As global tensions escalate, interest in European defence stocks is surging, and not just because of the war in Ukraine. Donald Trump’s aggressive rhetoric and unpredictability are significant factors fueling this trend, particularly his threats to weaken NATO support if European nations don’t increase their military spending.

This has served as a wake-up call for the EU countries leading the European Commission to create the “ReArm Europe Plan/Readiness 2030”, accelerating defence budgets and driving investor interest in European defence companies.

Whether you’re a European or American investor, now may be the time to explore how to get exposure to this sector through individual stocks and European defence ETFs.

Why are European defence stocks gaining momentum?

Europe is undergoing a significant defence rethink. Germany is increasing its defence spending bill with little worry about possible budget deficits. Poland is now one of the biggest defence spenders in Europe (almost 5% of its GDP is related to defence expenses), and France and Italy are investing heavily in cyber and traditional defence sectors.

These shifts have been triggered not only by security threats in Eastern Europe but also by uncertainty about the reliability of the US as a defence partner, especially under Trump-like leadership.

For investors, this shift means:

- Strong long-term government contracts;

- Heightened demand for European-made defence systems;

- Potential for capital appreciation as companies scale production and R&D

How to invest in European defence stocks?

Two main routes are picking individual stocks or investing through European defence ETFs. Each has benefits: stocks offer higher potential upside while ETFs give broader exposure with less risk.

Best European defence stocks

Here are the key financial statistics for the specified European defence companies as of March 2025:

Rheinmetall AG (Germany)

A key supplier of tanks, armored vehicles, and ammunition, Rheinmetall is central to Europe’s military build-up.

- P/E ratio (TTM): ~75

- Market capitalization: €59 billion

- Earnings per share (EPS): €17.81

- Forward P/E Ratio: ~44

Leonardo S.p.A. (Italy)

Specialises in helicopters, avionics, and integrated defence systems. A rising star in NATO-related defence procurement.

- P/E Ratio (TTM): ~24

- Market capitalization: €25.83 billion

- Earnings per share (EPS): €1.86

- Forward P/E Ratio: ~25

Saab AB-B (Sweden)

Makers of the Gripen fighter jet and other high-tech defence systems. Sweden’s NATO membership only boosts its relevance.

- P/E Ratio (TTM): ~52

- Market capitalization: SEK 215.806 billion

- Earnings Per Share (EPS): SEK 7.74

- Forward P/E Ratio: ~40

BAE Systems PLC (UK)

A global player in air, sea, and cyber defence, with deep involvement in U.S. and EU defence contracts.

- P/E Ratio (TTM): ~24

- Market capitalisation: £45.93 billion

- Earnings per share (EPS): £0.64

- Forward P/E Ratio: ~22

Thales SA (France)

Leader in electronic defence, cybersecurity, and radar systems. Trusted by European and global defence forces.

- P/E Ratio (TTM): ~51

- Market capitalization: €50.26 billion

- Earnings per share (EPS): €4.89

- Forward P/E Ratio: ~21

European defence ETFs

For those who prefer diversification and lower volatility, European defence ETFs offer access to multiple companies across the sector.

For European investors

- WisdomTree Europe Defence UCITS ETF EUR Unhedged Acc

This is the only 100% focused-European defence companies ETF, explicitly launched to tap into Europe’s defence boom. It includes leading names like Rheinmetall, Leonardo, and BAE Systems. It’s UCITS-compliant, low-cost, and available on trading platforms like Interactive Brokers, DEGIRO, and Freedom24.

Characteristics:

- Inception date: March 2025

- ISIN: IE0002Y8CX98

- Ticker: WDEF

- Replication: Physical

- Distribution policy: Accumulating

- Assets Under Management (AUM): + €500 million

More info here.

For US investors

While direct access to UCITS ETFs like WisdomTree Europe Defence UCITS ETF may be limited, US investors can:

Buy ADRs (American Depositary Receipts) of companies like Airbus (EADSY) or BAE Systems (BAESY).

Use global defence ETFs that include European exposure, such as:

- iShares U.S. Aerospace & Defence ETF (ITA):

- Inception date: May 1, 2006

- ISIN: US4642887602

- Ticker: ITA

- Replication method: Physical (Full Replication)

- Distribution policy: Distributing

- Assets Under Management (AUM): +$6.50 billion

- SPDR S&P Aerospace & Defence ETF (XAR):

- Inception date: September 28, 2011

- ISIN: US78464A6313

- Ticker: XAR

- Replication method: Physical (Optimized Sampling)

- Distribution policy: Distributing

- Assets Under Management (AUM): +$2.90 billion

Step-by-step on how to buy a defence stock/ETF

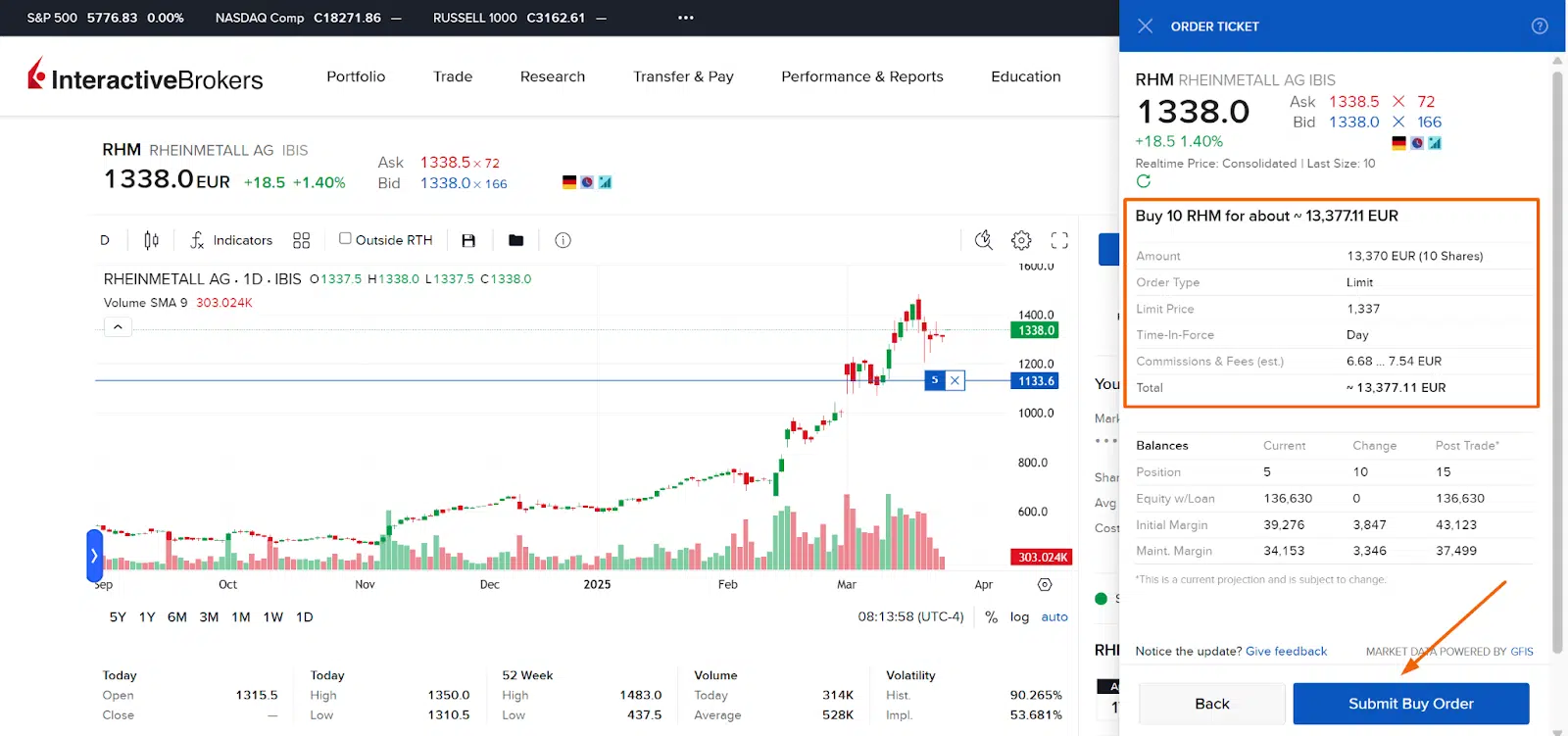

For our example, we will use Interactive Brokers, a worldwide broker available in Europe and the US. And we will buy the Rheinmetall AG stock.

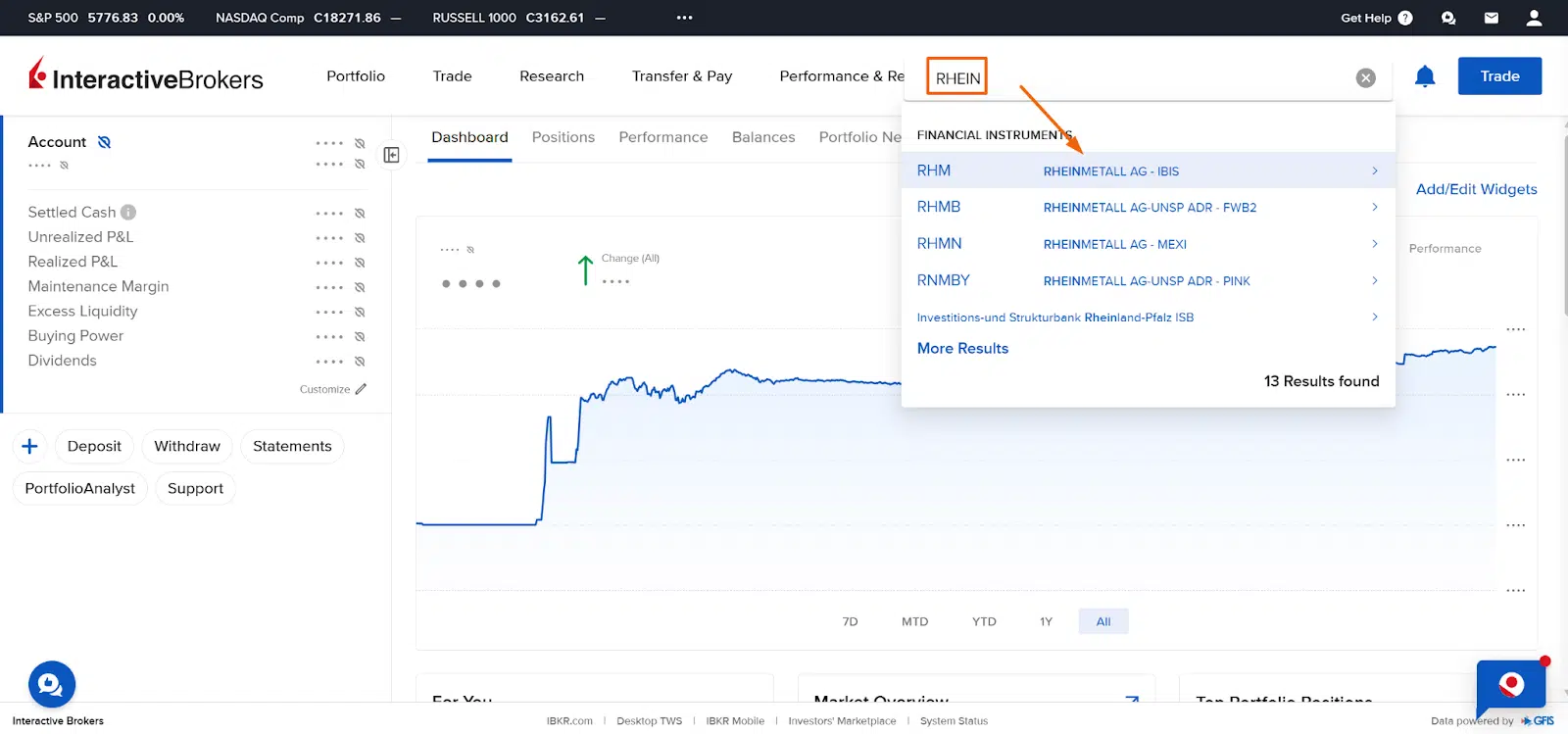

Step 1: Search for “Rheinmetall” and select the first option:

“IBIS” means that it is traded on Xetra, a German stock exchange.

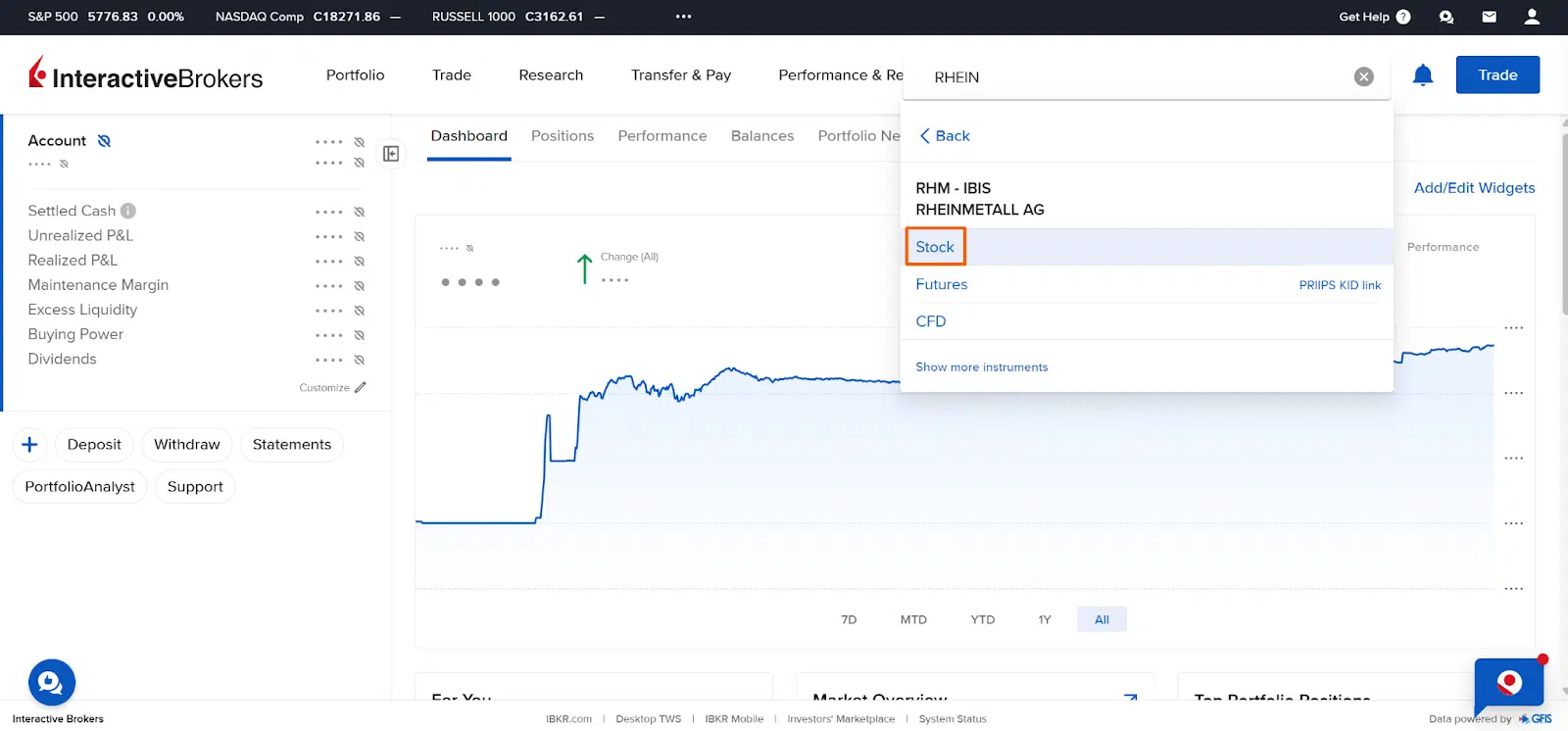

Then, select “Stock”:

- Step 2: Place a “Buy” order:

If you check the image carefully, you will notice a hidden view of “Your Position”, which is my investment in this stock (Yeah, I have skin in the game on this one).

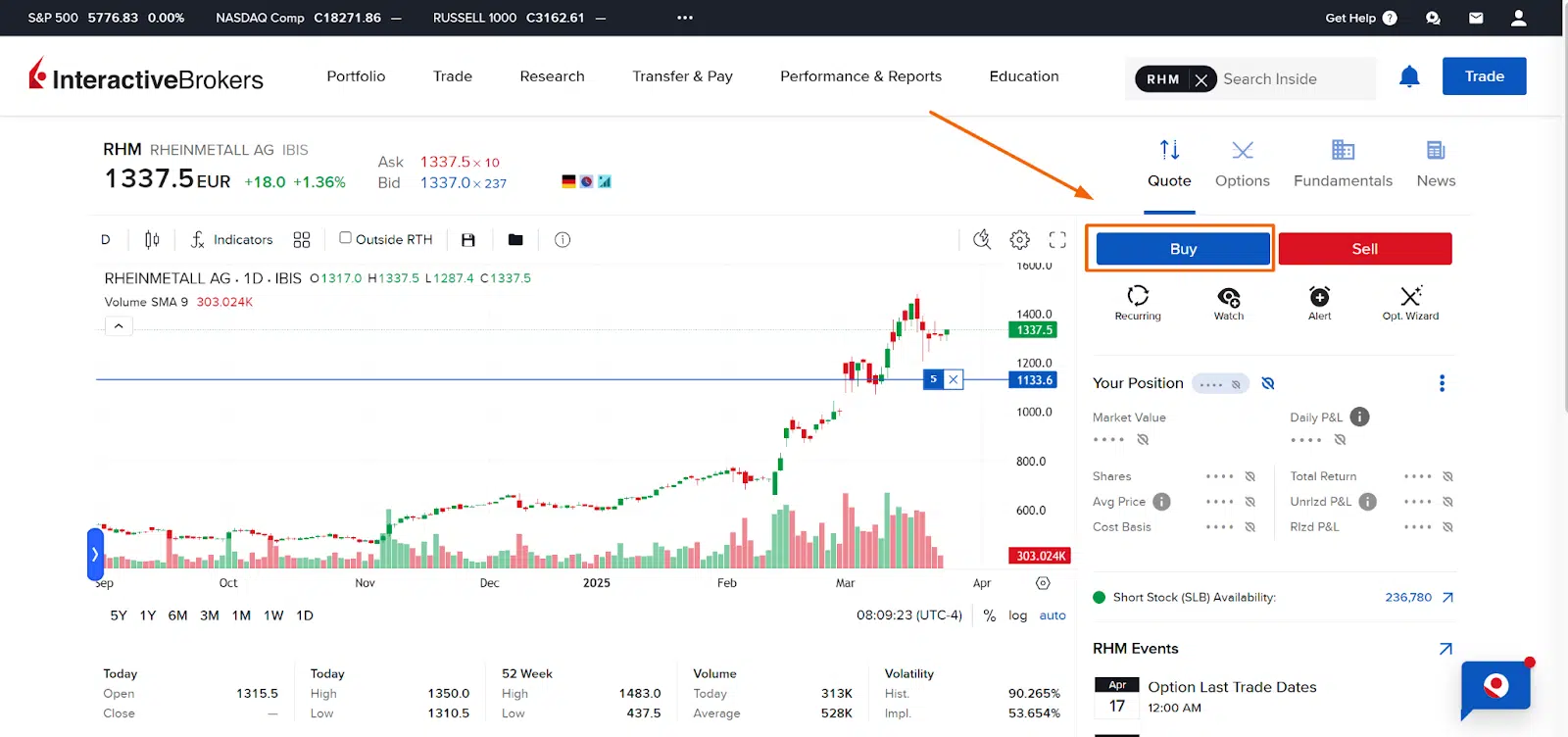

Step 3: Fill in order details

As the “Order ticker” appears on the right side, scroll down and select your parameters. In our case, we choose to buy 10 shares with a “limit” order of €1,337 – the maximum value per share we are willing to pay (you could give a “market” order, and you would buy the stock, almost instantly, at the best available price).

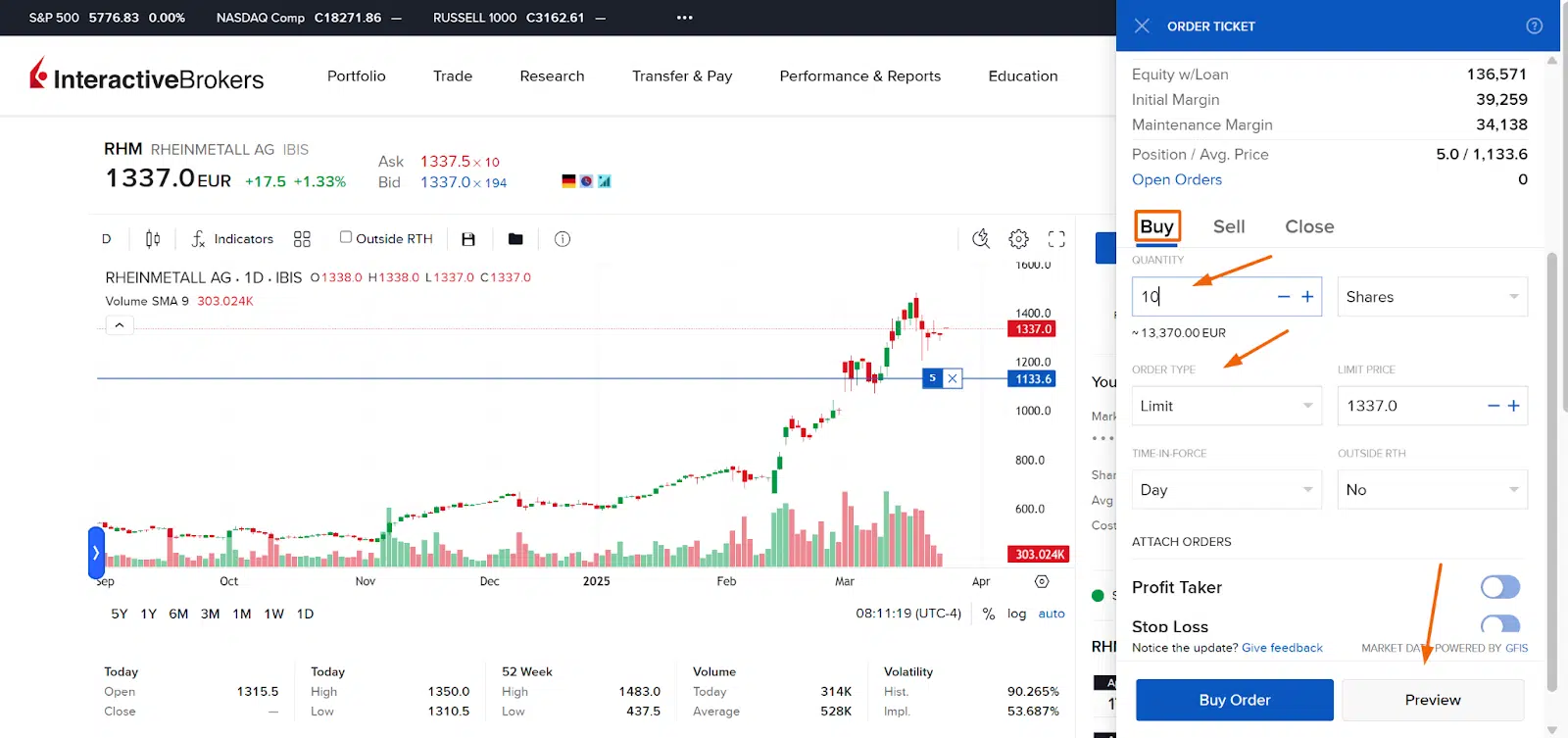

Step 4: Click “Preview” and, finally, “Submit Buy Order”

Here, you can give a final check, including the commissions you will pay for executing the order (up to €7.54 in our case).

Once you are ready, click “Submit Buy Order”, and that’s it!

Investment strategy tips

For European investors:

- Use platforms like Interactive Brokers, DEGIRO or Freedom24 to access the WisdomTree ETF.

- Favor UCITS ETFs for better tax treatment and regulatory protection.

- Consider a mix of ETF + individual stocks for a core-satellite strategy.

For American investors:

- Use ADRs for direct stock exposure (e.g., Airbus – EADSY, Leonardo – FINMY).

- Check your brokerage’s international access (e.g., Interactive Brokers, Fidelity, Schwab).

- Focus on global ETFs that include defence exposure outside the U.S.

Final thoughts

The European defence sector is no longer in the shadow of its American counterparts. Thanks to rising geopolitical threats and strategic uncertainty around U.S. commitments under Trump, Europe is ramping up its military spending at historic levels — and investors are paying attention.

Whether you’re looking to invest in the best European defence stocks like Rheinmetall or Thales, or prefer the simplicity of an ETF like the WisdomTree Europe Defence UCITS ETF EUR, the opportunities are there for both US and European investors.

Remember to weigh your risk tolerance, geopolitical views, and long-term goals before jumping in. The defence sector may be volatile, but it often proves resilient in uncertain times.