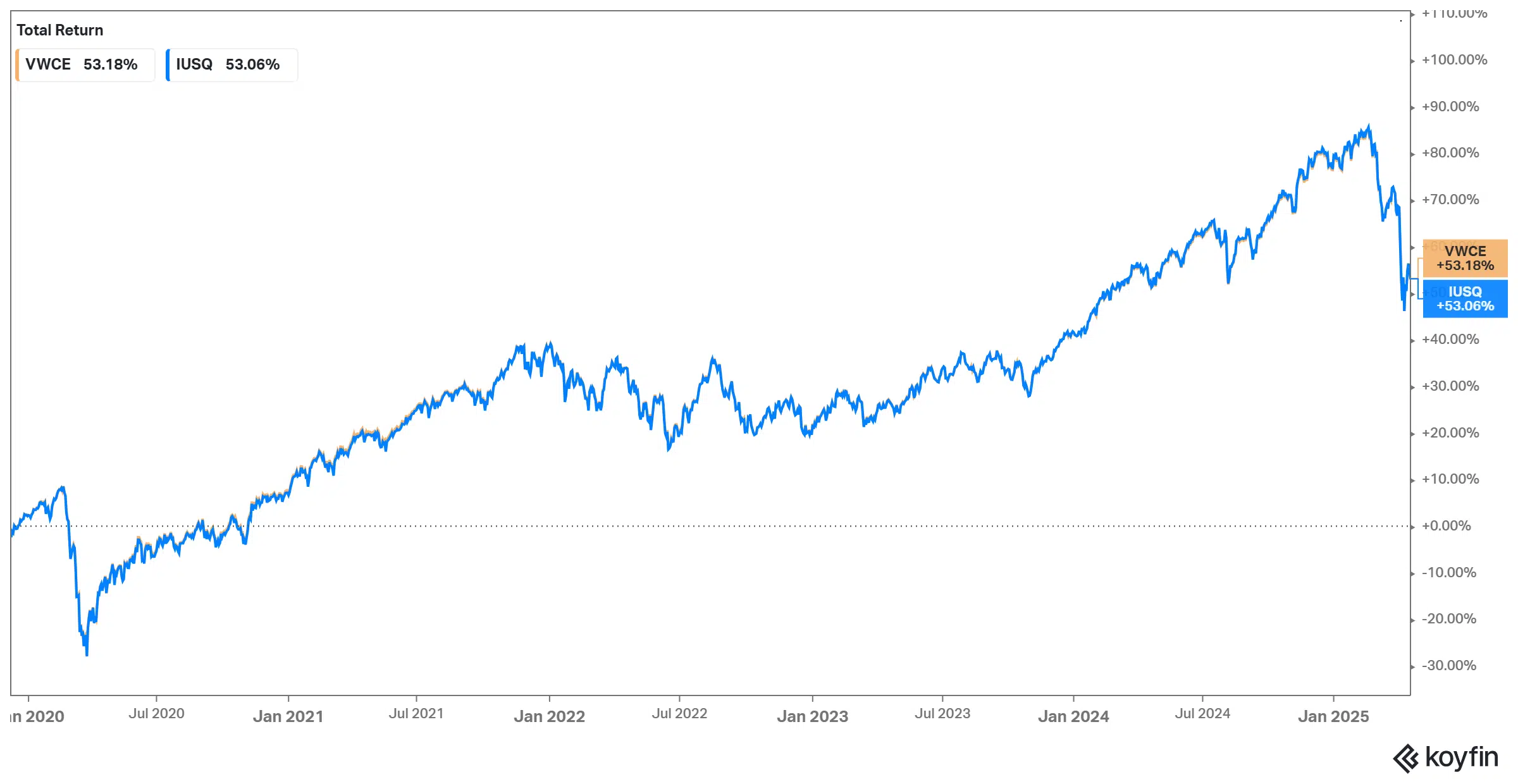

The chosen ETFs to measure the performance of each index are the Vanguard FTSE All-World UCITS ETF (USD) Accumulating (VWCE) and the iShares MSCI ACWI UCITS (Acc) (IUSQ).

Our team has gathered the historical performances of these two ETFs since 2019 to showcase the performance of each underlying index. When comparing the performance of both indices (the underlying assets of each ETF), it becomes evident that the ETFs exhibit very similar results, with a slight but marginal edge in favour of the ETF replicating the FTSE All-World index compared to the MSCI ACWI.

In orange, it is possible to observe the evolution of the Vanguard FTSE All-World UCITS ETF (USD) Accumulating (VWCE), while in blue, it is possible to observe the trend of the iShares MSCI ACWI UCITS (Acc) (IUSQ).

Cheapest brokers to invest in ETFs

Now that you’re familiar with the differences between the two indexes and have decided, it’s time to choose the best broker to move forward with your investment. That’s why we collected all this information, evaluated the most important features of different European ETF brokers, and compiled a list of the 4 ETF brokers in Europe.

Without further delay, here are four ETF brokers in Europe and why you should consider them:

- eToro: Best for social trading and commission-free ETF investing

- Interactive Brokers: Best for the largest ETF offering

- DEGIRO: Best for low-cost ETF trading

- Trading 212: Best for commission-free stock and ETF trading

Disclaimer: Investing involves risk of loss; eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

| Broker | ETF fees | Minimum Deposit | Number of ETFs | Regulators |

| eToro | $0 (other fees apply) | $50 (varies between countries) | 300+ | FCA, CySEC, ASIC |

| Interactive Brokers | Tiered Pricing: 0.05% of Trade Value (min: €1.25, max: €29.00) | €/$/£0 | 13,000+ | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB |

| DEGIRO | €/£0 (in some ETFs, + a €/£1 handling fee), plus an annual €/£2.50 connectivity fee | €/£1 | 200+ | DNB and AFM |

| Trading 212 | €/£0 | €/£0 | 600+ | FCA, CySEC, ASIC, BaFin |

Conclusion

In conclusion, both the MSCI ACWI and FTSE All-World Index offer extensive global equity exposure. The MSCI ACWI covers developed and emerging markets worldwide, while the FTSE All-World Index includes large and mid-cap stocks. Both prioritise diversification, mitigating sector-specific risks.

The choice between the MSCI ACWI and FTSE All-World Index depends on individual preferences and investment objectives. The MSCI ACWI provides a broader and more all-encompassing global exposure, while the FTSE All-World Index offers comprehensive coverage with some differences.