South Africa is an upper-middle-income country, with its residents enjoying a growing level of disposable income. With money to spend, the question that naturally comes to mind is how to make the most of it. One easily accessible way to build and preserve wealth is through the stock market.

In this article, we’ll delve into ways for South Africans to pick stocks, how to buy shares on the international markets, gain exposure to the national stock market, tips for choosing a stock broker to buy shares, opportunities for foreigners to gain exposure to South African shares, and more!

Choose a stock to buy

Since there are tens of thousands of public companies around the world, there is no silver bullet when it comes to choosing a stock to purchase. That said, generally, companies are divided in two ways:

- Value stocks: these companies are usually attractively priced in terms of price-to-earnings or other ratios but face slower growth going forward;

- Growth stocks: these companies offer a high long-term growth rate but are more expensive from a valuation perspective in the near term.

You can favour one type or diversify across both value and growth, with value companies in your portfolio to meet medium-term goals. In contrast, growth companies should be able to help you achieve your long-term aspirations!

Resources you can use are:

- Stock screeners such as Finviz

- Company reports, filings and presentations

- Macroeconomic and industry publications

In any case, make sure to consider several companies, evaluate their performance relative to competitors, and try to pick the most attractively priced business!

How to buy shares on the international markets (Step-by-step guide)

1. Choose a good stock broker

Once you have chosen the stock you want to invest in, you need to find a broker where you can make the purchase. As South Africa is an emerging market, you need to make sure the broker you choose works with residents of South Africa. Below we highlight Interactive Brokers, which is available to South Africans:

| Broker | Stock commission, US | Minimum Deposit | Regulators |

| Interactive Brokers | USD 0.005 per share with a minimum of USD 1.00 | €/$/£0 | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB |

2. Open and fund your account

Once you have weighed the pros and cons of each broker, you are all set to open an account. The process usually takes a few days as the broker verifies your identity. After the process is finalised, you must deposit money into your account.

3. Place a “Buy Order”

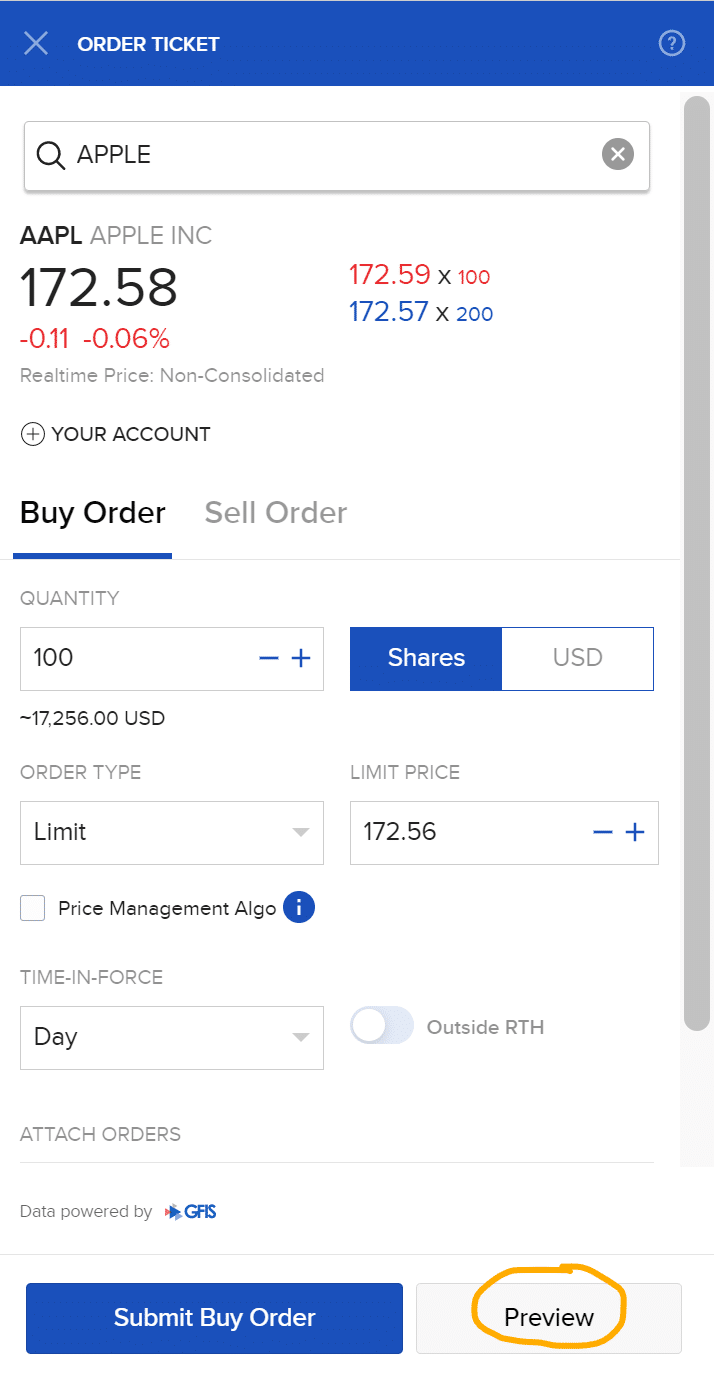

If you have found an online broker that suits your needs, managed to open an investment account, and made the initial deposit, you are all set to buy your stock. All you have to do is find the share within your chosen broker and place a buy order. For this example, we will use Interactive Brokers WebTrader.

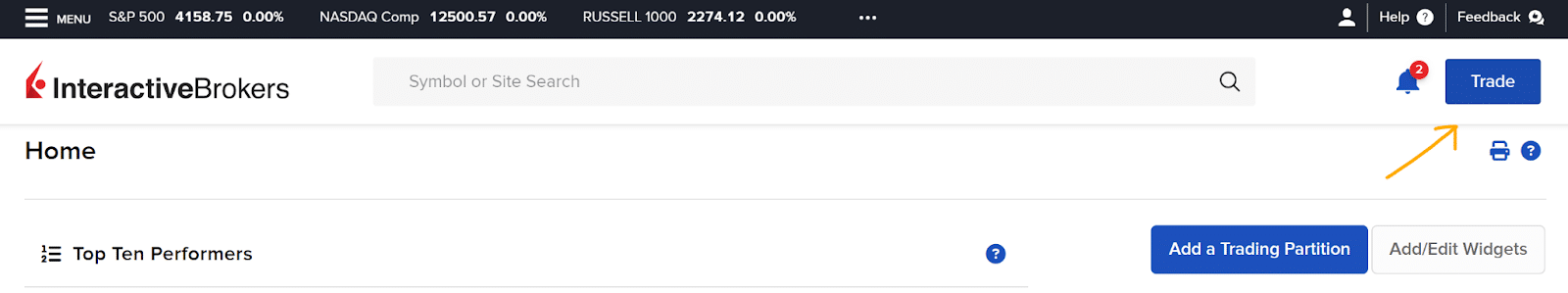

1 – Click the Trade button in the top right corner:

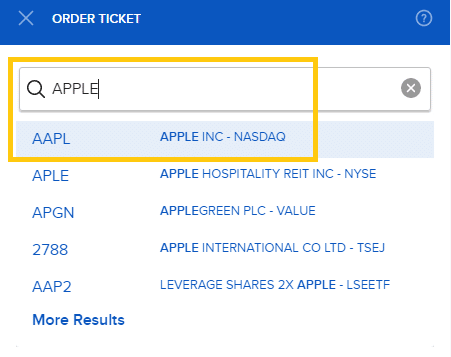

2 – Search for the chosen stock (we will use Apple, ticker “AAPL”):

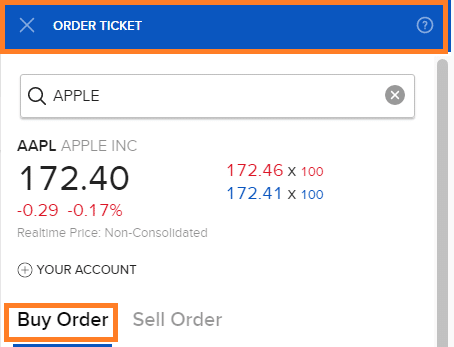

3 – Make sure the order ticket is set to “Buy Order”(blue colour on top) rather than “Sell Order” (red colour on top):

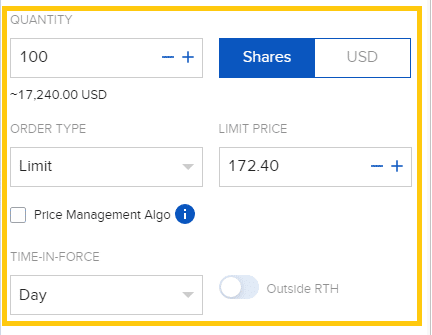

4 – Choose the order details. Now, it’s time to fill all boxes highlighted below:

- Quantity. Here you define the number of shares you want to purchase; By default, “Shares” is selected instead of “USD.” If you select “USD,” you would enter a dollar amount in quantity, and the system calculates how many shares you can purchase.

- Order Type: By default, Interactive Brokers sets your order type as Limit. This is good since it allows you to set a maximum price at which you are willing to buy the shares. The most commonly used alternative is a market order.

- Limit Price: Assuming you kept the “Limit” as the type of order, you need to set the maximum price you are willing to pay per share. If you use Market order, you do not need to fill this and will buy at the best available Ask price.

- Time-in-force is set to “Day” by default.

5 – Preview the order: Finally, you should click “Preview” to double-check all order parameters (believe it or not, mixing buy and sell orders is a mistake everyone can make!):

6 – Send the order: Finally, after checking all order parameters (if you made a mistake, you should click “Back”), you can select “Transmit Order”:

ETFs – an alternative way to gain exposure

ETFs, or exchange-traded funds, allow you to gain exposure to a dozen or even hundreds of companies with a single investment. ETFs can be a good option if you:

- Are unsure which specific stock to choose.

- Want to limit your portfolio volatility (usually, ETFs invest in companies in several sectors affected by vastly different factors, limiting your exposure to idiosyncratic risks).

- Are interested in following a specific theme in your investments (South African stocks, technology stocks, real estate stocks, etc).

Some ETFs you may want to consider are:

- iShares MSCI South Africa ETF (ticker EZA) has 43 South African companies in its portfolio. Fund size is about $300 million with an expense ratio of 0.58%.

- VanEck Africa Index ETF (AFK) invests in 80 companies, primarily in South Africa, with 34% of assets in South African companies. Morocco, Nigeria and Kenya are other large exposure countries. The expense ratio is 0.98%.

You are free to choose from thousands of ETFs investing all around the world.

Buying shares on the Johannesburg Stock Exchange

The process of buying shares directly on the local market is very similar to the one outlined above for international securities. The exchange even has a section dedicated to beginners. You can find a list of members active on the exchange here.

There are around 288 companies listed on the Johannesburg securities exchange. You can find all instruments available for trading here.

The main benefit of buying shares on the local market is that you will not incur foreign exchange conversion fees from opening an account in USD, EUR or any other currency. This is because shares on the Johannesburg securities exchange trade in the South African rand. If you buy Apple stock, you would have to:

- Sell ZAR, and buy USD to open the trade

- Sell USD, and buy ZAR to close the trade

Thus you would incur two foreign exchange fees in the process.

The downside of the local market is that you are limited to the instruments available to trade there, many of which are tightly correlated with South Africa’s economic fortunes. Thus if you want to diversify your wealth across the world, the best way is to invest overseas or pick an export-oriented company.

Accessing South African equities as a foreigner

If you are an investor outside South Africa and want to gain exposure to the country’s growth potential, the most straightforward way to buy South African equities is through an ETF as highlighted above. The downside is that country-specific ETFs usually have a higher expense ratio compared to the ETFs for developed markets such as the United States. Thus you must carefully evaluate whether the excess return you expect will cover the higher ETF costs!

If you want to buy a specific South African company, the best way would be to get in touch with one of the leading brokers listed above. The drawback is that you will have to incur foreign exchange fees.

Additional resources

If you would like to learn more, explore our website and YouTube channel, where we cover the top brokers in various regions and offer step-by-step guides for investing on these platforms.

For further assistance, feel free to reach out to us or book a meeting with us directly.

Bottom line

To sum it up, here’s what you need to do:

- Choose a stock to buy. If you want to invest outside South Africa, you need to carefully consider which company or ETF to pick, as there is a myriad of companies to choose from. There are about 288 listed companies on the local market – a decent selection for a diversified portfolio.

- Find a suitable stock broker: For international markets, make sure the broker works with residents of South Africa. For the Johannesburg securities exchange, it is best to get in touch with a local exchange member. In any case, consider the fees and market access of the broker.

- Open an account and deposit money: After deciding which trading platform to use, you must go through the account opening process and deposit money.

- Send a buy order to your broker for the stock you like: That’s the easiest part (the process is intuitive)! After having your brokerage account and the name of the company that you want to buy, you just have to place a trade!

We hope that this post addressed some of your concerns. Make sure to do your research to find out the best investing strategy for you!