Widely known in Europe, Trading 212 has attracted the attention of several Canadian investors, offering high interest on uninvested cash, a slick and modern app, low commissions, and a free share signup bonus.

Want to know if Trading 212 is available in Canada, the company’s expansion plans, and the alternatives available for Canadian investors? We’ve got you covered!

Is Trading 212 available in Canada? 🇨🇦

No, Trading 212 is not yet available in Canada.

Trading 212 is investing in its global expansion, however the company hasn’t shared publicly any plans to expand to Canada.

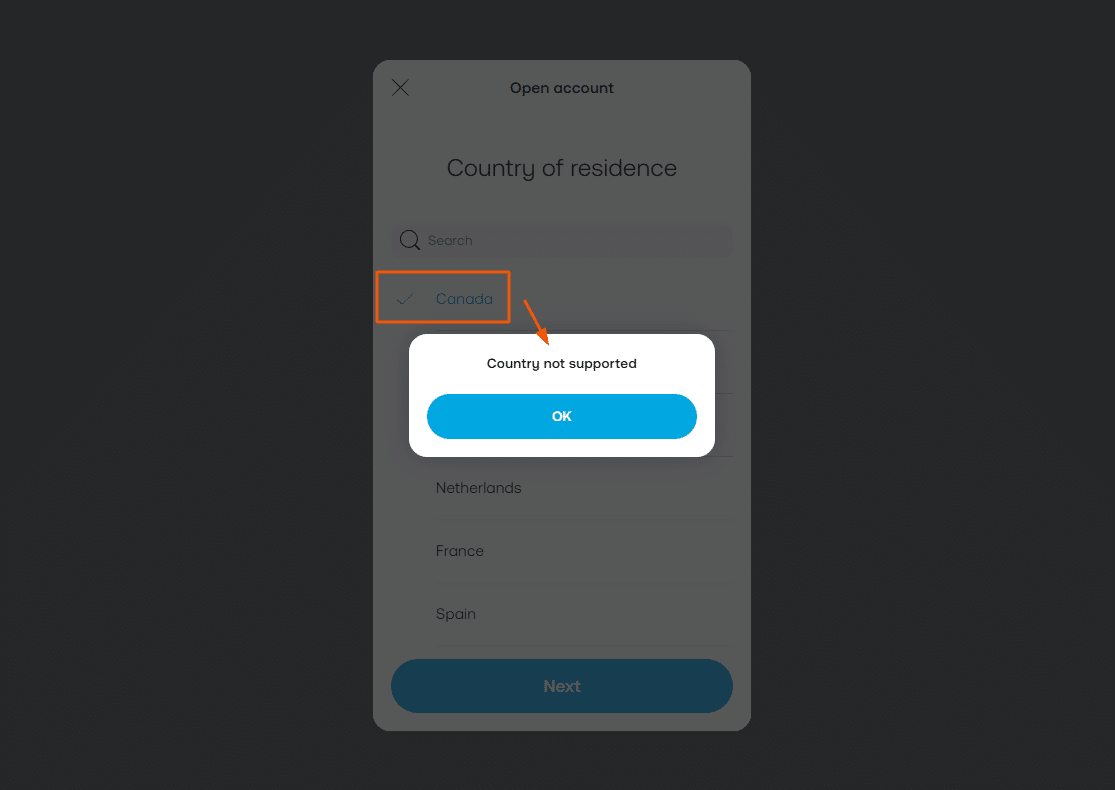

We have tried to open an account and Canada was not on their list of supported countries:

Trading 212 Alternatives in Canada

- Interactive Brokers: Best overall

- Wealthsimple: The closest alternative. Best for beginners

Moving to Canada: What Happens to Your Trading 212 Account?

For investors moving from Germany or another supported country to Canada, a common concern arises: what happens to your investments with Trading 212? Since Trading 212 is not registered in Canada, those who become tax residents in Canada will find that Trading 212 can no longer offer them services as retail investors due to regulatory restrictions.

Here’s What You Need to Know:

- Once you become a Canadian tax resident, Trading 212 may not be able to serve you due to the lack of registration or passporting into the CAD financial system.

- Investors are advised to choose a CAD broker to facilitate a “free” movement of their portfolio. This means transferring your investments without having to sell them, ensuring you can maintain your holdings without incurring immediate tax liabilities.

- Trading 212 does offer a migration service for transferring out investments. It’s recommended to open a Canadian brokerage account first to ensure a smooth transition.

Conclusion

If you want to open a Trading 212 account from Canada, you’re in bad luck: it is not possible. However, we believe any of the above mentioned brokers will be good choices.

Whether you value security and reputation or want a commission-free trading platform, the alternatives presented should be a good starting point. Explore their websites and decide for yourself!

If you haven’t found a match, you can still look at our comparison of online brokers available by country.