Unlike other brokers, DEGIRO does not pay interest on uninvested cash. Whether you hold EUR, GBP, or any other currency in your account, you won’t earn any interest on your parked funds.

In this article, we will explain DEGIRO’s current business strategy and suggest alternatives that can earn you up to 2.20% in euros.

Why doesn’t DEGIRO pay interest on cash?

DEGIRO hasn’t explicitly addressed this, but an analysis of its financial statements shows that it doesn’t pass any interest to its clients and doesn’t plan to.

Let’s first understand why you might expect to receive interest on your cash, whether in EUR, GBP, or another currency. We’ll use EUR as an example since it’s the currency DEGIRO reports in its financial statements.

The European Central Bank (ECB) aims to maintain price stability within the European Union (EU) through its monetary policy, which includes setting interest rates. One such rate is the “deposit facility” rate, which banks earn when they deposit money with the ECB. As of June 2025, that rate was 2.00%.

DEGIRO deposits clients’ money in banks that, in turn, deposit it with the ECB, earning 2.00%. By offering a 0% interest rate to clients, DEGIRO keeps all that interest for itself. In DEGIRO’s financial statements, this gain is recorded as “interest income.”

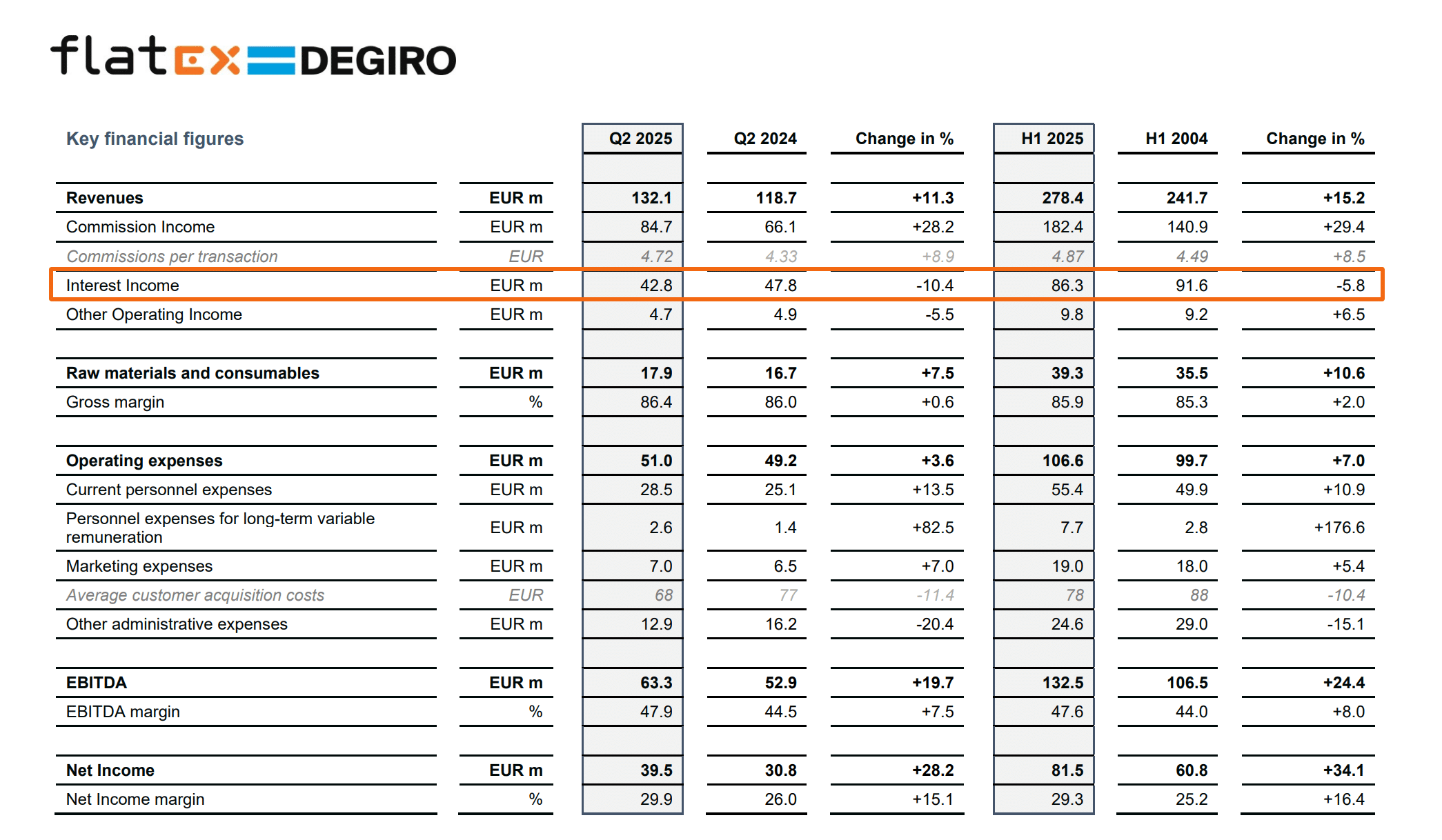

The interim management report for Q2 2025 (found here) shows that “interest income” amounted to 42.8 million euros, making up ~32% of the total “Revenues” (132.1 million euros):

As indicated in their report: “Due to the large proportion of customer deposits held directly with the German Federal Bank, flatexDEGIRO benefits directly from the positive interest rate environment and the on average higher deposit facilities of the European Central Bank (ECB) in 2024.

In addition, flatexDEGIRO increased interest rates for collateralized margin loans to the respective interest rate environment at the beginning of 2024, which, paired with higher utilization of margin loans by flatexDEGIRO customers, also had a positive effect on net Interest Income.” (emphasis added).

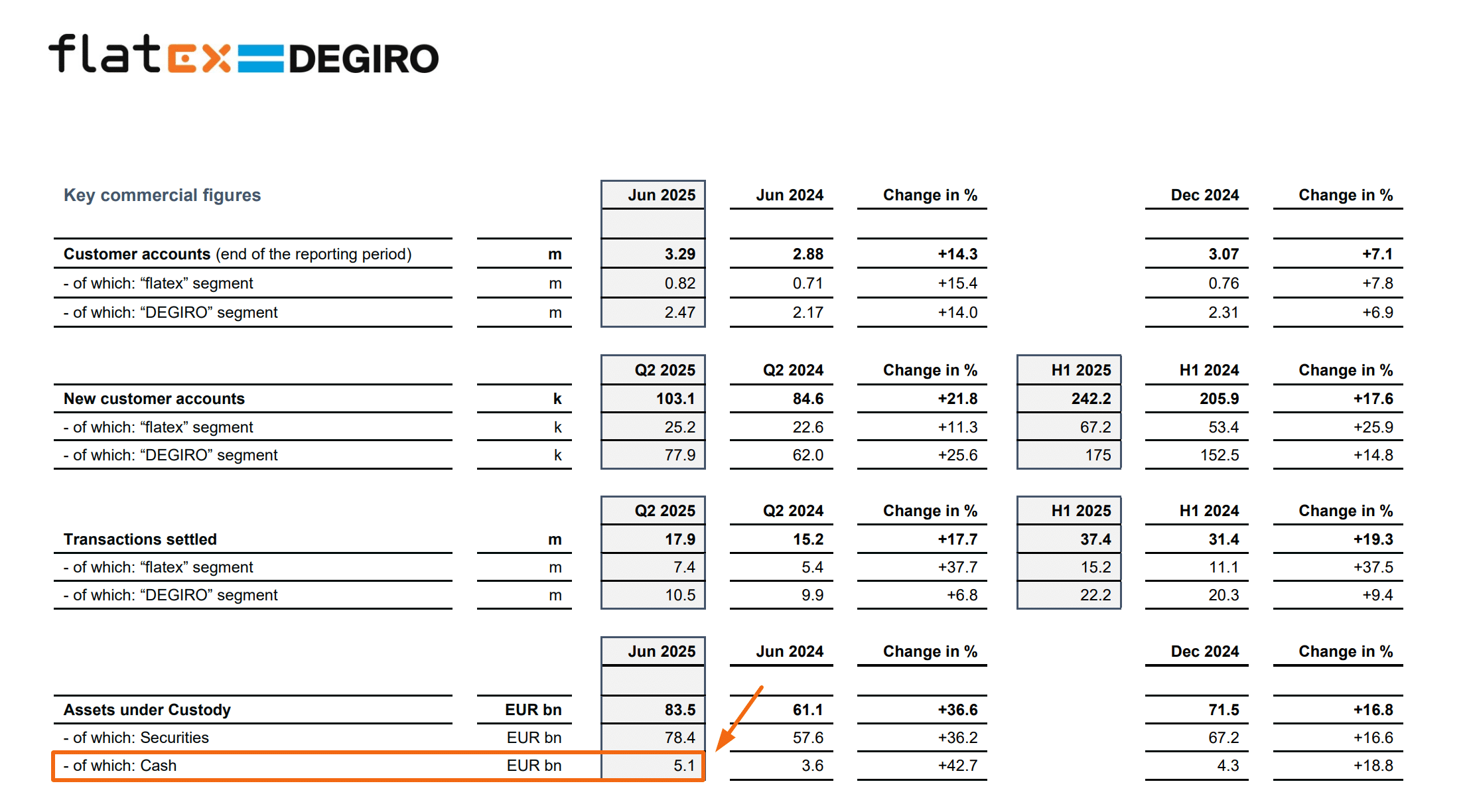

The “Interest income” comes from the interest on the majority of cash under custody (5.1 billion) – clients’ money parked in their accounts:

Will DEGIRO start paying interest on cash?

There is no indication that they will. In fact, the opposite can be implied. The interim management report for Q2 2025 states in the “Outlook” section:

“Interest Income declined by a modest 10 percent despite a significantly lower interest rate environment. Higher average utilization of margin loans and higher average amounts of customer Cash under Custody largely offset this effect.” (emphasis added).

Since interest income makes up a significant portion of DEGIRO’s revenues, it would be unlikely to start paying any interest to its customers, particularly when they have started to come down. If DEGIRO did not pay any interest when interest rates were high, why do they pay now?

Alternatives to earn interest on cash

If you’re looking for alternative brokers that pay interest on your cash, check our articles, where we filter the best brokers and digital banks for getting interest on your cash in EUR. Summary:

| Broker | Interest on cash (EUR) | Amount limits | Where is it held? |

| Trading 212 | 2.20% | No limit | Banks and MMFs* |

| Lightyear | Up to 1.91% | No limit | MMFs* |

| Trade Republic | 2.00% | Interest on cash balances up to €50,000 | Banks |

| Interactive Brokers | 1.394% | No limits, but no interest on cash balances < €10k | Banks and MMFs* |

*Money Market Funds

Updated on 07/10/2025

Bottom line

All in all, DEGIRO is suitable for investing in stocks, ETFs, bonds and other financial instruments. Unfortunately, there are better options to consider when it comes to getting a risk-free return (or very close to it) on your uninvested money.

FlatexDEGIRO Bank Dutch Branch, trading under the name DEGIRO, is subject to integrity oversight by the De Nederlandsche Bank (DNB) and by the AFM (Dutch Authority for the Financial Market).

Do you have any feedback or doubts about this broker? Consider reading our review, then contact us and share your experiences.

Disclaimer: When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.