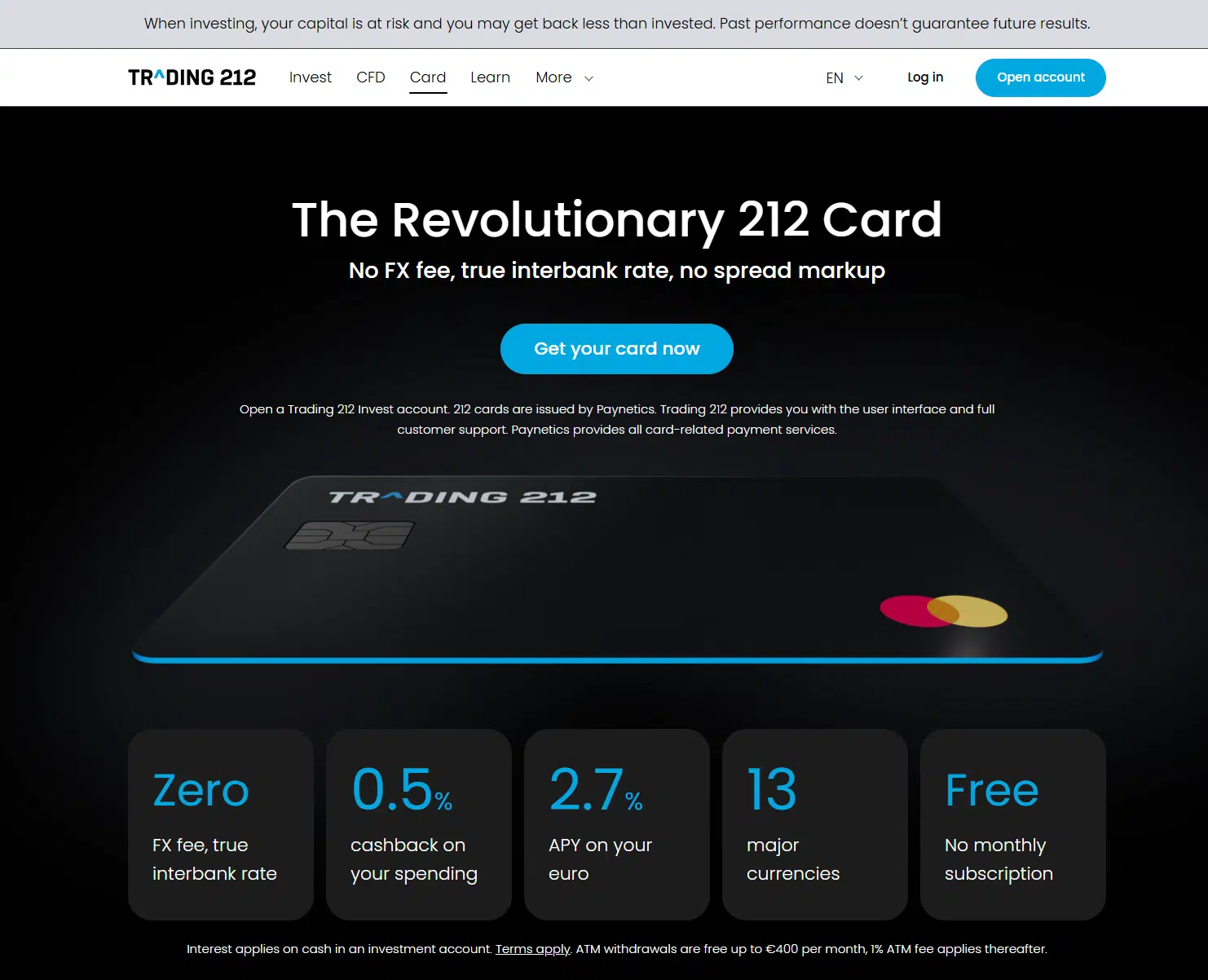

Hello, investor! This article will provide our review of the newly launched Trading 212 Card, a new addition to the fintech landscape. Trading 212, known for its investment platform, has introduced this Mastercard-backed debit card to bridge the gap between investment activities and everyday spending. The Trading 212 Card aims to provide a seamless financial experience for investors and casual spenders.

The card offers cashback on daily purchases and the flexibility to invest spare cash, potentially transforming how you manage your finances. Plus, you can gain a free fractional share worth up to €/£100 just by signing up with the Trading 212 promo code: IITW.

With the ability to hold multiple currencies and benefit from no FX fees (true to interbank rate), it may be suitable for international travelers and online shoppers. Security and ease of use are key aspects of this card’s design, making it a potential option for those looking to streamline their financial activities.

In this review, we will discuss the Trading 212 Card’s key features, how the card works, its availability, fees, pros and cons, and more. Read on to find out more!

Key features & benefits

- Cashback Rewards: Earn 0.5% cashback, capped at €23/£20 per month;

- Competitive Currency Exchange: Zero foreign exchange (FX) fee, true interbank rate;

- Free ATM Withdrawals: Withdraw up to €/£400 per month from ATMs without incurring any additional fees;

- Choice of Cards: Opt for a free virtual card for convenient online shopping or order a physical card for a one-time fee of €/£4.95;

- Enhanced Security: Equipped with EMV chip technology, PIN protection, 3D Secure, and zero-liability fraud protection;

- Multi-Currency Wallet: Hold and spend in 13 supported currencies;

- Protection Scheme: Protection for assets and cash up to £85,000 for UK residents and up to €20,000 for EU residents.

How does the Trading 212 Card work?

The Trading 212 card operates using the uninvested cash in your account. Funds are drawn directly from your uninvested cash balance in your Trading 212 Invest account whenever you make a purchase or ATM withdrawal. This setup ensures that your investments remain untouched while you manage your day-to-day expenses.

Spending limits

The card has specific spending limits for EU and UK residents, as detailed in the following table:

| Transaction limit | ATM withdrawal limit | Money transfer limits | |

| Per transaction | €9,999/£9,000 | €400/£340 | €/£2,000 |

| Daily | €10,000/£9,000 | €2,000/£1,800 | €/£2,000 |

| Monthly | €60,000/£54,000 | €10,000/£9,000 | €/£2,000 |

Is Trading 212 Card available in my country?

Currently, the Trading 212 Card is available to UK residents, as well as some EU residents, aged 18 or over who hold a Trading 212 Invest account.

Note: If you are from a country outside of the UK and EU, you will not be eligible for the initial version of the card.

Where can I use the Trading 212 card?

The Trading 212 card can be used internationally wherever Mastercard is accepted. While there are no additional fees for international use, a 0.15% FX fee applies to currency conversions.

How to get the Trading 212 card?

1. Open the Trading 212 app and navigate to the Card tab:

2. Select between a virtual or physical card:

3. For a physical card, provide your delivery address and confirm your order:

Additionally, by using the Trading 212 promo code IITW, users can receive a free fractional share worth up to €/£100 upon signing up.

Note: If you are an EU citizen, you will be placed on the waitlist to receive the card.

How to add money to the Trading 212 Card?

You can add money to your Trading 212 card using several options:

- Link your bank account for an instant transfer;

- Use a bank transfer with the provided details and reference number;

- Use your debit/credit card for a direct payment;

- Use Google/Apple Pay for quick deposits.

Trading 212 Card cashback

To learn more about how the cashback works with the Trading 212 Card, check out our in-depth article on Trading 212 Cashback.

Fees

- ATM Withdrawals: Free for up to €/£400 per month, with a 1% fee on amounts exceeding this limit;

- Physical Card Issuance: One-time fee of €/£4.95 (€/£3.50 for manufacturing and €/£1.45 for delivery).

Security and protection

Trading 212 adheres to FCA’s Client Assets Sourcebook regulations, ensuring robust protection for your funds. Advanced security measures include:

- EMV Chip technology: Provides enhanced security for your transactions;

- PIN protection: Safeguards your card with a personal identification number;

- 3D Security: Adds an extra layer of protection for online transactions;

- Zero-liability fraud protection: Ensures you are not held responsible for unauthorized transactions.

Pros and cons

Pros

-

0.5% Cashback

-

No Maintenance Fees: Avoid monthly charges.

-

Advanced Security Features: Benefit from enhanced protection for your transactions.

-

Free ATM Withdrawals: Withdraw up to €/£400 per month without additional fees.

- Integration with Apple Pay and Google Pay: Convenient mobile payments.

Cons

-

Limited Availability: Currently only available to UK and EU residents.

-

Physical Card Fee: A fee is required to get the physical card.

- Spending Limits: Daily and monthly limits apply to transactions and withdrawals.

Customer support

Trading 212 offers comprehensive support through various channels to ensure users receive the assistance they need:

- Help Centre: Access a wealth of information through their Help Centre, which includes FAQs and detailed guides;

- In-App Chat: For direct assistance, use the in-app chat feature to speak with an agent;

- Urgent issues: For urgent matters like lost or stolen cards, you can freeze your card directly in the app or contact their support team for immediate help.

Trading 212 Interest on uninvested cash

Trading 212 also offers an attractive interest rate on uninvested cash held in your Invest account, allowing you to earn interest in thirteen different currencies, including EUR (2.20%), GBP (4.10%), and USD (4.10%).

If you want to learn more about the Trading 212 uninvested cash offer, check out our detailed article.

Bottom line

In summary, the Trading 212 Card is a valuable addition to the Trading 212 platform, offering users a seamless way to integrate their investment and spending activities.

If you’re already a Trading 212 user and prioritize convenience and cashback, this card could be a great fit.

With features like cashback rewards, low FX fees, and advanced security measures, it stands out as a versatile financial tool.

However, potential users should consider whether the cashback cap and the need to fund spending from their investment account align with their needs.

For an in-depth review of Trading 212 as a broker, check out our detailed Trading 212 review. We cover everything you need to know about the platform, from its diverse investment options to the overall user experience.

And remember, by signing up with the Trading 212 promo code IITW, you can receive a free fractional share worth up to €/£100.

Hope we helped, and feel free to get in touch if you want to share feedback or have any questions!