Founded in 2011, SoFi Technologies, Inc., commonly known as SoFi, is a US-based personal finance company and online bank. SoFi has gained popularity over the years for its commitment to offering more affordable loan options for financing education. More than just a typical online bank, SoFi offers diverse financial services, including a brokerage account with SoFi Invest.

In this article, we examine SoFi’s latest statistics that matter most, such as SoFi’s assets under management (AUM), number of users, revenue, and other relevant data, which highlight the growth and success of SoFi over the years, as well as its impact on the investing and banking industry.

Whether you’re a current or potential SoFi user or simply interested in the investment and banking industry, keep reading to discover the latest SoFi statistics.

Overview

SoFi is a US-based personal finance company and online bank. They are mainly known for their Checking and Savings accounts alongside investment opportunities. Before SoFi went public in 2021, CEO Anthony Noto clearly defined his ambition for the company to be a “one-stop shop”. It targets the gap between brick-and-mortar retail banks and online brokerages by coupling wealth management services with loan options.

Here are some key corporate facts about SoFi:

- Founded year: 2011

- Headquarters: San Francisco, California, U.S

- IPO date: June 1, 2021

- Listed Exchange: NASDAQ

- Sector: Finance

- Industry: Personal finance, Software, Banking

- Ticker: SOFI

- Founder: Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady

- Number of employees: 5,900+ (January 2026)

Ownership

SoFi went public in June, 2021, and its stock (NASDAQ: SOFI) ownership structure s a mix of institutional, retail and individual investors. Approximately ~30% of the company’s stock is owned by Institutional Investors (including mutual funds and ETF investors), and ~763% is owned by Public Companies and Individual Investors.

| Investor Type | Ownership |

| Public Companies and Individual Investors | 63.52% |

| ETFs | 11.90% |

| Mutual Funds | 11.20% |

| Other Institutional Investors | 8.94% |

| Insiders | 4.42% |

Source: TipRanks

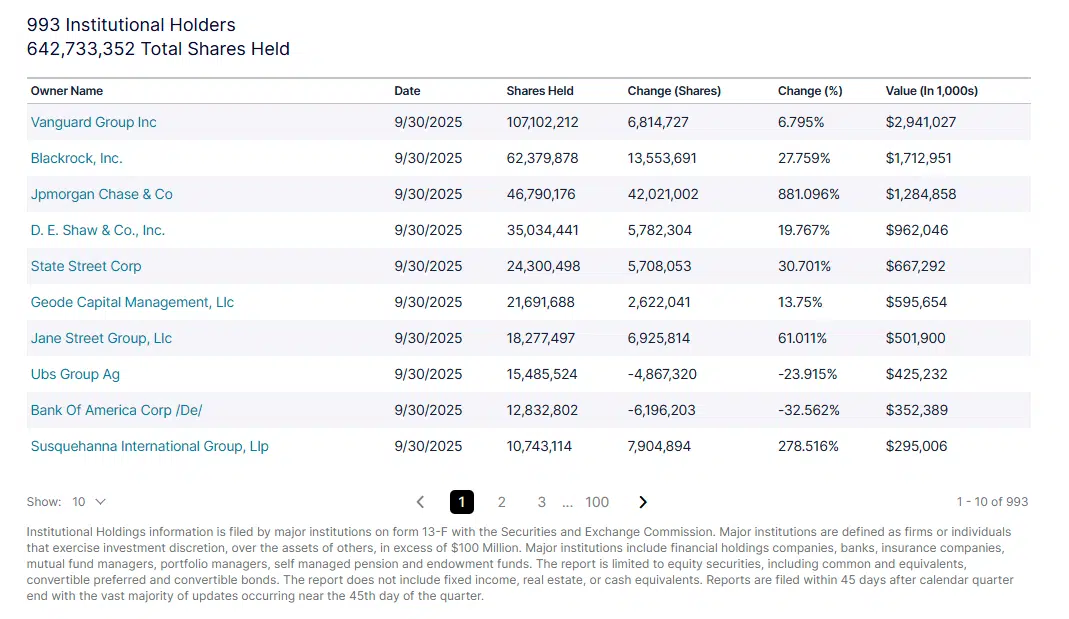

As of January 2026, The Vanguard Group, Inc. was the major institutional investor, holding a significant 7.65% ownership stake in SoFi stock. In addition to its institutional holdings, Vanguard, through its Vanguard Index Funds, has also emerged as a major investor in SoFi stock, holding a 7.19% stake. Overall, Vanguard holds approximately ~15% of SoFi stock; however, the distinction between the two components isn’t clear.

Source: Nasdaq

SoFi AUMs

SoFi’s assets under management (AUM) have experienced significant growth, reaching a peak of $37 billion during the third quarter of 2023.

Since SoFi only went public at the end of 2020, we couldn’t find additional information about the company’s AUM for the preceding years. However, for the subsequent years, we relied on the annual report to calculate AUM, which combines the loans provided by SoFi with the deposits in Investment accounts and Checking and Savings accounts.

SoFi Users

In the first quarter of 2025 (Q1 2025), SoFi Technologies Inc. achieved a significant milestone by surpassing 10.9 million members, marking a 34% year-over-year increase. The company defines these users as “SoFi members,” adhering to the principle: “Once someone becomes a member, they are always considered a member unless they violate the terms of service.” It’s important to note that not all of these members are necessarily active users.

This growth reflects SoFi’s ongoing efforts to expand its user base and market presence, demonstrating the company’s commitment to providing comprehensive financial services to a growing number of clients.

| Period | SoFi Users (in thousands) |

| Q1-2019 | 704 |

| Q2-2019 | 759 |

| Q3-2019 | 864 |

| Q4-2019 | 976 |

| Q1-2020 | 1,086 |

| Q2-2020 | 1,204 |

| Q3-2020 | 1,501 |

| Q4-2020 | 1,851 |

| Q1-2021 | 2,281 |

| Q2-2021 | 2,560 |

| Q3-2021 | 2,937 |

| Q4-2021 | 3,460 |

| Q1-2022 | 3,868 |

| Q2-2022 | 4,319 |

| Q3-2022 | 4,743 |

| Q4-2022 | 5,223 |

| Q1-2023 | 5,656 |

| Q2-2023 | 6,240 |

| Q3-2023 | 6,957 |

| Q3-2024 | 9,400 |

| Q1-2025 | 10,900 |

| Q4-2025 | 12,600 |

SoFi Revenues

SoFi generates revenue through three primary business segments: Lending, Technology Platform, and Financial Services. The lending segment generates income through interest on personal, student, and home loans. The Technology segment generates revenue through services provided to both financial and non-financial institutions. Finally, the Financial Services segment generates income primarily through fees associated with SoFi Invest accounts, checking and savings, and the SoFi Credit Card.

As of the first quarter of 2025 (Q1 2025), SoFi Technologies Inc. reported record adjusted net revenue of $771 million, marking a 33% year-over-year increase.

| SoFi Revenues 2018 | $240 million |

| SoFi Revenues 2019 | $451 million |

| SoFi Revenues 2020 | $621 million |

| SoFi Revenues 2021 | $1,010 million |

| SoFi Revenues 2022 | $1,540 million |

| SoFi Revenues 2023 | $2,122 million |

| SoFi Revenues 2024 | $2,606 million |

| SoFi Revenues Q1 2025 | $772 million |

| SoFi Revenues Q3 2025 | $962 million |

Below, we will present the quarterly revenue figures for SoFi.

| Q4-2019 | $62 million |

| Q1-2020 | $86 million |

| Q2-2020 | $136 million |

| Q3-2020 | $217 million |

| Q4-2020 | $182 million |

| Q1-2021 | $216 million |

| Q2-2021 | $237 million |

| Q3-2021 | $277 million |

| Q4-2021 | $280 million |

| Q1-2022 | $322 million |

| Q2-2022 | $356 million |

| Q3-2022 | $419 million |

| Q4-2022 | $443 million |

| Q1-2023 | $460 million |

| Q2-2023 | $489 million |

| Q3-2023 | $531 million |

| Q3-2024 | $697 million |

| Q4-2024 | $739 million |

| Q1-2025 | $772 million |

| Q3-2025 | $962 million |

Average Revenues Per User

The Average Revenue Per User (ARPU) is a critical metric for evaluating a company’s revenue generation efficiency. It is obtained by dividing the total revenue for a given period by the average of users for that same period.

| SoFi Average Revenue per User 2019 | $462 |

| SoFi Average Revenue per User 2020 | $335 |

| SoFi Average Revenue per User 2021 | $292 |

| SoFi Average Revenue per User 2022 | $295 |

| SoFi Average Revenue per User 2023 | $283 |

| SoFi Average Revenue per User 2024 | $261 |

The figures show that SoFi’s ARPU has decreased over the years, beginning at $462 in 2019 and falling to $261 in 2024. This key metric provides valuable insights into SoFi’s revenue generation strategy and operational efficiency. However, the decline in ARPU may not necessarily indicate poor productivity; it could be attributed to factors outside of SoFi’s control, such as the onset of the COVID-19 pandemic in 2020, when a vast number of investors joined the platform.

SoFi Profit

The company experienced a substantial net loss of -$484 million in 2021, and although its losses decreased to -$320 million in 2022. In 2024, SoFi was profitable for the first time! Still, these financial results underscore the challenges SoFi faces in expanding its business.

| SoFi Profit 2019 | – $240 million |

| SoFi Profit 2020 | – $224 million |

| SoFi Profit 2021 | – $484 million |

| SoFi Profit 2022 | – $320 million |

| SoFi Profit 2023 | – $341 million |

| SoFi Profit 2024 | + $499 million |

| SoFi Profit Q1 2025 | + $71 million |

| SoFi Profit Q1 2025 | + $139 million |

SoFi Products

As highlighted above, SoFi operates in three main segments: Lending, Technology Platform, and Financial Services. In the Lending segment, SoFi offers three products: personal loans, student loans, and home loans. Moving on to the Technology Platform, we discuss accounts on the Galileo platform, which provides technology services to both financial and non-financial institutions, and on the Technisys, a cloud-native digital banking platform.

The Financial Services segment encompasses products such as SoFi Checking and Savings, SoFi Invest, and the SoFi Credit Card, providing digital banking, investment solutions, and a credit card. Additionally, SoFi offers various services, including loan referrals, personal finance management through SoFi Relay, employer-based financial benefits through SoFi At Work, and insurance products through SoFi Protect.

| Year | Lending Products | Financial Services Products | Technology Platform Accounts |

| 2019 | 798,005 | 387,357 | n/a |

| 2020 | 917,645 | 1,605,910 | 59,735,210 |

| 2021 | 1,078,952 | 4,094,245 | 99,660,657 |

| 2022 | 1,340,597 | 6,554,039 | 130,704,351 |

| 2023 | 1,663,000 | 9,479,000 | 145,000,000 |

| 2024 | 2,000,000 | 12,700,000 | 168,000,000 |

| Q1 2025 | 2,129,833 | 13,785,592 | 158,432,347 |

| Q3 2025 | 2,462,588 | 16,090,465 | 157,859,670 |

Source: SoFi Q3 Report 2025

Below, we will look more closely into the Lending Products and Financial Services Products:

| Qtr | Lending Products | Financial Services Products |

| Q3-2019 | 0.752 million | 0.268 million |

| Q4-2019 | 0.798 million | 0.387 million |

| Q1-2020 | 0.842 million | 0.601 million |

| Q2-2020 | 0.862 million | 0.783 million |

| Q3-2020 | 0.893 million | 1.160 million |

| Q4-2020 | 0.918 million | 1.606 million |

| Q1-2021 | 0.945 million | 2.239 million |

| Q2-2021 | 0.981 million | 2.686 million |

| Q3-2021 | 1.031 million | 3.237 million |

| Q4-2021 | 1.079 million | 4.094 million |

| Q1-2022 | 1.139 million | 4.724 million |

| Q2-2022 | 1.202 million | 5.362 million |

| Q3-2022 | 1.280 million | 5.919 million |

| Q4-2022 | 1.341 million | 6.554 million |

| Q1-2023 | 1.416 million | 7.138 million |

| Q2-2023 | 1.504 million | 7.897 million |

| Q3-2023 | 1.594 million | 8.854 million |

| Q3-2024 | 1.891 million | 11.760 million |

| Q4-2024 | 2.000 million | 12.700 million |

| Q1-2025 | 2.130 million | 13.786 million |

| Q3-2025 | 2.463 million | 16.090 million |

Taking a closer look, it’s evident that SoFi has significantly expanded its investment segment. Comparing Q3-2019, where SoFi had 268 thousand products, to the following year, the number surged to 1.606 million—an impressive year-over-year increase of nearly 500%. By the third quarter of 2024, SoFi’s investment segment boasted a remarkable 11.760 million products, outpacing the lending segment, which had 1.891 million. While the investment segment experienced substantial growth, the lending sector also exhibited stability with incremental year-over-year increases, though not as pronounced.

Let’s now take a closer look at the main contributors for which segment in the first quarter of 2025:

Q3 – 2025: Investment Segment

| Product | Q3 2025 Total |

| Money | 6.337 million |

| Relay | 6.034 million |

| Invest | 3.045 million |

| Credit Card | 0.392 million |

Q3 – 2025: Lending Segment

| Lending Product | Q3 2025 Total |

| Personal Loans | 1.792 million |

| Student Loans | 0.623 million |

| Home Loans | 0.048 million |

Source: Q3 2025 Investor Presentation

Valuation

SoFi’s growth is also evident in its increasing valuation, which has surged over the years. However, a notable setback occurred post-2021, with the company’s valuation plummeting from $12.76 billion to $4.28 billion in the subsequent year (2022).

Significantly, key executives, including President Chad Morton, CRO Aaron Webster, and CMO Lauren Stafford Webb, have recently sold a notable amount of company shares, raising concerns. On the other hand, CEO Anthony Noto and CFO Chris Lapointe have actively boosted confidence in SoFi by purchasing shares.

| Year | Valuation |

| 2015 (Jan)** | $1.10 billion |

| 2017 (Feb)** | $3.80 billion |

| 2019 (May)** | $4.30 billion |

| 2020* | $1.25 billion |

| 2021* | $12.76 billion |

| 2022* | $4.28 billion |

| 2023* | $9.54 billion |

| 2024* | $15.45 billion |

| 2025* | $36-23 billion |

*The valuation was determined through the market capitalisation at the end of each year

** SoFi went public at the end of 2020. The preceding valuations were determined on a pre-money basis and were sourced externally, specifically from Crunchbase.

Bottom Line

In summary, SoFi Technologies, commonly known as SoFi, stands out as a “one-stop shop,” bridging the gap between traditional banks and online brokerages. SoFi is a US-based personal finance company and online bank that goes beyond traditional banking, offering diverse financial services, including brokerage accounts through SoFi Invest.

In this article, we delved into key statistics like assets under management, user base, and revenue, showcasing SoFi’s significant growth and impact on the finance industry.

FAQs

Is SoFi Safe? Is my money with SoFi protected?

Yes, SoFi is safe. It is a member of the Securities Investor Protection Corporation (SIPC), which protects funds held in a brokerage account in case of brokerage failure, covering up to $500,000 of missing assets. Additionally, Check and Savings Accounts are covered by Federal Deposit Insurance Corporation (FDIC) insurance up to $250,000 per individual account (joint accounts are insured up to $500,000).

Is SoFi regulated?

Yes, SoFi is regulated by the Securities and Exchange Commission (SEC), and by the Financial Industry Regulatory Authority (FINRA).

Does SoFi work Internationally?

No, SoFi isn’t available internationally. Only US and HK residents are allowed to open an account with SoFi.

1Includes SoFi Checking and Savings accounts held at SoFi Bank in Q3 – 2023, and cash management accounts.