Interactive Brokers has been one of the most reputable and popular global brokers ever since being founded in 1978, but especially in recent years.

They are known for their global availability (with some exceptions), a wide selection of financial products from over 150 global markets, access to advanced trading tools, and reasonable fees.

All of this makes them mainly appealing to intermediate and advanced investors, but they have also made significant improvements in reaching beginner investors in recent years, quickly becoming one of the largest brokerage firms internationally.

In this article, we will dive deep into the numbers behind Interactive Brokers. Namely, we will explore their assets under management (AUM), number of users, revenue, and more. We will focus on the latest data but will also show how some of these metrics evolved over time.

Our goal is to provide you with valuable information about the platform, regardless of whether you are just thinking about joining it, are already using it, or are just curious. Let’s dive in!

Overview

Interactive Brokers was founded in New York, US, in 1978 by Thomas Peterffy, who is still the company’s chairman and largest shareholder. He emigrated to the United States from Hungary in 1965 and built the company intending to apply cutting-edge computer technology to automate trading and lower costs.

Today, Interactive Brokers is headquartered in Greenwich, Connecticut, with 3,100+ employees across its international offices in North America, Europe, and Asia.

They are also regulated by top-tier financial institutions in multiple countries, and the company is listed on the NASDAQ exchange under the ticker IBKR.

For more information about the platform, please read our comprehensive Interactive Brokers review.

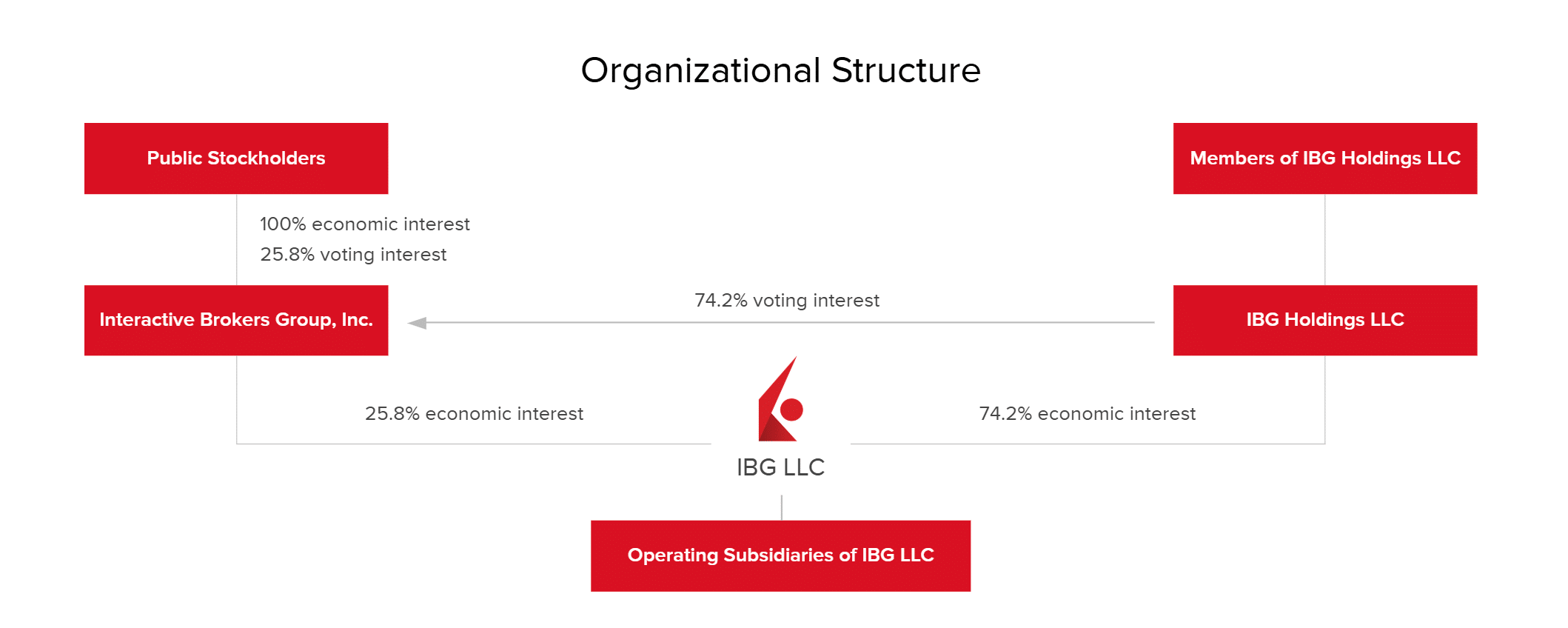

Ownership

Interactive Brokers is a public company, meaning its shares are traded on the stock market. However, only around 24.5% of the company is publicly held, while the remainder is held by their employees and affiliates, with the founder Thomas Peterffy being the largest shareholder at around 70% stake in ownership.

Some of the other major shareholders include Vanguard Group Inc., BlackRock Inc., Orbis Allan Gray Ltd, Kayne Anderson Rudnick Investment Management LLC, and more. (source: fintel.io)

Interactive Brokers Users

As of March 2025, Interactive Brokers group has 3.62 million client accounts.

Interactive Brokers have shown steady growth in their user base over the years. We can see clearly that the events of 2020 (namely the COVID-19 pandemic) have caused a surge in user count, doubling between 2019 and 2021.

The growth in customer accounts hasn’t stopped since then, with Interactive Brokers currently having 3.62 million users (32% higher than the prior year and 2% higher than the prior month). This is especially impressive, given that they broke the 1 million user mark less than three years prior (in 2020).

Besides the pandemic (which was a boost for most financial platforms worldwide), Interactive Brokers made some adjustments to appeal to a wider investor base. Most notably, they abolished their monthly inactivity fee and minimum deposit requirement, as well as launched the beginner-friendly IBKR GlobalTrader App. These changes have significantly lowered entry barriers for beginner investors.

| Year | Customer accounts (thousands) |

| 2006 | 77 |

| 2007 | 95 |

| 2008 | 111 |

| 2009 | 134 |

| 2010 | 158 |

| 2011 | 189 |

| 2012 | 210 |

| 2013 | 239 |

| 2014 | 281 |

| 2015 | 331 |

| 2016 | 385 |

| 2017 | 483 |

| 2018 | 598 |

| 2019 | 690 |

| 2020 | 1,073 |

| 2021 | 1,676 |

| 2022 | 2,091 |

| 2023 | 2,430 |

| 2024 (Nov) | 3,190 |

| 2025 (March) | 3,62 |

Source: Interactive Brokers yearly and monthly reports

Interactive Brokers Assets Under Management (AUM)

With more users flocking to the platform, it was natural to expect a significant increase in assets under management (AUM). We can see similar trends here, with steady growth until 2020, when it exploded, more than doubling from 2019 to 2021.

The year 2022 wasn’t as good for most financial markets, so it was natural to see a significant year-over-year drop in AUM from 2021 to 2022 (nearly 18%). The trend was, however, reversed in 2023, with the AUM on the platform nearly reaching its all-time high by the end of Q3 2023.

As of March 2025, Interactive Brokers group has $573.5 billion in client equity, 23% higher than the prior year and 2% lower than the prior month.

| Year | Assets Under Management (USD billions) |

| 2006 | 6.1 |

| 2007 | 8.8 |

| 2008 | 8.9 |

| 2009 | 15.2 |

| 2010 | 22.1 |

| 2011 | 25.1 |

| 2012 | 32.9 |

| 2013 | 45.7 |

| 2014 | 56.7 |

| 2015 | 67.4 |

| 2016 | 85 |

| 2017 | 125 |

| 2018 | 128 |

| 2019 | 174 |

| 2020 | 289 |

| 2021 | 374 |

| 2022 | 307 |

| 2023 | 426 |

| November 2024 | 540 |

| March 2025 | 573.5 |

Source: Interactive Brokers yearly and monthly reports

Interactive Brokers Average Account Size

As of March 2025, Interactive Brokers has an average account size of ~$158,000.

If we take into account assets under management and the number of customer accounts, we can work out the average account size per Interactive Brokers’ client.

This number has also been rising steadily over the years, breaking the $200,000 mark for the first time in 2014. The growth trend, however, peaked in 2020 at around $269,000, followed by a significant decline in the following years, nearly halving by Q3 2023.

This decline can be attributed to multiple factors, most notably to the significant influx of beginner investors and the rough year of 2022 for most financial markets.

| Year | Average account size (USD thousands) |

| 2006 | 79 |

| 2007 | 92 |

| 2008 | 80 |

| 2009 | 113 |

| 2010 | 139 |

| 2011 | 132 |

| 2012 | 156 |

| 2013 | 191 |

| 2014 | 201 |

| 2015 | 203 |

| 2016 | 220 |

| 2017 | 258 |

| 2018 | 214 |

| 2019 | 252 |

| 2020 | 269 |

| 2021 | 223 |

| 2022 | 146 |

| October 2023 | 148 |

| November 2024 | 169 |

| March 2025 | 158 |

Source: Interactive Brokers yearly and monthly reports

Interactive Brokers Valuation

Interactive Brokers is a public company whose stock (ticker: IBKR) is traded on the NASDAQ stock exchange (the second largest stock exchange in the world). The stock’s price has had its ups and downs but has shown strong growth in the long term.

At the time of this writing (April 23, 2025), the IBKR stock is trading at around $157 per share, giving Interactive Brokers a market cap of around $66.55 billion. As such, the company is a part of the S&P 400 (a stock index comprised of 400 US mid-cap stocks).

To put their market cap into perspective, we can compare it to some of their competitors.

| Company | Market cap (April 23, 2025) |

| IG Group | $3.64 billion |

| Robinhood | $37.27 billion |

| Interactive Brokers | $66.55 billion |

| Charles Schwab | $138.88 billion |

Other competitors such as Fidelity Investments, Saxo Bank, or eToro are not public (listed on the stock exchange), so they can’t be compared in this regard.

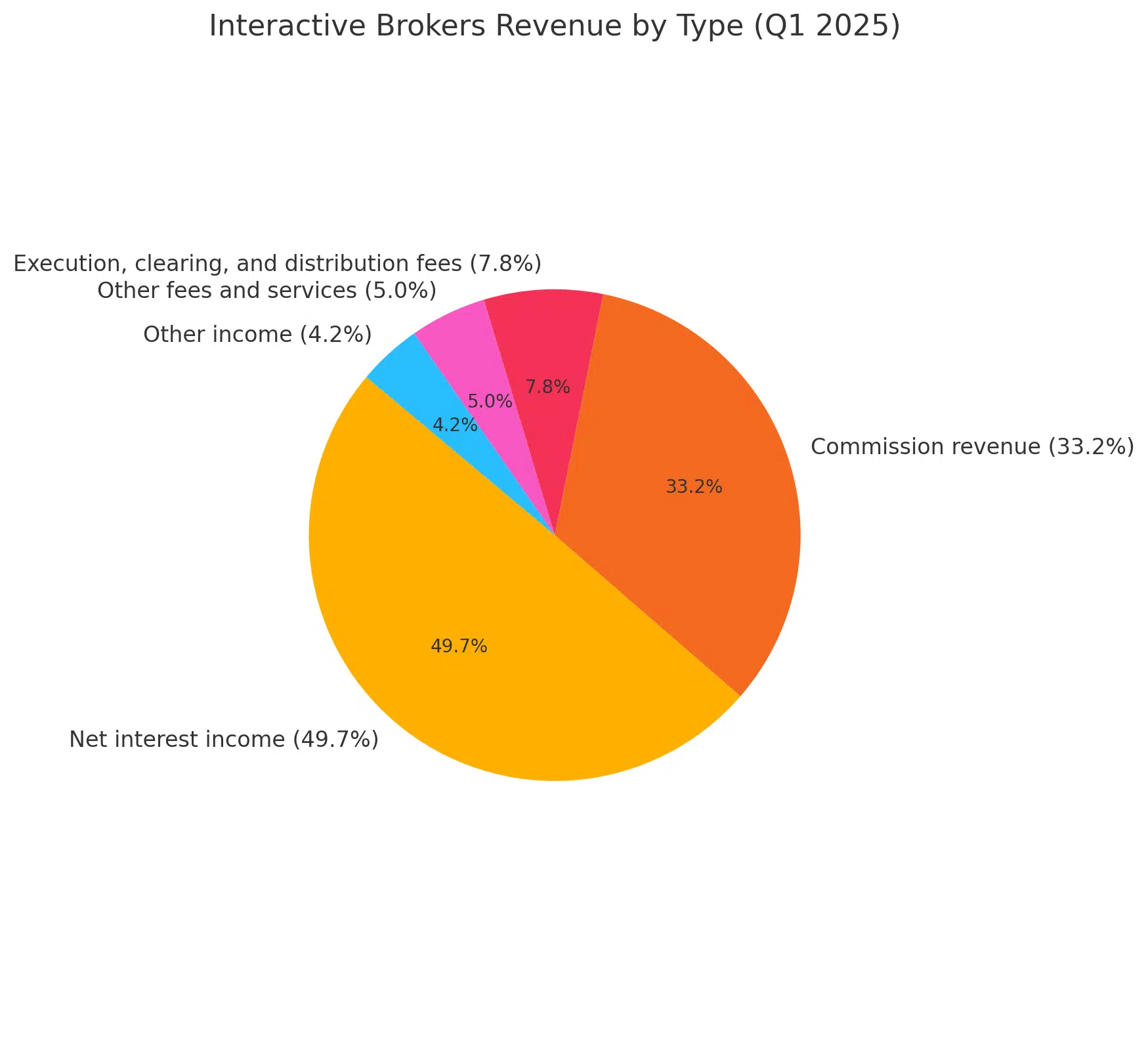

Interactive Brokers Revenue

As an online brokerage platform, Interactive Brokers generates most of its revenue through various fees charged to its clients and their net interest income.

To put it more simply, Interactive Brokers earns a commission on each trade made on its platform, as well as from lending funds to its clients (e.g. through margin accounts). Other notable sources of revenue include other fees (such as execution, clearing, and distribution fees) and various other income streams (investments in other companies, currency diversification strategy, etc.).

The most recent financial data provided by the company (Q1 2025) includes the following:

- Net interest income: $770 million (3% year-over-year increase)

- Commission revenue: $514 million (36% year-over-year increase)

- Execution, clearing, and distribution fees: $121 million (20% year-over-year increase)

- Other fees and services: $78 million (32% year-over-year increase)

- Other income: $65 million

- Pretax profit margin for the quarter: 74%

- Total equity: $17.5 billion

You can access their financial and operating info, including quarterly earnings reports, annual reports, and more, at this link.

Conclusion

Interactive Brokers have positioned themselves as a trustworthy broker that offers good service to most investors on the spectrum from absolute beginners to professionals. Making their impressive range of services cheaper and simpler for beginner investors has particularly been the driving force behind their growth in recent years.

To sum it up, Interactive Brokers is one of the most durable and reputable global brokers. Current trends such as its healthy long-term growth in user base, assets under management, and revenue all point in one direction: Interactive Brokers looks like it’s here to stay.

FAQs

Is Interactive Brokers safe and regulated?

Interactive Brokers is one of the most reputable global brokers and is regulated by top-tier financial institutions in several countries. These include FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, and MNB.

When was Interactive Brokers founded, and by whom?

Interactive Brokers was founded in New York, US, in 1978 by Thomas Peterffy, who is still the company’s chairman and largest shareholder.

In which countries is Interactive Brokers available?

Interactive Brokers is available globally, with some exceptions. You can see the full list of available countries here.

Is there a minimum deposit required to open an Interactive Brokers account?

No, there is no minimum deposit to open an Interactive Brokers account.