Hello, fellow investor! Upon analysing key factors regarding Pocket Option, we do not recommend opening an account with them. You should not ignore several red flags we have detected during our due diligence, which we’ll dive into in this review.

As a side note, we have done a similar review on Quotex, another binary options broker which resembles a scam.

Looking for supervised and regulated brokers to invest in? Check our list of recommended brokers!

Video summary

Watch a short recap of our review in the video below:

What is Pocket Option?

Pocket Option is a non-regulated online broker that exclusively offers binary options, a financial product where your payoff is “all or nothing” within a time frame defined by you.

Let’s say that Apple is trading at $100, and you believe it will be trading above that in the next 5 minutes. You get your money back plus a premium if the stock is above $100. If it finishes below $100, you lose all your money. That’s it.

Is Pocket Option regulated?

By exploring their website, we detected a notorious red flag: Pocket Option has no regulatory approval. Our first action in any broker review is to assess if reputable financial authorities regulate the platform within the US, European Union and/or the UK, like the Securities and Exchange Commission (SEC) or the Financial Conduct Authority (FCA), a criteria that Pocket Option did not pass.

The company behind the Pocket Option website, Infinite Trade LLC, is registered in the Republic Of Costa Rica, San Jose. The real owner of Pocket Options changes the name frequently, as previously it was named “Gembell Limited”, a company registered in the Republic of the Marshall Islands, an offshore tax haven. It is not supervised by top-tier regulators, and there is no guarantee that investors will be compensated if the broker goes bankrupt. Investor protection schemes are reliable within the US, EU or UK financial regulatory environment but not in tax havens.

Indeed, the FCA has already issued a warning stating that the firm is not authorised to provide, promote or offer financial services or products in the UK.

As said earlier, please keep in mind that it is common for these kinds of firms to change names regularly.

Finally, it was difficult to find any details about the company. There is no LinkedIn company page, no information on the employees… Nothing.

Trustpilot reviews: Are they fake?

If you search for “Pocket Option” in Trustpilot, you will get several domains like “pocketoption2.com” or “pocketoptionco.uk” (none of these domains exist) instead of the real one: “pocketoption.com”.

When we first conducted this Pocket review, the company was live on TrustPilot with over 3,000 reviews; however, it had already been flagged by TrustPilot (see image below). After carefully reading through dozens of reviews, we noticed that most positive feedback was untrustworthy. We think most of these are fake. Many of these reviews employed broad statements, lack specific details, and utilise language that is not typical of genuine customer reviews.

Finally, we clearly saw a pattern of complaints from the negative reviews: difficulties when withdrawing your money, price discrepancies and chart manipulations.

Aggressive sales approach

A typical behaviour within platforms that want to take your money as soon as possible is to create a feeling of FOMO (Fear Of Missing Out). Within the homepage, two elements stand out:

- Continuous pop-ups in the bottom left corner of the screen with messages like “David earned $250 in 32 seconds”

- A Registration fill out that is impossible to hide

These practices are rarely present, if ever, in regulated online brokers.

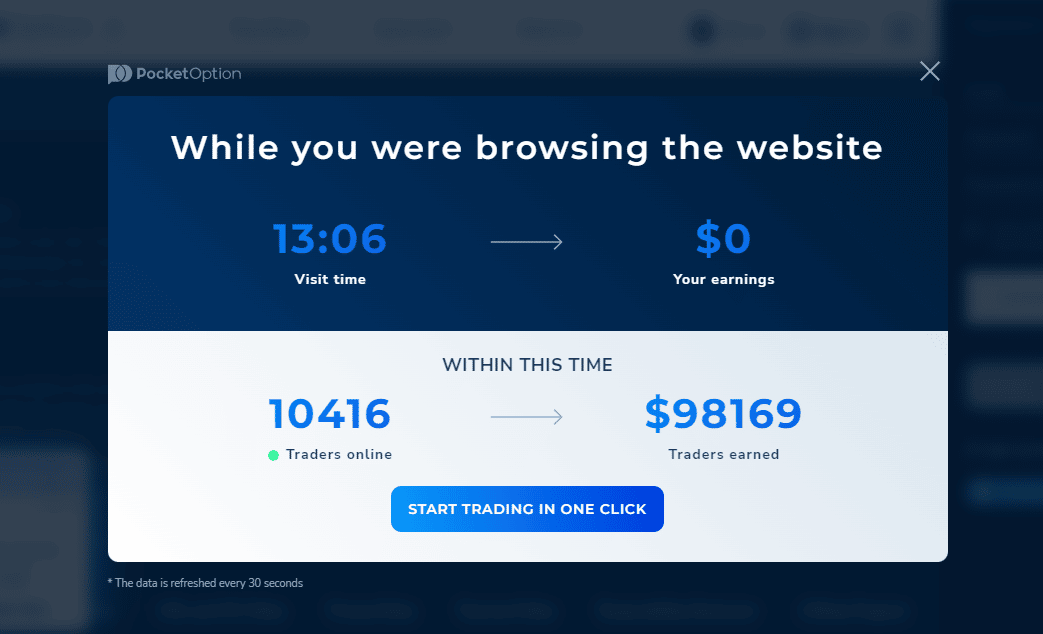

As if that weren’t enough, Pocket Option shows a pop-up message that appears after browsing their website for a while (It shows 13:06 minutes since I was exploring other related websites while having their page open). This is clearly an aggressive sales tactic to show that “you are wasting your time” by wanting to know more about the platform before signing up.

Did you know that they accept deposits from restricted countries?

It is mentioned in the footer that “Depending on the region and payment method. Infinite Trade LLC does not provide service to residents of the EEA countries, USA, Israel, UK and Japan” (our highlight). However, they accept deposits without asking you first where you are located.

Eventually, you will want to withdraw your money. When that happens, Pocket Option will require you to verify your account, meaning they will know you’ve deposited from a restricted country. As such, your Pocket Option withdrawal will likely be denied.

So, is Pocket Option a scam?

At Investing in the Web, we are 99% convinced that you are not safe putting your money in this company. Since it is missing the 1%, we will “control” ourselves and not call it a scam, but it operates very dubiously.

Again, we strongly recommend not investing in companies with so many red flags, no matter how appealing their offering might be (Pocket Option minimum deposit, demo account or even a Pocket Option promo code).

Regulated and supervised Online Brokers (our recommendations)

- Interactive Brokers: Best overall Online Broker

- eToro: Best for commission-free investing and social trading

- Webull: Best low-cost US Broker

- Public: Best US broker for fees transparency

61% of retail CFD accounts lose money.

Bottom line

There is some information you should verify before considering opening an account with any broker:

- Always double-check if the platform is regulated in major developed countries (US, UK, and EU);

- Search on reputable regulators’ websites (FCA, SEC,…) to check if the platform is registered or, on the other hand, is on a warning list;

- If you feel a “salesy” approach, dig deeper;

- Do not trust all reviews you read online (check several sources), particularly if no negative points are mentioned.

We hope you found this review useful!

FAQs

What are binary options?

Binary options are a complex financial product with only two outcomes: win or lose. Binary options have an expiration date (set by you), a strike price and a specific payoff. Let’s use an example for better understanding: For example, it is Monday morning, and you believe stock X will be trading above $85 at 2:30 p.m. Through a binary option, you can bet that the stock will finish above $85. If it does, you win. If not, you lose the amount you bet. It resembles gambling more than investing. Given the all-or-nothing payout structure, binary options are sometimes referred to as “all-or-nothing options” or “fixed-return options.”

Please note that binary options differ from more conventional options since the latter lets you manage your position (trading the option before the expiration date). While a binary option is an “all or nothing” approach.

How does Pocket Option make money?

Supposedly, Pocket Options make money by providing a lower payout ratio when someone earns. Example: You bet $50 that stock Y will rise above $20 in the next minute. Another person believes it will drop below $20, an opposite view to yours. Pocket Option may pay, for instance, $40 to the winner. So, one of the investors will lose the $50, and the other will win $90 (initial $50 + $40), so Pocket Option keeps the $10 for itself.