The investing world has changed dramatically over recent years, being democratized and made more accessible to everyone. Retail investors have been an instrumental part of this story, along with significant technological and societal changes.

In this article, we will focus on some interesting investor statistics from recent years. Most notably, we will focus on retail investors – people like you and me. But let’s not get ahead of ourselves.

Who are retail investors?

Simply put, retail investors are people who invest and manage their own funds.

Doing that, they are increasingly becoming more important in the global financial markets. By investing their savings, they are actively participating in growing the value of individual companies, supporting research and development, and financing government and company debt, among others. In short, they are making the “financial pie” bigger for everyone.

The retail investment market is fairly big already since it includes retirement accounts, brokerage firms, online trading, and robo-advisors.

We will later see how the role of the retail investor has become even more significant over the years, with especially dramatic changes since 2020. But let’s first take a look at the pros and cons of retail investing.

Retail investor statistics

1. 95% of retail investors live outside major financial centers and earn average incomes

One of the most comprehensive (over half a million participants) analyses of retail investing in recent years has been the Modern Trader report, published by Broker Notes in 2018.

There are some very interesting insights in it, which differ substantially from what is commonly portrayed by the term “investor” in mainstream media. Namely, retail investors are ordinary people earning around $/€40,000 per year. The vast majority (95% of them) actually live outside major financial centers. This means that retail investing has been a global game for many years.

2. Women are investing more than ever (67%)

Technology and societal changes bring about greater inclusion, with more women participating in the markets, although still being vastly underrepresented (1 in 7 investors in 2018 were women). However, in recent years, this gender gap has been closing, with 60% of women investing in the stock market and 68% saving for retirement portfolios in 2023.

Still, there is a lot of work to be done here, especially since multiple studies have shown that women exhibit a better risk-to-return ratio than men on average.

3. American households own more than 58% of the US stock market

According to the SEC, in 2020, “American households own $29 trillion worth of equities—more than 58% of the U.S. equity market—either directly or indirectly through mutual funds, retirement accounts, and other investments.”

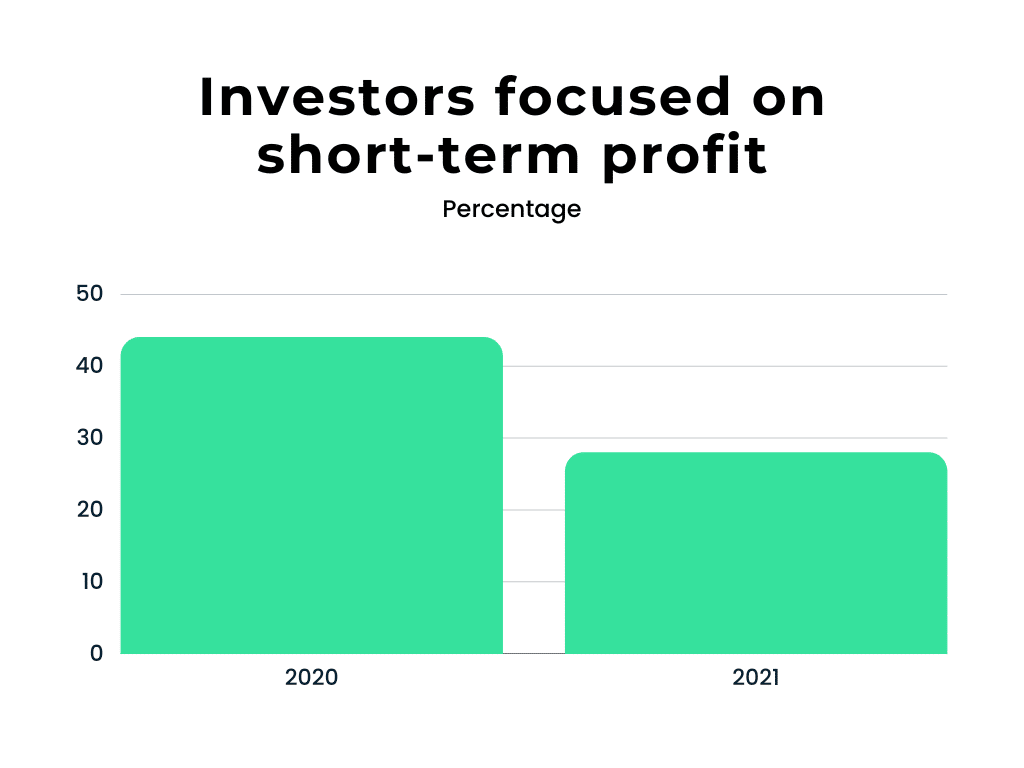

4. Investors are getting less focused on the short-term profit

Some social media communities (most notably r/wallstreetbets) have even single-handedly started to shift the markets, clashing often with institutional investors for the first time in history. However, many had negative experiences with speculative investments then, with “meme stocks” and Bitcoin suffering drawdowns of 70% or more.

Although it would be easy to paint an average retail investor as a speculative active trader, the numbers offer a different view. For example, in 2020, a sizable portion (44%) of new investors were focused on short-term profit, with that number falling to just 28% in 2021.

5. 43% of new retail accounts in 2022 were opened by investors aged 18-35

Millennial and Gen Z age groups have been a driving force of change, with 71% of the Gen Z group starting to invest after March 2020. According to the Fidelity report, 43% of new retail accounts in 2022 were opened by investors between 18-35 years old.

Another investing powerhouse (Charles Schwab) reported more new users in 2020 than in 2018, 2019, 2021 and 2022 combined.

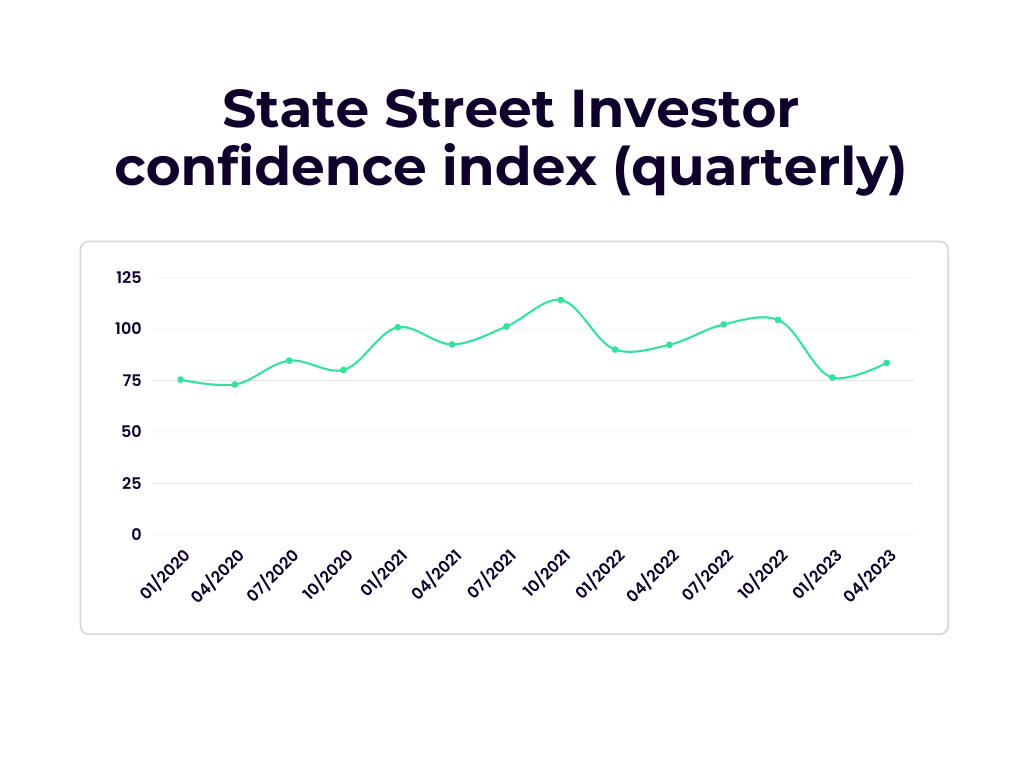

6. Investors get more confidence in bull markets

Many members of the Millennial and Gen Z age groups rely on social media (TikTok, Reddit, Discord, etc.) as their primary information source (financial and otherwise). While quality content is anchored in facts and backed by data, a considerable amount is speculative and opinion. Balancing new technologies and possible disinformation they bring to the table will be a considerable challenge for these groups.

Also, these new investors tended to be more optimistic about their future success in the stock market, probably because of the record returns for nearly all asset classes in this period. This was reflected in the State Street Investor Confidence Index, which hit record highs in 2021 but has slowly tapered off since.

The fear of missing out (FOMO) has been the dominant driver of this influx of new investors, with the term even entering the mainstream during this time.

Apart from the larger participation of female and young investors, there has been a substantial influx of new investors from emerging countries. India and Indonesia saw particularly large increases in their number of retail investor households during this period. These trends suggest that the retail investor space is becoming more diverse and inclusive.

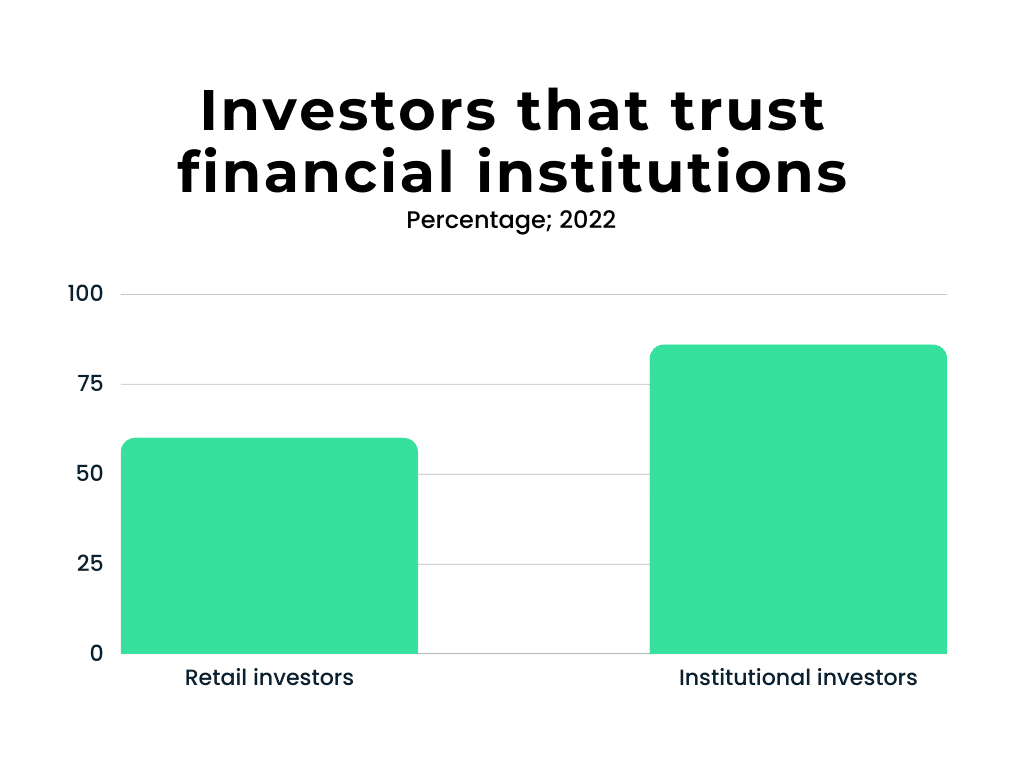

7. Only 60% of retail investors trust the financial institutions

The sustained inflation and the subsequent rise in interest rates have cooled off the markets in a dramatic way. There have also been collapses of the major crypto exchange (FTX) and 4 American banks (Silicon Valley Bank, Silvergate Bank, Signature Bank, and First Republic Bank).

It is not a surprise that a global study by the CFA Institute in 2022 found that only roughly 60% of their surveyed retail investors trust the financial services industry versus 86% of institutional investors.

8. Retail investors account for 52% of global AUM (projected to be 61% by 2030)

Nevertheless, retail investors have become a force to be reckoned with. It is estimated that they accounted for 52% of global assets under management in 2021, which is expected to grow to over 61% by 2030.

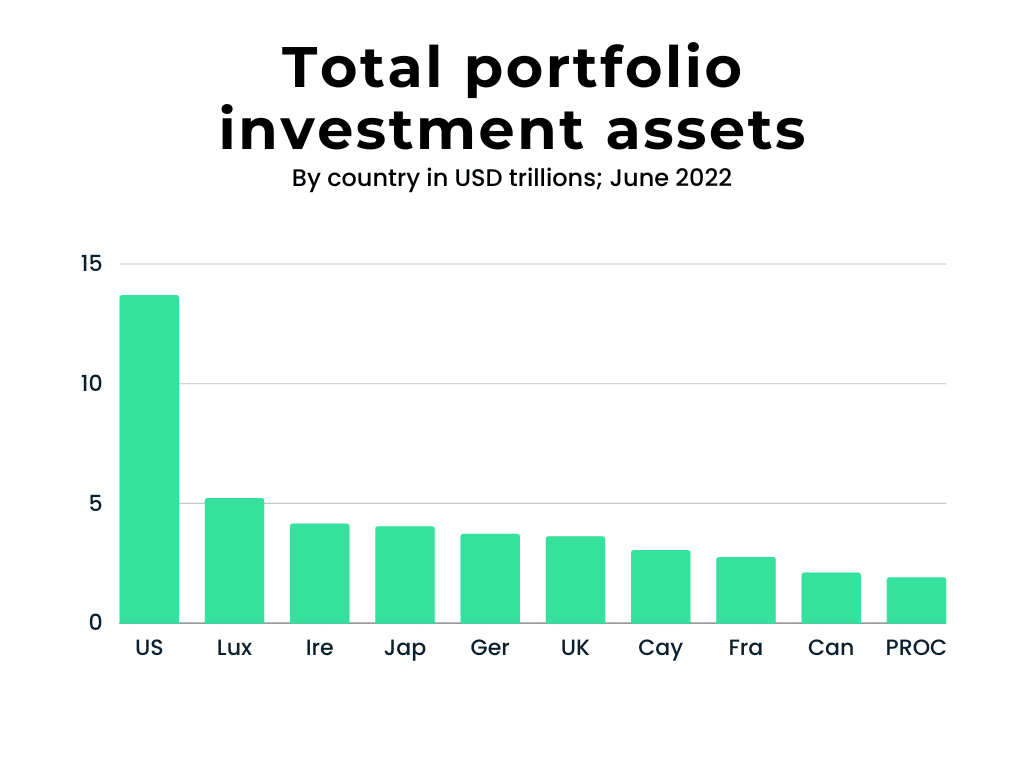

9. Most of the money is still invested in the US

It is also interesting to ask: where is all this money? According to the data from IMF, the US, as the world’s financial center is still far and away in the lead, but some countries with a favorable tax system, such as Ireland, Luxembourg, or the Cayman Islands, are taking their slice of the pie as well.

10. The biggest capital inflows in 2022 were in Tesla, followed by ETFs and Big Tech companies

Also, we have witnessed a record-breaking $1.3 billion inflows to the stock market every day (on average) for the first half of 2022, from retail investors alone.

Company reputation, values, and leadership are factors that are more important to retail investors than ever. A prime example of this is the fact that Tesla’s net retail flows in 2023 so far ($9.75 billion) are greater than the next 9 individual stocks or ETFs combined ($8.5 billion). Several meme stocks made it into the broader top 100 list, but it seems that they are slowly falling out of favor.

11. Only 1% of investors plan to sell their investments in 2023

According to a survey from Finimize, only 1% of retail traders plan to sell off their investments in 2023, while 65% will continue investing, and 29% plan to add to their portfolios.

This survey encompassed over 2000 retail investors from the US, Europe, and Asia and offered us some other interesting insights, such as:

12. 80% of investors think the market will bottom out in 2023

According to the same Finimize survey.

13. 72% of investors plan to invest in individual stocks, but only 38% in crypto

According to the same Finimize survey.

14. 84% of the respondents never invested in meme stocks

According to the same Finimize survey.

15. The biggest concern was the rising cost of living at 55%, followed by rising interest rates at 28%

According to the same Finimize survey.

Conclusion

In the words attributed to a great baseball player Yogi Berra: “It is difficult to make predictions, especially about the future.” Nevertheless, looking at the trends, we can conclude that:

- Investing is becoming global and more inclusive of all income, gender, race, age, national, and other groups

- We can especially thank new technologies for this greater access to financial markets, including brokerage platforms, ETF, roboadvisors, cryptocurrency, etc.

- The COVID pandemic has likely been a catalyst that substantially accelerated all these changes

- Some things never change, such as investors’ psychology and emotions. Greed (FOMO) and fear have always moved markets in a significant way and will likely continue to do so in the future

Thank you for reading our article about retail investor statistics.