Indexes such as the FTSE All-World and MSCI World track the performance of a specific group of stocks or financial assets. They essentially serve as benchmarks to gauge the market’s performance or specific sectors.

Investing in these types of indexes through ETFs and index funds that replicate the respective index’s performance is possible. Through these investment vehicles, investors achieve diversification across a broad set of companies or assets represented by the index.

In a nutshell, the difference between MSCI and FTSE is that the MSCI index tracks the performance of companies from developed markets/countries only, while the FTSE index tracks the performance of companies from developed and emerging markets.

So, FTSE might be the best fit if you want to gain exposure to emerging markets. If you prefer to gain exposure to developed markets only, MSCI could be a good fit.

In this article, we’ll dive into the differences between the FTSE All-World and MSCI World so that you can make a better-informed decision when choosing which index to invest in. We will cover performance, country exposure, sector exposure, availability of ETFs, and more!

FTSE All World vs MSCI World compared in a nutshell

Our team has compiled all the information discussed throughout the article into a table, so that it can be easier for you to observe the differences and make a decision.

| ETF | FTSE All-World | MSCI World |

| Inception Date | June 2000 | June 2008 |

| Markets | Developed and Advanced Emerged Segments | Developed |

| Number of holdings | 4,228 | 1,352 |

| Top 5 Countries | US, Japan, UK, China, France | US, Japan, UK, France and Canada |

| Top 5 Sectors | Information Technology, Consumer Discretionary, Financials, Industrials and Health care | Information Technology, Financials, Health care, Consumer Discretionary and Industrials |

| Top 5 Constituents | Apple, Microsoft Corp, Amazon.com Inc, Nvidia Corp, Tesla Inc | Apple, Microsoft Corp, Amazon.com Inc, Nvidia Corp, Tesla Inc |

Updated as of April 30, 2025.

Overview of the FTSE All World vs MSCI World

The FTSE All-World Index is a market-capitalization-weighted index* that represents the performance of large and mid-cap stocks from developed and emerging markets around the world. The index aims to provide investors with broad exposure to global equity markets.

On the other hand, the MSCI World Index is also a market-capitalization-weighted index that tracks the performance of large and mid-cap stocks from developed markets worldwide. The index focuses solely on developed markets, excluding emerging markets.

*A market-capitalization-weighted index gives more importance to companies with a larger market value. This means that the performance of bigger and more successful companies will have a greater impact on the index’s value.

Performance

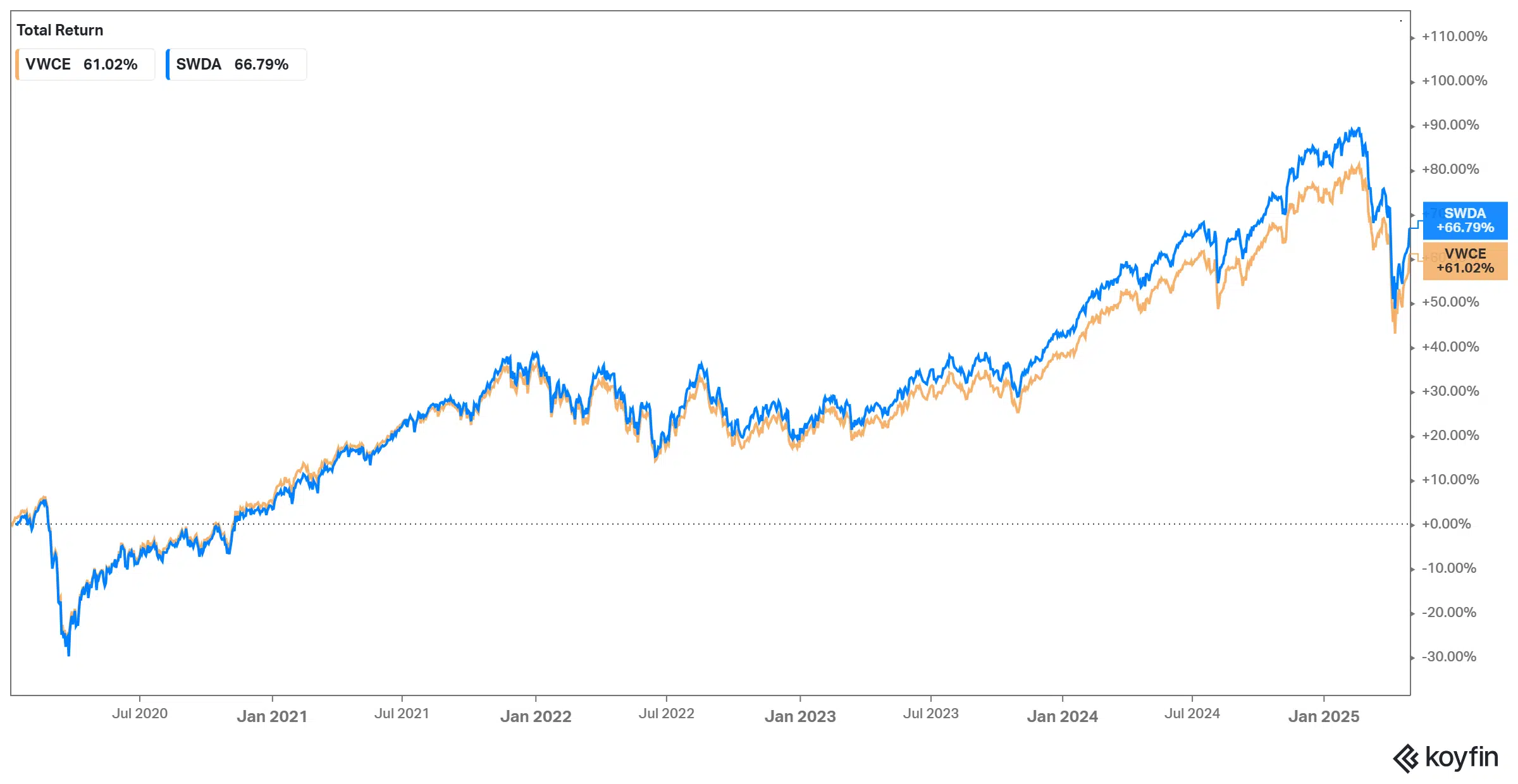

The chosen ETFs to measure the performance of each index are the Vanguard FTSE All-World UCITS ETF USD Accumulating (VWCE) and the iShares Core MSCI World UCITS ETF USD (SWDA).

Our team has collected the historical performances of these two ETFs since 2020 to showcase the performance of each index. When comparing the performance of both indices (the underlying assets of each ETF), it is evident that the MSCI World outperforms the FTSE All-World index.

In orange, it is possible to observe the evolution of the Vanguard FTSE All-World UCITS ETF USD Accumulating (VWCE), while in blue, it is possible to observe the trend of the iShares Core MSCI World UCITS ETF USD (SWDA).

Nevertheless, it is crucial to recognise that past performance does not indicate future returns, and these results may not persist indefinitely.

Country Diversification

When it comes to country diversification, the FTSE All-World Index and the MSCI World Index have some differences.

| FTSE All-World | MSCI World | ||

| Country | Weight (%) | Country | Weight (%) |

| USA | 62.05% | USA | 71.04% |

| Japan | 6.03% | Japan | 5.65% |

| UK | 3.58% | UK | 3.84% |

| China | 3.31% | Canada | 3.20% |

| France | 2.52% | France | 2.94% |

| Other | 22.48% | Other | 13.32% |

Updated as of April 30, 2025 | Source: FTSE Russel, MSCI

The FTSE All-World Index aims to provide broad exposure to global equity markets by including stocks from over 50 countries, covering both developed and emerging markets. This results in a higher weighting of “other” countries, especially emerging markets. This means the index includes companies from a wide range of countries worldwide, offering investors a more comprehensive representation of global markets.

On the other hand, the MSCI World Index focuses solely on developed markets. It includes stocks from 23 developed countries, representing a significant portion of the global market capitalisation in those markets. As a result, the MSCI World Index may have a narrower country diversification compared to the FTSE All-World Index.

Sector Diversification

Both indices focus on the same sectors of activity, with Information Technology standing out prominently in both cases. Generally speaking, all other categories have a similar percentage incidence in both indices.

| FTSE All World | MSCI World | ||

| Sector | Weight (%) | Sector | Weight (%) |

| Information Technology | 26.71% | Information Technology | 23.86% |

| Consumer Discretionary | 14.06% | Financials | 17.25% |

| Financials | 13.84% | Health Care | 10.82% |

| Industrials | 13.05% | Industrials | 11.25% |

| Health Care | 10.93% | Consumer Discretionary | 10.22% |

| Consumer Staples | 6.09% | Communication Services | 8.00% |

| Energy | 5.02% | Consumer Staples | 6.64% |

| Materials | 3.77% | Energy | 3.64% |

| Communication Services | 3.00% | Materials | 3.39% |

| Utilities | 2.89% | Utilities | 2.76% |

| Real Estate | 2.51% | Real Estate | 2.17% |

Updated as of April 30, 2025 | Source: FTSE Russel, MSCI

Both the FTSE All-World Index and the MSCI World Index promote diversification by avoiding sector dominance. This allows investors balanced exposure to various industries, reducing concentration risk and enhancing portfolio diversification.

Number of Holdings

The MSCI World Index has a wide range of 1,352 constituents, including large and mid-cap stocks from 23 Developed Markets (DM) countries. It covers around 85% of the market value in each country.

In contrast, the FTSE All-World Index has an even larger number of holdings, with 4,228 constituents. This index includes large and mid-cap stocks from the FTSE Global Equity Index Series, covering approximately 90-95% of the total market value.

Top 10 Holdings

Our team has gathered the top 10 holdings of each index, so the table confirms that they are pretty similar. However, each stock’s weights in the respective index differ. For example, while Apple has a weight of 4.02% in the FTSE All World, it reaches 4.66% in the MSCI World.

| FTSE All World | MSCI World | ||

| Stock | Weight (%) | Stock | Weight (%) |

| Apple Inc | 4.02% | Apple Inc | 4.66% |

| Microsoft Corp | 3.77% | Microsoft Corp | 4.07% |

| Nvidia Corp | 3.27% | Nvidia Corp | 3.89% |

| Amazon.com Inc | 2.22% | Amazon.com Inc | 2.54% |

| Meta Platforms Inc Class A | 1.54% | Meta Platforms Inc Class A | 1.74% |

| Alphabet Inc Cl A | 1.20% | Alphabet Inc Cl A | 1.35% |

| Broadcom | 1.14% | Broadcom | 1.25% |

| Tesla Inc | 1.01% | Tesla | 1.19% |

| Alphabet Inc Cl C1 | 1.00% | Alphabet Inc Cl C | 1.17% |

| Lilly (Eli) & Co | 0.92% | Lilly (Eli) & Co | 1.06% |

Updated as of April 30, 2025 | Source: FTSE Russel, MSCI

Availability of ETFs

As you may already know, you cannot directly purchase an index. You need to buy a fund that tracks that index. Two funds that can track an index include exchange-traded funds (ETFs) and index funds.

Our team has compiled a selection of ETFs replicating both indices, focusing on ETFs available on European stock exchanges such as gettex, Borsa Italiana, and Xetra, among others.

FTSE All World

| Name | ISIN | Ticker* | TER | AUM | Replication method | Use of income |

| Vanguard FTSE All-World UCITS ETF Distributing | IE00B3RBWM25 | VWRL | 0.22% | + EUR 9,5 M | Physical | Distribution |

| Vanguard FTSE All-World UCITS ETF (USD) Accumulating | IE00BK5BQT80 | FTWG | 0.22% | + EUR 7,00 M | Physical | Accumulating |

| Invesco FTSE All-World UCITS ETF Acc | IE000716YHJ7 | FWRG | 0.15% | + EUR 2,30 M | Physical | Accumulating |

*: All the tickers presented refer to the Italian stock exchange. However, the same ETFs can be found on other European exchanges with different tickers.

MSCI World

| Name | ISIN | Ticker*1 | TER | AUM | Replication method | Use of income |

| iShares Core MSCI World UCITS ETF USD | IE00B4L5Y983 | SWDA | 0.20% | + EUR 50,000 M | Physical | Accumulating |

| HSBC MSCI World UCITS ETF USD (Acc) | IE000UQND7H4 | HMWA | 0.15% | + EUR 63 M | Physical | Accumulating |

| iShares MSCI World UCITS ETF (Dist) | IE00B0M62Q58 | IWRD | 0.50% | + EUR 5,400 M | Physical | Distributing |

| HSBC MSCI World UCITS ETF USD | IE00B4X9L533 | HMWD | 0.15% | + EUR 5,500 M | Physical | Distributing |

| Invesco MSCI World UCITS ETF | IE00B60SX394 | SMSWLD | 0.19% | + EUR 3,400 M | Synthetic | Accumulating |

*1: All the tickers presented refer to the Italian stock exchange. However, the same ETFs can be found on other European exchanges with different tickers.

Cheapest brokers to invest in ETFs

Now that you’re familiar with the differences between the two indexes and have decided, it’s time to choose the best broker to move forward with your investment. That’s why we collected all this information, evaluated the most important features of different European ETF brokers, and compiled a list of the 4 ETF brokers in Europe.

Without further delay, here are four ETF brokers in Europe and why you should consider them:

- eToro: Best for social trading and commission-free ETF investing

- Interactive Brokers: Best for the largest ETF offering

- DEGIRO: Best for low-cost ETF trading

- Trading 212: Best for commission-free stock and ETF trading

Disclaimer: Investing involves risk of loss; eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

| Broker | ETF fees | Minimum Deposit | Number of ETFs | Regulators |

| eToro | $0 | $50 (varies between countries) | 300+ | FCA, CySEC, ASIC |

| Interactive Brokers | Varies by exchange with tiered Pricing: 0.05% of Trade Value (min: €1.25, max: €29.00) | €/$/£0 | 13,000+ | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB |

| DEGIRO | €/£0 (in some ETFs, + a €/£1 handling fee), plus an annual €/£2.50 connectivity fee | €/£1 | 200+ | DNB, AFM |

| Trading 212 | €/£0 | €/£0 | 600+ | FCA, CySEC, FSC |

Conclusion

To summarise, the FTSE All-World Index and the MSCI World Index offer investors broad exposure to global equity markets. The FTSE All-World Index encompasses both developed and emerging markets, while the MSCI World Index focuses solely on developed markets. This variation in country composition gives investors different exposure levels to regions and market development.

Moreover, both indexes prioritise sector diversification, ensuring a well-rounded representation across various industries. This approach promotes portfolio diversification and mitigates the risk of overexposure to specific sectors.