Investing in gold has long been considered a reliable way to preserve wealth, as shown in the documentary “The Story Of Man’s 6000-Year Obsession”, available for free on our documentaries page. In the UAE, gold holds a special place due to the region’s strong historical and cultural ties to the precious metal.

“How do I invest in gold?”, you may be wondering. One of the most accessible ways to do this is through Gold Exchange-Traded Funds (ETFs). Gold ETFs offer a convenient, low-cost way to invest in gold without physically holding the metal.

This article will guide you through the key considerations, regulations, and platforms available for investing in Gold ETFs in the UAE, helping you make informed decisions while diversifying your portfolio.

What are Gold ETFs?

Gold ETFs are straightforward (only have one job): give you exposure to Gold by tracking the price of gold bullion in the over-the-counter (OTC) market. The way it does that is by physically buying gold bars and holding them in secure vaults as well as some cash (to easily meet redemptions, if needed).

You have no need to buy physical gold. The ETF does that for you!

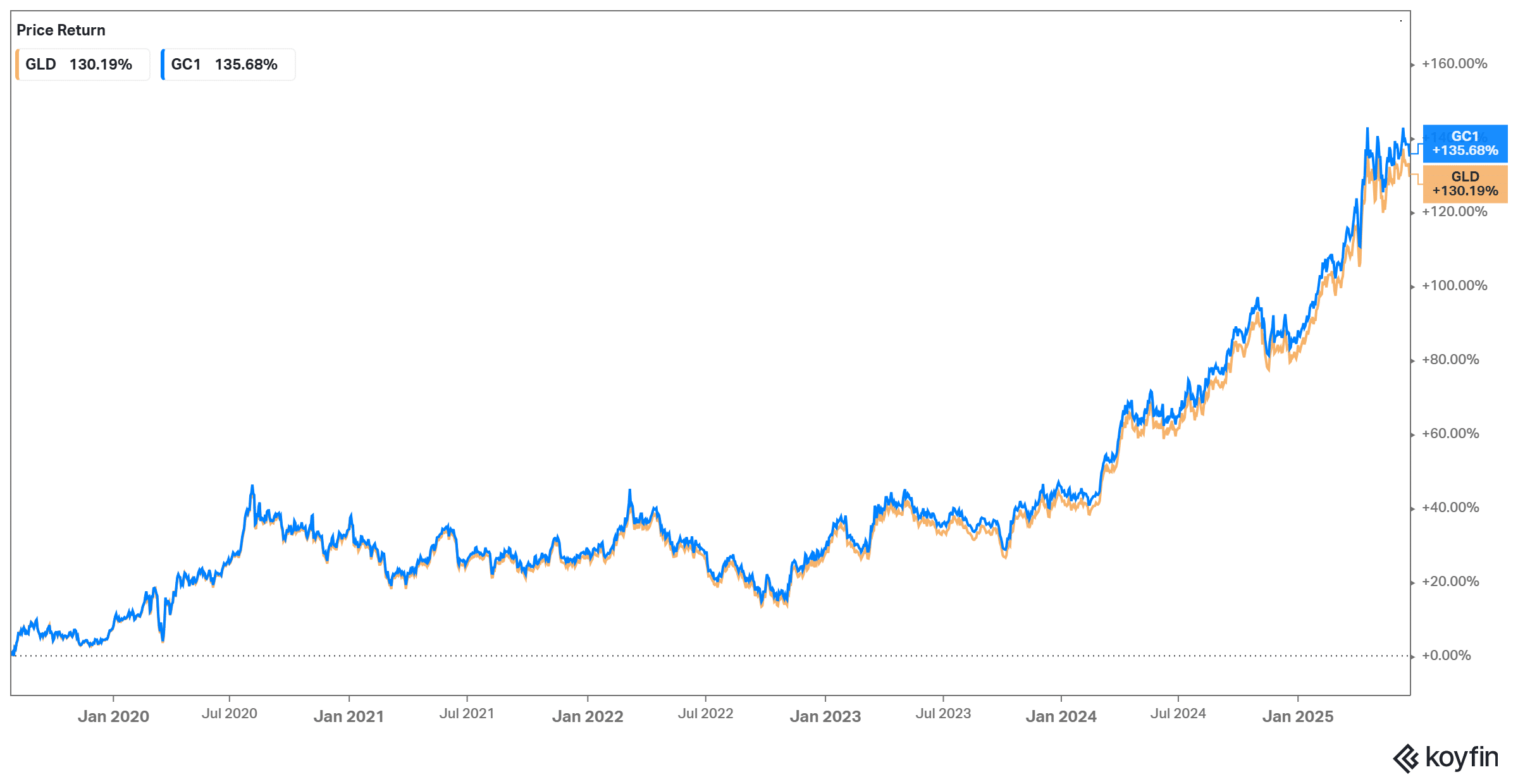

As such, the price of a Gold ETF can be expected to move in lockstep with spot gold prices. In the following graph, you can see the evolution of the GLD (a gold ETF) – orange line – and the gold itself – blue line, side by side:

The slight performance difference is mostly related to the expense ratio of 0.40% of the ETF. This annual cost compensates the ETF provider for managing it.

The physically-backed nature of this product eliminates any uncertainties about its capability to replicate the price of gold.

How to invest in gold ETFs in the UAE (step-by-step)

Step one: pick an ETF tracking the price of Gold

There are several ETFs that track the price of Gold. We will present five of the biggest ETFs by assets under management (AUM), in this order: three are traded in USD and two in EUR (All are physically backed by gold bullion):

| ETFs | Ticker | Expense ratio | AUM (in billions) |

| SPDR Gold Shares | GLD (in USD) | 0.40% | +100 |

| iShares Gold Trust | IAU (in USD) | 0.25% | +45 |

| SPDR Gold MiniShares Trust | GLDM (in USD) | 0.10% | +15 |

| Invesco Physical Gold A | SGLD (in EUR) | 0.12% | +23 |

| iShares Physical Gold ETC | PPFB (in EUR) | 0.12% | +20 |

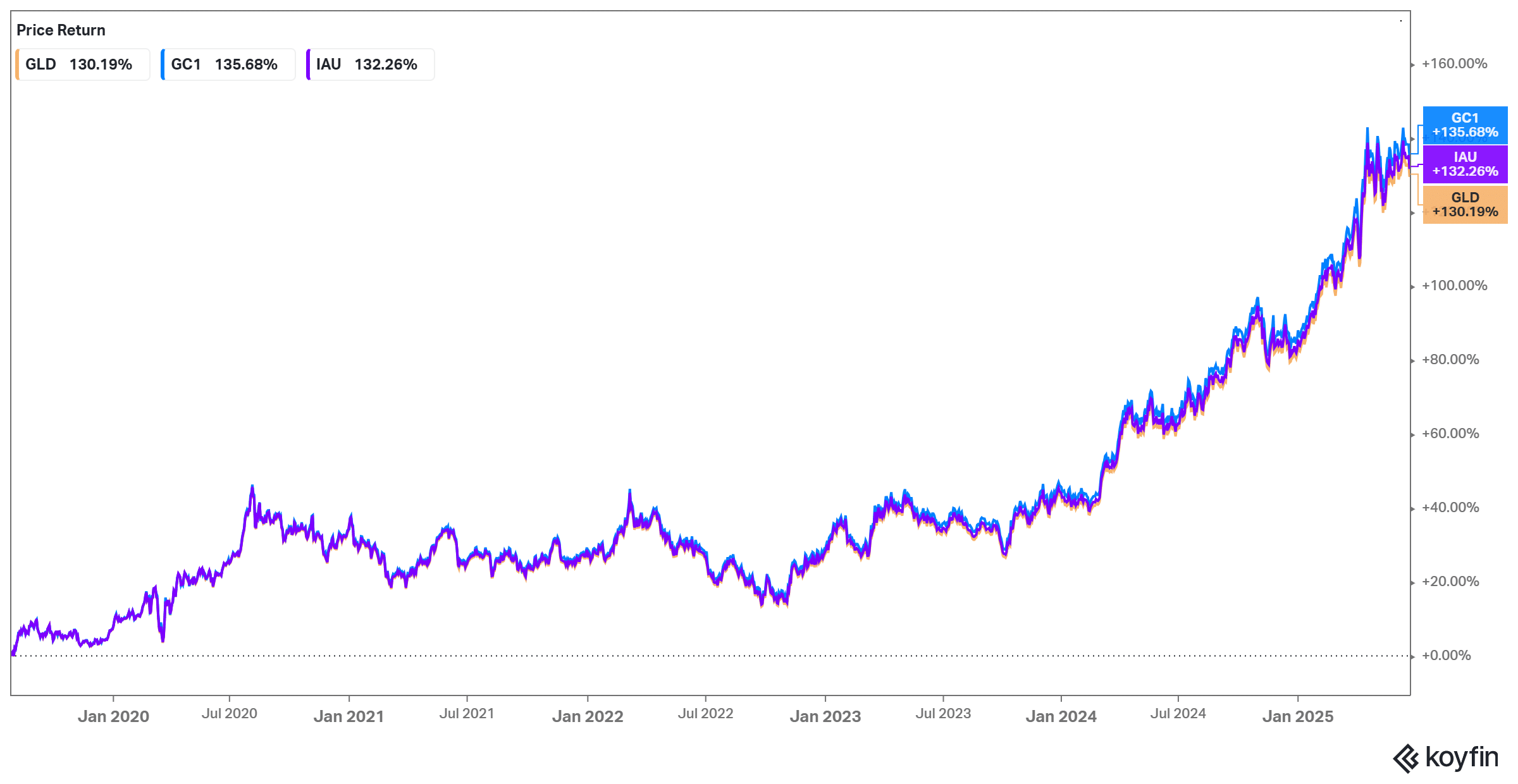

For a UAE resident looking for a USD version, we recommend the SPDR Gold MiniShares Trust (GLDM) due to its lowest total expense ratio (TER) of 0.10%. This has translated into a better performance compared to the other two ETFs over the last 5 years:

On the other hand, if you want a EUR version, both the Invesco Physical Gold (SGLD) and the iShares Physical Gold ETC (PPFB) are equally solid options.

Step two: choose a good ETF broker

After selecting an ETF, the next step is to identify a reliable broker who will let you invest in it. Some important factors to consider when selecting an ETF broker are the fees and minimum deposit, among others. Here is a summary of some ETF brokers:

| ETF broker | Minimum deposit | ETF fees |

| Interactive Brokers | $0 | Varies by exchange with tiered pricing: Between $0.0005 and $0.0035 per ETF share |

| eToro | $0 | $0 |

| XTB | $0 | $0 |

| Saxo | $0 | Up to 0.08% (min. 1 USD) |

| Sarwa | $0 | 0.25% of the traded amount with a maximum amount of $1 |

For a detailed analysis, please check our article on the best trading platforms in the UAE.

Step three: Place a “Buy Order”

Once you have chosen a suitable ETF broker and funded your account, you are ready to place a “Buy Order” for any gold ETF. For this example, we will use eToro. Keep in mind that you can follow these steps to execute your purchase with any broker:

a) Search for the desired gold ETF

Use the search function or browse through the available ETFs to find the specific gold ETF you have selected. Refer to the ticker symbol to locate the ETF accurately (in our case, we searched for GLD).

b) Click on “Trade”

After selecting “trade”, the following window will appear:

Now, you must choose the appropriate order type based on your preferences and trading strategy.

- The amount: how much you want to invest (in our case, it is $10);

- Leverage: x1 (no leverage in this example);

- Order type: market order, where it executes the trade at the prevailing market price and provides immediate execution (we have chosen this one);

We are using eToro as an example due to its simplicity, but please keep in mind that GLD is offered as a Contract for Difference (CFD), which means that you do not own the “real” asset but a product that promises to replicate the price movement of GLD. In practice, it should give you the same result, but be aware of that.

c) Place the order

Click “Buy” to submit your order. You will quickly notice an “Order filled” pop-up if the market is open when you place your order:

And that’s it!

Are there Gold ETFs in the UAE stock market?

In the UAE, there are two local stock exchanges: the Dubai Financial Market (DFM) and the Abu Dhabi Securities Exchange (ADX). However, there seem to be no Gold ETFs available.

In our research, we started by visiting the DFM website and got no ETF when typing “Gold”:

We also explored the ADX website and got the exact same conclusion:

Your only option is to choose Gold ETFs traded on other stock exchanges, such as the NYSE and Euronext.

Risks involved in gold ETFs

As with any investment, you face several risks when investing in an ETF, and gold ETFs are no exception. Here are the main risks:

- Market risk: The price of gold fluctuates based on global supply and demand, economic conditions, interest rates, and geopolitical events. If gold prices fall, the value of the gold ETF will also decline;

- Tracking error: A gold ETF may not perfectly track the price of gold due to management fees or market inefficiencies. While many ETFs aim to closely follow the gold price, a small deviation known as a “tracking error” can occur;

- Geopolitical risk: Gold is often viewed as a “safe-haven” asset, but geopolitical instability can lead to both spikes and crashes in the gold price, depending on market reactions to uncertainty or economic crises.

- Interest rate risk: When interest rates rise, the opportunity cost of holding gold (which generates no income) also rises, making gold less attractive compared to interest-bearing assets like bonds. This can negatively impact gold prices and gold ETFs.

- Storage and insurance risk: For gold ETFs backed by physical gold, there is a risk related to the storage and safekeeping of the gold. While this is typically handled by the ETF provider, any issues in the security or insurance of the vaults could have a negative impact.

Another risk often mentioned is currency risk because the currency in the UAE is the dirham (AED), and gold is traded in USD. However, that’s not the case here. Since 1997, the AED has been pegged to the US dollar at 1 USD = 3.6725 AED, so there is little currency risk. The currency fluctuations of these two currencies show that:

Gold ETFs vs gold bullion: which is better?

We believe you are most likely well served with gold ETFs instead of directly buying gold bullion yourself. Nonetheless, let us show you its own advantages and drawbacks. Here’s a comparison to help you decide which might be better for you:

1. Convenience

Gold ETFs:

- Easier to buy and sell on stock exchanges through a brokerage account;

- No need to worry about physical storage, security, or insurance;

- Highly liquid, allowing quick trades at market prices.

Gold Bullion:

- Requires physical storage (in a safe, bank vault, or at home), which involves costs and risks;

- Selling physical gold may take longer, and you’ll need to find a buyer or a dealer, potentially at a less favorable price.

2. Costs

Gold ETFs:

- Low management fees (typically ranging from 0.10% to 0.40% annually);

- No storage or insurance fees, but brokerage commissions apply for buying and selling.

Gold Bullion:

- Upfront costs like dealer markups and possibly higher premiums over spot prices;

- Ongoing storage and insurance fees if you store gold in a secure facility;

- Selling may involve additional fees or lower prices than market value (due to dealer markups).

3. Liquidity

Gold ETFs:

- Highly liquid. You can buy or sell them during market hours just like any stock.

Gold Bullion:

- Less liquid. You may need to sell through a dealer or private buyer, which can take time and may involve negotiating the price.

4. Ownership

Gold ETFs:

- You do not own physical gold; rather, you own a share in a fund that holds gold or tracks the gold price.

Gold Bullion:

- You have direct ownership of physical gold, which is appealing to those who want tangible assets.

5. Price exposure

Gold ETFs:

- Directly track the price of gold, but small tracking errors or fund fees may result in slightly lower returns over time.

Gold Bullion:

- You own the physical gold, so its price will rise or fall in line with the spot price of gold;

- You have exposure to the actual commodity without any management fees.

6. Security

Gold ETFs:

- Secure and insured through custodians. The risk of theft or loss is minimal.

Gold Bullion:

- If stored at home, bullion is more susceptible to theft. Storing it in a bank or a secure facility is safer but comes with costs.

All in all, choose gold ETFs if you prioritize convenience, liquidity, lower costs, and ease of trading or choose gold bullions if you value direct, tangible ownership of gold, and you’re looking for a long-term store of value or hedge against economic collapse.

Bottom line

In conclusion, investing in gold ETFs from the UAE is a popular option for individuals seeking exposure to the price of gold. Here’s a summary of the steps to follow:

- Pick an ETF tracking the gold price: Look for ETFs such as GLD or IAU, which offer competitive management fees;

- Find a suitable broker: Choosing a reliable ETF broker is crucial for investing in any ETF, including gold ETFs. Consider factors such as the number of available ETFs, fees, and the minimum deposit. Here’s our list of the best ETF brokers in the UAE for your reference;

- Open an account and deposit money: After deciding which trading platform to use, you must go through the account opening process and deposit money;

- Send a buy order to your broker for the picked ETF: Sending a buy order to your broker is a straightforward and intuitive process. Just fill in the required fields to execute the trade!

We hope this guide has addressed your concerns and provided valuable insights. Remember to conduct thorough research to determine the best investment strategy for your needs.

Happy investing!