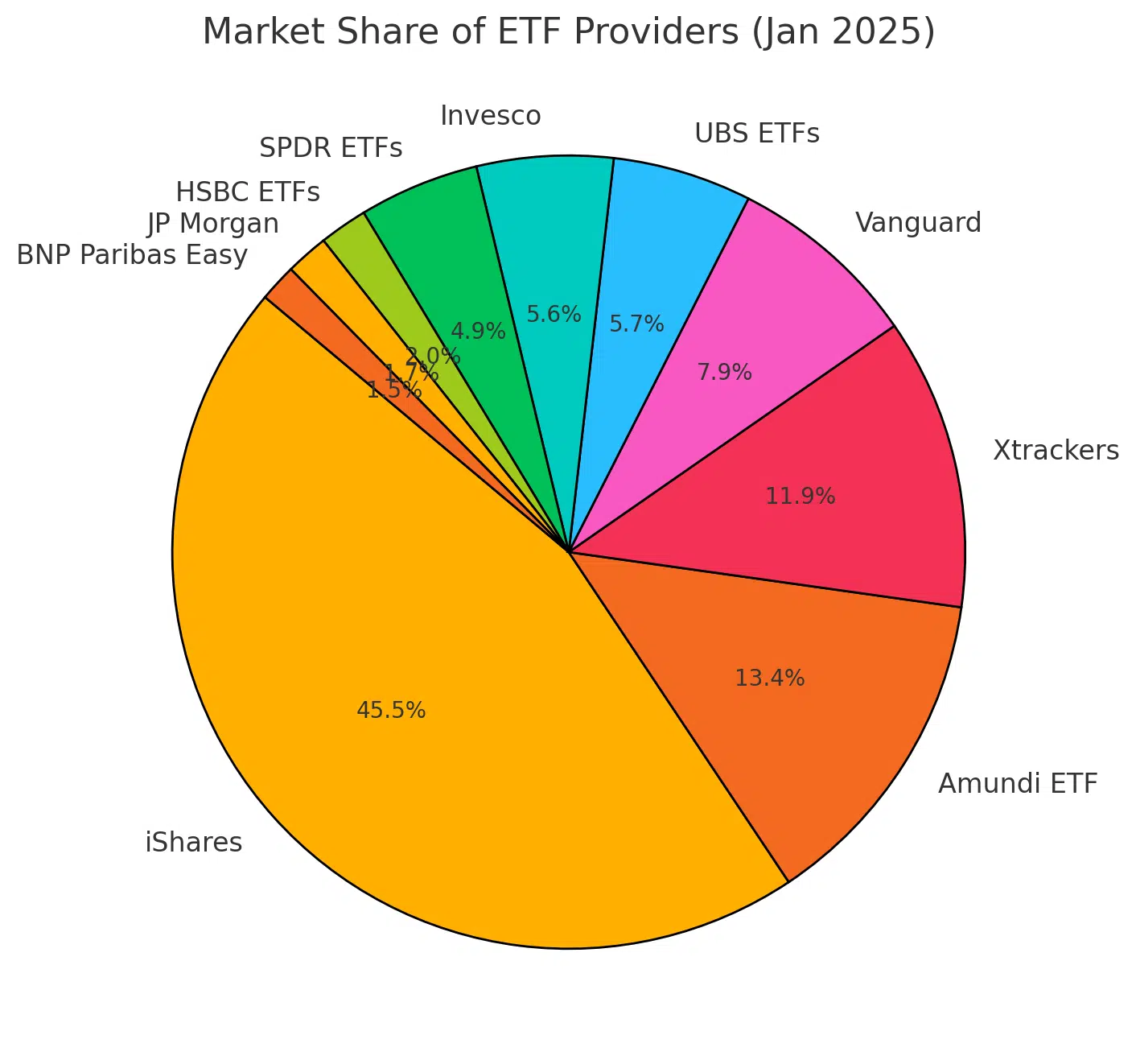

Vanguard and iShares (by Blackrock) are well-known in the ETF market as they are two big ETF providers. iShares dominates the ETF space in Europe with a market share of 45.5% as of January 2025.

On the other hand, Vanguard, despite being the 2nd biggest asset manager in the world, appears in 4th position in the European ETF market with a market share of 7.9%, behind Xtrackers and Amundi:

In this article, we will dive into Vanguard and iShares to help you choose which provider to go for.

What are Vanguard and iShares?

Vanguard is a US-based company set out in 1975 with over $9 trillion in assets under management (AUM). Worldwide, it offers mutual funds, ETFs, Money market funds, certificates of deposit (CDs), stocks and bonds. In Europe, the focus is the ETF market.

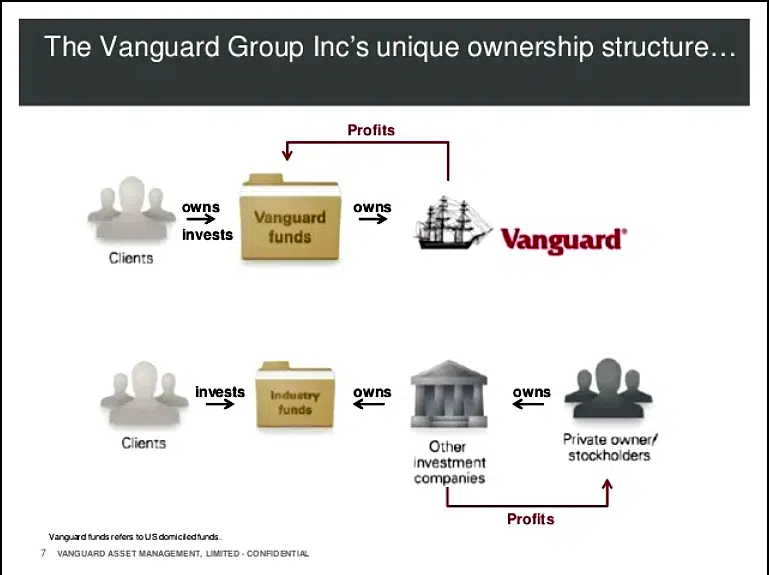

One particularity about Vanguard is its ownership structure. The company is owned by its funds, which in turn are owned by Vanguard’s fund shareholders.

On the other hand, iShares is the “subsidiary” of BlackRock (the biggest asset manager in the world with over $10 trillion in AUM), and it is dedicated to the ETF market in Europe and internationally. It has over 1,400 funds globally and over $3.3 trillion in ETFs alone.

What is the difference between Vanguard and iShares?

There is little differentiation between those firms, apart from the costs and the benchmarks tracked. Both firms offer diversified, low-cost, and tax-efficient access to the world’s investment markets.

Besides, they structure the ETFs in similar ways. Both offer physical replication (Optimized sampling or full replication), distributing or accumulating ETFs and, in most cases, similar benchmarks for the ETFs (we will show a different case below).

Let us give you an example by comparing the following ETFs:

- Vanguard S&P 500 UCITS ETF (USD) Accumulating (ISIN: IE00BFMXXD54)

- iShares Core S&P 500 UCITS ETF USD Acc (ISIN: IE00B5BMR087)

As the name implies, both ETFs replicate the performance of the S&P 500. A side-by-side comparison shows that they are similar in characteristics:

| ETF/characteristics | Vanguard S&P 500 | iShares Core S&P 500 |

| Benchmark | S&P 500 | S&P 500 |

| TER (annual cost) | 0.07% | 0.07% |

| Distribution policy | Accumulating | Accumulating |

| Replication | Physical | Physical |

| AUM | +€15 billion | +€85 billion |

The only difference between those two ETFs is the Assets Under Management (AUM). The iShares ETF AUM is much higher than the Vanguard. The inception dates can justify that. The iShares ETF was created in May 2010, whereas the Vanguard ETF was only listed in May 2019.

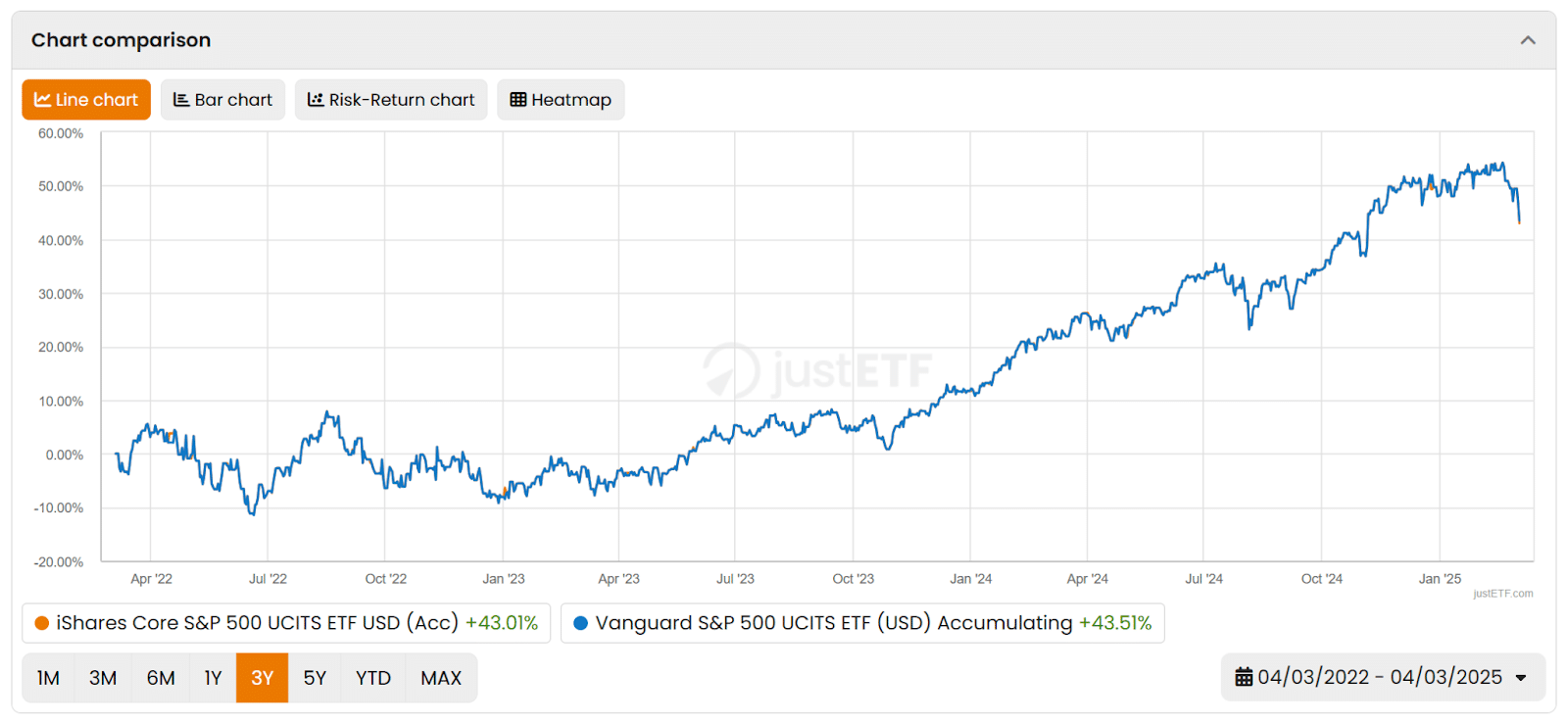

In terms of performance, it is practically the same (the lines are overlapped between each other):

What about the VWCE or the IWDA?

The VWCE (Vanguard FTSE All-World UCITS ETF) and the IWDA (iShares Core MSCI World UCITS ETF) are famous ETFs offered in Europe, and none have a similar competitor. In other words, iShares does not provide a competitor to VWCE, and Vanguard does not offer a competitor ETF to the IWDA.

In this case, the differences are notorious, mainly because they track different benchmarks:

| ETF/characteristics | VWCE | IWDA |

| Benchmark | FTSE All-World index | MSCI World index |

| TER (annual cost) | 0.22% | 0.20% |

| Distribution policy | Accumulating | Accumulating |

| Replication | Physical | Physical |

| AUM | +€14 billion | +€75 billion |

The FTSE All-World Index is a market-capitalisation-weighted index representing the performance of large and mid-cap stocks from both Developed and Developing countries. In contrast, the MSCI World Index captures large and mid-cap representation across 23 Developed Markets countries.

Naturally, the performance differs:

Are there any major tracking differences between their ETFs?

Apart from the above examples, iShares and Vanguard may differ in managing tracking differences in their ETFs. Tracking difference is the deviation between an ETF’s performance and the performance of its benchmark index. Here’s how they compare:

1. Replication methodology

- iShares: Uses a mix of full replication (holding all index constituents) and sampling/optimization (holding a subset) depending on liquidity, cost, and market access.

- Vanguard: Primarily follows full replication, especially in large and liquid indices, but may use sampling for complex or less liquid indices.

2. Securities lending

- iShares: Engages in securities lending more actively, generating extra revenue that helps offset ETF expenses and reduce tracking differences.

- Vanguard: Also engages in securities lending, but typically at a lower scale. Profits from lending are mostly returned to the fundholders, which can help reduce tracking differences.

3. Fee structures

- iShares: Generally, it has slightly higher expense ratios than Vanguard for similar ETFs. Higher fees contribute to a slightly larger tracking difference.

- Vanguard: Known for its low-cost structure, which helps minimize the tracking difference.

4. Performance consistency

- iShares: Has a broader variety of ETFs, including synthetic and optimized strategies, which may cause slightly higher tracking differences in some cases.

- Vanguard: Generally has smaller tracking differences, especially in broad market ETFs, due to its focus on full replication and cost-efficiency.

In the bigger picture, If minimising tracking differences is a priority, Vanguard ETFs may perform better due to lower fees and full replication. iShares ETFs can have slightly higher tracking differences, but they offset this through securities lending and wider ETF offerings.

Are iShares and Vanguard safe?

Yes, both firms present safe structures. Vanguard and iShares earn money only by managing the ETFs. The investments are still yours. So, if Vanguard or iShares collapsed, the customer funds would be unaffected.

Which ETF provider should you choose?

Given the examples above, your choice should be more related to the benchmark you want to track (the S&P 500, MSCI World, NASDAQ,…) and less about which firm to use.

Both iShares and Vanguard are reputable ETF providers offering low-cost, diversified, and tax-efficient investment solutions. The right choice depends on your specific investment goals and preferences:

Go for iShares if you want:

- A wider range of ETFs, including niche and emerging market options.

- Higher liquidity, as many iShares ETFs have larger AUM and longer track records.

- Exposure to MSCI World ETFs like IWDA, which Vanguard does not offer.

Go for Vanguard if you prefer:

- Lower fees in some cases, thanks to its mutual ownership structure.

- ETFs with smaller tracking differences, especially for broad market indices.

- Exposure to FTSE All-World ETFs like VWCE, which iShares does not offer.

In the S&P 500 ETF comparison, both Vanguard and iShares ETFs are nearly identical in fees, structure, and performance – making either choice a solid option.

Ultimately, both providers are safe and well-established, and choosing between them should be based on the specific ETF, tracking methodology, fees, and the benchmark that best fits your portfolio strategy.