Europe is one of the world’s most active regions for online trading, home to millions of retail and professional investors. Today, traders across Europe can choose from a wide range of CFD trading apps, from beginner-friendly mobile platforms to advanced solutions designed for active and professional traders.

While competitive spreads and low commissions matter, the best CFD trading app should also offer access to the instruments you want (forex, indices, commodities, stocks, or crypto CFDs) and deliver a secure, intuitive trading experience.

Europe’s robust regulatory framework, enforced by national financial authorities, ensures strong investor protection, including negative balance protection, while platform quality and risk-management tools often make the real difference.

In this guide, we highlight the best CFD trading apps in Europe, comparing fees, features, regulation, and usability, so you can choose the platform that fits your strategy and trade with confidence.

The best CFD trading apps in Europe

Here’s the list of our top picks for the best CFD trading apps in Europe:

- Plus500: The best CFD trading app in Europe, offering a clean interface, tight spreads, thousands of CFDs across major markets, and strong risk-management tools like guaranteed stop-losses.

Disclaimer: 79% of retail CFD accounts lose money. - Interactive Brokers: Best CFD trading app for experienced traders. A professional-grade broker with advanced platforms (TWS, WebTrader, mobile apps) and broad access to global CFD markets.

- eToro: Best for social & copy trading, allowing users to automatically follow and copy other CFD traders. A CFD-focused platform with social features like CopyTrader and a news feed.

- XTB: A strong choice for forex and short-term CFD trading, combining fast execution with the xStation app and advanced charting tools.

- Capital.com: A beginner-friendly CFD app with an intuitive interface, wide market coverage, and built-in educational and risk-management features.

For a list of trading apps we do not recommend, you can visit our full list of brokers and filter by “Not recommended”.

Comparison table

*You can the details fees on this page: https://www.plus500.com/en-cy/help/feescharges

Other resources

- Check our YouTube channel! You will find step-by-step guides of how to invest in the S&P 500 on different apps, as well as other educational videos about investing and investment platforms.

- Explore our tools: Check our comparison tool, reviews, broker bonuses, and others.

Review of each broker

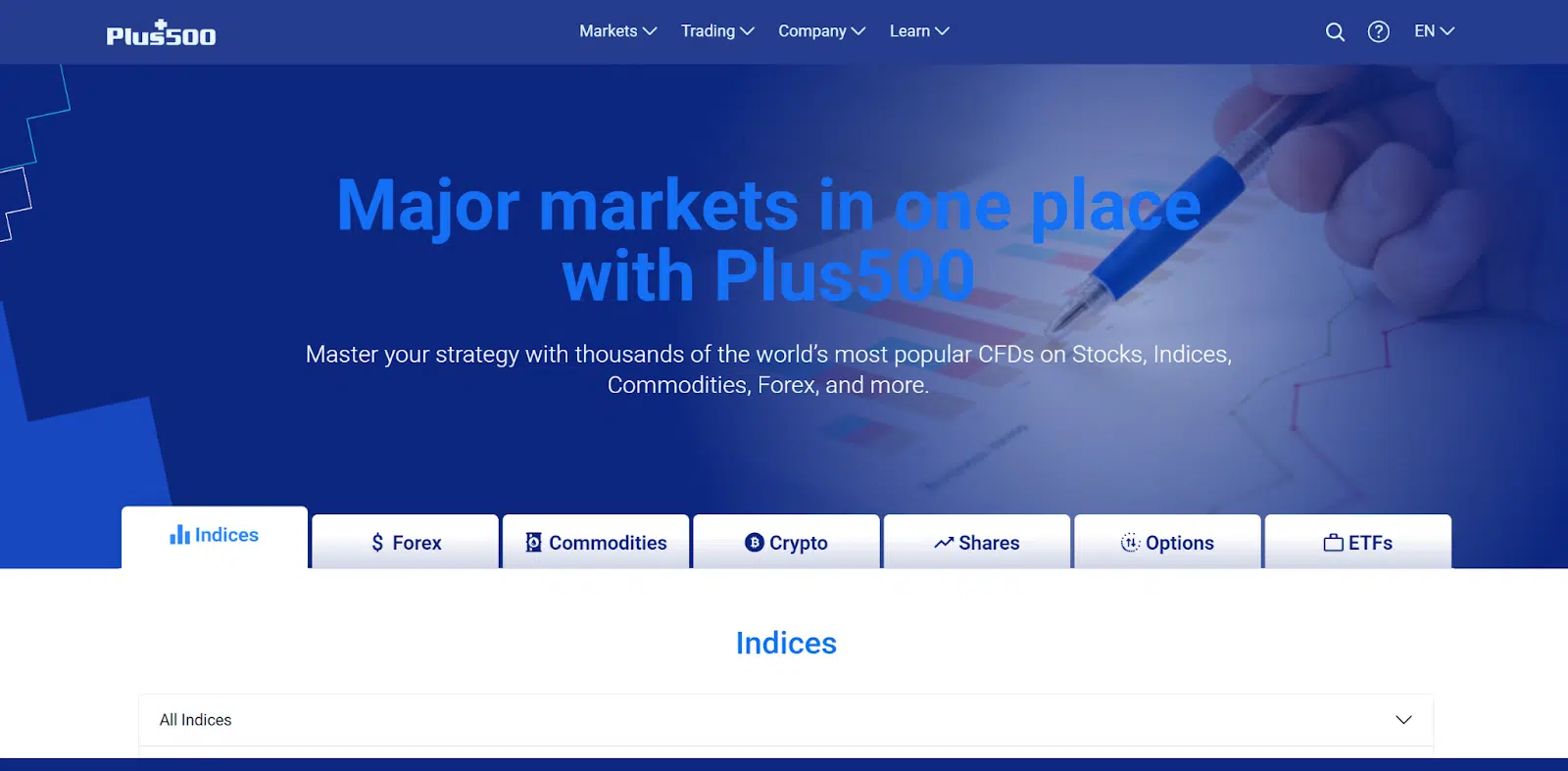

#1 Plus500 at a glance

79% of retail CFD accounts lose money.

Founded in 2008 and listed on the London Stock Exchange (ticker: PLUS), Plus500 is one of Europe’s most established and widely used CFD brokers. It is particularly known for its user-friendly interface, transparent pricing, and strong focus on risk-managed CFD trading.

Unlike multi-asset brokers that offer numerous platforms, Plus500 takes a streamlined approach with a single proprietary platform, available on web, desktop, and mobile (iOS and Android). This unified experience makes it especially appealing to traders who want to focus exclusively on CFDs.

The Plus500 platform is designed with usability in mind, offering real-time quotes, advanced charting, customizable alerts, and integrated risk-management tools, including guaranteed stop-loss orders and negative balance protection. These features are built directly into the trading interface, making them straightforward to apply even for less experienced traders.

Plus500 provides access to thousands of CFD instruments across major asset classes, including indices, forex, commodities, cryptocurrencies, stocks, options, and ETFs. This broad coverage allows traders to diversify strategies and trade global markets from a single app.

Pricing at Plus500 is mostly spread-based, meaning there are no trading commissions, which simplifies cost calculation and appeals to short-term and active CFD traders. Overnight funding costs apply to leveraged positions, as is standard with CFD trading. There is also an inactivity fee of $10 if you do not log in to your account for at least three months.

From a regulatory standpoint, Plus500 operates in Europe through its subsidiary Plus500CY Ltd, which is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC – Licence No. 250/14), complying with strict EU regulatory standards, including leverage limits, client fund segregation, and mandatory negative balance protection.

Pros

-

Excellent CFD-focused platform with a clean, beginner-friendly interface

-

Commission-free trading with transparent, spread-based pricing

-

Strong built-in risk management, including guaranteed stop-loss orders

- Free and unlimited demo account for practice

Cons

-

Limited advanced trading tools compared to professional platforms

-

No support for MT4/MT5, TradingView, or third-party trading platforms

- Not ideal for algorithmic or highly sophisticated trading strategies

Want to learn more? Check our full Plus500 review.

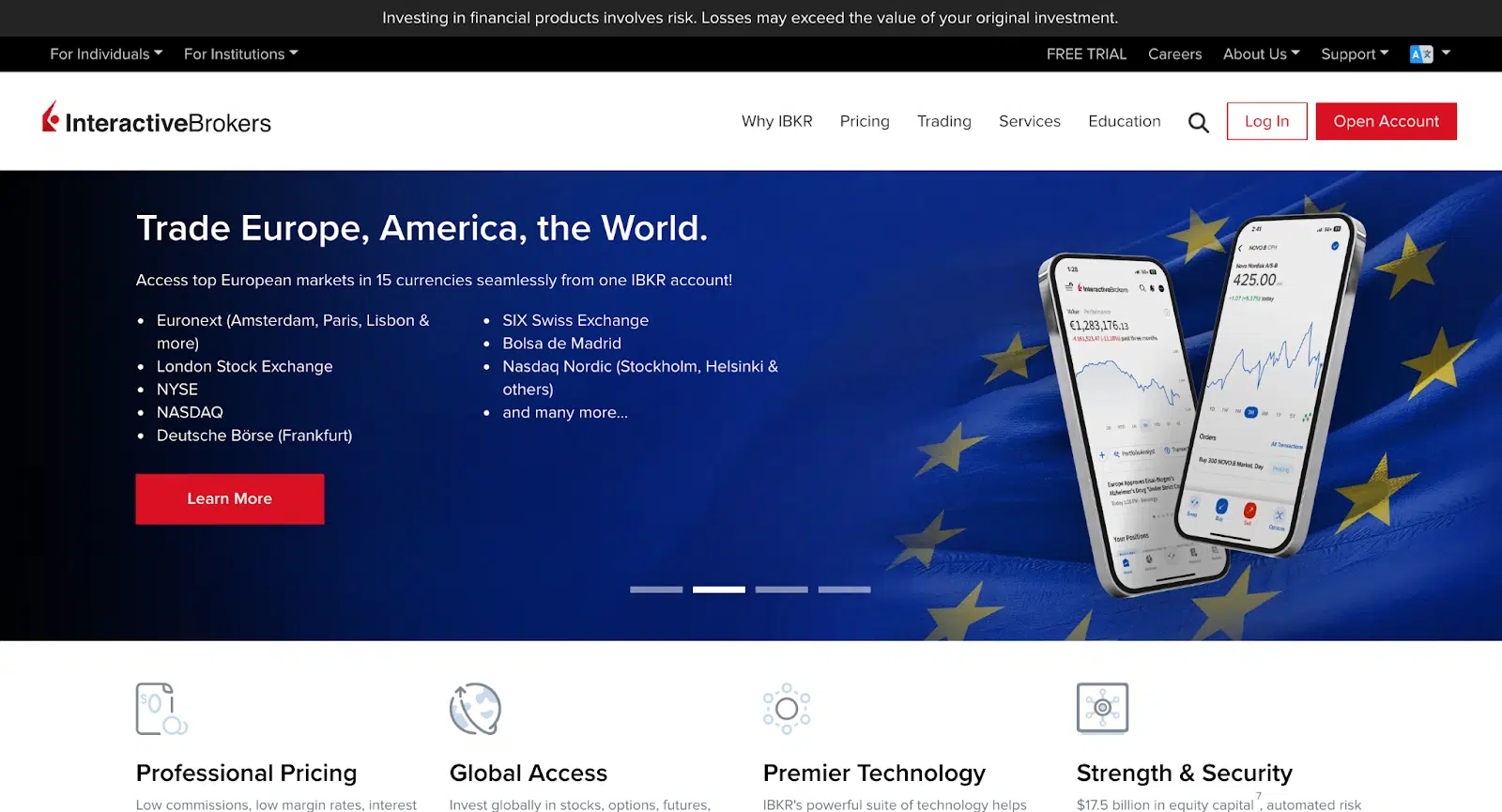

#2 Interactive Brokers at a glance

Founded in 1978 and listed on NASDAQ (ticker: IBKR), Interactive Brokers is one of the most established and technologically advanced brokers in the world. While best known for its multi-asset offering, IBKR also provides a robust and cost-efficient CFD trading solution, particularly suited to experienced and professional traders.

Interactive Brokers offers CFDs on a wide range of global markets, including stocks, indices, forex, and commodities, with competitive pricing, deep liquidity, and institutional-grade execution. Compared to CFD-only brokers, IBKR’s CFD offering stands out for its tight spreads, transparent cost structure, and access to major international exchanges.

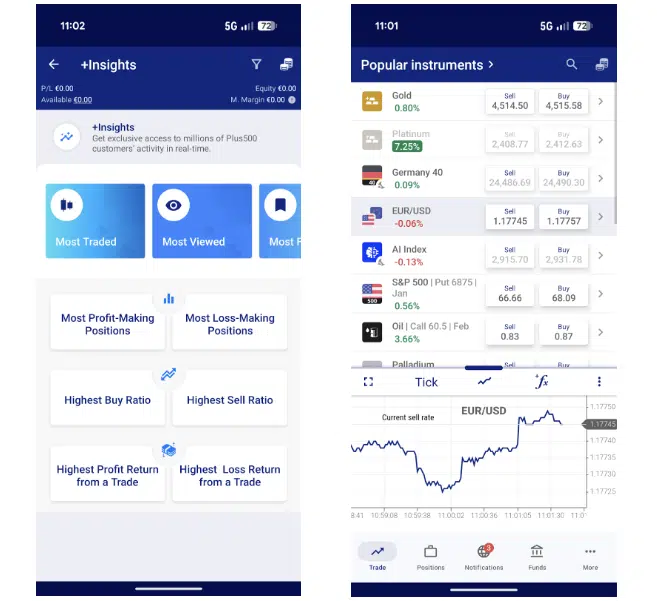

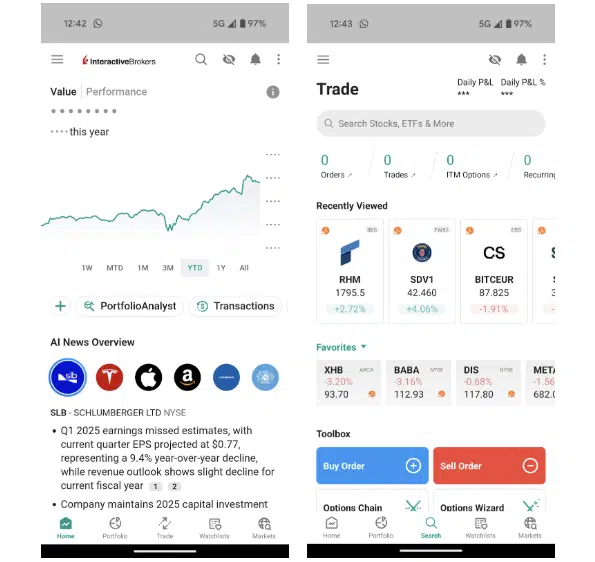

For mobile trading, Interactive Brokers provides two distinct apps; however, only one allows you to trade CFDs:

- IBKR Mobile: Designed for active and experienced traders, this app delivers advanced charting, multiple order types, real-time risk metrics, and full access to IBKR’s CFD markets. It is one of the most powerful mobile trading apps available for CFD traders who want professional tools on the go.

Here’s a quick look at IBKR Mobile:

The other app is IBKR GlobalTrader, but it is only designed for stocks, ETFs, and options.

The platforms also integrate strong risk-management features, including margin monitoring, real-time alerts, and automatic liquidation safeguards, helping traders manage leveraged CFD positions more effectively.

In terms of fees, for US stocks, commissions start at $0.005 per share (minimum $1 per order), and for EU CFD stocks, commissions are 0.05% of trade value (minimum €3 per order).

From a regulatory perspective, Interactive Brokers operates in Europe through its subsidiary Interactive Brokers Ireland Limited, which is regulated by the Central Bank of Ireland (CBI). Assets, including cash, are protected up to €20,000 under the Investor Compensation Scheme ICCL.

Pros

-

Very broad CFD offering across global markets (stocks, indices, forex, commodities)

-

Highly competitive pricing with tight spreads and low commissions

-

Powerful mobile app (IBKR Mobile)

-

Professional-grade execution and risk-management tools

- Strong regulation and high investor protection standards in Europe

Cons

-

The mobile app can feel complex for beginners

-

CFD trading is less intuitive compared to CFD-only brokers

-

Complicated and time-consuming account opening process (but entirely online)

-

Limited crypto access

-

Calculating fees can be complex

- Interface and setup require a learning curve for new traders

Want to learn more? Check our Interactive Brokers review.

Note: Interactive Brokers offers two commission plans: “Tiered” and “Fixed”. The commissions mentioned here refer to the “Tiered” plan, which, based on our experience, is the most cost-effective option, especially since it rewards higher frequency activity with lower per-trade costs.

#3 eToro at a glance

46% of retail CFD accounts lose money.

Founded in 2007, eToro has grown into one of the most widely used and beginner-friendly trading platforms globally. It recently went public with an initial public offering (IPO), listing on the Nasdaq exchange in the US (ticker: ETOR).

eToro’s proprietary web and mobile platform is designed for simplicity, making it particularly appealing to beginner and intermediate CFD traders. Features like CopyTrader enable users to automatically replicate the CFD strategies of experienced traders, while the integrated news feed adds a social-media-style learning layer to trading.

As a CFD broker, eToro uses spread-based pricing and includes key EU-mandated protections such as negative balance protection and leverage limits. While easy to use, its tools are more geared toward discretionary and social trading rather than advanced technical or professional CFD strategies.

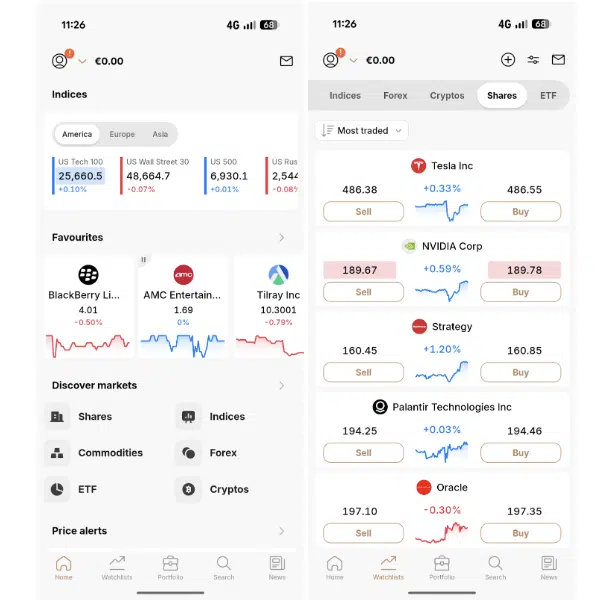

Here’s a quick look at the eToro investing app:

It’s important to note that all accounts are USD-based, meaning a 0.5% currency conversion fee applies when depositing or withdrawing euros. This can be avoided by depositing in euros using eToro’s Money wallet, which is a separate app.

In Europe, eToro operates through its subsidiary eToro (Europe) Ltd. under a CySEC license, ensuring compliance with MiFID II regulations. This provides investor protection, with compensation available for up to €20,000 under the Investor Compensation Fund (ICF) in Cyprus.

Pros

-

Social and copy trading features (CopyTrader, news feed)

-

Offers a welcome bonus in Europe

-

Beginner-friendly web and mobile CFD trading platform

-

Wide range of CFD markets, including stocks, forex, indices, and crypto

-

Demo account available

- Regulated within the EU (CySEC)

Cons

-

0.5% EUR currency conversion fee on deposits/withdrawals - can be avoided by depositing using eToro Money wallet

-

Limited advanced charting and research tools

-

Withdrawal fee of $5

- Inactivity fee of $10 per month after 12 months

For more information, please consult our review on eToro.

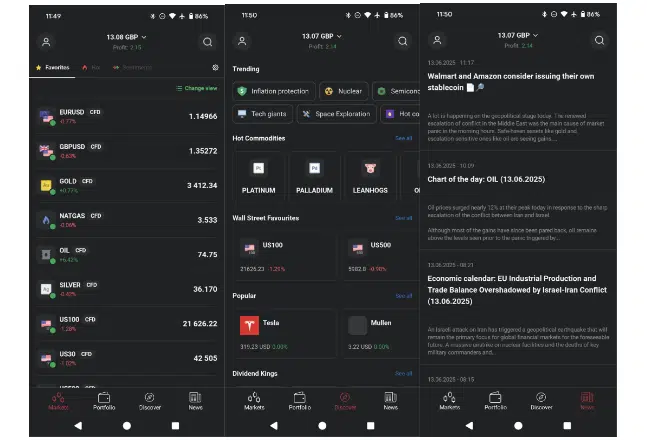

#4 XTB at a glance

69-80% of retail CFD accounts lose money.

Founded in 2002, XTB is a publicly traded company listed on the Warsaw Stock Exchange and a global broker based in Poland, known for its robust trading app and extensive educational resources. It provides access to CFDs on forex, indices, commodities, stocks, ETFs, and crypto, with a particular focus on active and short-term traders.

XTB’s proprietary xStation platform, available on web, desktop, and mobile, is one of its main strengths. The app offers fast execution, advanced charting, integrated market analysis, and economic calendars, making it especially suitable for forex and short-term CFD trading. The interface strikes a strong balance between usability and professional-level tools.

For beginners, XTB offers a demo account that allows trading with virtual funds, providing hands-on experience with the platform. XTB’s xStation is a natively designed mobile app optimized for mobile trading with its full range of assets.

CFD trading on XTB benefits from competitive spreads, transparent pricing, and key EU investor protections such as negative balance protection. While XTB also offers commission-free stock and ETF investing under certain conditions, its platform is particularly appealing to traders who actively manage leveraged CFD positions.

You can see what the XTB investing app looks like here:

There is no platform fee to use XTB’s mobile trading app, and it does not charge any fees for account maintenance or withdrawals above €50.

One drawback is that XTB charges an inactivity fee of €10 per month after one year of no trading activity and if no deposits have been made in the last 90 days.

XTB operates through multiple European entities and is regulated by various national financial authorities within the EU’s harmonised regulatory framework. This ensures consistent investor protections, including client fund segregation and negative balance protection.

Pros

-

Powerful xStation platform with advanced charting and analysis tools

-

Strong offering for forex and short-term CFD traders

-

Competitive spreads with no commission on CFDs

-

Natively designed mobile app optimised for investing

-

Extensive educational resources

- No account opening or maintenance fees

Cons

-

Platform may feel complex for complete beginners

-

0.5% currency conversion fee

-

Limited product offerings for long-term investors

-

Withdrawals under €50 cost €5

- Inactivity fee of €10 per month if your account is inactive for 12 months

If you want to find out more, you can read our in-depth XTB review.

#5 Capital.com at a glance

CFDs involve a high level of risk. 69% of retail investors lose money.

Founded in 2016, Capital.com is a fast-growing CFD broker known for its user-friendly trading app, transparent pricing, and strong emphasis on trader education. It provides access to CFDs on forex, indices, commodities, stocks, ETFs, and crypto.

Capital.com’s proprietary mobile app offers real-time quotes, advanced charting, technical indicators, and smart alerts, making it particularly well suited for beginner and intermediate CFD traders. The interface is clean and intuitive, reducing the learning curve often associated with leveraged trading.

Capital.com offers an unlimited demo account with virtual funds, allowing traders to practice CFD strategies and explore the platform risk free. The mobile app is natively built and optimised for trading on the go, with fast execution and smooth navigation across markets.

You can see what the Capital.com investing app looks like here:

CFD trading on Capital.com benefits from competitive spreads, no commission charges, and key EU investor protections such as negative balance protection. The broker also stands out for its educational approach, offering in-app learning tools and behavioural insights designed to help traders better understand risk and decision making.

There are no fees for opening or maintaining an account, but Capital.com charges an inactivity fee of €10 if the account remains inactive for more than one year.

In Europe, Capital.com operates through Capital Com SV Investments Limited, which is authorised and regulated by the Cyprus Securities and Exchange Commission (Licence No. 319/17).

Pros

-

Very intuitive and beginner-friendly CFD trading app

-

Commission-free CFD trading with transparent pricing

-

Wide range of CFD markets, including stocks, forex, and crypto

-

Unlimited demo account for practice

-

Strong educational and risk-awareness tools

- No account maintenance or withdrawal fees

Cons

-

Lacks advanced tools for professional or algorithmic traders

-

Limited platform customisation compared to advanced brokers

- Inactivity fee

For a deep dive, read our review of Capital.com.

Criteria for the best CFD trading apps in Europe

The selection of CFD trading apps featured in this article is based on criteria that, in our view, address the needs of most retail CFD traders across Europe. Our assessment focuses on platforms that combine regulatory safety, competitive pricing, and practical tools for trading leveraged products.

Below are the key factors considered:

1. Regulation, security, and asset protection

All selected CFD trading apps operate under European financial regulators and comply with the EU’s harmonised regulatory framework. We evaluated investor protection measures, including client fund segregation, negative balance protection, and safeguards for uninvested cash, to ensure a secure trading environment for retail traders.

2. Trading costs and fees

Costs play a critical role in CFD trading performance. We reviewed spreads, commissions (where applicable), overnight financing charges, inactivity fees, currency conversion costs, and any platform or withdrawal fees. Priority was given to brokers offering transparent, competitive pricing suitable for active and short-term CFD trading.

3. Range of CFD markets

A strong CFD platform should provide access to a wide selection of markets. We prioritised apps offering CFDs on forex, indices, commodities, stocks, ETFs, and cryptocurrencies, allowing traders to diversify strategies and trade global markets from a single account.

4. Ease of use and trading tools

User experience is essential when trading CFDs, especially on mobile. We assessed app usability across account setup and funding, order execution, charting, and risk-management features such as stop-losses. Platforms that balance simplicity for beginners with advanced tools for experienced traders scored higher.

5. Customer support quality

Reliable customer support is critical in fast-moving CFD markets. We evaluated support availability, response times, and effectiveness, as well as the range of communication channels offered, including live chat, email, and phone support.

Investor compensation scheme

The Investor Compensation Scheme (ICS) is the last safeguard for investors. When everything goes wrong, the ICS steps in to provide protection.

In the table below, we highlight the regulators of origin for each broker and the coverage limits applicable to European investors:

| Broker | Regulator | Investor Protection |

| Plus500 | CySEC (Cyprus) | Up to 90% of a maximum of €20,000 for assets |

| Interactive Brokers | CBI (Ireland) | Up to 90% of a maximum of €20,000 |

| eToro | CySEC (Cyprus) | Up to 90% of a maximum of €20,000 for assets |

| XTB | BaFin (Germany), KNF (Poland), and other | Up to €20,000 |

| Capital.com | CySEC (Cyprus) | Up to 90% of a maximum of €20,000 for assets |

Which CFD trading app should you choose in Europe?

Choosing the best CFD trading app in Europe isn’t straightforward, as the right platform largely depends on your experience level and the markets you want to trade. A good starting point is deciding whether you prefer a beginner-friendly app focused on simplicity or a more advanced platform designed for active and professional CFD traders.

There is no single “perfect” CFD trading app for all European traders; each platform has its own strengths and trade-offs. Plus500 stands out as the best overall choice for CFD trading thanks to its intuitive interface and robust risk-management tools. At the same time, Interactive Brokers is better suited for experienced traders seeking advanced functionality and access to global CFD markets.

For traders interested in social and copy trading, eToro offers a unique learning-driven approach. In contrast, XTB is a solid option for forex and short-term CFD traders who value advanced charting and analysis. Finally, Capital.com is well-suited to beginners looking for a clean, easy-to-use app with strong educational support.

Ultimately, the best CFD trading app is the one that aligns with your experience level, risk tolerance, and trading goals. Taking the time to compare features, costs, and tools can make a meaningful difference in your long-term trading results.

Disclaimer: This content does not constitute investment advice. Contracts for Difference (CFDs) and other derivative instruments are complex products that employ leverage and therefore involve a high risk of rapid capital loss. Public data indicate that between 69 % and 83 % of retail investor accounts lose money when day-trading leveraged products with brokers such as XTB, Plus500, Interactive Brokers (IBKR), Capital.com. Before trading, make sure you fully understand how these products work and whether you can afford to lose your entire investment.