Diversification is essential, and it works! Since Trump took office for a second time, the U.S. stock market has suffered due to instability caused by the new wave of tariffs.

As of October 3, 2025, the S&P 500 is up 2.19% since the start of 2025, while the STOXX Europe 600 (Europe’s equivalent of the S&P 500) is up 16.18%:

Video summary

Overview of the European stock market landscape

The European stock market is a diverse and complex ecosystem with multiple countries, currencies, and regulatory frameworks. Unlike the US, where a few major exchanges (like the NYSE and Nasdaq) dominate, Europe’s capital markets are decentralized, with each country operating its national exchange.

Still, if we had to pick only one European index, it would be the STOXX Europe 600 index. It gives a broad exposure to European stocks. You can check the complete list of stocks in the index here.

To understand how to invest in the European market, it’s important to break it down into three layers:

European Union (EU)

The EU is a political and economic union of 27 member states. While the EU promotes financial market integration through regulation like MiFID II, each country still retains its own stock exchange and tax systems.

Key stock exchanges in EU countries include:

- Euronext (a pan-European exchange covering France, Italy, the Netherlands, Belgium, Portugal, Italy, and Ireland)

- Deutsche Börse (Xetra) in Germany

- BME in Spain

- Warsaw Stock Exchange (WSE) in Poland

United Kingdom (Post-Brexit)

Although the UK left the EU in 2020, London remains one of Europe’s most important financial centers. The London Stock Exchange (LSE) lists both domestic and international companies and remains a major gateway for global investors into European assets.

Investing in UK stocks means dealing with the British pound (GBP) and a separate regulatory regime.

Switzerland and other non-EU countries

Other notable non-EU markets include:

- Switzerland (SIX Swiss Exchange), known for large multinational companies like Nestlé, Novartis, and UBS

- Norway (Oslo Børs)

- Iceland and Liechtenstein, smaller but accessible through certain brokers

These countries are not part of the EU or the Eurozone but are economically linked through the EEA (European Economic Area) or bilateral agreements, making them accessible to European investors.

How to invest in a European stock (or ETF) – step by step

To invest in any European stock, you must first find a broker that allows you to invest in it. We will be using Interactive Brokers as the example below.

The European stock to buy will be ASML Holding N.V., a Dutch multinational corporation, one of the world’s leading manufacturers of chip-making equipment (one of its clients is Nvidia).

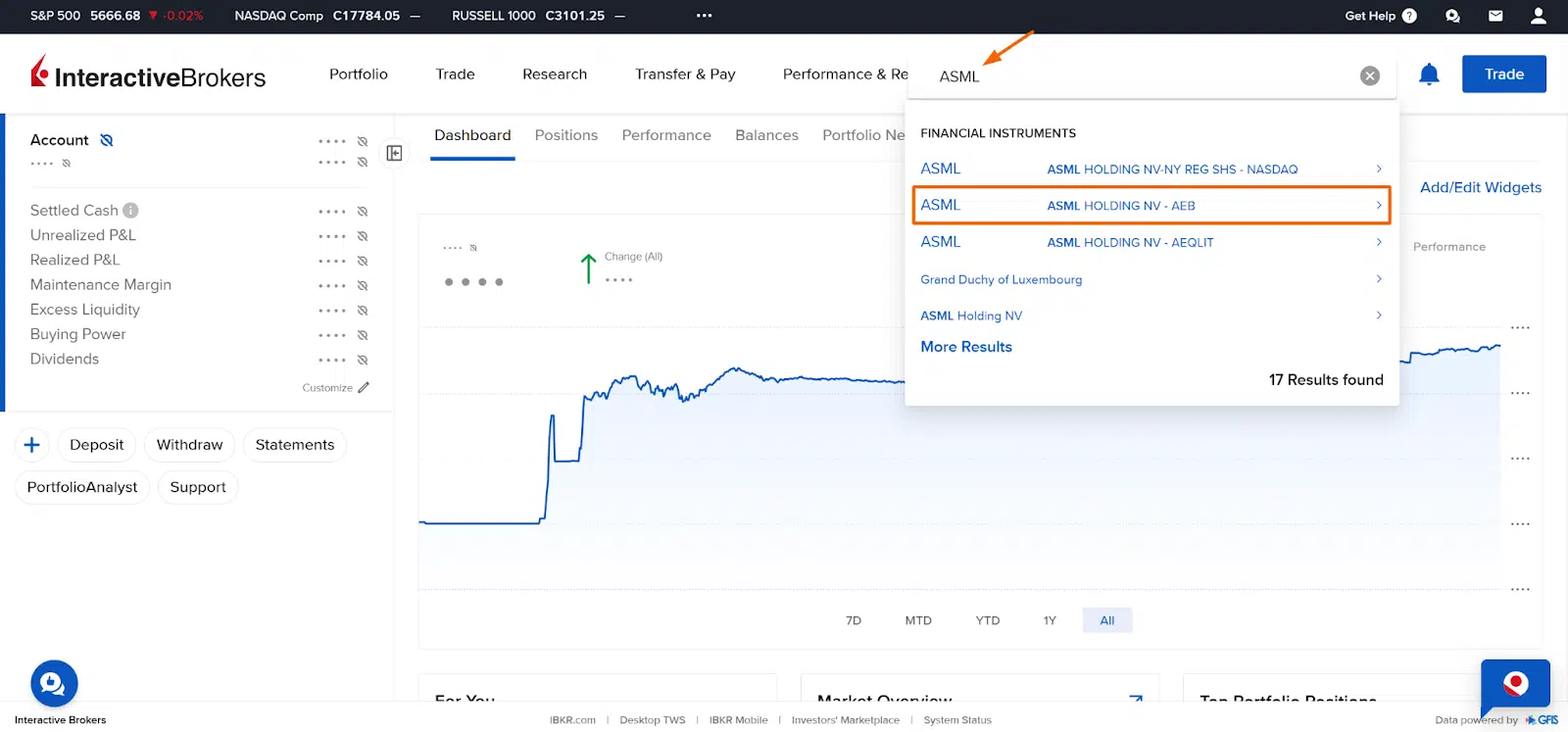

- Step 1: Open your Interactive Brokers account, search for “ASML”, and choose the second option (traded in the AEB – Euronext Amsterdam):

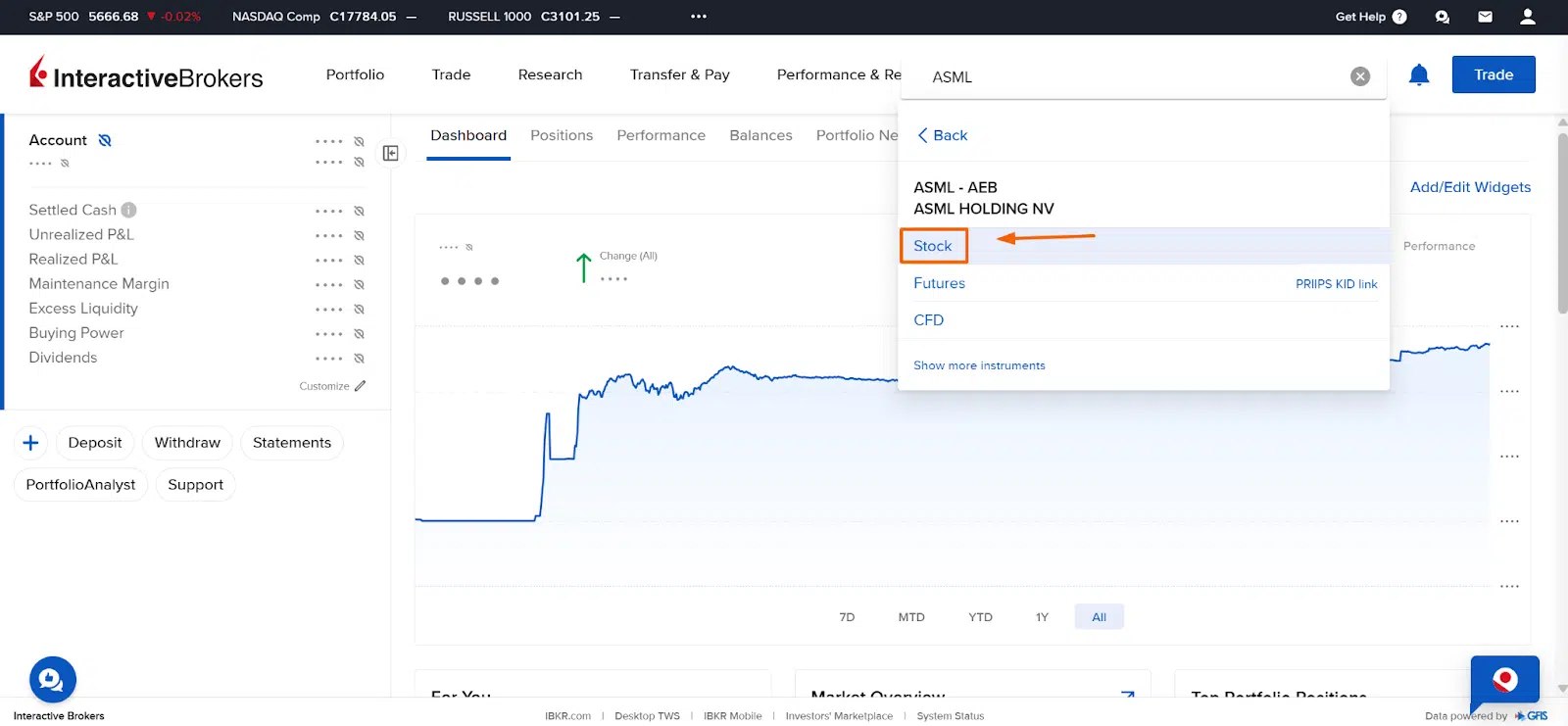

Then, select “stock”:

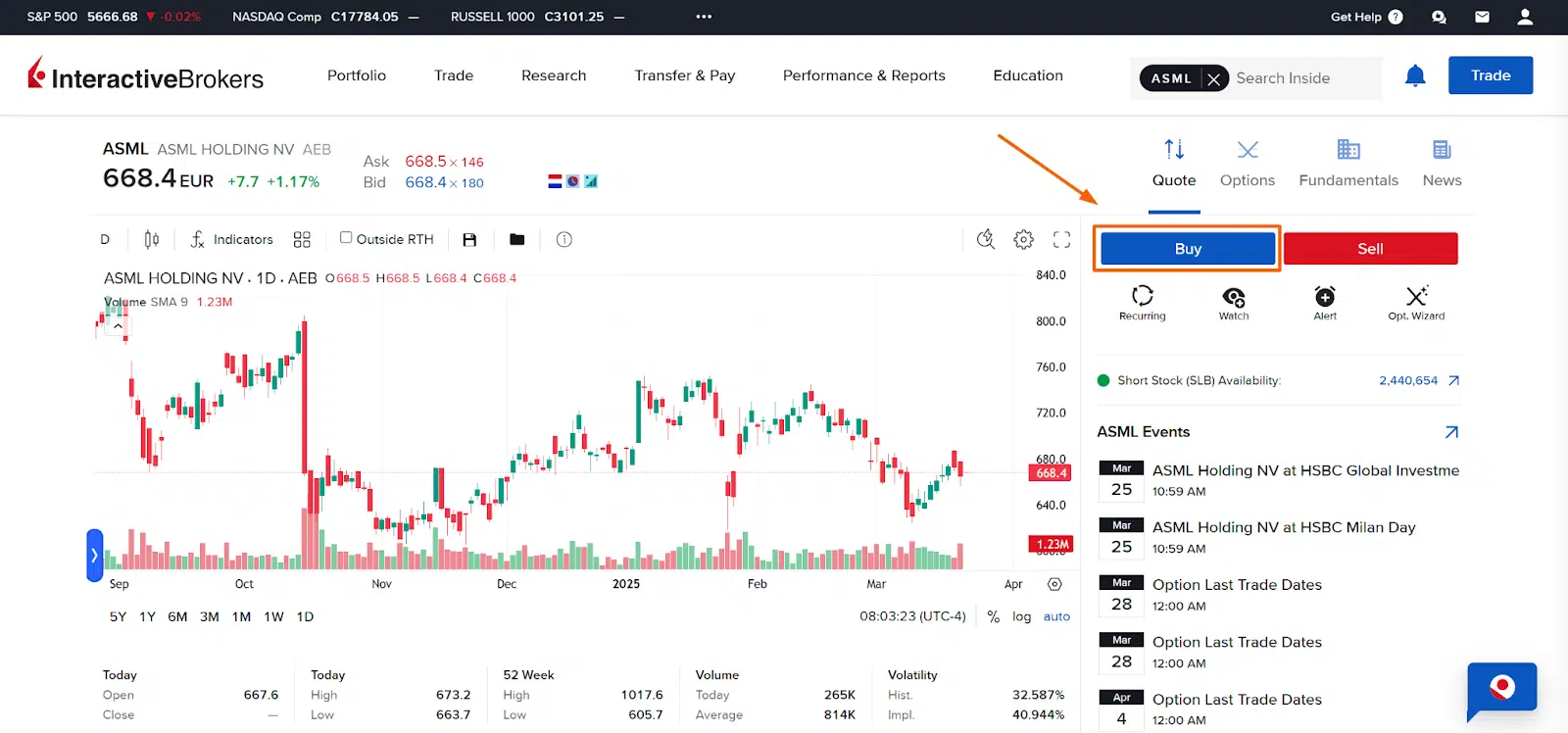

- Step 2: Click “Buy”:

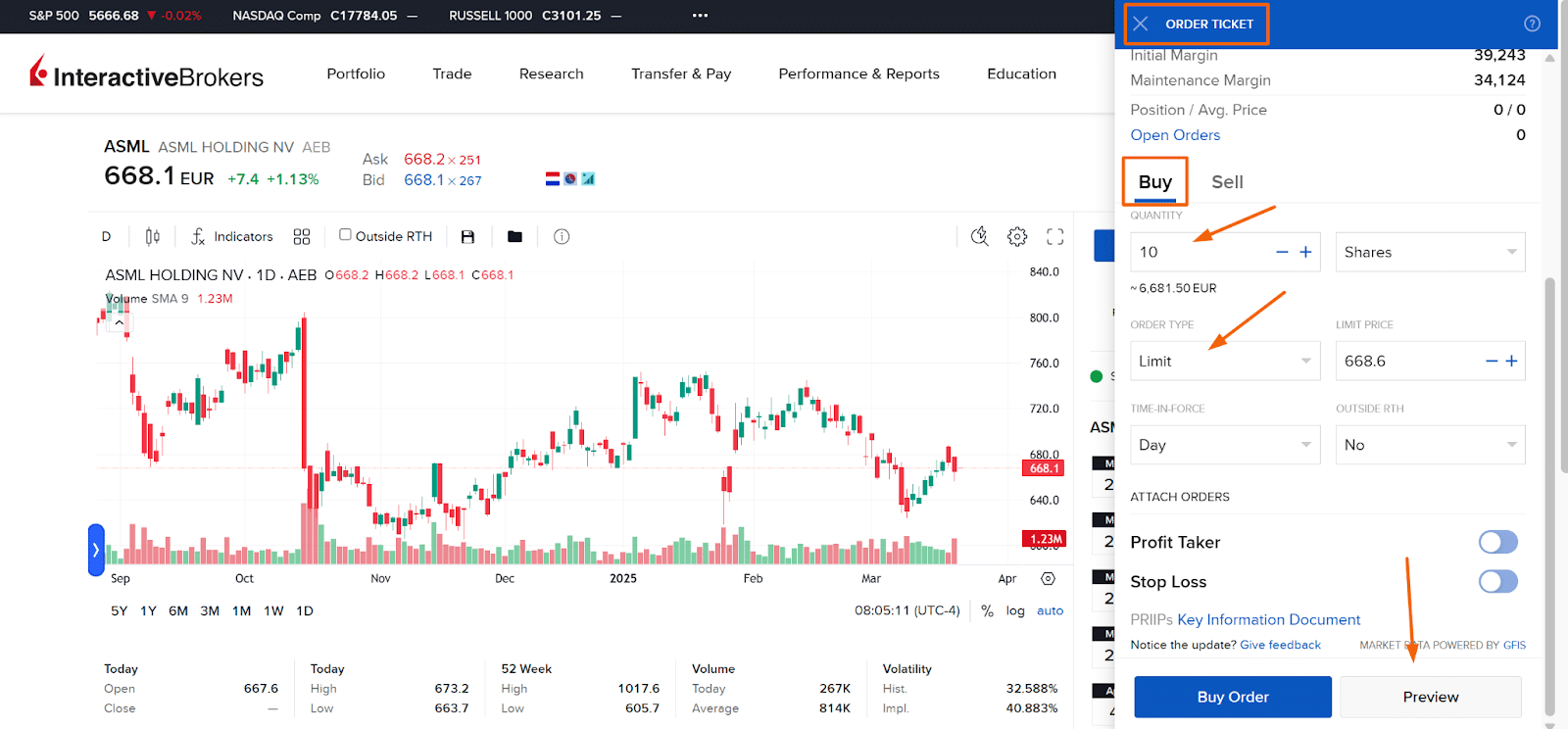

- Step 3: Give your “Buy” order details

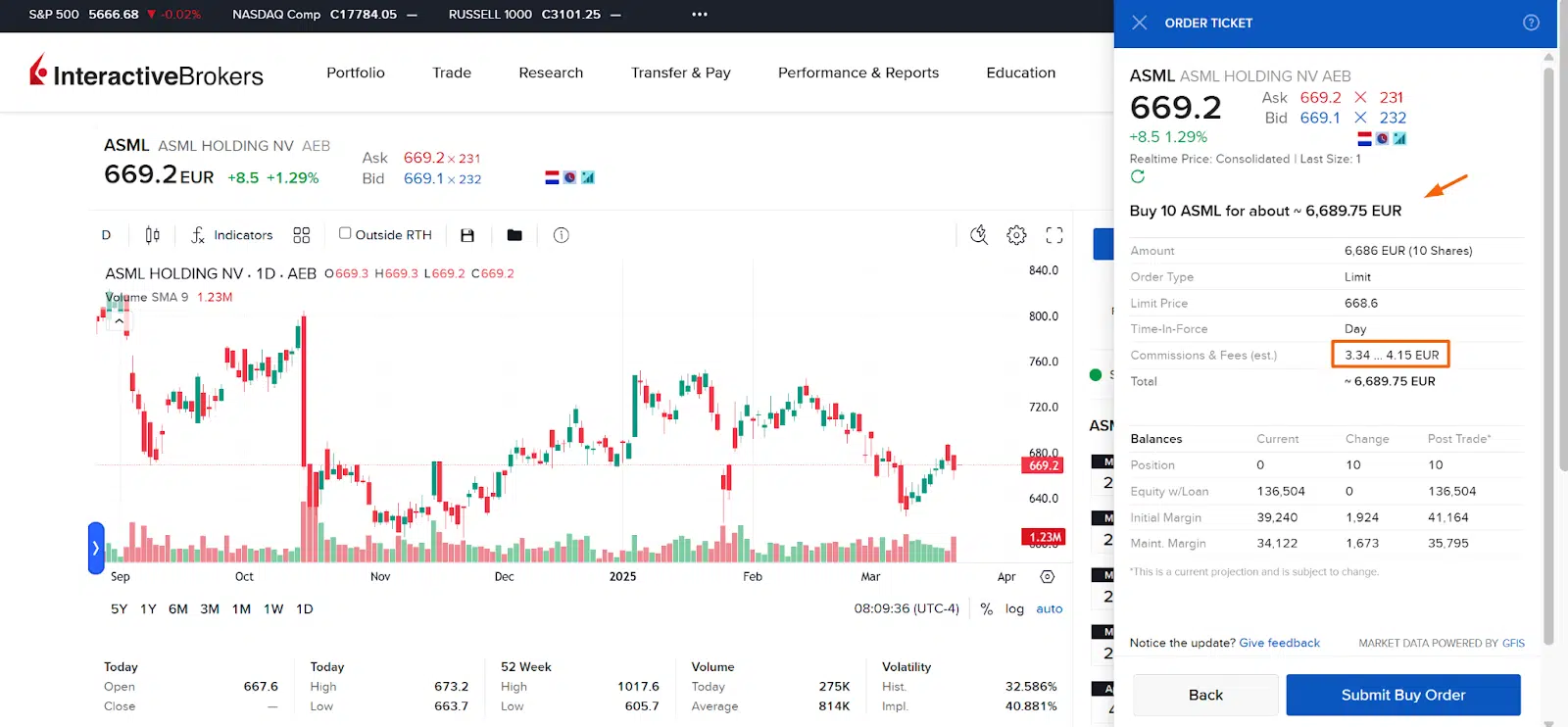

Select the number of shares you want to buy (10 shares in our example), the “order type”, which we select as “Limit”, which means that we are willing to buy each share up to a specific price (€668.60 in our case). If you select “Market”, you would instantly buy at the best available market price.

Then click “preview”:

- Step 4: Analyze all the details before submitting your order.

Here, you can give a final check before clicking “Submit buy order”, including the commissions paid for the execution of this order:

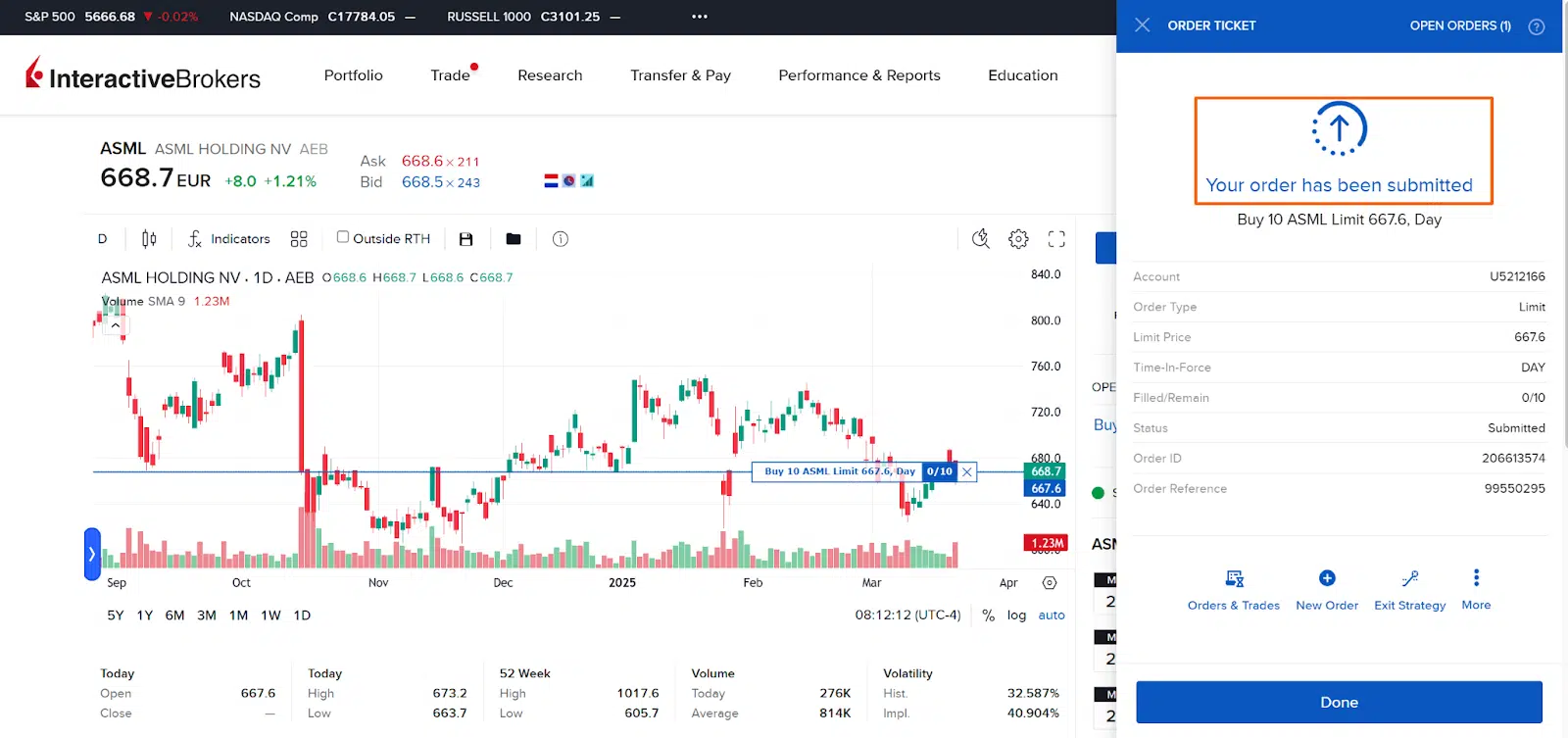

- Step 5: Click “Submit buy order” and wait for your order to be fulfilled:

Please remember that if the price exceeds your “limit” price, your order may not be executed if it does not reach the maximum price you are willing to pay (€668.6). If you just want to buy and not wait, give a “market” order.

What about ETFs that track the European stock market?

If picking individual stocks sounds too time-consuming or risky, ETFs (Exchange-Traded Funds) can be a great way to get broad exposure to European markets. They allow you to invest in dozens or even hundreds of companies at once at a very low cost.

Whether you’re looking to track a broad index like the STOXX Europe 600 or focus on a specific country or sector, there’s likely an ETF. ETFs are traded on stock exchanges just like regular shares and can be bought through most brokers that support European markets.

Below, we will share ETFs for European investors (European-domiciled ETFs such as UCITS funds) and ETFs for non-European investors (US, India, Canada, and others).

European ETFs for European investors

Here are four popular European ETFs to consider (in order from the largest to the lowest assets under management – AUM):

Amundi Stoxx Europe 600 UCITS ETF Acc

- Description: The Amundi Stoxx Europe 600 UCITS ETF Acc seeks to track the STOXX® Europe 600 index. The STOXX® Europe 600 index tracks the 600 largest European companies.

- ISIN: LU0908500753

- TER: 0.07%

- Replication method: Physical

- Distribution policy: Accumulating

- AUM: +€10B

iShares Core MSCI Europe UCITS ETF EUR (Acc)

- Description: The iShares Core MSCI Europe UCITS ETF EUR (Acc) seeks to track the MSCI Europe index. The MSCI Europe index tracks the leading stocks from 15 European industrial countries.

- ISIN: IE00B4K48X80

- TER: 0.12%

- Replication method: Physical

- Distribution policy: Accumulating

- AUM: +€10B

iShares Core EURO STOXX 50 UCITS ETF EUR (Acc)

- Description: The iShares Core EURO STOXX 50 UCITS ETF EUR (Acc) seeks to track the EURO STOXX® 50 index. The EURO STOXX® 50 index tracks the 50 largest companies in the eurozone.

- ISIN: IE00B53L3W79

- TER: 0.10%

- Replication method: Physical

- Distribution policy: Accumulating

- AUM: +€4B

iShares Core MSCI EMU UCITS ETF EUR (Acc)

- Description: The iShares Core MSCI EMU UCITS ETF EUR (Acc) seeks to track the MSCI EMU index. The MSCI EMU index tracks large and mid-cap stocks from countries in the European Economic and Monetary Union.

- ISIN: IE00B53QG562

- TER: 0.12%

- Replication method: Physical

- Distribution policy: Accumulating

- AUM: +€4B

These ETFs are UCITS-compliant, meaning they follow European Union regulations on investor protection and fund diversification. This is especially important if you’re a European investor, as UCITS ETFs are widely accessible and tax-efficient.

European ETFs for Non-Europeans investors

Investors outside Europe, including those based in the US, India, Canada, and other regions, often seek exposure to European markets through ETFs listed on US exchanges. These ETFs, offered by major providers like Vanguard, iShares, and SPDR, track European stock indices but are domiciled in the US, making them more accessible and tax-efficient for many international investors.

For example, U.S.-based investors avoid complex tax rules such as PFIC regulations by using U.S.-domiciled ETFs, which are suitable for accounts like taxable brokerage accounts, IRAs, and 401(k)s. Investors from countries with favorable tax treaties or access to U.S. markets may also benefit from easier access and broader broker support.

Here are three popular US-domiciled ETFs that provide exposure to European equities:

Vanguard FTSE Europe ETF (VGK)

- Description: The Vanguard FTSE Europe ETF seeks to track the performance of the FTSE Developed Europe All Cap Index, which includes large-, mid-, and small-cap stocks across developed European markets.

- ISIN: US9220428745

- TER: 0.09%

- Replication method: Physical

- Distribution policy: Distributing

- AUM: +$20B

iShares Europe ETF (IEV)

- Description: The iShares Europe ETF aims to track the S&P Europe 350 Index, which covers 350 leading blue-chip companies from 16 developed European countries.

- ISIN: US4642878618

- TER: 0.58%

- Replication method: Physical

- Distribution policy: Distributing

- AUM: +$1.5B

SPDR STOXX Europe 50 ETF (FEU)

- Description: The SPDR STOXX Europe 50 ETF seeks to track the STOXX Europe 50 Index, which represents 50 of the largest and most liquid blue-chip companies in Europe.

- ISIN: US78463X2027

- TER: 0.29%

- Replication method: Physical

- Distribution policy: Distributing

- AUM: +$230M

Which brokers allow you to trade European stocks (or ETFs)?

These are some of the brokers that allow you to invest in European stocks or ETFs:

- Interactive Brokers: The best broker overall. Low fees for stocks, ETFs, options and low conversion fees – Available worldwide.

- XTB: 0% commissions on stocks and ETFs for monthly turnover up to €100,000 (above this amount, a 0.2% commission applies, min. €10) – Available worldwide

- Trading 212*: 0% commissions on stocks, ETFs and cryptos with no limits (Other fees may apply. See terms and conditions). High interest on uninvested cash – Available in the EEA, UK and other countries, excluding the US

- Lightyear: Emerging low-cost broker in Europe; mobile-first and expanding quickly – Available in the EEA.

- DEGIRO: It has a wide range of products, but it charges a minimum of €1 per trade + an annual €2.50 connectivity fee – Available in 15 European countries

- Freedom24: Offers stocks, ETFs, bonds and options – Available in Europe, UAE and others, excluding the US.

Bottom line

Whether you’re reacting to recent US market volatility or simply looking to diversify globally, the European stock market offers a wide range of opportunities — from blue-chip giants like ASML and Nestlé to broad ETFs that cover hundreds of companies across the continent.

Thanks to modern brokers, low-cost ETFs, and improved cross-border access, investing in European stocks is more accessible than ever. Just remember to consider factors like currency risk, taxation, and regional exposure when building your strategy.

No matter your approach — stock picker or ETF investor — Europe can be a strong complement to your portfolio. Start small, stay informed, and always invest with a long-term mindset.

*When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.