Disclaimer: Investing involves risk of loss.

As one of the leading discount brokers tailor-made for Europeans, DEGIRO consistently remains in the spotlight. Founded in 2008 and headquartered in Amsterdam, DEGIRO is a low-cost brokerage offering several asset classes with low costs (external costs apply), which is excellent for long-term portfolios. The natural question: is DEGIRO safe?

Yes, we consider DEGIRO a reliable broker for the following reasons:

- Asset segregation: Your assets are untouchable in the event of the company’s default;

- Investor protection: If asset segregation fails, then the German Investor Compensation Scheme protects individuals by up to €20,000;

- Top-tier regulators: DNB and AFM regulate DEGIRO;

- Cash protection: DEGIRO’s method of opening a dedicated cash account automatically introduces cash protection up to €100,000.

- Transparency and strong track record: DEGIRO has been operating since 2008, is a listed company, and has a banking license.

This article highlights and discusses the due diligence we’ve done before we concluded that DEGIRO is a safe platform.

What Is DEGIRO’s business model?

DEGIRO operates as a low-cost, online brokerage platform, primarily serving retail investors across Europe. As a subsidiary of flatexDEGIRO AG, a publicly traded financial services company based in Germany, DEGIRO’s business model focuses on providing accessible and affordable investment services.

With DEGIRO, European investors benefit most from their extraordinary international exposure. They offer access to more than 50 exchanges across 30 countries.

It was awarded by us as the “Best European Discount Broker” in 2025.

How DEGIRO makes money

DEGIRO earns its revenue through commissions (earned per transaction) and interest (clients’ deposits over the European Central Bank [BCE] at the deposit facility rate).

The commission refers to DEGIRO’s charge for providing their service. While the lowest or among the lowest in Europe in terms of costs, a few key details from their fee schedule show:

- US or Canadian stocks: €/£1.00;

- European stocks: €/£3.90 per transaction;

- ETFs (globally, with zero-cost exceptions): €/£2.00;

- European bonds: €/£2.00;

- European options: €/£0.75 per contract.

For the interest component, represents ~29% of the overall revenue. As shown in the first three months’ report of 2025:

DEGIRO’s Financials

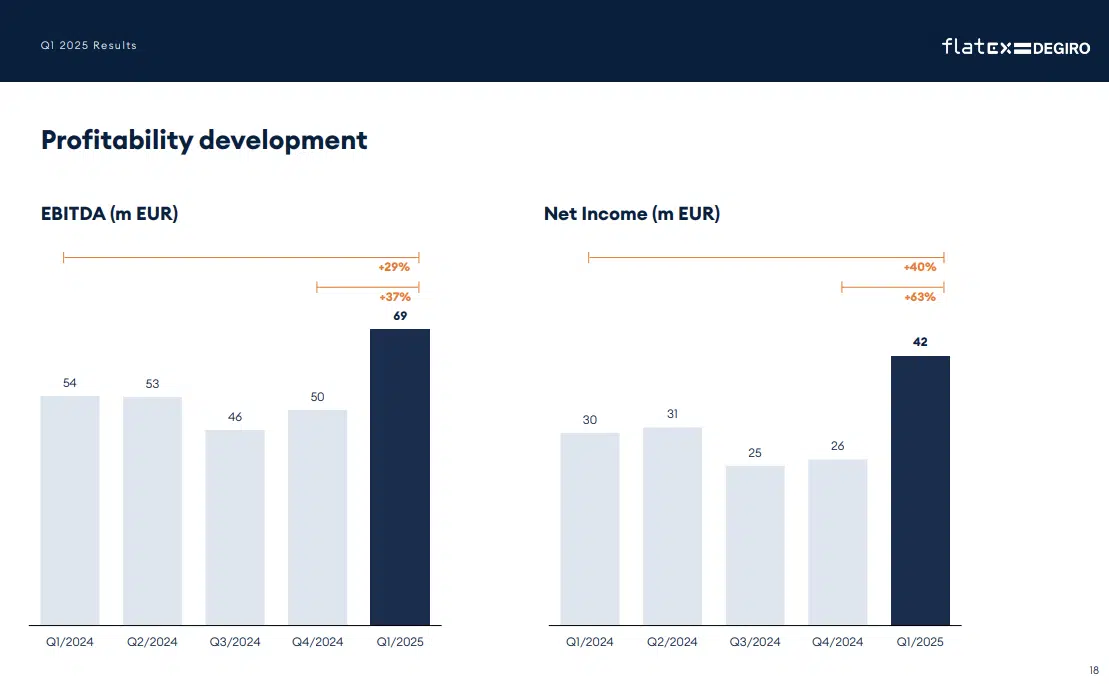

Essential to answering the question – Is DEGIRO Safe? – lies the latest financials for the company. We want to see a growing enterprise with solid earnings (EBITDA and net income):

Several notes on the last report:

- Revenue: €146.3 million, marking a 19% increase year-over-year (Q1 2024: €123.0 million).

- EBITDA: €69.2 million, up 29.1% compared to Q1 2024 (€53.6 million).

- Commission Income: €97.7 million, a 30.5% increase from Q1 2024 (€74.8 million), driven by higher trading activity and increased commission per transaction.

- Interest Income: €43.5 million, slightly down by 0.9% from Q1 2024 (€43.8 million), due to lower interest rates, offset by higher customer cash deposits and margin loans.

- Commission per Transaction: €5.02, an 8.0% increase from Q1 2024 (€4.64).

- Net Income: €42.0 million, a 40.1% increase year-over-year (Q1 2024: €30.0 million).

- Customer Accounts: 3.20 million at the end of Q1 2025, up 14.0% from Q1 2024 (2.81 million).

- Transactions Settled: 19.5 million, a 20.8% increase from Q1 2024 (16.1 million).

- Assets Under Custody: €75.8 billion, up 30.5% from Q1 2024 (€58.0 billion).

- Customer Deposits: €4.63 billion, an 8.5% increase from the end of 2024 (€4.27 billion).

- CET1 Ratio: Maintained a strong Common Equity Tier 1 (CET1) ratio of over 25%, with a regulatory capital surplus of approximately €100 million.

What If DEGIRO defaults?

An unlikely occurrence, but helpful to contemplate for your added benefit and security. Let’s consider four separate factors.

1. Your assets are segregated

Client assets are maintained separately from DEGIRO and are not treated as recoverable assets to creditors. Your assets remain yours.

Since the company is a licensed investment firm authorized by the Netherlands Authority for the Financial Markets (AFM), but it is the German Investor Compensation Scheme which protects investors in the event that DEGIRO fails to safeguard client assets.

2. Investor protection

With the German Investor Compensation Scheme, individual clients are protected from any losses from non-returned assets up to 90% (with a maximum of EUR 20,000). This applies per individual and not per account. If an individual has opened multiple accounts, the scheme protects all aggregated assets. Further information on the scheme can be found in English here.

A frequent misunderstanding with the scheme is that all assets above the €20,000 threshold are lost. Not at all–the practice of asset segregation ensures that all your assets are secure. The scheme comes into effect only if DEGIRO is discovered to have failed to sufficiently protect client assets, or in the case of fraud.

3. Ample regulation

The flatexDEGIRO Bank Dutch Branch, operating under the name DEGIRO, is the Dutch branch of flatexDEGIRO Bank AG. The latter entity is supervised by the German Federal Supervisory Authority (BaFin).

Within the Netherlands, the flatexDEGIRO Bank Dutch Branch is subject to integrity supervision by the Central Bank of the Netherlands (DNB), and further supervision by AFM.

4. Additional cash protection

When you open an account with DEGIRO, you also open a cash account with flatexDEGIRO Bank. All your uninvented money will be held in a segregated bank account with a personal IBAN.

Your money is thus guaranteed by up to €100,000 since the German Deposit Guarantee Scheme also applies. However, this cash account is not used for other banking or personal matters–only to hold money for your DEGIRO account.

Final thoughts

Even though it was popular before the coronavirus pandemic, retail investing succeeded incredibly as remote working inspired many to take up new passions–and investing is a superb choice.

However, there remains a seemingly limitless plethora of online brokers to choose from. Low fees are a must for traders, but so are asset protection, protection, and regulation. So, is DEGIRO safe? Yes, absolutely.

As a final tip, once you begin trading, please ensure you keep records of your holdings, trade confirmations, and account statements every month. This little step will make the job easier for the regulators when filing insurance claims.

Stay safe out there!

FAQs

Is DEGIRO safe?

Given its regulation by AFM and DNB and the guarantees provided by the Geramn Investor Protection Scheme, in addition to asset segregation, we feel confident in saying: yes, it is safe.

Does DEGIRO offer options and futures?

Yes. However, forex trading is not available, nor is crypto.

What’s the minimum amount for opening a DEGIRO account?

DEGIRO’s minimum deposit is €/£0.01.

Where can I find more information on DEGIRO?

Please check out our comprehensive DEGIRO review.