The ripple effects of the bond market devaluation due to a series of interest rate hikes over the past few years have continued to benefit investors. Bonds are now offering even more attractive returns. For instance, a US Treasury bond that provided a mere 0.22% yield at the beginning of 2022 now offers an interest rate exceeding 4%, a significant shift for fixed-income investors.

While Americans can easily buy Treasury Bonds through TreasuryDirect, it’s not as straightforward for Canadian investors. The good news is that it is still possible to invest in US Treasury Bonds from Canada through different products.

In this article, we will provide a step-by-step guide on how Canadian investors can invest in US Treasury Bonds, including T-bills and T-notes, through the secondary market or ETFs. By the end of this article, we hope you’ll understand the process and be ready to invest in US Treasury Bonds from across the pond.

What are US Treasury Bonds?

US Treasury Bonds are debt securities issued by the United States Department of the Treasury to finance government operations and pay for public services. They are backed by the full faith and credit of the US government, making them one of the safest investment options available.

Treasury bonds have a fixed interest rate and a maturity date ranging from a few months to thirty years. They are sold at auction and can be purchased by individuals, corporations, and foreign governments. In the US, interest earned on Treasury Bonds is exempt from state and local taxes and, in some cases, federal taxes.

Treasury Bonds vs Treasury Notes vs Treasury Bills

Treasury Bonds, Treasury Notes, and Treasury Bills are all debt securities issued by the US Department of the Treasury but differ in maturity dates and interest rates.

- Treasury Bills (T-bills) have the shortest maturity date, typically less than one year, and are sold at a discount to their face value. They offer low-risk, short-term investments and are often used as a government funding source.

- Treasury Notes (T-notes) have a maturity date of 2 to 10 years and pay interest every six months. They offer higher interest rates than T-bills but lower than Treasury Bonds.

- Treasury Bonds (T-bonds) have the longest maturity date, ranging from 10 to 30 years, and pay interest every six months. They offer the highest interest rates among the three and are often used as a long-term investment option.

How to buy US Treasury Bonds from Canada

As an American citizen, you can invest directly in US Treasury Bonds through TreasuryDirect.gov. Unfortunately, as a Canadian citizen, you are not eligible to participate in TreasuryDirect.gov. In essence, your options are limited to purchasing bonds on the secondary market or through bond exchange-traded funds (ETFs).

Please note that some brokers do not support these products, so we’ll focus on Interactive Brokers below.

Option 1: Buy US Treasury Bonds in the secondary market

Interactive Brokers provides the opportunity to invest in T-Bills and Treasury Bonds in the secondary market. Treasury investments are highly liquid and feature low spreads. Additionally, the commission per trade is 0.002% of the Face Value (minimum of $5).

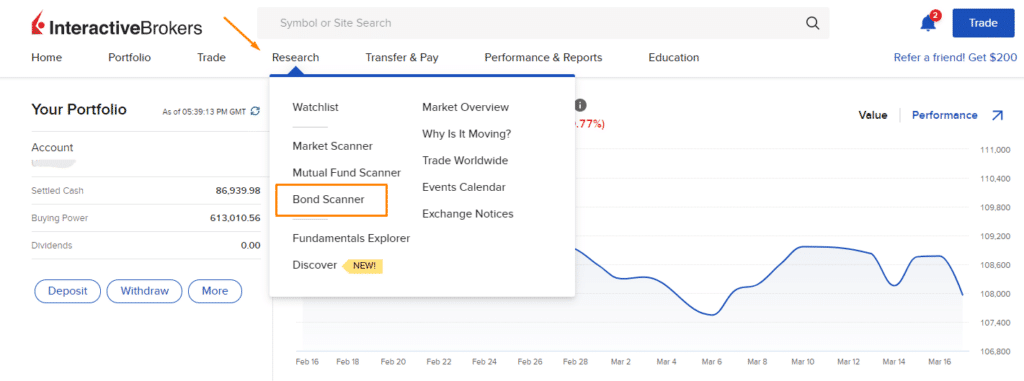

Interactive Brokers offers a vast universe of over 1 million bonds, including US government securities, corporate bonds, etc. You can use their Bond Search tool (“Bond Scanner”) to search availability by maturity, yield, and interest rate, and compare prices against other brokers.

However, since these are complex instruments, you must ask IBKR for trading permission for bonds in your account settings.

Here’s an example of a US bond on IBKR’s Web platform:

Option 2: Buy US Treasury Bond ETFs

When selecting a Government Bond ETF, it’s crucial to evaluate both the risk and return it offers. Yield-to-Maturity represents the anticipated return on investment. Duration, on the other hand, indicates the level of risk you incur by investing in the Bond ETF.

If you are an Interactive Brokers user, you have the option to purchase a variety of bond ETFs. Interactive Brokers offers ETFs that track short-term and long-term bonds as well. As an example, which is in vogue due to inflation concerns, is the iShares 0-5 Year TIPS Bond Index ETF:

This ETF is a CAD-hedged US Treasury bond ETF to mitigate currency risk, so you are protected by currency movements between the USD and CAD.

You can also invest in unhedged ETFs if you are willing to invest in USD and accept the currency risk: beware that if your account balance is in CAD and you invest in USD, you’ll have to convert your money, and the broker will charge you a small currency conversion fee.

The pros and cons of Investing in US Treasury Bonds from Canada

Pros

- High Credit Quality: US Treasury Bonds are backed by the US government, which makes them highly creditworthy, and the possibility of default is minimal.

- Liquidity: Treasury Bonds can be easily bought and sold, with prices based on the coupon rate relative to current interest rates.

- Generally lower risk: Bonds are less risky than other products like stocks.

Cons

- Interest rate risk: As interest rates rise, the price of your bonds will fall.

- Inflation risk: the interest may not compensate for inflation.

- Currency risk: It is important to note that investing in USD bonds with non-hedged CAD-denominated funds exposes you to currency risk. This means that the fluctuation in exchange rates between USD and CAD could benefit or harm your investment. Holding USD-denominated assets exposes investors to currency risk (since their base currency is not the USD and needs to be converted).

- Historically lower returns: In the long run, bonds tend to perform worse than other riskier asset classes.

- A complex asset class: Bonds can be considered one of the most complex non-derivative assets. As mentioned before, their value is inversely proportional to interest rates – when rates increase, investors demand higher yields. However, the coupon and principal of bonds are fixed. That’s why, in some brokers, you need to request trading permission to be able to trade those asset classes.

Conclusion

In conclusion, investing in US Treasury Bonds from Canada is a viable option for those looking for a stable investment opportunity. Using a platform like Interactive Brokers, investors can access the US Treasury market and purchase Treasury Bonds and T-Bills on the secondary market. Furthermore, purchasing a Government Bond ETF allows investors to diversify their portfolio by gaining exposure to various Treasury Bonds with varying durations.

It’s crucial to consider the risks involved, including currency risk and interest rate fluctuations. Evaluating the Yield-to-Maturity and Duration of a Government Bond ETF will assist you in determining the level of risk and potential returns associated with the investment.

Overall, investing in US Treasury Bonds can provide an excellent opportunity to diversify your portfolio, protect your capital, and achieve steady returns over time. With careful consideration of the risks involved and the variety of platforms available, investors from Canada can capitalize on this lucrative investment opportunity.