REITs, short for Real Estate Investment Trusts, allow investors to gain exposure to the largest asset class in the world – real estate, followed by bonds and stocks.

In this article, we’ll delve into how to buy REITs from Europe, including how to choose a good REIT, tips for choosing a REIT broker, and more!

REIT Basics

1. REIT varieties

REITs come in all shapes and sizes. Some focus on only one type of real estate, while others operate in several real estate sectors. Generally, you can choose between:

- Residential REITs;

- Commercial property REITs (office, retail);

- Cell tower, data center REITs;

- Timberland, farmland REITs;

- Logistics, self-storage REITs;

- Lodging and casino REITs;

- And more!

The above varieties, coupled with different geographical exposures, make every REIT unique. Think about the different factors affecting multi-family REIT leasing apartments in the Southern United States, a farmland REIT in Eastern Europe, or a logistics REIT leasing warehouse space around the world!

2. REIT performance indicators

Once you have settled on a geography and property sector, other REIT characteristics to consider are:

- Rental growth (the higher, the better);

- Occupancy (the higher, the better);

- Leverage or loan-to-value ratio (higher means higher return and greater risk);

- Net asset value per share (compare it with the share price).

There is no magic formula for choosing the right REIT. Some offer large short-term returns, while others have pipeline projects that will bear fruit in the long term!

3. REIT research

While starting with the biggest REITs such as Prologis (ticker PLD), American Tower (AMT), Vonovia (VNA), or Segro (SGRO) is a good idea, digging deeper can be rewarding!

Resources you can use are:

- Nareit, the U.S. REIT industry website;

- EPRA, the European public real estate association;

- Stock screeners such as Finviz;

- Company reports, presentations and transcripts;

- REIT Fund/ETF holdings;

- And more!

In any case, comparing several REITs and weighing their pros and cons is always a great idea. A good approach is to use industry-accepted performance indicators and ranks the REITs from best to worst on each metric.

How to buy REITs from Europe (Step-by-step guide)

1. Choose a good REIT broker

Once you have chosen the REIT you want to invest in, you need to find a broker where you can make the purchase. Since REITs trade just like ordinary shares of any other company, terms offered for trading REITs are no different from those offered for trading stocks.

| Broker | REITs commissions, US | Minimum Deposit | Regulators |

| eToro | $1 | $50 (varies between countries) | FCA, CySEC, ASIC |

| Interactive Brokers | Tiered Pricing: Up to $0.0035 per share (min. $0.35) | €/$/£0 | FINRA, SIPC, SEC, CFTC, IIROC, FCA, CBI, AFSL, SFC, SEBI, MAS, MNB |

| DEGIRO | €1 (+€1 handling fee) | €1 | DNB and AFM |

Disclaimer: Investing involves risk of loss.

We recently compared DEGIRO and Interactive Brokers, two leading discount brokers available to Europeans!

2. Place a “Buy Order”

If you have found an online broker that suits your needs, managed to open an investment account, and made the initial deposit, you are all set to buy your REIT. All you have to do is find the REIT within your chosen broker and place a buy order. For this example, we will use Interactive Brokers Trader WorkStation (TWS).

1 – Search for the chosen REIT (we will use Prologis, ticker “PLD”):

2 – Click “Buy”:

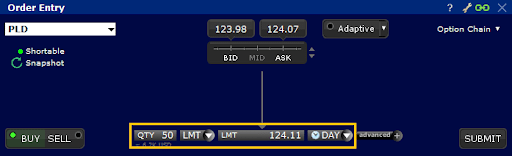

3 – Choose the order details

Now, it’s time to fill all boxes highlighted below:

- QTY: Short for quantity. Here you define the number of shares you want to purchase;

- Type of order: By default, Interactive Brokers sets your order type as LMT, short for Limit Order. This is good since it allows you to set a maximum price at which you are willing to buy the shares. The alternative is MKT or market order.

- Limit Amount: Assuming you kept the “LMT” as the type of order, you need to set the maximum price you are willing to pay per share. If you use Market order you do not need to fill this and will buy at the best available Ask price.

- Order duration is set to DAY by default.

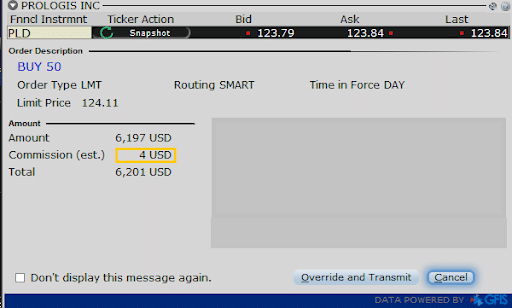

4 – Place the order:

Finally, click “Submit” and a new window will show up. Here, you can take a final look at all the details, including the commissions, before clicking “Transmit”:

REIT ETFs

REIT ETFs, short for exchange traded funds, offer investors the ability to gain exposure to several REITs. In this regard, the investment becomes even more diversified. REIT ETFs are a great pick for investors who are unsure which specific REIT to choose.

Some solid REIT ETFs to consider are:

- Vanguard Real Estate Index Fund (ticker VNQ);

- Vanguard Global ex-U.S. Real Estate Index Fund (VNQI);

- iShares STOXX Europe 600 Real Estate UCITS ETF (EXI5).

VNQ focuses on North America and has 170 REITs in its portfolio. VNQI gives exposure to all regions except the U.S., with 200 REITs. Last but not least, EXI5 tracks 35 REITs in the Euro Stoxx 600 Real Estate Index.

Bottom line

To sum it up, here’s what you need to do:

- Choose a REIT to buy. Each REIT offers a unique combination of geographical and sector exposure. You should also consider the REIT’s occupancy, leverage, and growth potential;

- Find a suitable REIT broker: Since REITs trade as ordinary shares, a broker offering excellent terms on stock trading is a great pick;

- Open an account and deposit money: After deciding which trading platform to use, you must go through the account opening process and deposit money;

- Send a buy order to your broker for the REIT you like: That’s the easiest part (the process is intuitive)! After having your brokerage account and the name of the REIT that you want to buy, you just have to place a trade!

We hope that this post addressed some of your concerns. Make sure to do your own research to find out the best investing strategy for you!

Happy investing!

Questions and further details

What is a REIT?

A REIT, or a real estate investment trust, is a company that invests in real estate. The REIT manages the property on behalf of investors, collects rents and pays for maintenance. To qualify as a REIT, a company has to distribute a high percentage of its profits, usually 90%, to investors.

What is the tax treatment of REITs?

REITs do not pay corporate tax like other ordinary companies. However, they do pay municipal taxes for the buildings they own and transfer taxes when they sell a building.

What is the advantage of REITs compared to a traditional real estate investment?

REITs allow investors to own a small share of a large building. They also allow shareholders to diversify across several cities or even continents. As a publicly listed investment, REITs are also liquid investments, unlike real estate. Last but not least, investors do not need to worry about the day-to-day maintenance of the buildings.

What are the disadvantages of REITs?

REIT management has to be paid out of the rent collected, which reduces returns. Shareholders also do not have direct control over rental terms and buy and sell decisions of individual properties. Due to the high payout of profits as dividends, revenue growth at REITs is below that of other companies.

Which European countries offer REITs?

In Europe, the United Kingdom, France, Germany, Spain, Belgium, the Netherlands, Finland, Ireland, Italy, Greece, Bulgaria and Turkey have a REIT regime in place. Luxembourg, Lithuania and Hungary are currently considering REIT legislation.

Can Europeans invest in REITs on other continents?

While not all countries have a REIT equivalent tax regime, major high-income economies such as the United States, Canada, Japan and Australia offer REIT structures. Medium-income economies such as Mexico and Brazil also have a REIT regime in place.

What is an Exchange Traded Fund (ETF)?

An ETF is a publicly traded fund that holds assets like stocks. When you invest in an ETF, you indirectly buy a large portfolio of assets. In the case of an iShares STOXX Europe 600 Real Estate UCITS ETF that means it will track the performance of underlying holdings used in the index. That would mean you can easily gain exposure to 35 different companies with just a single investment!

Is now a good time to invest in REITs in Europe?

If anyone would know the future they would be rich. Over long periods of time, REITs are able to increase rents in line with inflation. As a result, real estate tends to keep its value in real terms and provides a recurring source of income.

Why should I invest in REITs from Europe?

REITs are a great way for investors to earn current income in the form of dividends which tends to grow in line with inflation.