Widely known in Germany, Trade Republic has attracted the attention of several Polish investors, offering high interest on uninvested cash of 2.00% (euros), a slick and modern app, and low commissions.

Want to know if Trade Republic is available in Poland, the company’s expansion plans, and the alternatives available for Polish investors? We’ve got you covered!

Is Trade Republic available in Poland? 🇵🇱

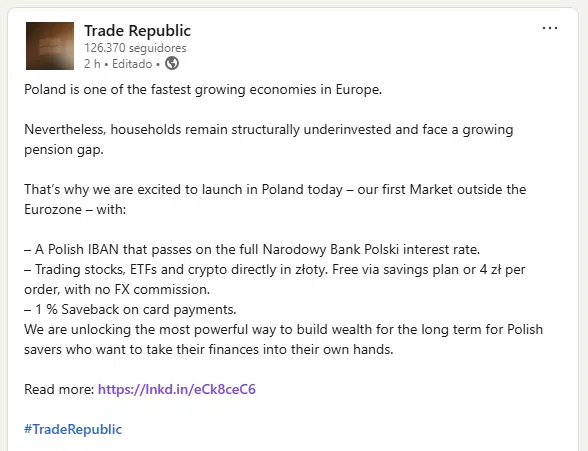

Yes, Trade Republic is now available in Poland, according to a press release made by the company and their LinkedIn account:

Poland is the first market outside the Eurozone where Trade Republic has launched. The offering includes:

- A Polish IBAN that passes on the full Narodowy Bank Polski (NBP) interest rate.

- Trading in stocks, ETFs, and crypto directly in złoty (PLN), free via savings plans or at 4 zł per order, with no FX commission.

- 1% saveback on card payments.

This launch reflects Trade Republic’s strategy to expand its presence in Europe and provide Polish savers with access to long-term wealth-building tools.

This launch reflects Trade Republic’s strategy to expand its presence in Europe and provide Polish savers with access to long-term wealth-building tools.

Should you use Trade Republic in Poland?

Now that Trade Republic is officially available in Poland, many investors might be wondering whether it is the right platform for them.

Trade Republic offers clear advantages, such as:

- A Polish IBAN linked to the Narodowy Bank Polski interest rate.

- Low-cost access to stocks, ETFs, and crypto in złoty.

- A simple, mobile-first platform.

However, there are also limitations to consider:

- Fewer advanced tools compared to global brokers.

- Limited range of assets versus some competitors.

- Customer support and educational resources may not be as extensive.

For beginners looking for a straightforward way to start investing, Trade Republic can be an attractive choice. However, for investors seeking more sophisticated features, broader asset classes, or specific account types, other strong alternatives are available in Poland.

Trade Republic alternatives in Poland

- Interactive Brokers: Best for experienced investors

- eToro: Best for commission-free ETF investing and social trading

- Trading 212: The closest alternative. New users get a free fractional share

Conclusion

If you are based in Poland, you can now open a Trade Republic account directly, as the broker has officially launched in the country. With a Polish IBAN, access to the full NBP interest rate, and low-cost trading in stocks, ETFs, and crypto, it is a solid option for many investors.

However, Trade Republic may not fit everyone’s needs. If you prefer a platform with a wider range of assets, more advanced tools, or different fee structures, the alternatives we’ve highlighted, such as Interactive Brokers, eToro, or Trading 212, remain excellent choices.

Ultimately, the best broker depends on your investment style and priorities. Explore each platform’s offering and choose the one that aligns best with your financial goals.

If you haven’t found a “clear” match, you can still look at our comparison of online brokers available by country.

Risk disclaimer: When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

FAQs

What is Trade Republic?

Founded in 2015, Trade Republic is an investment app that allows users to invest in Stocks, ETFs, Bonds, Derivatives, and Crypto (+Saving Plans that include all these assets). It has over 8 million clients, which have over 100 billion in assets under management. Trade Republic is regulated by BaFin and Bundesbank. In the case of bankruptcy, up to €100,000 in cash is protected by the deposit guarantee scheme and your shares are held at the HSBC Bank custodian in Germany.

How does Trade Republic make money?

As economists like to say, “There is no such thing as a free lunch”. Trade Republic is still making money through payment for order flow (PFOF), which consists of paying brokerages to route orders to market makers for trade execution, thus creating a potential conflict of interest between the brokerage and the customer. According to the latest update, “Payment-for-order-flow agreements only accounted for about a third of Trade Republic’s overall income” (our bold). Since the EU plans to ban PFOF from 2026 onwards, Trade Republic must adapt and focus on other income sources, namely:

- Securities fending: Your stocks or ETFs are most likely not parked in a single place. Usually, brokerage firms lend your securities in exchange for an interest rate. Third parties borrow securities for several reasons, such as hedging a position, arbitrage an opportunity, creating a structured product, or shorting selling;

- Transaction fees: Trade Republic charges no trading fees (apart from external settlement costs), so this might be an option to increase their revenues in the future;

- Withdrawal fees: For withdrawals below €100, it charges €1;

- Among others: Registration annual meeting, etc.