We are all well aware of what ChatGPT is at this stage and what benefits AI tools can bring into our everyday life. But did you know you can use AI to simplify your stock analysis?

In this blog post, we will review finchat.io, a generative AI tool that will provide you with information on 100,000+ global public companies and 100+ super investors.

What are the use cases of Finchat?

The modern investor is far more financially competent than those in decades gone by. This is partially down to the sheer wealth of information and resources available at the click of a button.

This wealth of information has brought about another pain point, much of the information we use for our stock analysis can be spread across multiple resources. With Finchat, you instantly call upon financial data from over 100,000 publicly listed companies to support your analysis.

Whether you are preparing Discounted cash flow models or looking for a short synopsis of all the earnings calls this week, you can get the financial data all in one place by using Finchat.

The Finchat tool also continues to be fed with 100s of investing books and letters from famous investors, so it is a wealth of really useful learning materials if you want an innovative way of learning about investing.

Finchat is still in its early days and will need to be used cautiously, but it is the future of how we will do our stock analysis.

Putting Finchat to the test

Let’s test out Finchat to get a better idea of how it works. We asked Finchat to provide us with Microsoft’s (MSFT) operating free cash for the past 5 years.

Within a matter of seconds, Finchat provided us with the following result:

Along with the narrative, Finchat provided us with several very useful data tables that can be broken down annually or quarterly:

What is encouraging is that even though the table for operating free cash flow was not readily available, the Finchat tool was intuitive enough to give us a suitable alternative (free cash flow).

This can be a real timesaver for you by cutting out the time of hopping from tool to tool, copying and pasting data, and wasting time doing simple analysis that can now be performed in a matter of seconds.

Next, we asked for a summary of 2023 Tesla’s Annual report, but this time, we wanted to go a step further and verify the data that Finchat was providing us with against the source data.

According to Finchat, the Total Revenues for the full year of 2023 were $96.77bn, and when we checked the investor relations section of Tesla’s website for the 2023 financial presentation, the figure quoted was precisely $96.77bn:

Source: 2023 Tesla Anual Report

What data does Finchat call upon for its answers?

The Finchat algorithm has been trained on all of the following data sources:

- Up-to-date financial data

- Earnings call transcripts

- Annual reports

- Quarterly reports

- Popular investing books

- Business KPIs

- Even 100s of Warren Buffet’s letters

Each week, more and more data is going to be fed to Finchat’s algorithm, which should see its performance continue to improve.

Is Finchat.io free to use?

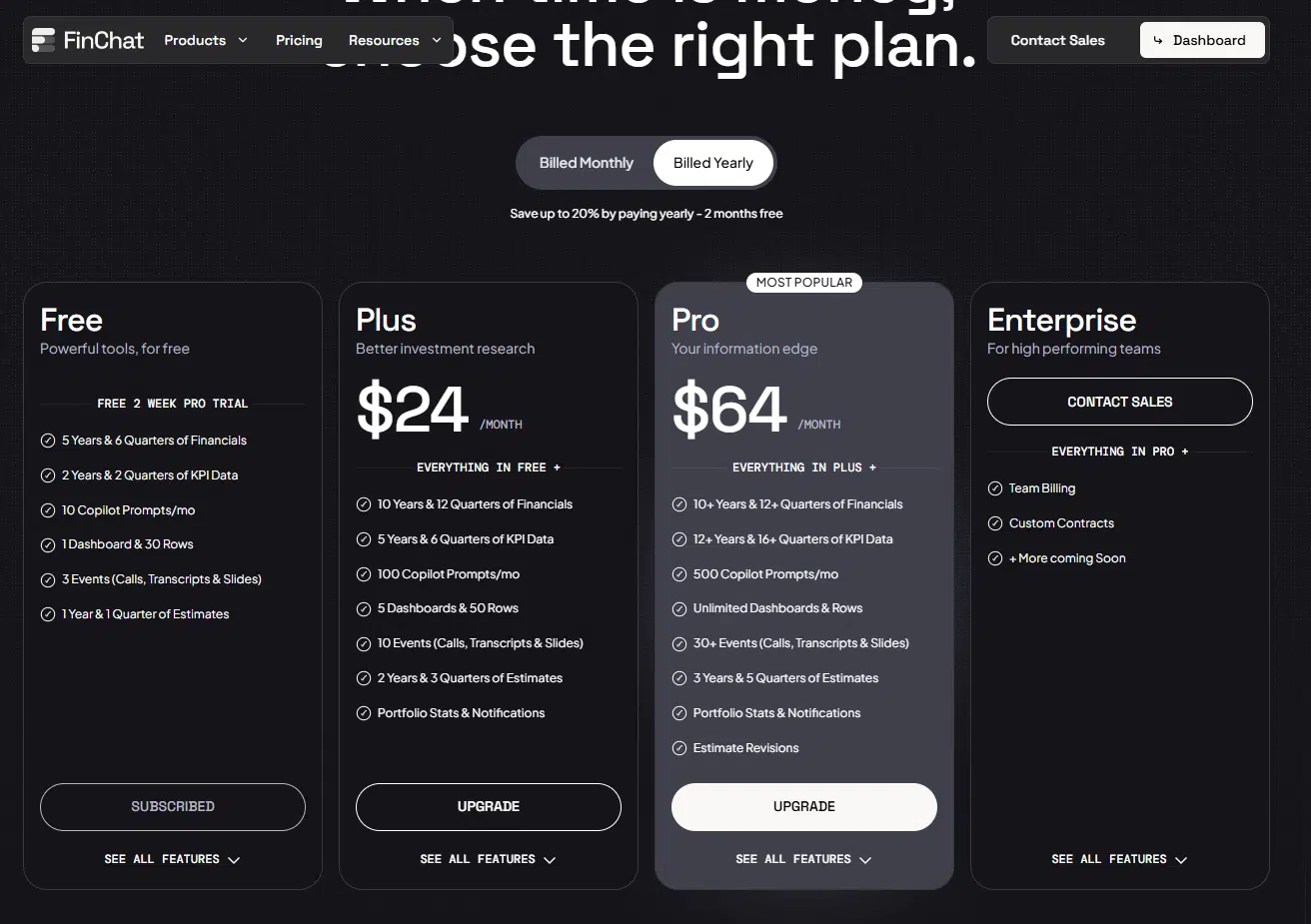

Currently, you can get 10 free prompts per day. Take this opportunity to test out the tool and see if it can form a core part of your stock analysis tools.

If you plan on upping your usage of Finchat, then you can upgrade your account and get 100 daily prompts for the price of $24 per month.

How to get the most out of Finchat

Finchat.io will only give you great answers if you are careful with the prompts you give it. Try not to be vague with your prompts. The clearer and more specific you are, then the more likely you’ll get the correct data you need.

It is also important to be cautious when using any online resource for analysing stocks, including Finchat. If you are planning on relying on any data from Finchat to make a financial decision, it is best advised to double-check key data for inaccuracies. While AI is less likely to make errors, these errors can still crop up with a new tool.

Should you start using Finchat now?

This is only the first release of the Finchat investment tool, so there are bound to be some teething issues. Still, as the algorithm is fed more and more data and is used by more investors, it will get exponentially better at giving you insightful data.

It would be foolish not to take advantage of the 10 free daily prompts that are currently on offer by Finchat to even just play with the tool and see what its capabilities are.

But if you do start using Finchat, make sure to proceed with caution, especially if you are relying on its data when making financial decisions. Always sense-check your data to make sure that it is correct.