You might already be familiar with SoFi, a personal finance company and online bank headquartered in San Francisco.

More than just a typical online broker, it provides a comprehensive range of financial services such as loan refinancing, banking, investing, insurance, personal loans, mortgages, and credit cards.

Want to know if SoFi is available in Canada, its expansion plans, and the alternatives available for Canadian users? We’ve got you covered!

Is SoFi available in Canada?

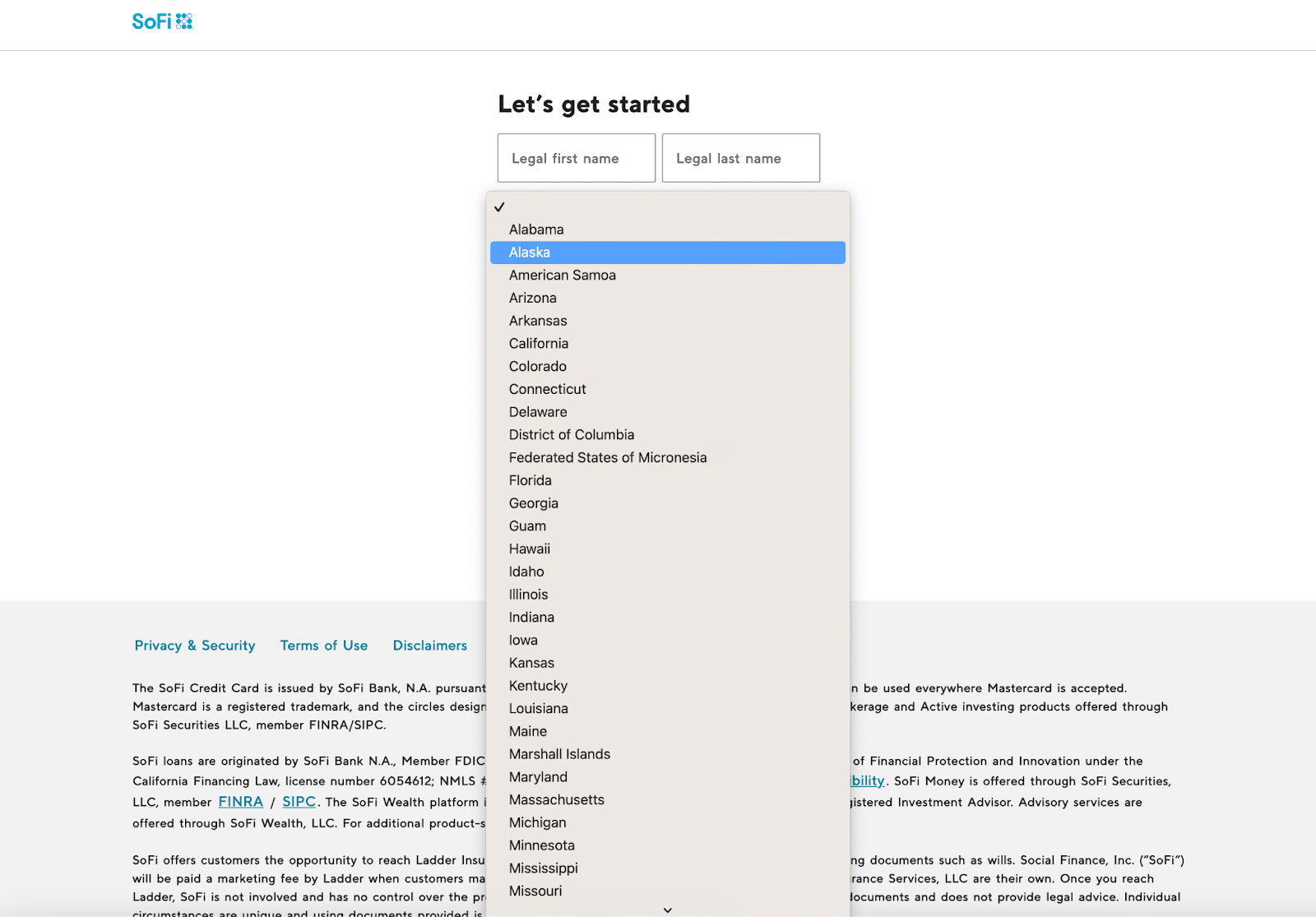

Unfortunately, Sofi is not available in Canada. Therefore, if you are a Canadian citizen or resident, you are unable to open an account with SoFi.

SoFi went international in April 2020 with its acquisition of the Hong Kong-based investing app 8 Securities. However, its global reach still remains limited to the United States and Hong Kong, implying that Canadian users are still unable to utilise the service.

Is SoFi coming to Canada?

SoFi initially intended to enter the Canadian market in 2017; however, the initiative was subsequently abandoned. Since then, there’s been no news about SoFi starting up in Canada.

So, for now, SoFi is not available in Canada, and there’s no clear sign that they’re planning to change that anytime soon.

SoFi alternatives in Canada

The good news is that our team has gathered the top alternatives for you, as a user in Canada, seeking a one-stop-shop similar to SoFi. With that in mind, here are our recommendations:

Interactive Brokers | Best all-round app

Online broker with a sophisticated trading platform that offers a wide range of products. The company, founded in the US and active in Canada for decades, also lets you access the useful IBKR GlobalTrader app.

WealthSimple | Best for online-banking

This digital bank combines cash-back debit cards, stocks, ETFs, cryptos, commission-free trades, managed to invest accounts, and tax filing services (Canada).

Questrade | Excellent Platform

The Canadian brokerage offers DIY investing services and pre-built portfolios with different objectives like retirement and education. It’s a great low-cost option allowing you to invest in stocks, ETFs, options, mutual funds and more.

Qtrade | Simple Fee Structure

Based in Canada, Qtrade has been around for over 20 years and offers Canadian investors the ability to trade stocks, ETFs, mutual funds, and options. It offers a few different price plans and also commission-free trading on some ETFs.

| Broker | Minimum Deposit | Products | US Stock Fees | CA Stock Fees | Regulators |

| Interactive Brokers | CAD $0 | Stocks, futures, options, Forex, commodities, bonds, mutual funds, hedge funds, ETFs, CFDs | Tiered pricing: Fom $0.0005 per share, min. $0.35, max. 1% of trade value | Tiered pricing: From CAD$ 0.003 per share, min.CAD $1, max. 0.50% of trade value | IIROC, FINRA, SIPC, SEC, CFTC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB |

| WealthSimple | CAD $1 | Stocks, ETFs, options cryptocurrencies | CAD $0 | CAD $0 | IIROC, SEC, FCA |

| Questrade | CAD $1,000 | Stocks, ETFs, options, forex, bonds, CFDs | $0.01/share (min. $9.95) | CAD 0.01/share (min. CAD 9.95) | IIROC |

| Qtrade | CAD $0 | Stocks, ETFs, options, mutual funds, fixed income and exchange-traded debentures | CAD 8.75 per trade (CAD 6.95 if you make 150+ trades per quarter or have a CAD 500k+ account balance) | CAD 8.75 per trade (CAD 6.95 if you make 150+ trades per quarter or have a CAD 500k+ account balance) | IIROC |

Interactive Brokers at a glance

Interactive Brokers is an exceptional broker available to Canadian traders and investors. The company was founded in 1978 and landed in Canada in 2000 through the legal entity Interactive Brokers Canada Inc. (IB Canada). Since its arrival, the company has become one of the most reliable brokers in the world.

Due to its sophisticated and powerful tools, the wide range of products available for trading, and its low prices, Interactive Brokers normally attracts advanced traders. However, the mobile app IBKR GlobalTrader is user-friendly and more suitable for beginners, simplifying investments without losing the powerful tools for which the broker is famous.

Interactive Brokers offers attractive features such as low commissions on US stocks, a demo account for practising investments, a wide range of tradable assets, and trading in CAD$.

Interactive Brokers is a good alternative for those who are searching to open a SoFi account in Canada because, just like SoFi, they offer a Debit Card – Interactive Brokers Debit Mastercard®, which lets you use your brokerage account assets to make purchases wherever the Debit Mastercard is accepted around the world.

Interactive Brokers is under the watchful eye of Canadian financial authorities, namely the Investment Industry Regulatory Organization of Canada (IIROC). These regulatory bodies ensure that Interactive Brokers follows strict rules and safeguards your investments, adding an extra layer of security for your money.

Wealthsimple at a glance

Wealthsimple provides intelligent and straightforward investment solutions that are accessible to everyone. Their emphasis on minimal fees and no account minimums has democratised investing, making it accessible to individuals who may have been excluded by traditional investment management services. Wealthsimple offers three main services:

- Wealthsimple Invest: This is a Robo-advisory platform that presents a range of investment options. It features automated portfolios with global diversification and optimisation for tax efficiency. Additionally, it provides socially responsible portfolios and halal portfolios compliant with Islamic law.

- Wealthsimple Cash: This service offers a debit card with cashback rewards on purchases and is linked to a high-interest savings account.

- Wealthsimple Trade: This commission-free stock and ETF trading app enables users to buy and sell stocks and ETFs on Canadian and US exchanges.

Wealthsimple stands out as an excellent alternative to SoFi since they offer bank services through the WealthSimple Cash Account, which gives you the opportunity to gain access to a Cash Card issued by Mastercard.

Wealthsimple is subject to regulatory oversight by IIROC, the Investment Industry Regulatory Organization of Canada.

Questrade at a glance

Questrade is a Canadian broker that’s been helping investors since 1999 as an alternative to the big banks.

You can invest using the app or web desktop and choose from a few different plans, including the competitively priced ‘Questwealth Portfolios’ for pre-built ETF portfolios. You can only hold cash in USD or CAD, but this brokerage is a solid option for beginners and more advanced investors with plenty of resources like up-to-date research, stock data, and charting tools.

Questrade provides tailored account options for both educational and retirement purposes. Similarly, SoFi offers specialised products designed for retirement planning, known as Individual Retirement Accounts, and for educational funding, with their initial offerings focusing on education loans. That makes Questrade a good alternative for those who are looking to open a SoFi account in Canada!

Questrade is under the watchful eye of Canadian financial authorities, namely the IIROC.

Qtrade at a glance

Qtrade is a Canadian brokerage that started back in 2000. You can sign up for a 30-day trial account and select between two plans, but the ‘Investor’ plan is the most accessible to retail investors (unless you make lots of trades/have a large portfolio).

Canadian investors have the ability to trade stocks, ETFs, options, mutual funds, and debentures (a type of bond). It’s a flat commission for most trades, apart from some free ETFs.

Many people who consider opening an account with SoFi are typically younger. This is because SoFi initially centred its business on providing loans for education. If you’re between 18 and 30, Qtrade is a good option to consider. If you establish a recurring monthly deposit of $50 or more, you can benefit from a fixed commission rate of just $7.75. What’s more, there are no minimum balance requirements and no quarterly fees associated with this offer.

Qtrade is also supervised by a Canadian financial authority, the IIROC. This regulatory body makes sure that Qtrade follows strict rules and safeguards your investments, adding an extra layer of security for your money.

Bottom line

For Canadians seeking financial solutions akin to SoFi, unfortunately, SoFi is not available in the country. Despite initial plans in 2017, there’s no recent indication of its arrival in Canada.

On a positive note, we’ve gathered excellent alternatives to SoFi for Canadian users. Interactive Brokers (IBKR) stands out as a reliable, all-in-one app with diverse trading options and a longstanding presence in Canada. Wealthsimple, a top choice, excels in online banking, offering services from robo-advisory to commission-free stock trading. Questrade is an excellent DIY investing platform, providing pre-built portfolios and allowing investment in various assets. Qtrade, known for its straightforward fee structure, is a Canadian brokerage facilitating trading in stocks, ETFs, options and gives great advantages to younger investors.

A reminder that the above should not be seen as investment advice and should be considered information only. Investors should do their own research and diligence about the best-suited services and opportunities for their risk, returns, and impact strategy.