Forex is one of the most active markets globally, and accessing it starts with choosing the right broker. At Investing in the Web, we help users find the platform that best fits their needs. If you’re looking for the best European Forex brokers, this guide is for you.

Best Forex Brokers in Europe

Forex brokers tend to focus on currency trading by offering a wide range of currency pairs and providing the tools needed to enhance your trading experience, such as charting tools, technical indicators, and economic calendars.

Here’s the list of our top picks for the best Forex brokers in Europe:

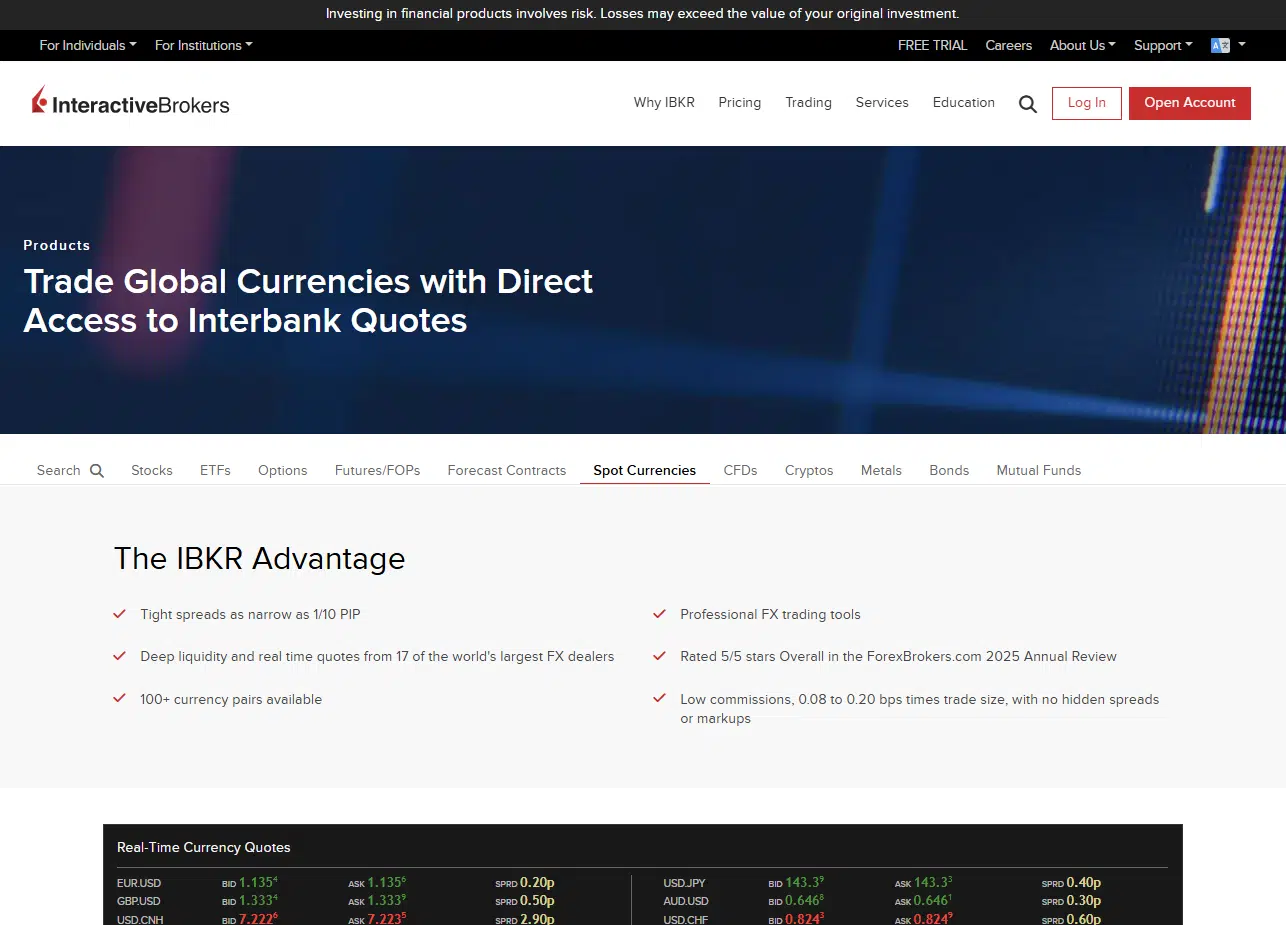

Interactive Brokers: Best overall

Interactive Brokers lets you trade over 100 currency pairs, with deep liquidity and real-time quotes. Plus, it offers low commissions, 0.08 to 0.20 bps times trade size, with no hidden spreads or markups. Their central trading platform, the Trader Workstation (TWS), offers professional FX trading tools, including the FXTrader, built for the currency markets.

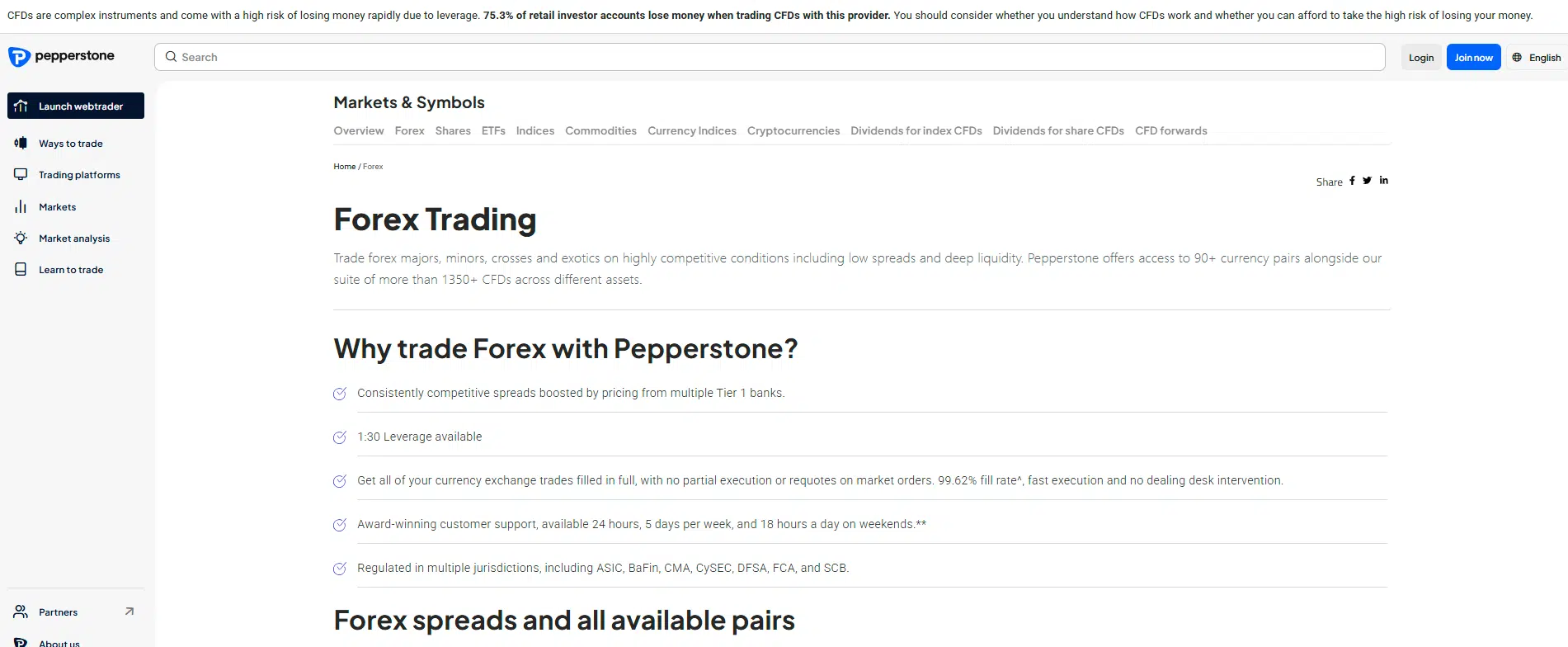

Pepperstone: Best MT4 and MT5 broker. Our second choice.

Founded in 2010, it allows you to trade forex majors, minors, crosses and exotics on highly competitive conditions, including low spreads and deep liquidity. Pepperstone offers access to 90+ currency pairs.

Disclaimer: 74-89% of retail CFD accounts lose money.

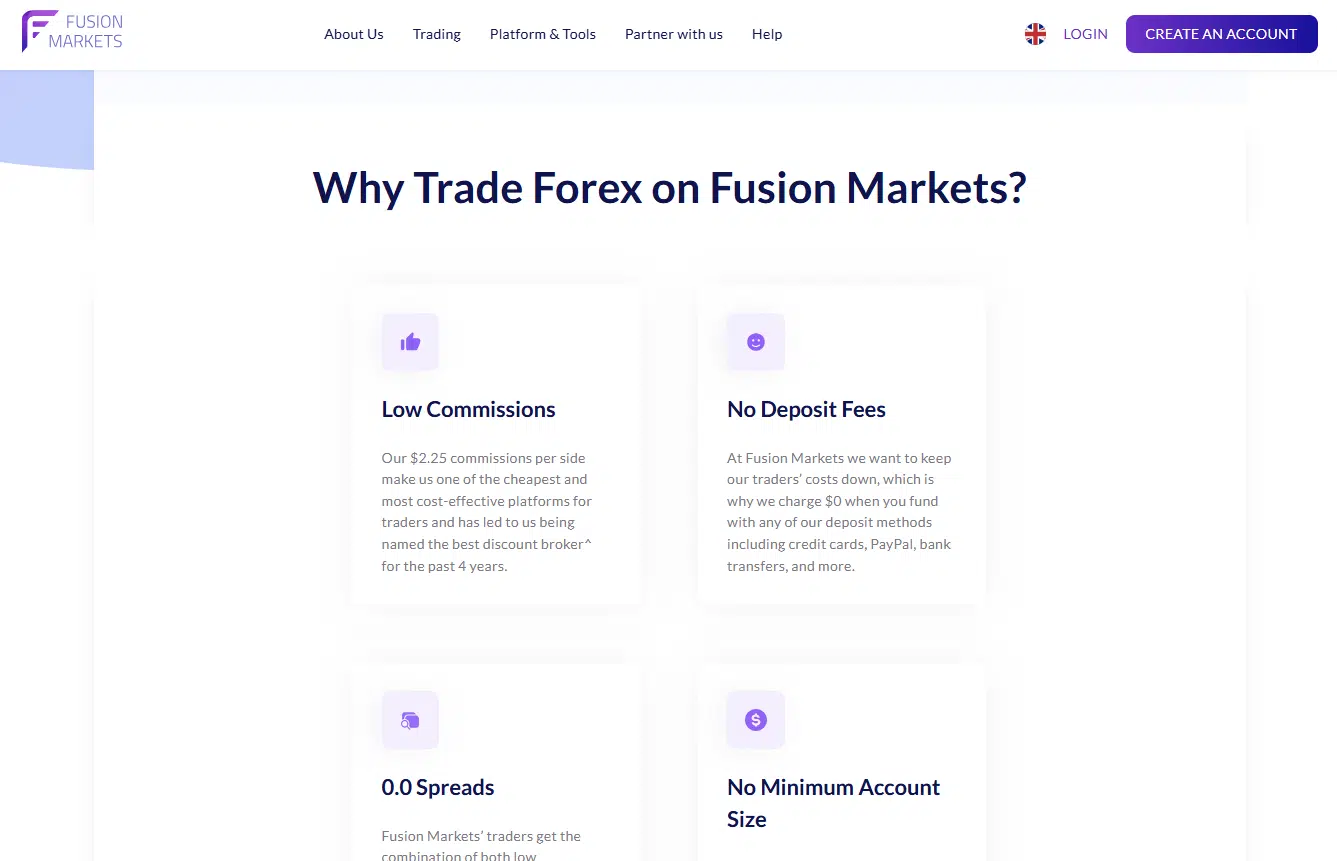

Fusion Markets: Best for the lowest Forex spreads

A CFD and Forex broker based in Australia offering over 250 products, no spreads on most currency pairs, no minimum deposit and a demo account to test their platforms and tools. It provides average spreads of 0.0 on forex majors and a $2.25 commission per trade.

Disclaimer: 74-89% of retail CFD accounts lose money.

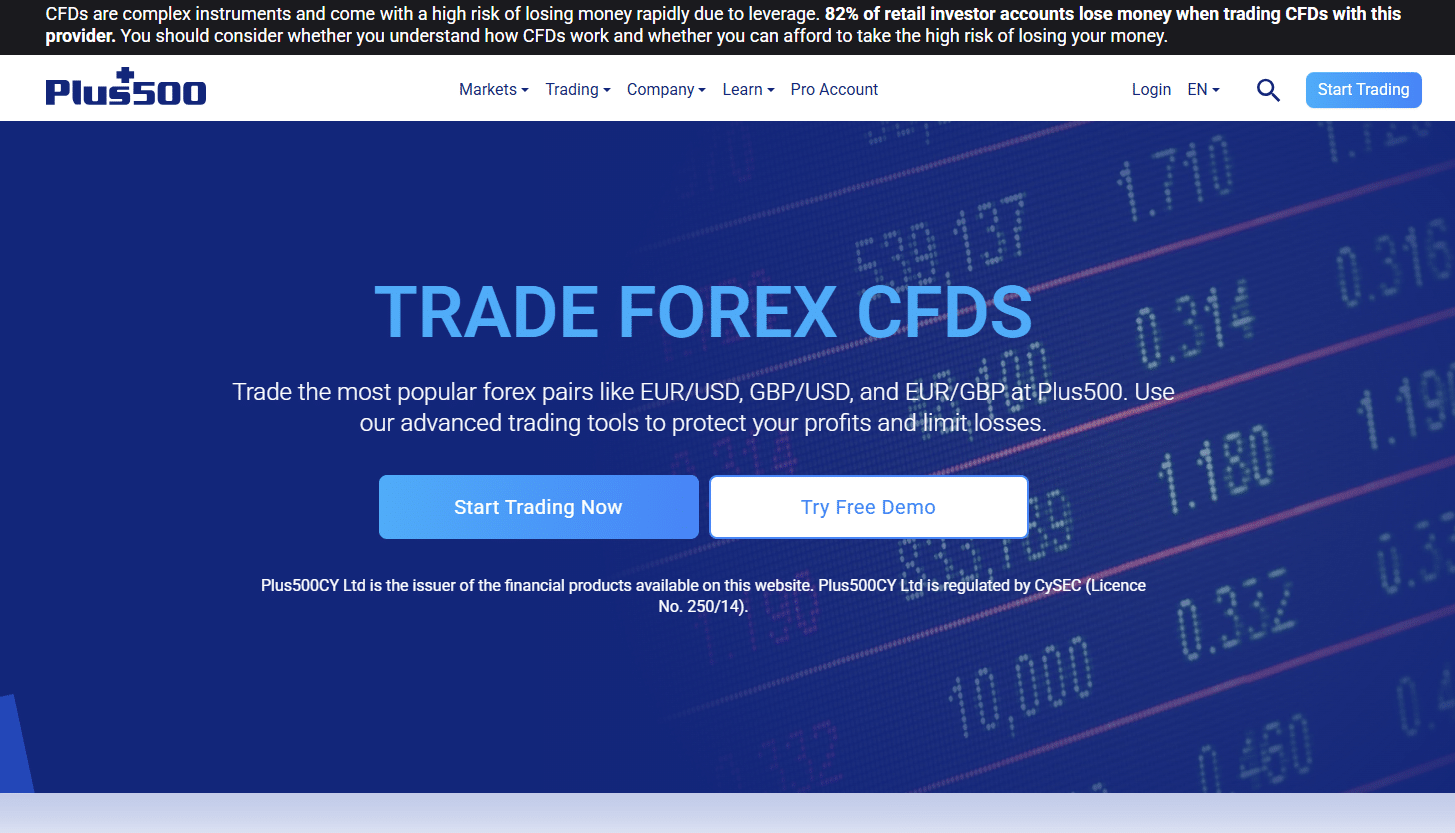

Plus500: Ideal for a demo account

Plus500 is a multi-asset online broker that offers no commissions when trading Forex CFDs. You can trade on 60+ Forex pairs with leverage up to 30x. You also have access to advanced trading tools, including stop loss, stop limit and guaranteed stop to limit losses and lock in profits.

Disclaimer: 82% of retail CFD accounts lose money.

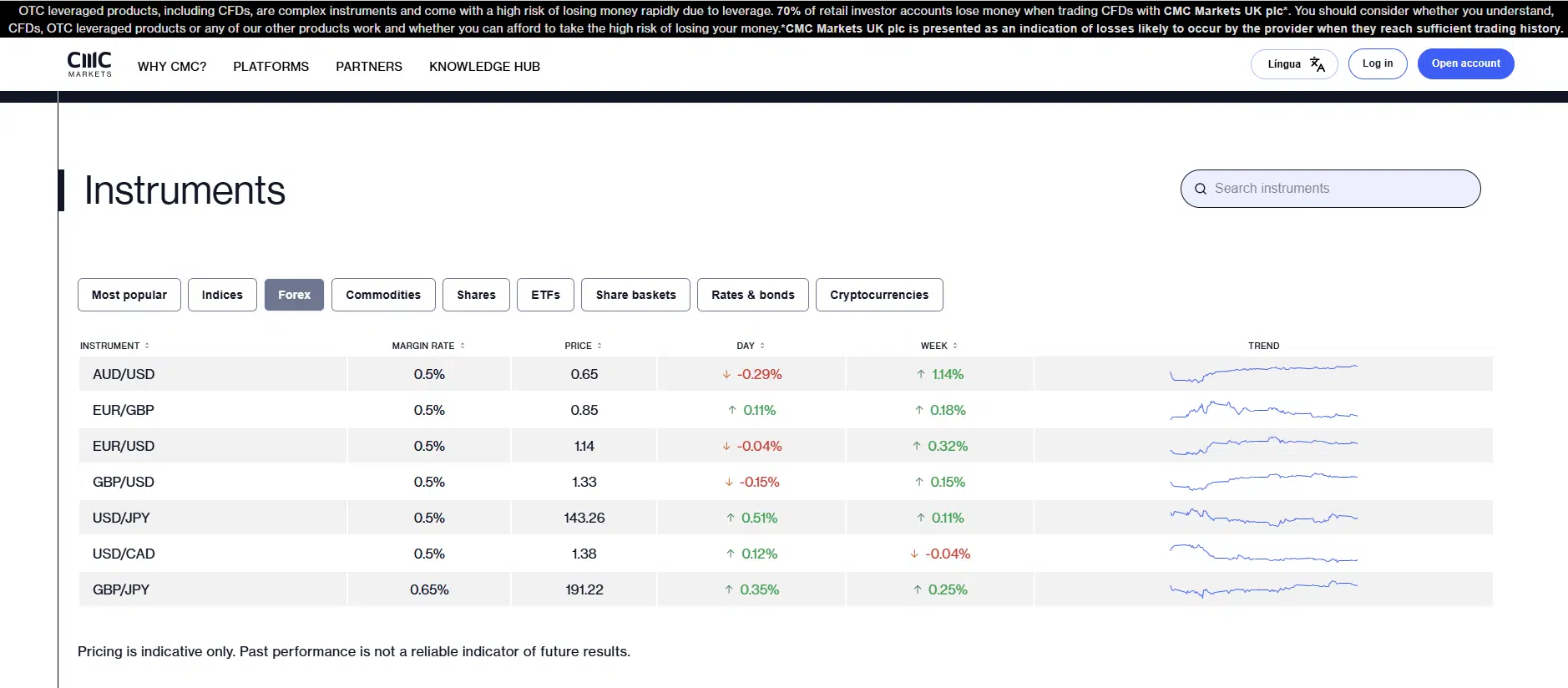

CMC Markets: Best for CFD trading

CMC Markets stands out in the Forex space with over 330 currency pairs, making it one of the most comprehensive Forex brokers globally. Whether you’re trading majors, minors, or exotics, CMC offers tight spreads and competitive pricing, especially for high-volume traders.

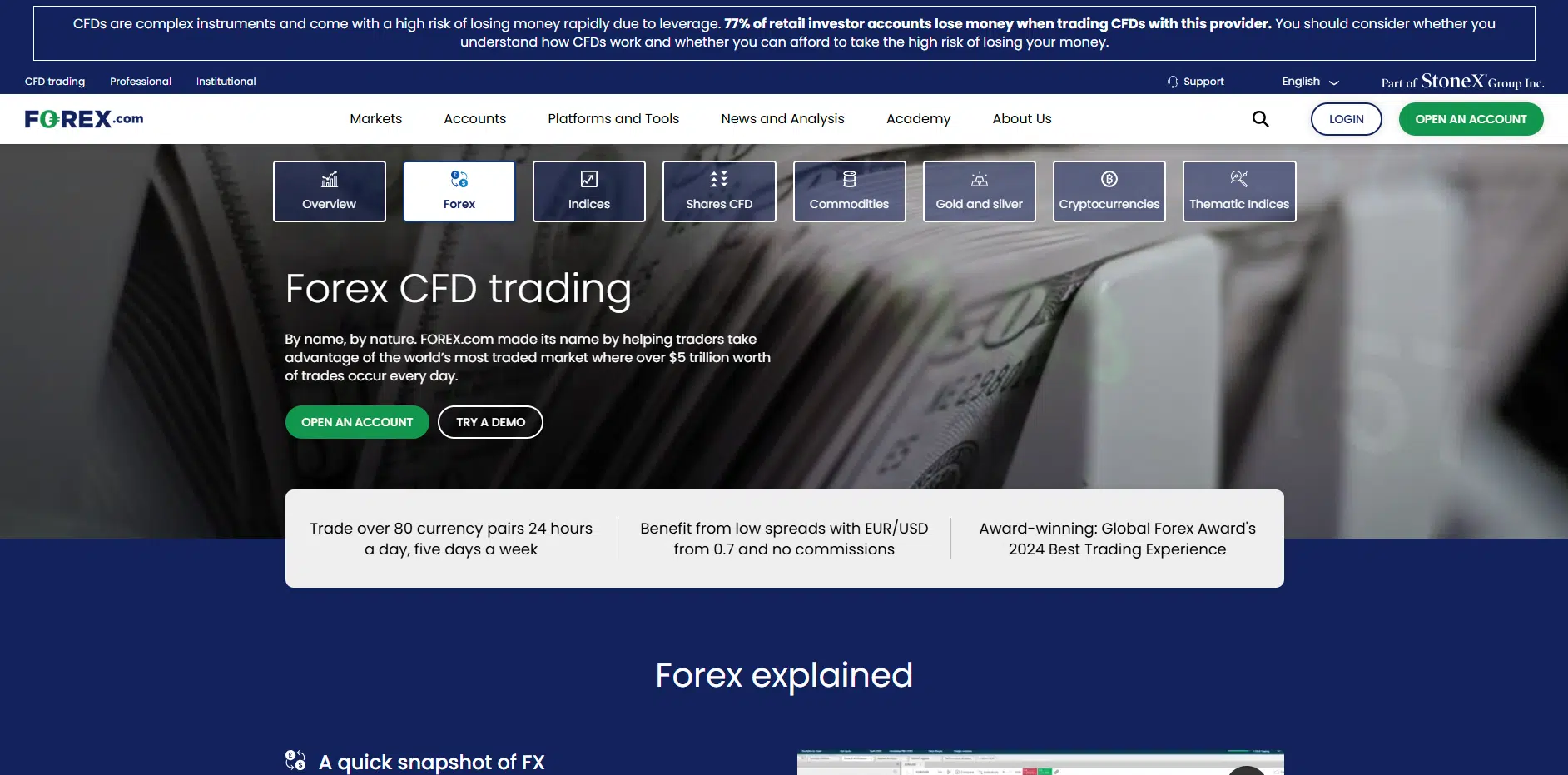

Forex.com: Best for professionals

With over 500,000 clients, Forex.com is an all-in-one trading platform for Forex and CFDs on indices, shares, commodities (including Gold and Silver), and cryptocurrencies. They offer over 80 currency pairs with relatively low spreads for highly liquid pairs, and have different account types that fit beginners and professional traders.

IG: Best for a wide range of markets

IG is known for its extensive 17,000+ financial products available on its platform and its comprehensive research and education materials. They have over 80 currency pairs available and spreads start from 0.6 pips. It is ideal for beginners and professionals looking to trade Forex while having access to other asset classes on the same platform.

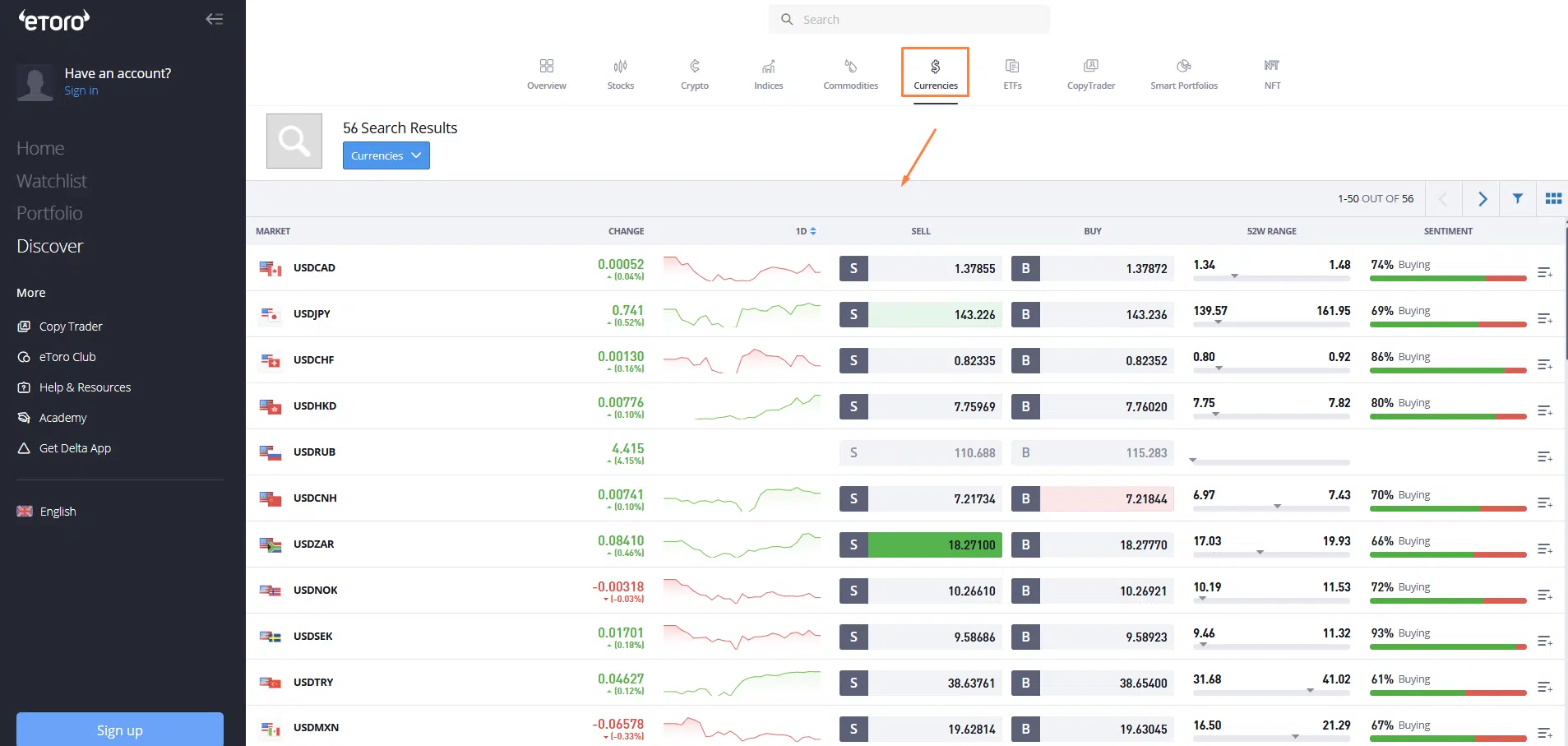

eToro: Best for social trading

eToro is the leading social trading broker, operating in more than 140 countries with over 35 million users. You can trade more than 55 currency pairs with the ability to copy the trades of other experienced investors, which makes the platform attractive for beginners.

Disclaimer: Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

XTB: Best for customer service

XTB is a well-known online broker having an exceptional customer support team compared to other brokers.They have 48 currency pairs available for trading and spreads are relatively low, starting at 0.1 pips.Their trading platforms, xStation 5 and xStation Mobile, are well-designed and user-friendly.

| Forex broker | Minimum deposit | Number of currency pairs | Spreads starting at (pips) |

| Interactive Brokers | €/$/£0 | 100+ | 0.1 (subject to commission) |

| Pepperstone | €/$/£0 | 90+ | variable |

| Fusion Markets | €/$/£0 | 75+ | 0.0 (subject to commission) |

| Plus500 82% of retail CFD accounts lose money. |

€/$/£100 | 60+ | variable |

| CMC Markets | €/$/£0 | 330+ | 0.7 |

| Forex.com | $100 | 80+ | 0 (subject to commission); 1 (no commission) |

| IG | For Card & Paypal: between £250 or $/€300; No minimum for bank transfer |

80+ | 0.6 |

| eToro | $10 in the UK (it varies between countries) | 55 | $0, but spreads starting 1 pip apply |

| XTB | $0 | 48 | 0.9 (standard account); 0 (pro account) |

Spreads are not fixed: they vary depending on the currency pair, liquidity, and market events. The above spreads are mentioned as presented on the broker’s website.

Video summary

Watch a short recap of our highest rated choices in the video below:

#1 Interactive Brokers at a glance

Interactive Brokers is one of the biggest global brokers, where you can access over 150 markets in 33 countries. Almost all financial instruments are available on their platforms, such as stocks, bonds, ETFs, Forex, Funds, Commodities, Options, Futures, CFDs, Crypto Futures, and even penny stocks. The company was founded in 1978, is listed on the NASDAQ exchange (Ticker: IBKR), and is regulated by many international top-tier regulators.

Interactive Brokers offers a robust and professional-grade environment for Forex trading, providing access to over 100 currency pairs across major and emerging markets. With deep liquidity, institutional-grade execution, and low trading costs, it is a top choice for advanced traders seeking efficiency and scale.

Key Forex Highlights:

- Trade 100+ currency pairs with institutional spreads

- Direct market access and smart order routing for optimal pricing

- Ultra-low commission-based pricing with tiered or fixed structures

- Advanced risk management tools and real-time analytics

- Integrated within the Trader Workstation (TWS), a platform designed for professionals

Interactive Brokers supports multiple base currencies, offers leverage up to 30x (this is the maximum allowed per regulation), and operates under strict regulation from top-tier global authorities. While the platform is best suited for experienced users, its mobile app and web platforms offer simplified access to the Forex market for less advanced traders.

With no minimum deposit, transparent fee structure, and reliable execution, Interactive Brokers is ideal for serious Forex traders who value performance, control, and global market access.

We recommend you check out our comprehensive Interactive Brokers review.

#2 Pepperstone at a glance

74-89% of retail CFD accounts lose money.

Pepperstone, founded in 2010, has positioned itself as one of the largest Forex and CFD brokers, helping over 750,000 retail trading accounts worldwide. It has earned several awards for its exceptional services, notably receiving the “Best MT4 and MT5 Broker” award for 2025 from us. With access to over 60 currency pairs and tight spreads starting from 0.0 pips, it particularly appeals to day traders, scalpers, and algorithmic traders.

Pepperstone operates under strict regulations from top-tier authorities like ASIC and FCA, reinforcing its dedication to providing a secure and trustworthy trading environment. The broker offers various trading platforms, including MetaTrader 4, MetaTrader 5, cTrader and TradingView, with features like advanced charting and automated trading.

Account types cater to various trader needs. The Razor account, favoured by scalpers and users of Expert Advisors, offers spreads starting from zero pips with a small commission, while the Standard account incorporates commissions into the spread rate and is suitable for those preferring a straightforward approach to trading.

Key Forex Highlights:

- Trade 60+ major, minor, and exotic Forex pairs

- Low latency execution and spreads from 0.0 pips on Razor accounts

- Commission-based and spread-based pricing models to suit different trading styles

- Regulated by FCA, ASIC, and other top-tier authorities, ensuring a secure trading environment

Pepperstone’s Forex offering is enhanced by strong platform flexibility, fast execution speed, and deep liquidity from multiple tier-1 providers.

Although the broker focuses solely on CFD products (meaning you do not own the underlying asset), it remains one of the best choices for Forex traders seeking cost-efficiency and execution quality.

Read our Pepperstone review for a deeper insight!

#3 Fusion Markets at a glance

74-89% of retail CFD accounts lose money.

Founded in 2017, Fusion Markets is a Forex and CFD broker with offices in Australia, Vanuatu and the Seychelles, but accepting clients from most countries worldwide (exceptions include the US and New Zealand). The Forex trading environment is compelling: tight spreads and access to over 90 currency pairs.

On AUD and USD currencies, the commissions offered are $2.25 per side commission, so a standard lot will be $4.50. On the “Zero Account”, spreads start from 0.0 and on the “Classic Account”, the spreads start at 0.9. The main difference between the two is that the latter includes your commissions in each trade. Apart from the trading fees, there are no deposits and some withdrawal fees.

Fusion Markets offers several investment platforms in desktop, web and mobile apps, namely MetaTrader 4 and 5, and cTrader. All platforms give you customisable charts, fundamental and technical indicators and an intuitive interface. cTrader presents more advanced market depth options like price depth and VWAP depth.

The demo account is particularly useful for a beginner. It lets you have real hands-on experience as you would be using real money with real-time market conditions, but in a risk-free environment. So, when switching to a real account, you will notice no difference between your training and real-life investing.

Fusion Markets is regulated in Australia, Vanuatu and Seychelles. In Australia, Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC) under the License nº 385620, a top-tier financial regulator. In Vanuatu and Seychelles, it is regulated by the Vanuatu Financial Services Commission (VFSC) and the Financial Services Authority of Seychelles (FSA), respectively.

We recommend you check out our comprehensive Fusion Markets review.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

#4 Plus500 at a glance

82% of retail CFD accounts lose money.

Founded in 2008, Plus500 is an online broker offering various financial products, including real shares and CFDs on forex, indices, shares, commodities, options, ETFs, and cryptocurrencies. It is available in over 50 countries and is listed on the London Stock Exchange.

Plus500 offers a straightforward and accessible way to trade the Forex market through its proprietary WebTrader platform. While primarily known for its CFD offering, the platform gives retail traders access to major and minor currency pairs with user-friendly tools and regulated protection across various jurisdictions.

Key Forex Highlights:

- Trade major and minor Forex pairs with leverage up to 30:1 (per EU regulation)

- WebTrader platform is intuitive, stable, and available across devices

- Forex orders supported: market, limit, stop loss, and trailing stop

- Spreads vary by currency pair, depending on liquidity and market conditions

- Regulated by top-tier authorities, including the FCA (UK) and CySEC (EU)

Plus500 is well-suited to beginner and intermediate traders seeking a clean interface and simplified experience. While spreads may be wider than some ECN-style brokers and Forex is only available via CFDs, the platform provides a reliable and regulated environment for retail Forex trading.

Finally, it is regulated by financial regulators like the FCA and CySEC, meaning that Plus500 is appropriately supervised and that there is an investor protection scheme under the entity in which you open an account. For instance, if you open an account as a European investor through Plus500CY Ltd, you are protected up to €20,000. Additionally, Plus500 provides negative balance protection for CFD trading on a per-account basis, only to retail clients from the European Union (regulatory requirement).

Want to know more about Plus500? Check our Plus500 Review.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

#5 CMC Markets at a glance

69% of retail CFD accounts lose money.

CMC Markets is a global CFD and Forex broker, operating since 1989 and listed on the London stock exchange. It is regulated by several international regulators, such as the UK’s FCA and the German BaFin.

CMC Markets is a long-established Forex and CFD broker, offering over 330 currency pairs, making it one of the most diverse Forex selections in the industry. With deep liquidity, competitive pricing, and flexible platforms, it caters to both active traders and those seeking broad market access.

Key Forex Highlights:

- Access to 330+ Forex pairs, including majors, minors, and exotics

- Tight spreads and no deposit or withdrawal fees

- Multiple platform options: CMC proprietary platform, mobile app, and MetaTrader 4 (MT4)

- Support for up to 10 base currencies, reducing conversion costs

- Regulated by FCA, BaFin, and other top-tier authorities

- Investor protection up to £85,000 (UK) and €20,000 (EU)

Unlike other brokers, CMC Markets supports up to 10 account currencies, and you can fund your account by credit or debit card, bank wire transfer, or PayPal. They do not charge any fees on deposits or withdrawals. However, if your account has no trading activity for 12 months, you will be charged a monthly inactivity fee of $15.

On the downside, you won’t be able to invest in real stocks or cryptos.

#6 Forex.com at a glance

76% of retail CFD accounts lose money.

Forex.com is a global online broker regulated by several top-tier regulatory authorities, such as the NFA and CFTC in the US, the FCA in the UK, the IIROC in Canada, and the FSA in Japan. Additionally, it is a subsidiary of a publicly traded company, StoneX, which makes it a safe broker due to strict requirements regarding its financial information reliability and availability. The Financial Services Compensation Scheme (FSCS) provides UK and EU Forex.com clients asset protection for up to £85,000 and up to €20,000, respectively.

Key Forex Highlights:

- Trade 80+ Forex pairs, including majors, minors, and exotics

- Multiple account types: spread-only, commission-based, and active trader discounts

- Platform options: MetaTrader 4, MetaTrader 5, and Forex.com’s proprietary trading platform

- No deposit or withdrawal fees; minimum deposit of $100

- Regulated in the US, UK, Canada, and others

Forex.com is flexible when it comes to trading platforms. They offer you three platforms: the two popular MetaTrader platforms, MT4 and MT5, and their exclusive trading platform, which can be accessed through their desktop app, the web, or the mobile application. It offers powerful tools for experienced traders requiring sophisticated functionality and analytic tools.

Forex.com does not charge any commission on depositing or withdrawing funds. The minimum deposit is $100, and you can fund your account through a bank wire transfer, credit or debit card, or Neteller or Skrill. As for pricing, Forex.com offers three accounts with different fee structures, ranging from spread-only to commission-based accounts, with special discounts for large trading volumes.

On the downside, Forex.com charges a monthly inactivity fee of $15 if you don’t trade for 12 months, and, as previously mentioned, they have limited financial instruments in some locations.

#7 IG at a glance

70% of retail CFD accounts lose money.

IG Group, headquartered in London and listed on the London stock exchange, is one of the oldest and largest financial companies to offer brokerage services. Its primary regulator is the FCA and several other international authorities, such as the ASIC in Australia, the BaFin in Germany, and the FINMA in Switzerland.

Key Forex Highlights:

- 80+ Forex pairs covering majors, minors, and exotic currencies

- Advanced and user-friendly proprietary platform plus support for MetaTrader 4

- Extensive market research, analysis tools, and educational resources via IG Academy

- Multiple funding options: credit/debit card, bank transfer, PayPal

- Account protection varies by region: up to £85,000 (UK), €20,000 (EU), CHF 100,000 (Switzerland)

- Minimum deposit ranges from $/£250 to €300, depending on location

You can fund your account using a credit card, debit card, bank transfer, or PayPal. The minimum deposit to open an account varies depending on your country, but it ranges between $/£250 and €300. IG has its own trading platform and allows you to use MT4 if you prefer.

As for safety and protection, it depends on which IG entity you opened your account with. For example, UK clients are protected up to £85,000; protection under the Swiss Financial Markets Supervisory Authority is up to CHF100,000; while other EU clients are protected for up to €20,000. Keep in mind that this protection is only in case of IG bankruptcy and is not related to your portfolio’s performance.

#8 eToro at a glance

61% of retail CFD accounts lose money.

Since 2006, eToro is a unique broker in the Forex space, offering a social trading platform where users can copy the trades of experienced investors. With access to over 50 currency pairs, eToro blends Forex trading with community-driven insights, making it a compelling option for beginners and intermediate traders.

Key Forex Highlights:

- Trade 50+ Forex pairs, including majors, minors, and selected exotics

- Social trading features allow you to follow and copy top-performing traders

- Regulated by FCA, ASIC, and CySEC, ensuring strong investor protection

- Multiple funding options: credit/debit card, bank transfer, PayPal, Skrill, Neteller

- Minimum deposit from $50, depending on region

- Intuitive platform focused on simplicity rather than advanced technical tools

eToro is ideal for those looking to learn from others or simplify the trading process through automation. While its Forex offering is less extensive than traditional brokers and spreads may be wider, its community features, low entry barrier, and strong regulation make it a great starting point for aspiring Forex traders.

eToro developed its web trading platform, which is intuitive and user-friendly for beginners. Finally, they charge a $5 per withdrawal request and a $10 monthly fee after one year of inactivity.

Read our eToro review here.

#9 XTB at a glance

76-83% of retail CFD accounts lose money.

XTB is a global CFD broker headquartered in Poland and listed on the Warsaw Stock Exchange, offering access to 48+ currency pairs with competitive spreads, no minimum deposit, and robust trading platforms. With regulation across multiple European jurisdictions and over 20 years of market presence, XTB provides a secure and reliable environment for Forex trading.

Key Forex Highlights:

- Trade 48+ Forex pairs, covering major and minor currencies

- Platforms: xStation 5 (desktop) and xStation Mobile, both user-friendly and feature-rich

- No minimum deposit, making it accessible to all traders

- Funding methods include bank transfers, credit/debit cards, Skrill, and Paysafe

- Regulated by FCA, KNF, CySEC, DFSA and FSC, offering high levels of investor protection

- Competitive spreads, especially on major pairs; commission-free trading model

XTB suits beginner to intermediate Forex traders who value strong educational resources, responsive support, and a seamless trading experience. While the number of Forex pairs is more limited compared to some global brokers, its transparent pricing, regulatory framework, and platform quality make it a solid choice for everyday Forex trading.

On the negative side, although XTB does not charge a fee on withdrawal amounts greater than €80, it charges a €16 fee for smaller amounts. Additionally, their product portfolio is limited to CFDs and Forex; after 12 months of inactivity, they start charging €10/month.

Read our XTB review for further insights.

What makes a Good Forex Broker?

Many features and benefits should be considered when looking for a good Forex broker, whether you are a beginner or an experienced trader. Among the most critical factors that you might want to check are:

- Regulation: It is the most important criteria, as you must ensure that the company is legit before transferring your money. As such, we recommend that you never consider a broker not regulated by a reputable authority.

- Commissions: Good brokers usually offer tight spreads and low commissions, but the rates depend on the instrument and market you are trading in.

- Deposit and withdrawal method: A reputable European broker will make it easy and convenient for users to deposit and withdraw funds by offering several methods, such as wire transfer, debit or credit card, or other electronic payment methods.

Bottom line

Searching for the best Forex broker in Europe and comparing different trading conditions is challenging. Many factors should be considered, and it is time-consuming to gather all the information to choose the best one that fits your needs. Our analysts performed this task and concluded their findings in this review of the “Best Forex Brokers in Europe”, summarized below:

Interactive Brokers

Best overallPepperstone

Best MT4 and MT5 brokerFusion Markets

Best for lowest Forex spreadsPlus500

Ideal for a demo accountCMC Markets

Best for CFD tradingForex.com

Best for professionalsIG

Best for all-inclusive productseToro

Best for social tradingXTB

Best for customer service

You can always try our “BrokerMatch” tool to know which broker might be best for you or you can also check our comparison table for an in-depth overview of the main features of several global brokers. You can also read our reviews for more information about the products and services offered by each broker.

Whether you’re a beginner trader looking to start your trading journey or an experienced investor searching for enhanced brokerage services, we hope this article saved you some time while searching for European Forex brokers. We recommend you do your own research to assess which online broker will be better for you (a demo account might be helpful).

FAQs

Can you trade in Forex without a broker?

No, you can’t have direct access to the Forex market without a broker. Still, you can exchange currencies over the counter at any exchange dealer.

Can I trade Forex with $10? And $100?

Yes, you can trade Forex with amounts as low as $100 or even $10. But the trade size will be small.

How to open an account with a Forex broker in Europe?

It is very simple, you just need to visit the broker’s website and sign up by filling the required fields and uploading the needed documents.

What is a PIP (percentage in point)?

Pip stands for “percentage in point”, which is the unit of change in an exchange rate. For example, 1 pip change in a rate is equal to a 0.0001 change.