Are you confused about whether to choose DEGIRO or XTB as a broker for your investing needs?

In this side-by-side comparison, we analyse DEGIRO and XTB to help you understand how these apps compare on some of the most common features and make a better-informed decision about the best broker for you.

Below, you’ll find the pros and cons of each broker, as well as a comparison table that features the different fees charged, the financial instruments supported, the regulation, and more. Keep reading!

DEGIRO vs XTB

- DEGIRO is best for low-cost trading from Europe

Disclaimer: Investing involves risk of loss. - XTB is best for commission-free ETFs, CFDs, as well as earning interest

XTB offers interest on your cash, and commission-free trading in stocks and ETFs in most countries where it operates. On the downside, XTB makes most of its money through CFDs, which are high-risk instruments.

DEGIRO doesn’t offer interest on users’ cash balances, and is generally more expensive than XTB, however, it does not offer CFDs, as DEGIRO is an execution-only broker. DEGIRO is a top choice if you’re looking for a serious broker to invest, and don’t want to get into forex and CFDs.

Side-by-side comparison

| Category | DEGIRO | XTB |

| Demo account | No | Yes |

| Account minimum | €/£1 | €/$/£1 |

| Interest on uninvested cash (annually) | 0% | EUR: 4.20% first 90 days, then 2.00% (quoted annually); USD: Up to 5% first 90 days, then 2.50% (quoted annually); GBP: 5.20% |

| US stocks fees | €/£1+€/£1 flat handling fee | €/$/£0Up to €100.000 in monthly volume transactions – Only applicable in some countries. |

| EU stock fees | €/£3.90+€/£1 flat handling fee | €/$/£0Up to €100.000 in monthly volume transactions – Only applicable in some countries. |

| ETFs | ETF Core List: €/£0 (+€/£1 flat handling fee)Other ETFs: €/£2 (+€/£1 flat handling fee) | €/$/£0Up to €100.000 in monthly volume transactions – Only applicable in some countries. |

| Currency conversion fee | 0.25% | 0.50% |

| Regulators | AFM, DNB | FCA, KNF, CySEC, DFSA and FSC |

About DEGIRO

DEGIRO is a European low-cost brokerage firm that has become very popular due to its low rates! With over 3 million users, the platform has become widely known for its “do-it-yourself” philosophy.

It offers a wide range of financial assets to trade, including stocks, ETFs (check the list of free ETFs), bonds, options, futures contracts, warrants, investment funds, and some leveraged products.

The mobile app and web trading platform are basic but very efficient and straightforward to use. Some downsides are the absence of any significant fundamental research and the lack of pricing alerts.

DEGIRO’s pros and cons

Pros

- ETF Core Selection list (external fees apply)

- User-friendly web and mobile app

- Wide range of investment options

- Education material: Investor’s Academy and Investing with DEGIRO

- Low overall commission structure

- No account opening, inactivity, or withdrawal fee

Cons

- 0.25% currency conversion fee (charged if you deposit or invest in a different currency than your base currency)

- €/£1 flat handling fee (charged in most transactions)

- €/£2.50 of connectivity fee (paid annually), per exchange where you’re invested

- Does not offer Forex, CFDs, and Cryptos

- No ISA account (for UK residents)

- Low-quality customer support

- No interest paid on cash balances

About XTB

XTB is a well-known online broker listed on the Warsaw Stock Exchange. It has two trading platforms (xStation 5 and xStation Mobile), a diverse range of tradeable instruments, and exceptional customer service.

xStation Mobile is a premier application for charts and technical analysis, with the ability to apply numerous indicators like moving averages and volume. Navigation is simple, with an intuitive order placing for any asset class.

On the negative side, XTB has a limited product portfolio and charges a €10 monthly inactivity fee (after 1+ year with no activity plus no deposit in the last 90 days).

XTB pros and cons

Pros

- Free stocks trading (only applicable to some countries)

- Customizable trading platform (charts and workspace)

- Low Forex Spreads

- Demo account

- No minimum account deposit

- Valuable education materials

- Top-tier Regulators

Cons

- Complex trading platform for a beginner

- High Stock CFD spreads

- Limited product portfolio

- Withdrawal fees for transfers below $100

- Inactivity fee (€10/monthly after 1+ year with no activity plus no deposit in the last 90 days)

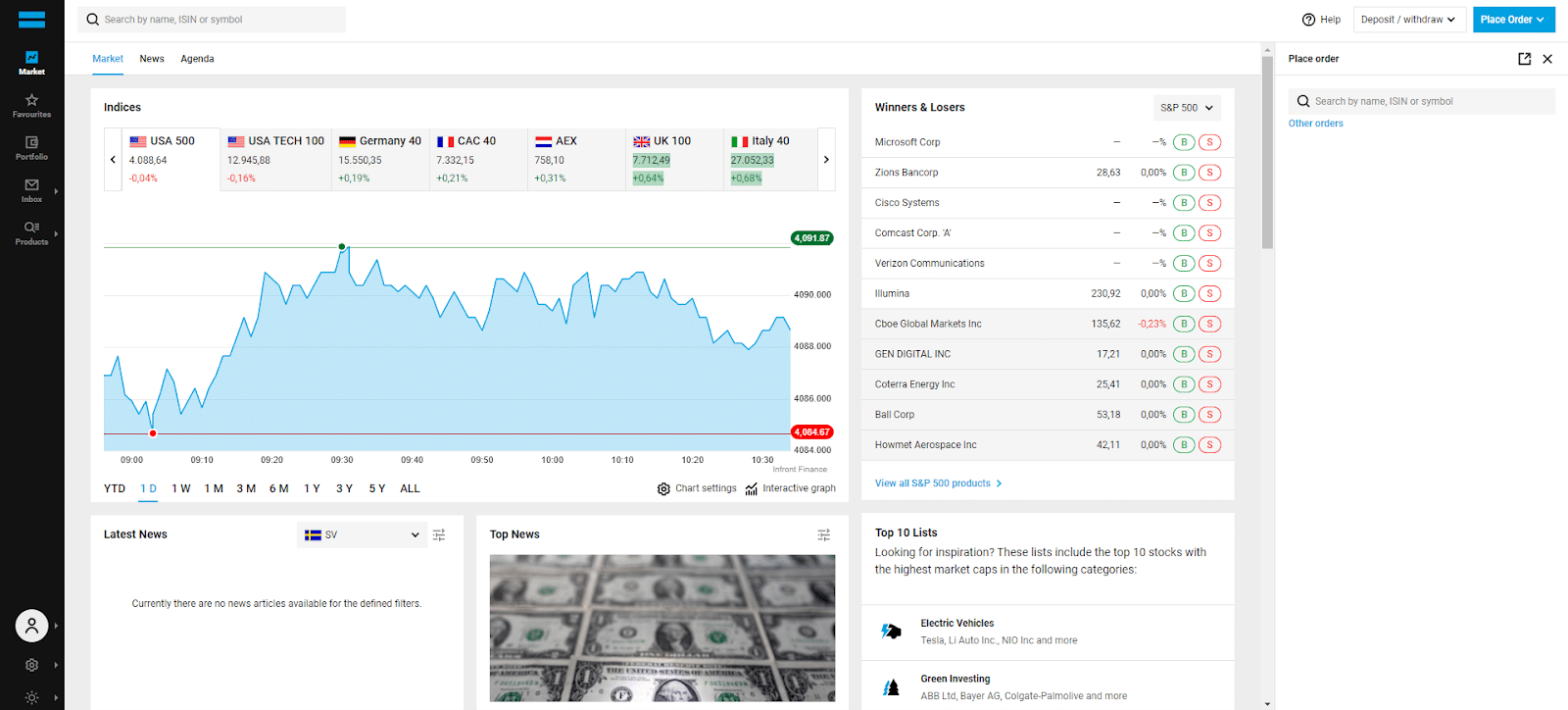

How to invest in the S&P 500 on DEGIRO and XTB

Want to learn how to invest in the S&P 500 on both DEGIRO, as well as XTB? Check our step-by-step videos below. It might also help you decide which app is more user-friendly and how you feel about each broker:

DEGIRO vs XTB: our veredict

Choosing between these two online brokers isn’t always an obvious decision. The differences between DEGIRO and XTB come from the trading platforms, products, fees, and security. Do you prefer a basic trading platform? Do you want to invest in ETFs only? Do you value security more?

Ultimately, the best online broker for you will depend on your profile, personal preferences, and objectives. Explore the websites above and decide for yourself!

Want to know more about DEGIRO and XTB? Explore our in-depth broker reviews, comparison table, and BrokerMatch tool.

Disclaimer: Investing involves risk of loss.