Hello, fellow investor! Today, we’ll take a closer look at amana, one of the leading trading and investing platforms in the UAE. It is trusted by 350,000+ users worldwide.

On the downside, amana’s app does not yet support Irish-domiciled ETFs and there’s no option to transfer positions to another broker, which may not appeal to long-term investors who prefer full ownership and transferability.

amana offers two main services:

- amana Trade: for self-directed investors who want to trade local assets (MENA stocks) and global assets (stocks, ETFs, crypto, and CFDs).

- amana Invest: a robo-advisor service that helps you build and manage a diversified portfolio automatically, similar to Sarwa.

amana group is regulated internationally, including by the Dubai Financial Services Authority (DFSA), ensuring strong investor protection standards. However, be aware that the UAE app is not directly supervised by the DFSA, so always confirm which amana entity your account belongs.

As an added perk, amana promotes its trading app by giving you a USD 100 signup bonus.

That’s amana in a nutshell! Let’s dive into all the details below.

Overview

amana is a UAE-based, regulated brokerage firm with over 15 years of experience in the financial markets. Headquartered in Dubai, it offers an easy and modern way for investors in the Middle East and beyond to access both local and global markets, all through a single intuitive app.

It allows users to trade with 0% commissions on U.S. and international stocks, ETFs, cryptocurrencies (over 375 digital assets), and MENA region shares, as well as leveraged products such as forex and commodities.

Investors looking for a more hands-off approach can use amana invest, a passive investment feature that helps you build diversified portfolios through automated plans. Meanwhile, active traders benefit from 24/5 U.S. stock trading hours, cashback on every trade (up to 20% on every trade), and a transparent fee structure with no hidden charges.

Fractional investing is available, allowing you to buy a portion of high-priced shares like Apple, Tesla, or Amazon with a small starting amount. You can also earn 3.00% interest on your uninvested USD cash.

amana also stands out for its crypto offering, supporting hundreds of coins, including Bitcoin, Ethereum, and Solana, with competitive spreads and simple onboarding.

Users can deposit and withdraw funds with zero fees when using the following Mastercard, Visa, Apple Pay, Wire transfer and UAE instant banking (for local UAE users) and Lebanon Whish Money (for users in Lebanon).

On the downside, amana’s product range, while broad, may not include every product (bonds, options,…) or professional tools offered by global brokers, and access is still region-focused.

Highlights

| 💵 Minimum deposit | $25 |

| 📍 Products offered | MENA region shares, stocks, ETFs, cryptocurrencies and CFDs in forex, commodities and indices |

| 💰 amana trade fees | 0% commission |

| 💰 amana invest fees | 0% commission |

| 💰 amana CFD fees | Overnight financing fees |

| 💰 MENA stocks fees | $0 for the first $100,000 investment or 50 trades |

| 💰 Inactivity fee | $10/month, if your account is inactive (no deposit or trades) for 12 consecutive months |

| 💰 Withdrawal fee | $0 |

| 💵 Interest on uninvested cash | 3.00% (USD) |

| 💵 Deposit methods | Bank transfer, Mastercard, VISA, Apple Pay, online wallets and UAE instant banking |

| 📜 Regulatory entities | SCA, CySEC, LFSA, DFSA, FSC, CMA |

| 🗺️ Supported countries | MENA region, European countries and others |

Pros and cons

Pros

- 24/5 hours trading on stocks and ETFs

- $100 bonus with amana promo code “IITW”

- 0% commissions on stocks, ETFs and crypto

- Amana Invest (passive investment plans)

- Interest on idle cash

- Cashback on every trade (up to 20%)

- Multi-asset access: U.S. + MENA equities, forex, CFDs, and crypto all in one place.

- MT4/MT5 support for traditional traders

- Good local reach: Enables UAE/Saudi/Qatar trading, local AED deposits

- Amana Invest: Automated ETF and crypto portfolios with no management fees.

- 24/6 customer support

Cons

- Doesn’t offer bonds or options

- No position transfers to other brokers

- Limited product range: LSE/Irish ETFs not yet available

- Emphasis on leverage and CFDs, which may not fit conservative, long-term investors

Investment platform

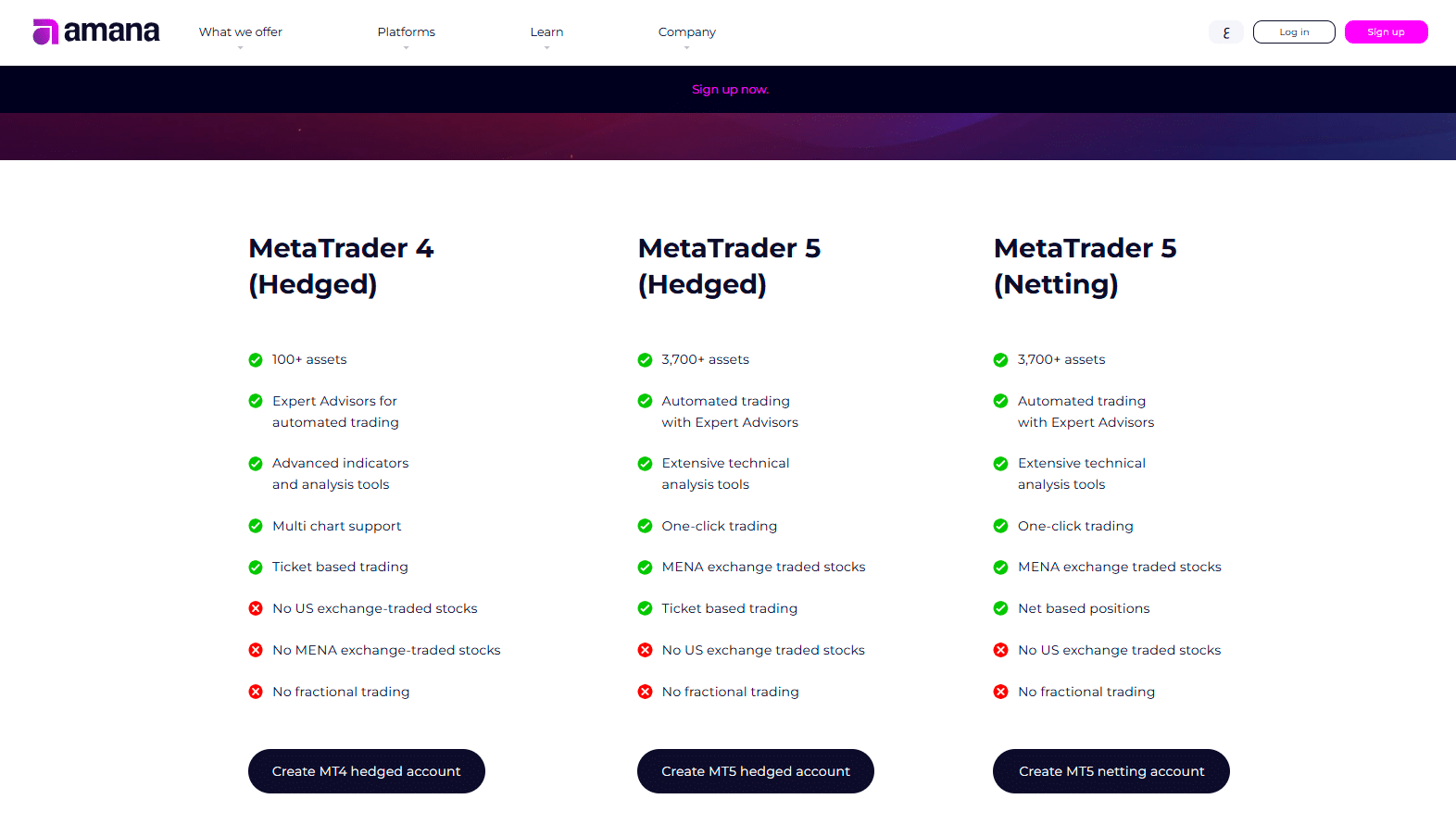

In amana, you can use three platforms: amana app (mobile), amana web and MetaTrader 4/5.

amana app

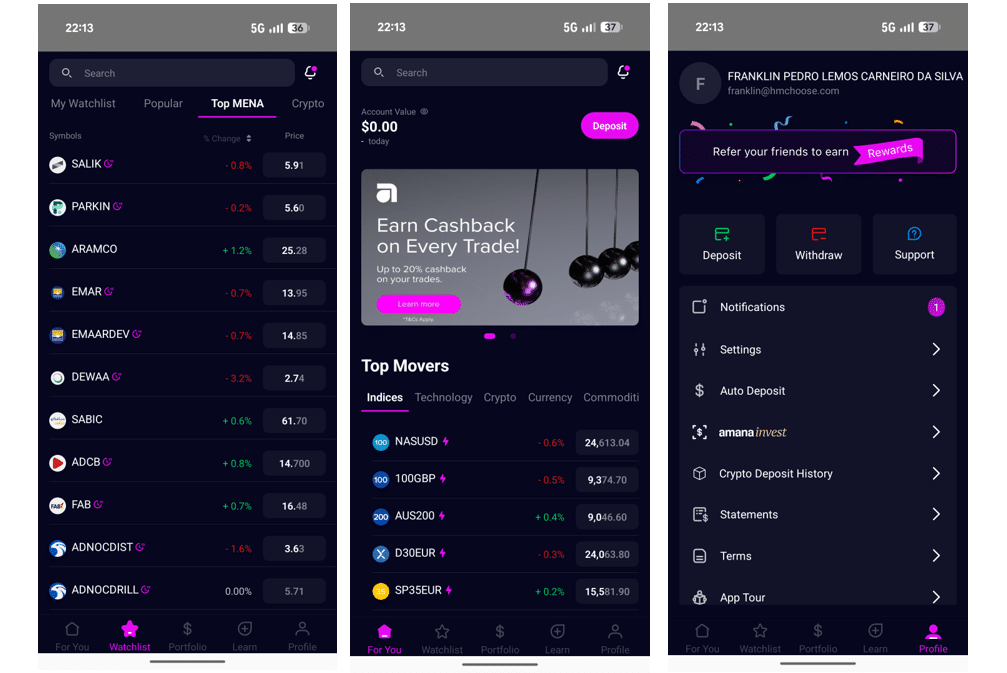

The amana app is amana’s proprietary mobile trading platform, designed to give users a simple, all-in-one experience for trading and investing.

Through the app, users can deposit and withdraw funds, trade across multiple asset classes, track performance, set alerts, and even learn basic market concepts, all without switching platforms. It’s available for both iOS and Android, catering primarily to investors in the UAE and the wider MENA region.

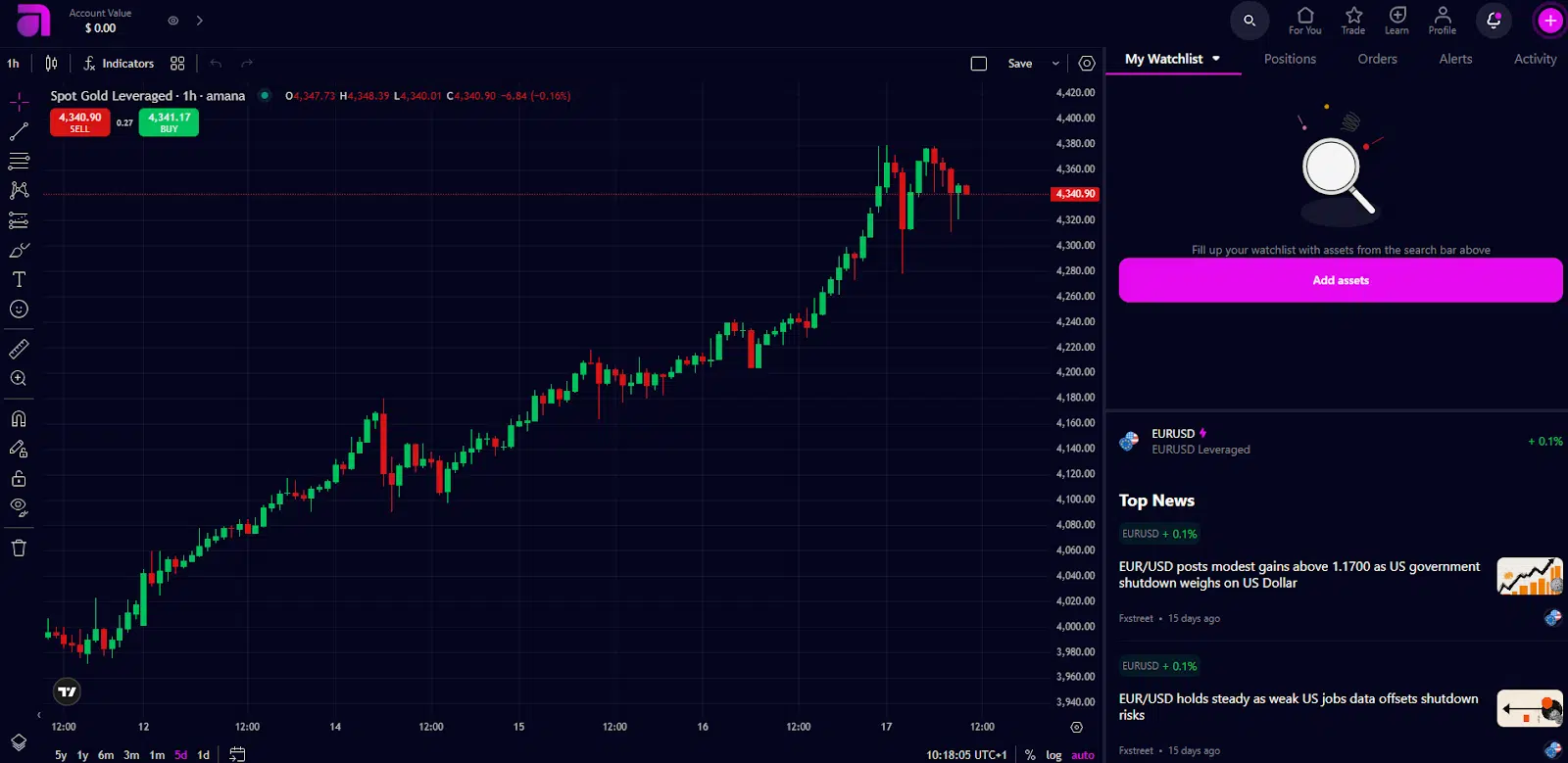

amana web

The amana Web platform is the browser-based interface of amana’s trading ecosystem. It is designed to complement the mobile app by providing a larger, more robust workspace for charting, order execution, and portfolio management via desktop or laptop.

Its goal is to offer more flexibility and depth than what’s typically feasible on a mobile screen, while retaining access to the same markets, orders, and account functions.

The amana Web platform provides a solid middle ground between mobile convenience and desktop power. It is well suited for traders who prefer working from a larger screen without installing complex software, while still needing charting tools, order execution, and account management in one place.

MetaTrader 4/5

amana offers full access to MT4 and MT5 trading platforms for customers, including those in the UAE. These MetaTrader platforms complement amana’s proprietary app and web interfaces, allowing users to use an industry-standard environment for trading.

The MT platforms are available in multiple forms: desktop clients, web versions, and mobile apps. When opening accounts (demo or live), amana allows the selection of MT4 or MT5.

Products & markets

The all-in-one trading app provides access to over 5,500 commission-free assets across global and regional markets. From stocks, cryptocurrencies, forex, metals, and indices to ETFs, commodities, and more. Also, it offers another separate service called amana invest (more on that below).

Here is a breakdown of what they support:

| Asset Class | Details |

| Physical US Shares | ✅ Over 2,100 physical U.S. shares, meaning users own the underlying stock rather than a derivative. |

| Physical MENA stocks | ✅ Includes more than 200 MENA and UAE-listed companies. |

| Global / EU / UK Stocks | ✅ Provides access to international equities, including select EU and UK companies. These are available alongside U.S. stocks within the same account. |

| ETFs | ✅ Available for both U.S. and global markets, offering exposure to diversified baskets of assets. |

| CFDs / Leveraged Products / Derivatives | ✅ CFDs are available on a wide range of assets, including stocks, indices, commodities, and crypto, allowing for leveraged trading. |

| Forex (Currency Pairs) | ✅ Supports more than 70 major, minor, and exotic FX pairs. |

| Commodities & Precious Metals | ✅ Includes products such as oil (WTI and Brent), natural gas, gold, silver, and other key commodities. |

| Indices | ✅ Access to major global indices such as the S&P 500, NASDAQ, FTSE 100, and DAX 40. |

| Crypto | ✅ Offers exposure to over 375 cryptocurrencies (leveraged and non-leveraged formats). |

| Fractional Shares | ✅ Users can purchase fractional shares, allowing investment in high-priced stocks with smaller amounts. |

| After-Hours Stock & ETF Trading | ✅ 24/5 trading on U.S. stock and ETF derivatives. |

| Options | ❌ |

| Bonds | ❌ |

| Futures | ✅ |

| Irish ETFs | ❌ |

LSE/Irish ETFs are not yet available. Many UAE investors prefer Irish-domiciled UCITS ETFs (not yet available on amana) to reduce U.S. tax exposure, by avoiding:

- A 30% withholding tax on U.S. dividends (standard for non-U.S. investors).

- A U.S. estate tax above $60,000 in U.S.-domiciled assets. This applies only if you die and have more than $60,000 in US assets.

Physical vs. Derivative: The “physical” assets mean you own the underlying. In contrast, CFDs / leveraged products are derivative contracts whose value tracks the underlying, but you don’t own the reference asset. amana offers both types for many instruments. Check this article “CFDs vs shares”.

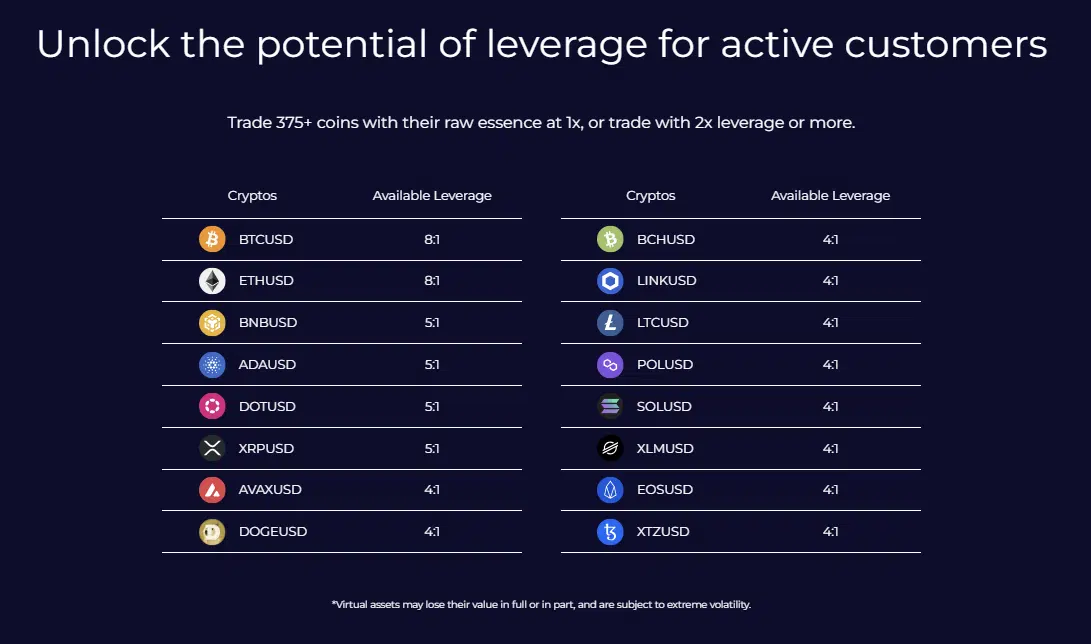

Within crypto, amana offers leverage up to 8x (only in Bitcoin and Ethereum, then it drops to less than 5x):

Apart from investing in more well-known cryptocurrencies, exploring gaming tokens or getting into meme coins, you can also deposit crypto (stable coins) into your account and invest automatically, as explained in “amana invest” section.

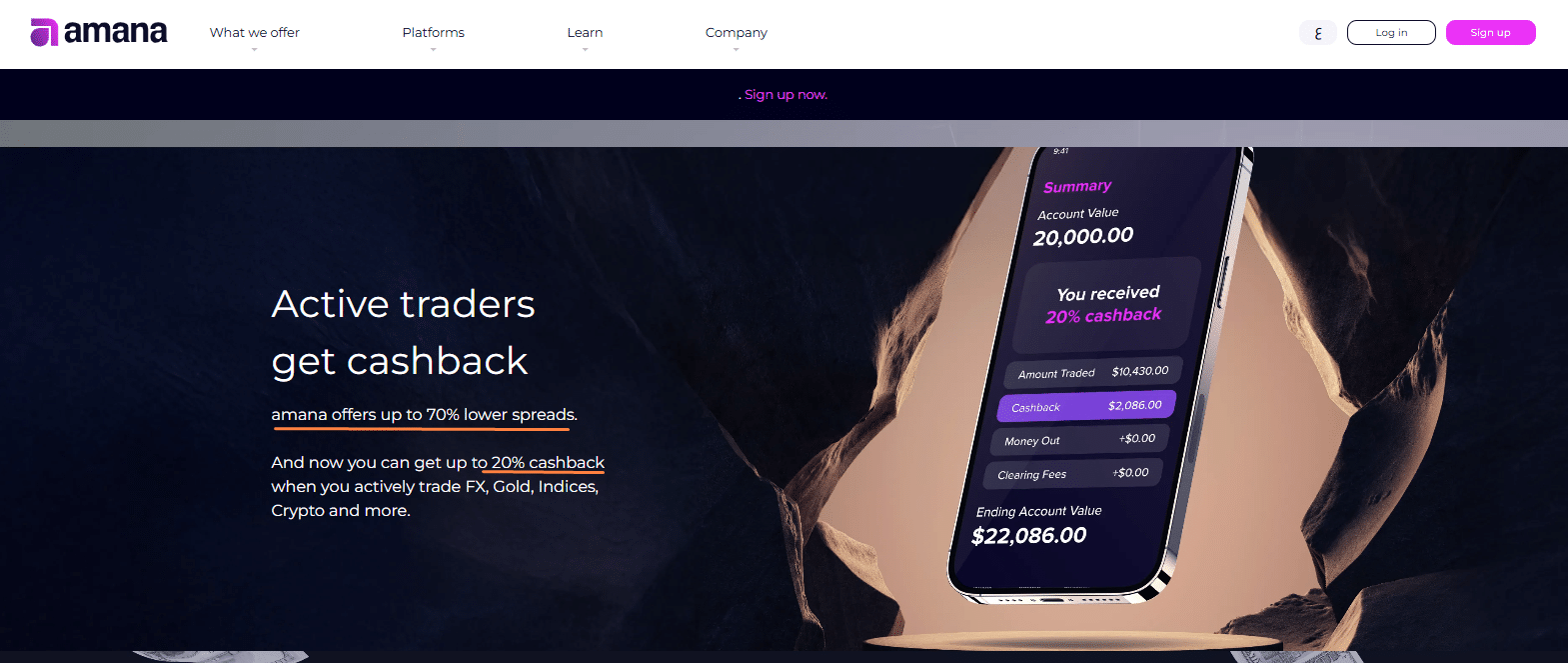

amana cashback

amana offers a cashback rewards program that rewards active traders by refunding part of the trading costs they incur through spreads.

The concept is simple: the more you trade, the more cashback you can earn. According to amana, eligible users can receive up to 20% cashback on the spreads paid when trading different asset classes such as forex, gold, indices, and cryptocurrencies.

The program works automatically in the background, there’s no need for manual enrollment or coupon codes. Please note that cashback rewards only apply to the app and MT5 accounts.

The cashback is paid within five business days after the end of each month. Importantly, trades that are opened and closed in under 60 seconds do not qualify, which prevents high-frequency “scalping” activity from being used purely to collect cashback.

The calculation is based on the spread you pay, not on the full trade value, meaning that your rebate represents a small portion of your trading costs rather than a percentage of your profit or turnover.

There is, however, a monthly cap of USD 50,000, beyond which no further cashback is paid.

amana invest

amana Invest is a passive/automated investment plan service offered by amana, designed to let users invest without needing to actively trade every asset themselves.

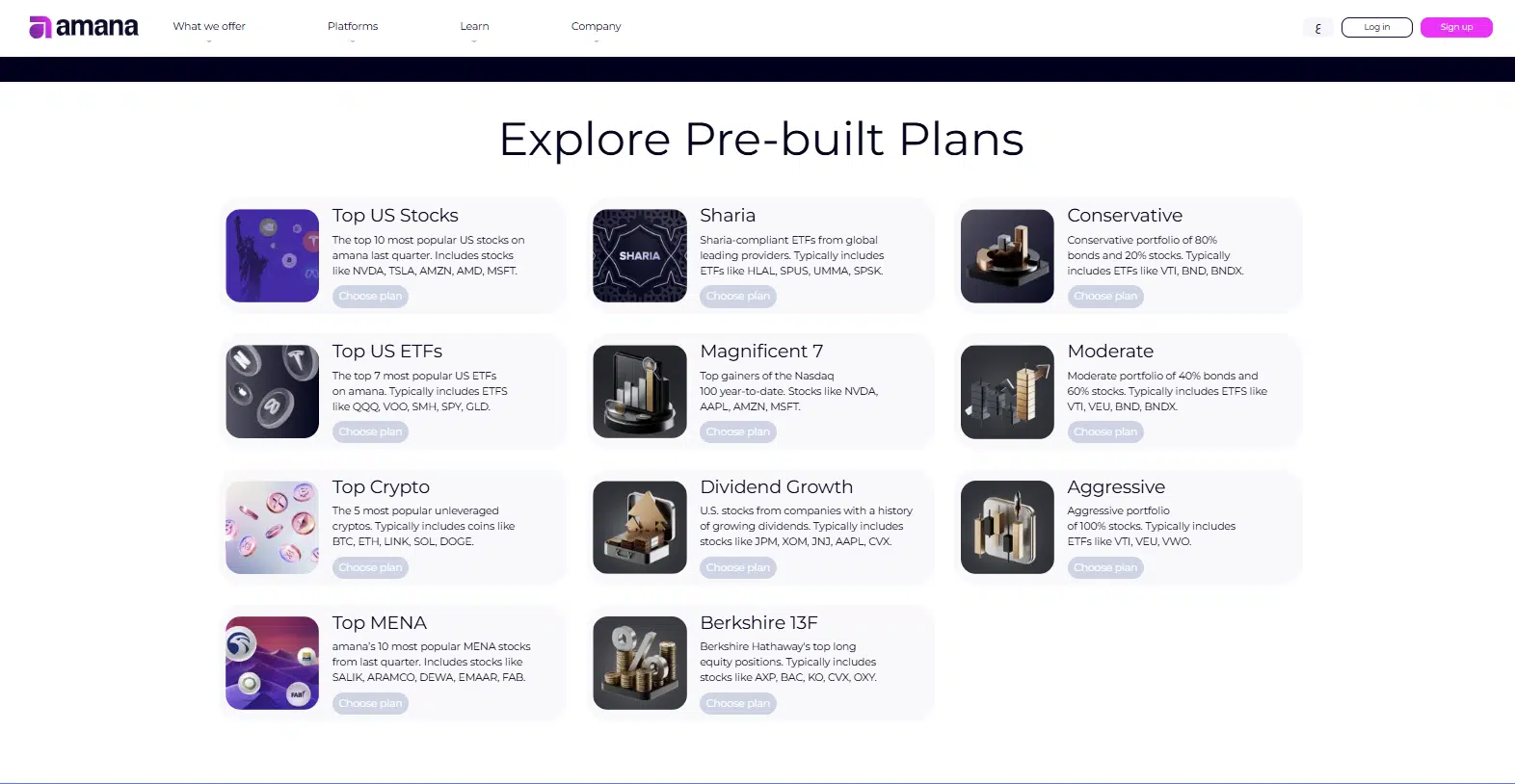

It is built around “investment plans” that can include stocks, ETFs, and cryptocurrencies. You can either choose from pre-built portfolios or build your own plan (with up to 20 assets) in line with your personal risk tolerance and goals.

The idea is to “set and forget”, you set up recurring contributions (daily, weekly, monthly) and amana executes the allocations for you. There is no leverage, no management fees, no exit fees, and no lock-in periods, according to their terms. You can pause or modify plans if desired.

If you go for pre-built portfolios, these are the ones available:

How it works

- Choose or customize a plan: You may pick from ready-made plans (e.g. conservative, high risk, thematic or sector-based, Sharia-compliant) or build your own by allocating percentages to specific stocks, ETFs or cryptos.

- Recurring funding: You decide how much and how often you want to invest (one-time, daily, weekly, monthly). amana uses fractional shares, so your whole amount is spread proportionally across your chosen assets, even if individual shares are expensive.

- Order execution: On the scheduled execution date, amana will attempt to place orders in each asset. If funds are insufficient or some orders can’t execute (e.g. trading halted), the plan may partially execute.

- Flexibility: You can pause the plan, change allocations, or stop contributions anytime. There are no lockups or exit fees.

- No leverage, no fees, no lockup: the model is an unleveraged, self-directed investing service. There are no management or performance fees, and you are not locked in.

Finally, you can request more leverage. We do not recommend using it since it increases the likelihood of getting liquidated, still, here’s what you can find:

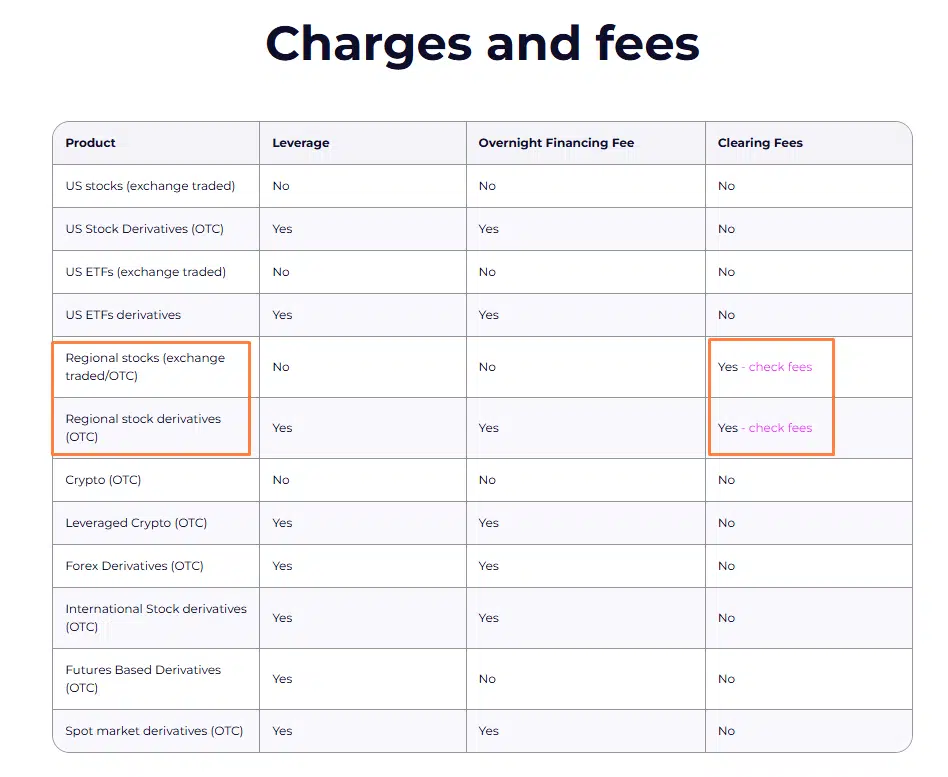

Fees

One of amana’s main selling points is its transparent and low-cost fee structure. We highly encourage you to read the CEO transparency statement.

The company positions itself as a modern, commission-free broker designed for retail investors in the UAE. Its marketing emphasizes “zero commissions” and “no hidden fees”. For ETFs and fractional shares, the structure follows the same pattern: no direct trading fees and no minimum investment requirements.

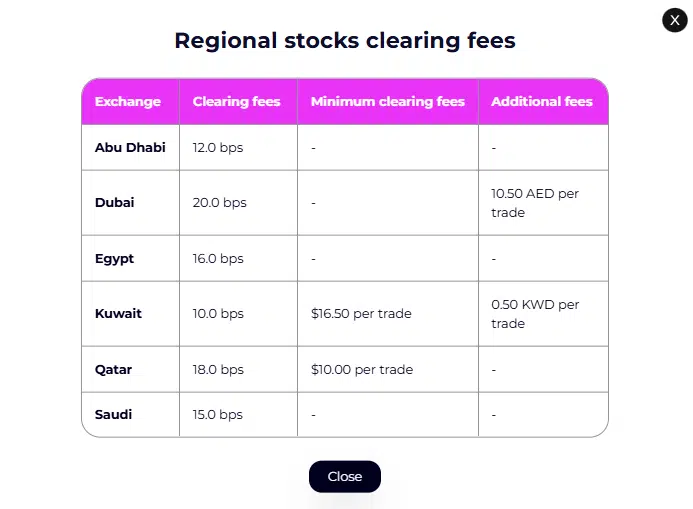

However, when it comes to “Regional Stocks”, there are some fees after the first $100,000 investment or 50 trades (source):

Clearing fees on regional stocks (Exchange-traded or OTC):

Clearing fees for regional stock derivatives (OTC):

That said, traders should understand that even “commission-free” brokers still earn revenue through spreads and other indirect mechanisms. In amana’s case, the spread, the small difference between the buy and sell price, is where much of the cost is embedded. They claim to offer “70% lower spreads”.

Spreads can vary depending on the asset class and market conditions. For example, highly liquid assets like major U.S. stocks or forex pairs tend to have tight spreads, while less liquid regional stocks or certain CFDs may carry wider ones.

For CFD and leveraged products, amana applies overnight financing charges (often called “swap” fees). These are interest-like costs that apply when you hold leveraged positions overnight. Although amana also offers swap-free (Islamic) accounts, these often come with other adjustments, so users should review the detailed terms.

In general, CFDs, leveraged products and overnight financing charges are not the way to build a long-term passive investing portfolio. Fees and leverage can harm your returns in the long-term.

Deposits and withdrawals via debit or credit cards are advertised as free of charge, and bank transfers usually do not incur amana fees, although your bank may still charge you. The lack of funding fees is a nice advantage compared to some regional brokers, particularly for users making frequent small deposits.

Finally, accounts that have been inactive for over 12 months with no deposits or trades will receive a 30-day notice to reactivate, or their accounts will be closed. Those with less than $100 will get a 30-day notice before being charged a $10 monthly maintenance fee until the balance is depleted. Once the funds run out, the account will be closed automatically.

Regulation

amana operates as a multi-jurisdictional brokerage group, with its entities authorised and supervised by several financial regulators around the world. This structure enables amana to provide services to clients across various regions, each governed by the standards of its respective regulatory authority.

| Entity | Regulator | Jurisdiction | Client Base / Role |

| AFS Global Ltd | Labuan FSA (LFSA) | Malaysia | Operates the amana app, holds client accounts, and provides trading services globally, including UAE residents. |

| amana Financial Services (Dubai) Ltd | DFSA | UAE (DIFC) | DFSA-authorized firm, not the contracting entity for amana app users. |

| amana Capital Ltd | CySEC | Cyprus | EU clients under MiFID II, with Investor Compensation Fund (ICF) coverage up to €20,000. |

| amana Capital S.A.L. | CMA | Lebanon | Lebanese domestic brokerage. |

| ACG International Ltd | FSC | Mauritius | Global operations support. |

| amana MENA Promotional Services L.L.C. | SCA UAE | UAE | Marketing and promotional functions, not client servicing. |

Entity details

AFS Global Limited (Labuan, Malaysia) – Actual contracting entity

Although amana Capital promotes its UAE presence through Amana Mena Promotional Services L.L.C., financial company authorised and regulated by SCA, License no. 20200000255, clients opening accounts via the amana app are legally contracting with AFS Global Limited, a separate entity within the amana Group.

According to the Client Agreement, all client relationships, account openings, and trading activities are conducted under AFS Global Limited, which is authorized and regulated by the Labuan Financial Services Authority (LFSA) in Malaysia.

AFS Global Limited (AFS):

- Incorporated in the Federal Territory of Labuan, Malaysia (Reg. No. LL14899)

- Licensed by the Labuan FSA under: Money Broking License No. MB/18/0025

Under this regulatory framework, clients’ funds are held in segregated accounts with reputable banks in the UAE, Malaysia or abroad, in compliance with LFSA client money rules.

However, Malaysia’s offshore regime does not include an investor compensation scheme, and client protections differ from those under the UAE’s DFSA or the EU’s MiFID II standards.

amana Financial Services (Dubai) Ltd (DFSA-Regulated Entity)

amana Financial Services (Dubai) Ltd (AFSDL) is the only DFSA-authorized entity within the amana Capital Group. It is based in the Dubai International Financial Centre (DIFC) and is supervised by the Dubai Financial Services Authority (DFSA) for activities conducted within the DIFC.

However, as explicitly stated by the DFSA in its public notice titled “Clarification of regulatory status of application launched by the amana Capital Group”:

- The “amana app” is not a DFSA-regulated product.

- Users of the amana app are not clients of AFSDL.

- Instead, they are clients of AFS Global Limited (Labuan, Malaysia), regulated by the LFSA.

- Therefore, DFSA protections and oversight do not extend to amana app users, even if they reside in the UAE.

Concerning the other entities, you can find the following details:

amana Capital Ltd (CySEC): This European entity offers services under the MiFID II framework. Clients benefit from the Investor Compensation Fund (ICF), which may cover up to €20,000 per eligible client in the event of firm insolvency.

amana Mena Promotional Services L.L.C. (SCA): Authorized in UAE, this company mainly provides marketing and promotional services rather than trading operations.

ACG International Ltd (FSC): Regulated in Mauritius, this entity supports amana’s global reach and provides services to clients in several regions outside the EU.

amana Capital S.A.L. (CMA): A Lebanese-licensed financial brokerage institution regulated by the Capital Markets Authority (CMA), offering local services within Lebanon.

Supported countries

amana does not offer an official list of countries where it accepts clients from. Still, we are aware that it operates in roughly 80 countries, which include most of the European countries and the MENA (Middle East and North Africa) region, such as Algeria, Egypt, Morocco, Saudi Arabia, and the United Arab Emirates.

Bottom line

The amana app is one of the most user-friendly, commission-free trading platforms in the UAE, combining a modern app, fractional investing, and a wide range of financial products with no commissions. It’s the “Robinhood” or Webull of the UAE.

However, due to its lack of DFSA regulation, focus on CFDs, and limited ETF offering, can be better suited for short-term and active traders than long-term, buy-and-hold investors.

It’s an impressive local alternative for fast, low-cost exposure to the UAE and U.S. markets. Those seeking a long-term, passive approach, may find Interactive Brokers or Sarwa, just to name a few, aligned with their goals.

Disclaimer: Investing in physical shares carries risk. Trading leveraged derivatives and volatile digital assets is high-risk and requires caution.