DEGIRO is one of the largest European online brokerage firms, with over three million customers.

DEGIRO is offering cryptocurrencies in German only, but it plans to expand to the Netherlands, Austria, France, and Spain in Q2 2025.

However, DEGIRO investors can still gain crypto exposure through different financial products, such as ETPs (Exchange Traded Products).

In this article, we’ll uncover how to gain exposure to cryptocurrencies in DEGIRO through ETPs, its pros and cons, and the DEGIRO crypto alternatives for those who want to trade real cryptocurrencies such as Bitcoin.

Can you buy crypto on DEGIRO?

Yes, but only in Germany. In other countries, DEGIRO does not give you direct exposure to any cryptocurrency (Bitcoin, Bitcoin Cash, Dogecoin, Ethereum, Litecoin,…), but it offers indirect exposure to the crypto space through other financial products.

In other words, you cannot buy Bitcoin on DEGIRO, but you can buy an ETP (Exchange Traded Product) that tracks the price of Bitcoin, meaning a similar exposure as buying the cryptocurrency you maybe be looking for.

An ETP is a financial instrument that tracks an underlying security, index, or financial instrument. ETPs can be benchmarked to various investments, including commodities, currencies, stocks, and bonds. So, an ETP is a good product if your only objective is to mimic the price movement of any security.

Cryptocurrency ETPs at DEGIRO

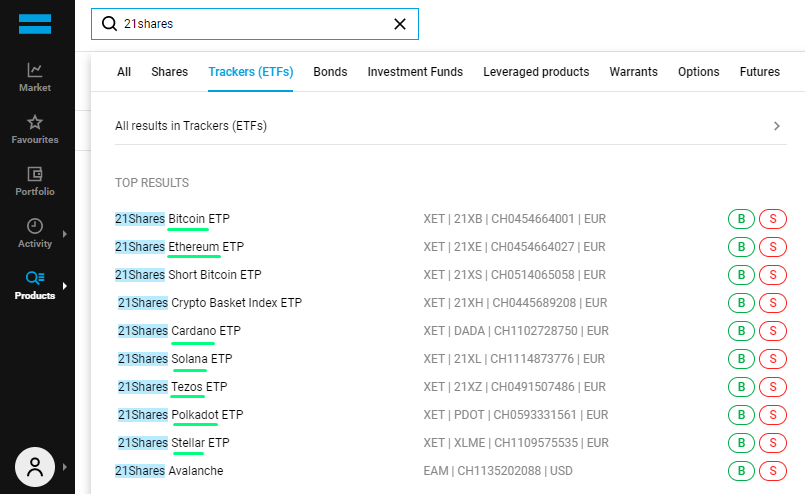

Through 21Shares ETPs, you can gain exposure to Bitcoin, Ethereum, Cardano and other cryptocurrencies at DEGIRO, as you can see:

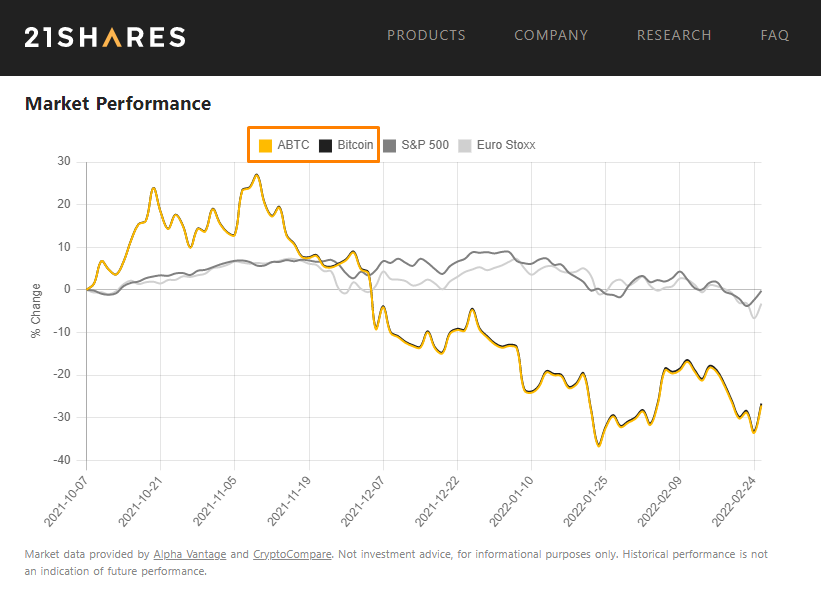

The 21Shares ETPs are non-interest bearing bonds fully physically backed by holdings of the cryptocurrencies that it gives you exposure to. For instance, the “21Shares Bitcoin ETP” (Ticker: ABTC) is designed to provide exposure to the performance of Bitcoin (BTC), the underlying asset, and it does an excellent job of doing precisely that:

The image clearly shows the overlap between the yellow line (21Shares Bitcoin ETP) and the black one (bitcoin itself). There is no divergence between those prices. Given those results, you may wonder: “Why should I invest through a third party (the ETP issuer – 21Shares in this case) when I can simply buy the underlying asset?”

To answer that question, we need to address the advantages and disadvantages of using ETPs to invest in cryptocurrencies.

Pros and Cons of investing in crypto ETPs

Pros

-

Easy way to invest in crypto through your broker. The hassle of opening a new account in an exclusively dedicated crypto broker or another traditional broker with direct exposure to cryptos may not be entirely justified (for organizational purposes, for example).

- The 21Shares ETPs are a highly regulated Swiss product with custody provided by Coinbase. So, you are pretty safe that the company itself will not close doors with no natural consequence, as it happened in other instances.

Cons

-

You have no direct ownership of crypto. Since you do not directly own the cryptos, you can't transfer into another wallet, make peer to peer transactions, use voting rights, and other keyholder rights.

-

Whereas Cryptocurrencies can be traded 24/7, ETPs only transact during market hours. In the first image of this article, you may have noticed the symbol “XET” in all ETPs. “XET” is the short version for Xetra, a german exchange, trading between 9 a.m. to 5:30 p.m. So, you can only buy or sell between those hours.

- You pay a management fee for owing an ETP. 21Shares charges a 1.49% annual fee for its ETP products (automatically deducted in the price of the ETP), which may be pretty expensive in the long term.

Alternatives for real exposure to cryptocurrencies

If your main goal is to own all the cryptos you buy, DEGIRO is not the right platform. As such, here are other alternatives:

eToro

Trusted by over 35 million users worldwide, it gives you access to over 100 cryptocurrencies. You can trade by yourself or copy other investors’ trades through social trading features. Read our eToro summary.

Coinbase

Coinbase is a top crypto exchange in the US and the second-largest exchange worldwide by trading volume. It has over 95 million users spread across 103 countries. Explore our Coinbase summary.

Crypto.com

A crypto investment and staking platform (earn interest). It created a native cryptocurrency called Cronos (CRO). It enables customers to pay for goods and services using the Crypto.com DeFi Wallet App. Explore our Crypto.com summary.

Kraken

Kraken is the fifth largest Bitcoin exchange globally, according to trade volumes. Kraken is operational in over 200 countries, with a chunk of its 12 million users resident in Europe. Read our Kraken summary.

Disclaimer: You should be aware that the risk of loss in trading or holding digital currencies can be substantial. As with any asset, the value of digital currencies can go up or down, and there can be a considerable risk that you lose money buying, selling, holding, or investing in digital currencies.

1# eToro

eToro at a glance

Founded in 2006, eToro is a well-known worldwide fintech startup and leader in the social trading field (following other people’s trades), with over 35 million users worldwide. Apart from letting you trade a wide range of crypto products, it also allows you to invest in other products such as CFDs, ETFs, stocks, commodities and Forex.

The commissions for trading crypto are 1% per trade.

Opening an account and depositing is easy, and you can even try it out with virtual money. You can buy cryptocurrency via various payment options, including credit cards and PayPal. On the downside, the only currency accepted is the USD, so you’ll pay currency conversion costs upon deposit and withdrawal, and spreads can be high for some products.

Want to know more about eToro? Read our full eToro review.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

2# Coinbase

Coinbase at a glance

Coinbase is the most successful crypto exchange by the number of customers. With over 80 million registered users worldwide, it was designed for beginners and professional cryptocurrency investors (for this last group, it also offers its more advanced Coinbase Pro platform).

The range of cryptocurrencies available is enormous, ranging from the most famous ones to the newer digital currencies. Besides the typical web platform, it also has a highly functional mobile app that allows users to buy, sell, and manage their cryptocurrencies at their fingertips.

On the “not so good side”, Coinbase has high fees on its standard Coinbase platform (particularly for smaller transactions – below $200) and a kind of complex fee structure.

Coinbase is licensed for money transmission in most US jurisdictions. In Europe, Coinbase Ireland Limited (and not Coinbase Europe limited) is regulated by the Central Bank of Ireland.

3# Crypto.com

Crypto.com at a glance

Crypto.com is an all-in-one crypto trading platform. Founded in 2016, crypto.com gives its users the possibility to trade, spend and store cryptocurrencies, especially the Crypto.com coin.

It is a solid crypto platform with over 90 crypto assets available at your disposal, offers a pre-paid Visa card that allows crypto spending and even earns rewards. You can keep your crypto in a high yield savings account.

Keep in mind that If you are new to cryptocurrency, you may be overwhelmed by Crypto.com’s trading interface, it will be hard to find any educational materials, and you will experience higher fees for low-volume trades.

4# Kraken

Kraken at a glance

Founded in 2011, Kraken is one of the oldest crypto exchanges in the world. You can easily buy/sell over 65 cryptocurrencies with low fees (up to 0.16%), versatile funding options, 24/7 customer support via live chat and high-security standards.

Kraken has a dedicated section for educational purposes called “Crypto Guides”. These are excellent tools for beginners to be informed before making any decision.

Placing an order by using “instant buy” can be expensive. Fees start at 0.90% for stablecoins and jump to 1.50% for any other crypto. Besides, Kraken’s trading platform and mobile app are pretty basic, so you might be disappointed if you’re looking for more advanced features.

Which crypto platform should you choose?

Before making your final decision, some factors should be addressed, including exchanges security, fees, liquidity, past lawsuits, markets, and user experience. Finding the best cryptocurrency exchange can take some time and effort, but it is definitely worth your time!

The best crypto exchange in your specific case will depend on your experience, preference, and objectives. Explore the websites above and decide for yourself!

A reminder that the above should not be seen as investment advice and should be considered information only. Investors should do their own research and diligence about the best-suited services and opportunities for risk, returns, and impact strategy.

Hope we helped!